The stock price keeps falling! Disney's major shareholder Nelson Peltz has hit the board again.

Local time on October 9, according to media reports, activist investor Nelson Peltz is seeking multiple board seats in the group after increasing his stake in Disney.。

Local time on October 9, according to media reports, activist investor Nelson Peltz is seeking multiple board seats in the group after increasing his stake in Disney.。

Peltz vs. Disney in proxy battle

According to people familiar with the matter, Peltz's Trian Fund Management (Trian Fund Management) has increased its holdings of Disney stock to more than 30 million shares in recent months, making the Trian Fund one of Disney's largest investors.。

People familiar with the matter said the Trian Fund believes Disney stock is undervalued and believes the board needs to take more responsibility。As a result, the fund is planning to seek multiple board nominations, including from Peltz.。

Needham analyst Laura Martin said Peltz would be "good for shareholders" in the short term as he focuses on creating value through more direct strategies such as asset sales.。According to Martin, Peltz is more willing to try to break up and sell the various parts, which will better care for public shareholders in the short term.。Bob Iger focuses more on the company's 5-10 year vision.。

Martin said: "Peltz has enough shares that I don't even know if he needs to get a board seat to really get something done here and make money from his investments.。We will wait and see。But at worst, there will be an activist on the board who will be more focused on the short term than anyone on the board currently。"

The Peltz and Trian funds had launched a months-long proxy contest in 2022 for a seat on Disney's board.。But Peltz later changed his mind and said in February that he was abandoning the proxy fight.。Peltz, who has pushed Disney to clarify its succession plans, reform its streaming business, cut costs and recoup its dividend, believes Iger's proposed new operating moves are in line with his ideas, which has also prompted it to abandon its proxy fight.。

When the stock price falls?

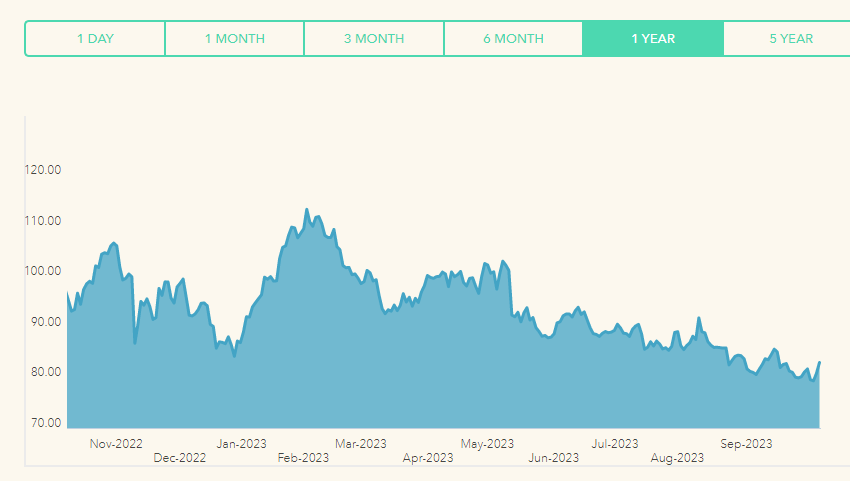

Last week, Disney shares hit a nine-year low。After Nelson Peltz sought a seat on Disney's board of directors, Disney shares were quoted at 84 on Monday (October 9)..$7, up about 2%, but still near a one-year low。

It's worth noting that Disney's stock price has fallen more than 20% since Peltz's last proxy battle ended, which is likely a big reason why Peltz has renewed its impact on Disney's board of directors this time around.。

The continued decline in Disney's stock price is related to the multiple dilemmas facing the company.。

One of the most important hurdles facing Disney is the transformation of the industry.。As consumers turn to streaming services instead of traditional TV or movie theaters, Disney is grappling with this historic industry shift.。Disney's business has been under pressure amid industry shifts。In recent years, the company has been facing a decline in television, advertising, film and other business problems。

