"Volume" to a new height! Cloud computing price war is raging Jingdong cloud into the game threatened to "the whole network price comparison"

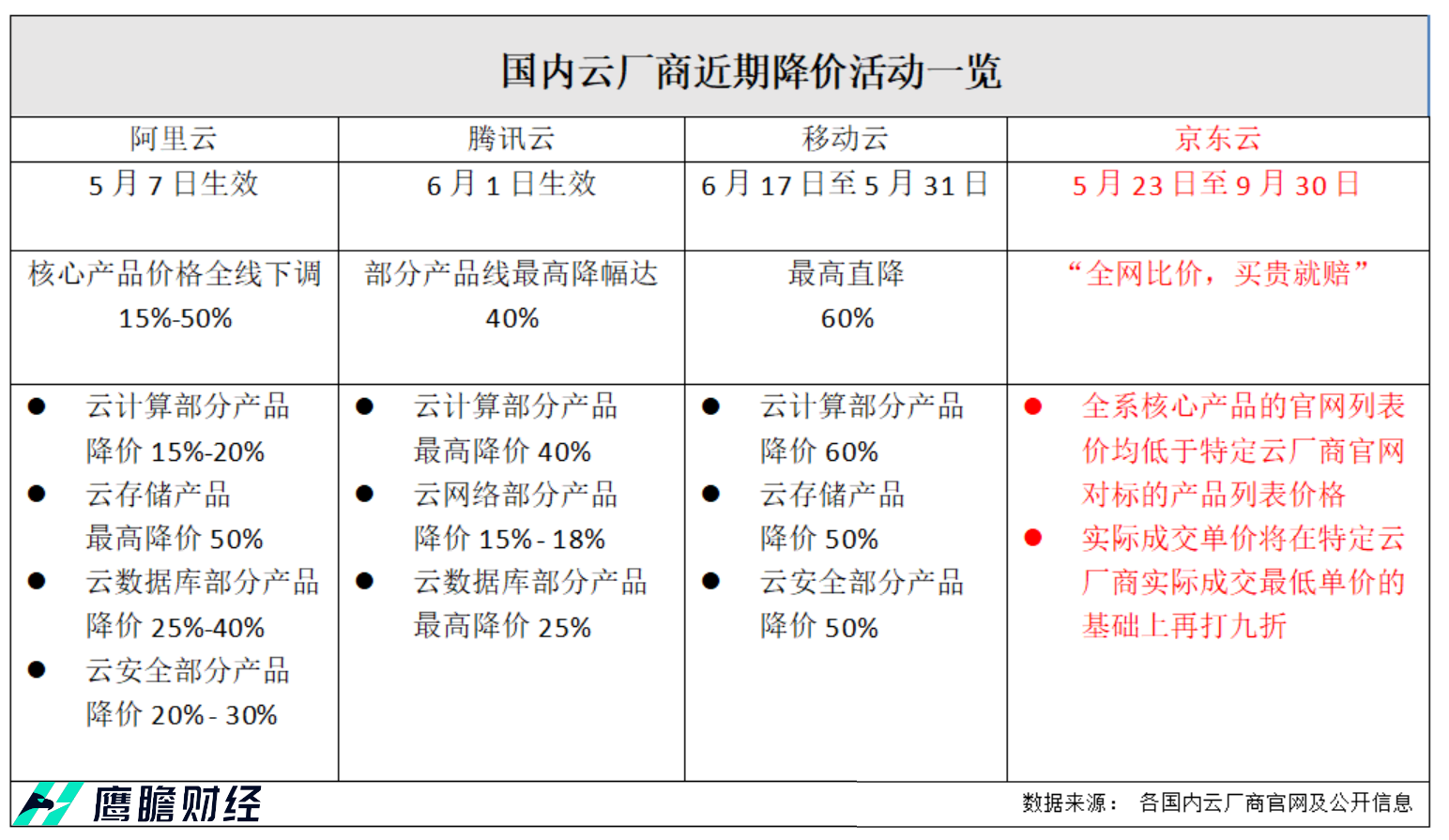

On May 23, JD Cloud announced that its core products directly participate in the market open price comparison, promised to "buy expensive, lose," and directly named the price comparison object: Ali Cloud, Huawei Cloud, Tencent Cloud.。

On May 23, JD Cloud announced that its core products directly participate in the market open price comparison, promised to "buy expensive, lose," and directly named the price comparison object: Ali Cloud, Huawei Cloud, Tencent Cloud.。

Come up and enlarge the move! Jingdong directly shows the bottom trump card to use cost-effective in exchange for market share.

