索尼2024Q1利润同比大增10% PS+再次拯救PS5下滑

索尼称,营收的增长主要得益于游戏业务、音乐流媒体业务和图像传感器业务的强劲增长。

8月7日,日本游戏巨头索尼公布了截至6月30日的2024财年第一财季业绩。

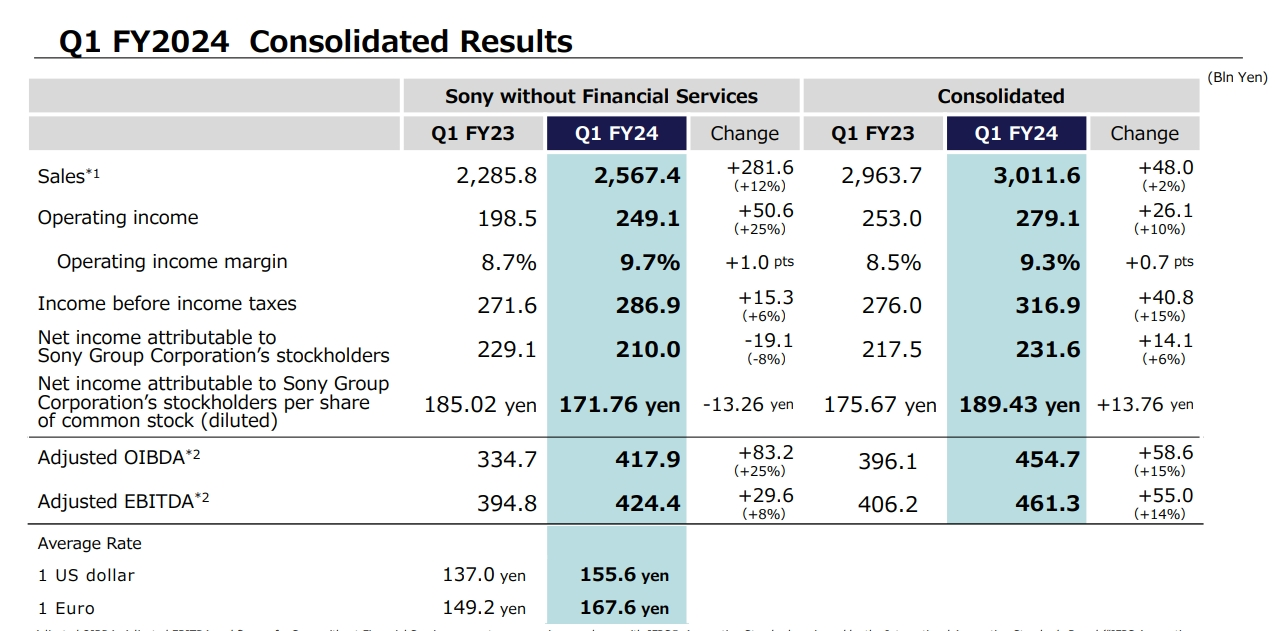

数据显示,索尼第一财季实现丰收,营收达3.01万亿日元,同比增长 2%,高于市场预期;营业利润达2,791.1亿日元,同比增长10%,同样高于市场预期;净利润达2,316.38 亿日元,同比劲增6.5%。

同时,索尼公司提高了全年收入的预期指引。公司预计,全年经营利润将提高至1.31万亿日元,高于此前预计的1.28万亿日元。

索尼称,营收的增长主要得益于游戏业务、音乐流媒体业务和图像传感器业务的强劲增长。

包括PlayStation游戏机在内的索尼游戏业务在报告期内暴增至8,649亿日元,比去年同期的7,719亿日元增长了12%。

索尼音乐和图像传感器的收入则分别增长了23%和21%,尤其是图像传感器业务,受到外汇汇率和销售额增长的影响,该业务的利润同比增长了约两倍,达366亿日元。

成也游戏,败也游戏。今年5月,索尼曾给出了令人失望的2023财年业绩。

在整个报告期内,索尼的拳头产品PlayStation 5的年销量仅为2,080万台,未达到索尼保证的2,100万台的预期。但是,由于受到游戏内付费销售增长和汇率的积极影响,索尼的游戏及网络服务业务(G&NS)仍能给出积极表现。

在本次财报中,PlayStation 5的销售依旧不尽如人意。索尼表示,公司在季度内共销售了240 万台PlayStation 5,远低于去年同期的330万台。

这一次,拯救硬件业务的又是软件销售。

索尼表示,报告期内,公司的第一方游戏软件的销售额以及网络收费服务(主要是PlayStation Plus订阅)都有强劲增长。在游戏机行业的长期转变下,越来越多的玩家开始涌向数字下载和订阅服务的玩法,这拯救了索尼G&NS的业绩。

尽管如此,本次索尼的游戏硬件业务还是达到了一个里程碑。索尼称,在近四年的时间里,PlayStation 5的累计销量已突破6,100万台,成为全球销量最好的主机之一。作为对比,任天堂Switch的累计销量为1.413亿台;微软Xbox One为5,796万台;索尼自家的PS4发布于2013年,累计销量榜为1.172亿台。

今日,还有消息称,索尼集团计划在未来三年内斥资1.8万亿日元用于增长投资,包括并购。

索尼曾和私募股权巨头阿波罗全球管理公司进行深入洽谈,计划合作收购美国媒体巨头派拉蒙全球,以巩固其在全球娱乐市场的头部地位。但是,由于种种原因,这笔震惊世界的收购最终未能成行。

截至目前,索尼已经退出了派拉蒙全球公司的收购战,将不再向其提出新的收购要约。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。