英国4月通胀数据出炉:抗通胀之路道阻且长

英国经济某些领域的价格压力依旧顽固。

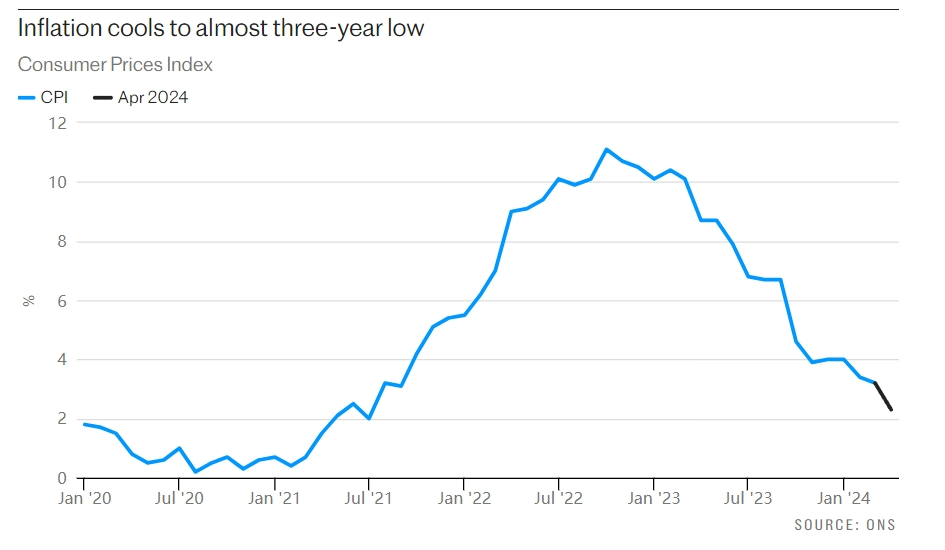

5月22日,英国国家统计局最新数据,4月份CPI同比上涨2.3%,较3月份的3.2%大幅下降,数据来到2021年夏季以来的最低水平。

具体而言,家庭能源价格的下降推动了CPI整体水平的下降。4月家庭传统双燃能源账单下降了12%,来到1,690英镑/年,拉低了通胀水平约0.4个百分点。此外,商品价格也录得自2021年2月以来的首次下滑,相较于去年同期下降了0.8个百分点。国家统计局首席经济学家格兰特·菲茨纳(Grant Fitzner)称,食品价格的通胀正在逐步缓解,4月超市商品价格仅上涨了2.9%,远低于去年20%的峰值。

尽管通胀跌跌撞撞下行,但本次数据仍但高于英国央行和经济学家预期的2.1%涨幅,代表英国经济某些领域的价格压力依旧顽固。首先,英国的服务业通胀始终居高不下,4月的5.9%水平和3月的6%水平基本持平。另外,剔除了价格波动较大的食品和能源价格后,4月份英国的核心通胀为3.9%,仅仅是略低于3月的4.2%。世界银行认为,英国的抗通胀之路仍然“道阻且长”,下半年预计英国通胀仍将小幅上涨2.6%,直至2026年初才能持续走低至目标水平。

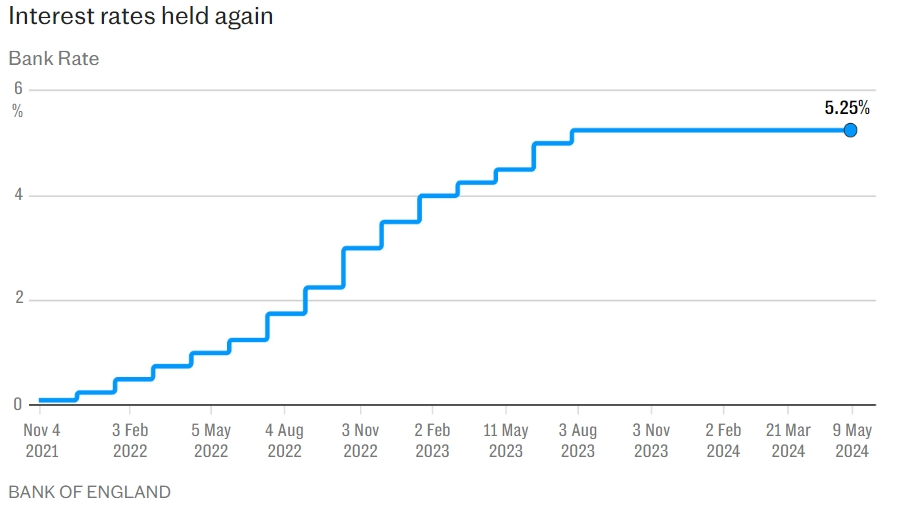

鉴于英国通胀放缓程度低于预期,交易员大幅削减了对英国央行降息的押注,市场不再预期今年两次降息、每次25个基点的概率为100%。市场预计年底前降息39个基点——相当于降息一次,第二次降息的可能性约为60%;而周二预期会降息54个基点。目前,市场押注英国央行最迟将在8月份进行首次降息。

在最近一次货币政策会议上,英国央行连续第六次将将利率维持在5.25个百分点。英央行行长贝利表示,他对通胀走高的时代已经结束感到“乐观”。但是,他对于央行的降息时点却始终闪烁其词,他称,“既不排除货币政策委员会将在下次会议上降息的可能,也不认为下次会议降息是既定事实。”

对于这份数据,英国影子财政大臣雷切尔·里夫斯(Rachel Reeves)表示,现在“不是保守党开香槟酒瓶塞、炫耀胜利的时候。”她还补充说:“目前英国面临的经济形势仍然严峻,家庭的经济情况糟糕,商品价格飙升,抵押贷款费用增加,税收创下了70年来的新高。”

KPMG英国首席经济学家耶尔·塞尔芬(Yael Selfin)也认为,虽然通胀下降接近英央行的目标,但可能还不足以说服央行在6月份降息。T. Rowe Price.首席经济学家托马斯·维拉德克(Tomasz Wieladek)则称,如果通胀数据保持这种强劲态势,今年夏季降息的可能性就较小,而且可能需要重新考虑加息。

英国央行的下次货币政策会议将于6月20日进行。

·原创文章

免责声明:本文观点来自原作者,不代表Hawk Insight的观点和立场。文章内容仅供参考、交流、学习,不构成投资建议。如涉及版权问题,请联系我们删除。