Jingdong Cloud said in the poster announcement, the official website list price of its core products are lower than the specific cloud vendor official website to the target product list price, and the actual transaction unit price will be in the specific cloud vendor actual transaction on the basis of the lowest unit price and then 10% off, directly the cloud computing market price war "volume" to a new height.。

According to the official website of JD Cloud, this price comparison activity involves the core products of JD Cloud, including: computing, storage, network, database, middleware, security, video services, cloud computers, is currently the most abundant product line among the cloud manufacturers that have launched price reduction activities, covering the service needs of industrial customers on the cloud, the whole chain of cloud.。

In addition, JD Cloud also guarantees that price reduction will never lead to quality reduction: willing to provide computer rooms of the same quality as JD Retail, ensuring 7 * 24-hour service, technical experts to provide 1-to-1 professional support, perfect training system support, technical experts to answer questions at any time。

It can be said that JD Cloud has been "planning for a long time" to enter the market this time, and as soon as it came up, it showed its own housekeeping skills - "cost-effective," which can be described as a master's trick, but not a lot of tricks, which is fatal.。

Previously, Jingdong Group founder Liu Qiangdong once mentioned in an internal meeting: "If you lose the low price advantage, all other so-called competitive advantages will return to zero."。In March this year, the relevant person in charge of Jingdong Cloud also said at the Jingdong Cloud City Summit Guangzhou station that the ultimate cost performance is an important feature of the next generation of digital infrastructure.。

Pan Helin, co-director of the Digital Economy and Financial Innovation Research Center of Zhejiang University's International Joint Business School, also pointed out that in the current environment, cost performance is what Jingdong is looking for, and the only way to gain market share。Whether on the C side or the B side, Jingdong hopes to obtain high performance at a low price。

Pan and Lin also said that JD Cloud's price cut is to create new business growth and gain more market share.。