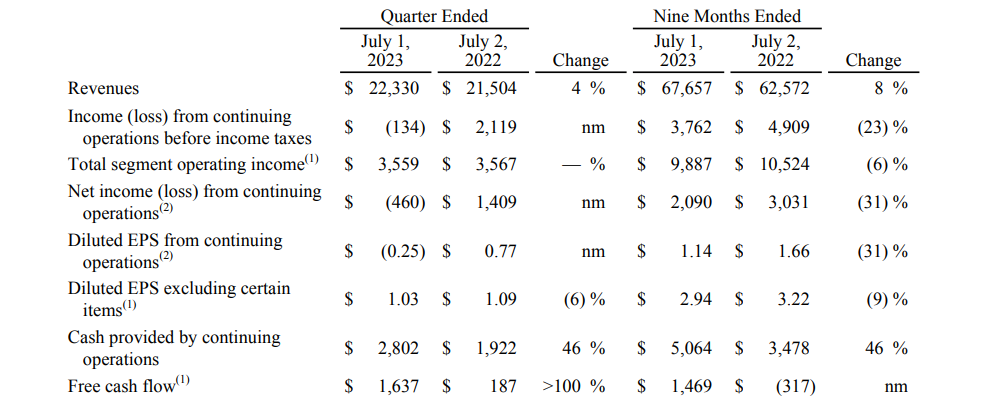

According to Disney's third-quarter fiscal 2023 earnings data, the company's third-quarter operating income was approximately 223.$300 million, up 3.84%。Net loss attributable to the parent is approximately 4.$600 million, compared to 14.$0.9 billion net profit。

In the third quarter, Disney's media and entertainment distribution segment earned about 140.$04 billion, down 0.75%。Among them, linear network operating income of about 66..$900 million, down 6.94%; direct-to-consumer operating income of approximately 55.$2.5 billion, up 9.23%。In the Disneyland, Experience and Products segment, revenue was approximately 83.$2.6 billion, up 12.6%。

In terms of streaming, Disney + had about 46 million paying subscribers in the U.S. and Canada in the third quarter, down 1% from the previous quarter.。Currently, Disney's streaming business is still in the red, but the company says the business is on track to be profitable by the end of fiscal 2024。

"Looking ahead, I believe our three businesses will drive the greatest growth and value creation in the next five years," Iger said in an earnings call.。They are film studios, park operations and streaming: these are inextricably linked to our brands and franchises。"

Another hurdle facing Disney is the strike。The wave of strikes in Hollywood in recent months has also greatly affected Disney's business development.。A double strike called by the Screen Actors Guild and the Screenwriters Guild of America brought Hollywood's film and TV series production to a halt, and Disney's film production and other businesses were suspended as a result.。In September, Disney CEO Bob Iger joined with Warner Bros. CEO David Zaslav, Naifei's co-CEO Ted Sarandos and NBC Universal Chairman Donna Langley and other executives in talks with the union to push for a preliminary labor contract with the American Writers Union.。But the Screen Actors Guild is continuing its strike.。

Despite the challenges, Disney has been actively "self-help"。

Disney's approach is also simple and crude, which is to "save money."。Disney has a $5 billion cost-saving plan for itself.。This cost-cutting plan includes layoffs.。Disney plans to cut about 7,000 jobs。Disney also pledged to restructure the business and streamline operations to make the business more cost-effective.。

In addition to "saving money," Disney also made specific adjustments for each business.。

As traditional cable and satellite TV distributors continue to lose subscribers, the company is evaluating the sale of its TV business.。In addition, Disney plans to make its flagship ESPN sports network available via streaming at some point in the future.。

Separately, following its third-quarter earnings release, Disney announced a price hike for its streaming service, Disney +。Effective December 12, 2023, the monthly fee for the ad-free Disney + service is from 10.$99 up to 13.$99; monthly fee for ad-free version of Hulu will start from 14.$99 up to 17.99美元。

Disney is also working to improve the quality of its films, focusing on franchises and major releases, seeking to maximize profits by distributing films in theaters and at home.。

In theme parks, Disney said it will double its investment in its theme parks over the next decade, spending $60 billion to develop new experiences based on the Avatar, Frozen, Journey to Dreams and Black Panther films to attract more traffic.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.