Exaggeration or fact?Ford Chairman Says U.S. Can't Compete With China in Electric Vehicles

Bill Ford, executive chairman of veteran U.S. automaker Ford, said the United States is not ready to compete with China in electric vehicle production.。

On June 18, local time, Bill Ford, executive chairman of Ford Motor, a veteran American automaker, said that the United States is not ready to compete with China in electric vehicle production.。

"They (China) are developing very fast and are produced on a large scale.。Now they are exporting。"They're not here right now, but we think they'll come, and at some point we need to be ready, and we're getting ready."。"

It's not just Bill Ford who has a great sense of crisis within Ford, but Ford CEO Jim Farley (Jim Farley) has publicly expressed similar views on more than one occasion.。

Back in June, Farley said at the 38th annual strategic decision-making meeting of the Alliance Bernstein that he believes Chinese electric vehicle manufacturers are seriously undervalued and expects these manufacturers to become more important in the future.。At the same time, he believes that this highly competitive field will undergo major changes.。

Farley believes that many electric car companies are chasing a market that is not large enough to justify the capital or valuations they put in, but he sees Chinese companies differently.。He said that if you look at an electric car in China 2.$50,000 of material, it's probably the best in the world。He said: "Apart from Norway, they (Chinese car companies) have not or have not shown any interest in exports.。But a shuffle is coming。I think this will benefit a lot of new Chinese companies.。"

Farley believes that U.S. automakers are currently constrained by costs, but manufacturing costs will fall sharply in the next few years, when an electric car could sell for about $25,000 (about 16.730,000 yuan) level.。And falling costs will trigger a massive price war in the industry.。

Farley's prediction of U.S. automakers last year was first validated by Chinese automakers this year。China's domestic car companies this year's "price scuffle" can be said to be thrilling, a number of new and old forces are forced to enter the "low price for market share" situation。As the fight draws to a close, monthly updates of sales data show how quickly the market is changing and how brutal the fight is.。

"Our costs are not competitive and we are working internally and with our partners to reduce costs in all areas," a Ford spokesman said.。"We can only win if we build a lean and flexible organization.。These actions are necessary to build a healthier and more sustainable business in China.。"

He also gave an example. Ford's electric car Mustang Mach-E starts at about $45,000, but the manufacturing cost of the battery is $18,000。This means that there is not much room for price cuts for Ford electric cars.。

In an effort to cut battery costs as much as possible, in February, Ford announced plans to invest $3.5 billion to build an electric vehicle battery plant in Michigan.。The investment will be in collaboration with Chinese battery company Ningde Times and will use Ningde Times technology.。But the news sparked controversy in the United States.。Bill Ford says Michigan battery plant is an opportunity for Ford engineers to learn technology and use it for themselves。He added: "This is a wholly owned Ford plant.。They will be our employees, everything we do is just about technology, that's all。"

One of the sources of Ford's internal sense of crisis is its steady decline in the Chinese market。Ford's sales in China have been on a downward trend since 2016。In 2022, Ford's car sales in China fell below 500,000 units for the first time in a decade.。By May 2023, Ford sold about 14,000 vehicles in China, with a market share of only about 0.8%。This data shows that Ford's influence in China is already quite weak.。Currently, Ford has only one electric model Mustang Mach-E on sale in China。

While there is a bit of competition in China, the good news is that Ford's performance in its "home base" - the United States - is still remarkable.。According to Motor Intelligence, Ford accounted for 7% of the total electric vehicle market in the United States last year..6%, ranked second。Although the electric car market has achieved a good result in second place, the bad news is that compared to the first Tesla more than 60% of the market share, Ford is still far away。

In addition, Ford is also facing another bad news, that is, China's new energy car companies have been "sea"。

According to the China Association of Automobile Manufacturers, China exported 1.07 million vehicles in the first quarter of 2023, up 58.1%。Japan's official data show that car exports in the first quarter of 95.40,000 vehicles, up 5.6%。In the first quarter of this year, China has surpassed Japan in auto exports to become the world's largest auto exporter。According to the Federation's forecast, China's auto exports will reach 4 million units this year, up nearly 30 percent year-on-year, and are expected to overtake Japan's auto exports for the whole of this year.。

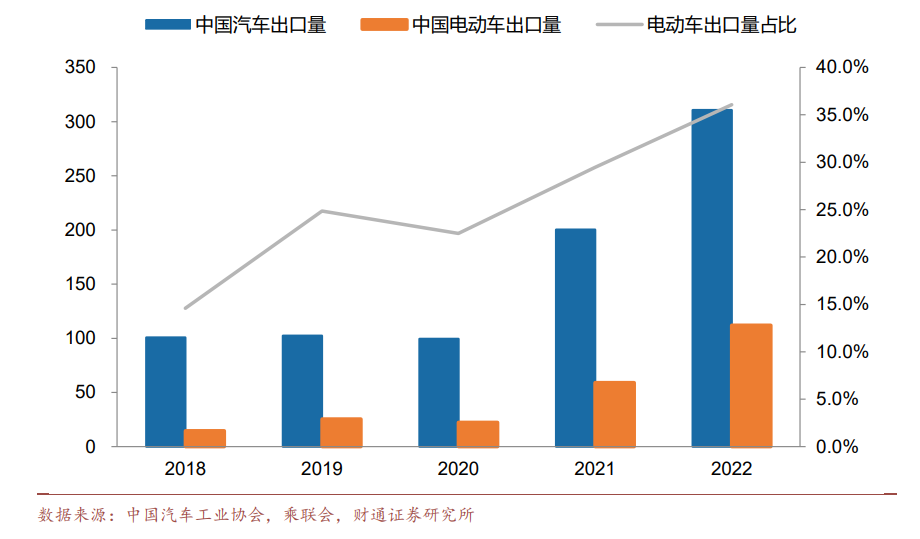

The proportion of China's electric vehicle exports is on the rise as a whole.。According to Caitong Securities, China's electric vehicle export market sold 590,000 units in 2021, accounting for 29% of total vehicle exports..5%; export market sales of 1.12 million units in 2022, accounting for 36% of total automobile exports。

The rise of China's electric car manufacturers has filled Ford with a sense of crisis。Last month, Farley, who is leading Ford's transition to electric vehicles, said that Chinese electric car makers are Ford's main competitors in the industry, and Ford needs a unique brand or lower costs to beat Chinese automakers.。"I think we see the Chinese as a major competitor, not GM or Toyota.。The Chinese will be the main competitors。"

"Either you need to have a very unique brand, which we think we did, or you have to beat them on cost," Farley said.。But how do you beat them in cost when they're five times your size?"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.