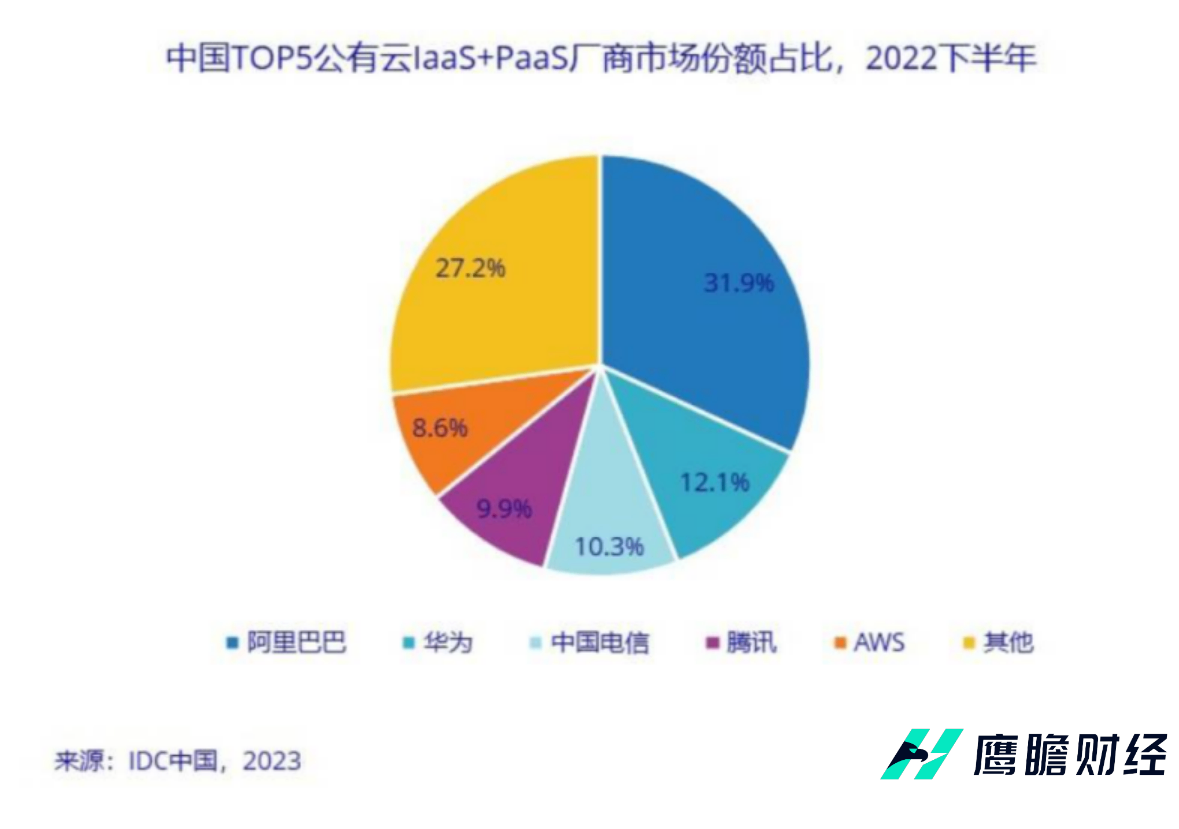

It is reported that although Jingdong has not yet disclosed the specific situation of its cloud business, but in terms of market share, Jingdong's business segment performance is generally。According to data released by IDC in April 2023, in the second half of 2022, the top five public cloud (IaaS + PaaS) markets in China were Alibaba Cloud (31.9%), HUAWEI CLOUD (12.1%), Skywing Cloud (10.3%), Tencent Cloud (9.9%), Amazon AWS (8.6%)。

One stone stirs up a thousand waves. Aliyun took the lead in the battle. Before January, all the major domestic cloud manufacturers came to an end.

Since Alibaba Cloud began announcing its largest price cut in history at the end of April, domestic cloud vendors have followed suit.。At that time, Alibaba Cloud announced a 15% to 50% cut in core product prices across the board, with a maximum drop of 50% for storage products, effective May 7.。Among them, the price of Elastic Compute 7-generation instances and Apsara Stack instances is reduced by up to 20%, the price of storage OSS deep cold archive is 50% lower than the previous lowest price, the price of network load balancing SLB and NAT gateway is reduced by 15%, the price of database RDS Apsara Stack is reduced by up to 40%, the price of video cloud and CDN is reduced by up to 20。

Over the past decade, Alibaba Cloud has reduced its computing costs by 80% and storage costs by nearly 90%.。Not long ago, Alibaba Cloud just launched two new products - ECS enterprise-class general-purpose computing power U instance, the price is up to 40% lower than the previous generation of major instances; object storage reserved space products, the price is up to 70% lower。

On May 16, Tencent Cloud also announced price cuts for a number of core cloud products, with some product lines falling by up to 40%, which will take effect on June 1.。Among them, in the cloud network, Tencent Cloud's LCU fee for load balancing CLB is reduced by 18%, and the standard NAT gateway is reduced by 15%; in the database, Tencent Cloud Database TDSQL-C serverless has newly released the resource package payment model, and the published price is reduced by up to 25% compared with the same specification package year-on-month product.。

On the same day, Mobile Cloud also said that during the period from May 17 to May 31, the price of its general-purpose entry-level cloud hosts and general-purpose network-optimized cloud hosts were reduced by 60% to 240 yuan per year and 806 yuan per year, respectively..4 yuan; 50% price reduction for cloud security center to 360 yuan per year; 50% price reduction for cloud hard disk backup to 7 yuan per year.2 yuan。

Less than a week later, JD Cloud announced that it would conduct a "full-network price comparison," which undoubtedly continued to give this vigorous price war another layer of fire.。

In this regard, IDC China Research Manager Cui Tingting said that the continuous expansion of the public cloud IaaS resource pool, the continuous investment in PaaS and SaaS product development and the continuous strengthening of the cloud consumption capacity of customer groups, giving domestic cloud vendors more price adjustment space.。

She also said that in the short term, the price reduction of cloud service providers will inevitably have a certain impact on the profitability of public cloud service providers, but from the current price reduction product range, the impact should be within the acceptable range.。In the long run, whether the price reduction will have a significant impact on the future cloud market pattern also requires continuous observation of the market.。

The price war of cloud manufacturers is surging, and the Internet department and the telecom department are secretly competing for the first listing.

At present, Alibaba Cloud ranks first in the market share of cloud services in China, but it is facing challenges from the business segments of the three major operators.。It is reported that last year, the three major telecom operators of cloud services business (Tianyi cloud, mobile cloud, Unicom cloud) revenue growth rate of more than 100%, Ali cloud and the gap between the three is slowly narrowing。

Yao Xuechao, an analyst at CCID Consulting's Cloud Computing and Big Data Industry Research Center, said that operators have unique resources and advantages in networks, channels and infrastructure, and the orders and volume of a large number of cloud-integrated businesses will directly drive the scale of the cloud business to double, providing the basis for the rapid expansion of the cloud business.。

In this regard, Ali is also actively seeking ways to expand its leading edge, including plans to spin off the cloud intelligence group。This month, Zhang Yong, Chairman and CEO of the Board of Directors of Alibaba Group and Chairman and CEO of Alibaba Cloud Intelligence Group, said that he plans to completely split and complete the listing of Cloud Intelligence Group from Alibaba Group in the next 12 months, forming a new company completely independent of Alibaba Group.。At the same time, Alibaba Cloud Intelligence Group will also introduce external strategic investors。

Recently, there is news that Alibaba Group has begun a new round of layoffs of Alibaba Cloud, the affected employees reached 7% of the total number of employees of the latter.。It is reported that the Alibaba Cloud service department has begun to notify the affected employees that they will receive severance pay with a compensation standard of N + 1 + 1, or be transferred to other Alibaba departments.。According to some analysts, Alibaba's layoff plan is in preparation for the future spin-off and eventual IPO of the business segment.。

According to the group's latest financial report data, the revenue of Alibaba Cloud's business segment in 2023 was 772.3 billion yuan, up 4% year-on-year, accounting for 9% of Ali's total revenue, making it the largest business segment outside of Chinese commerce.。In addition, according to Gartner's ranking of the global cloud computing IaaS market in 2022, Alibaba Cloud ranked third in the world in 2022 and ranked first in the Asia-Pacific market.。

And as the main competitor of the telecommunications department, Tianyi Cloud is naturally not to be outdone.。

As early as March 2022, China Telecom made it clear at its results presentation that "it will actively explore the possibility of a spin-off of Tianyi Cloud in compliance with regulatory rules."。"At that time, China Telecom Chairman Ke Ruiwen said in a high profile that the company had signed a framework agreement for the capital increase and share expansion of Tianyi Cloud with four central enterprises, including China Electric, China Electronics, China Chengtong and China Guoxin.。

In this regard, Yao Xuechao believes that the development of cloud computing needs heavy asset spending and long-term investment, is a market with strong scale effects and barriers, the head of the Internet cloud manufacturers competitive landscape is relatively stable; and operators relying on their own unique advantages continue to increase investment in cloud computing, the current more emphasis on high revenue growth and market penetration.。He also said that as competition in the market intensifies, there may be a race to match and catch-up between operators and head Internet cloud vendors in the next few years.。

From this perspective, instead of seeing this cloud vendor's scramble to cut prices as a price war, it is better to see it as a "head-on encounter" between vendors for the future business landscape.。

On the bright side, Ali, Tianyi, Jingdong and other manufacturers have announced high-profile price reduction actions, public, on the surface is to benefit the market, to achieve the effect of drainage, expand its market share, in fact, is also a disguised show off the business division of the "arsenal," because only the technical maturity to a certain extent, in order to open the space for its profits, to provide capital for the war.。

Secretly, Alibaba Cloud, as a representative of the Internet department, is also secretly competing with the outstanding telecom player Tianyi Cloud, both of which have significantly accelerated the pace of splitting and listing, hoping to provide more support and freedom for their own cloud business to help them seize market share as much as possible when the industry landscape is not yet fully stable, which is a battle without gunpowder smoke.。

According to the latest International Data Corporation (IDC) "China Public Cloud Services Market (2H2022) Tracking" report, the overall market size of China's public cloud services (IaaS / PaaS / SaaS) reached 188 in the second half of 2022..$400 million, of which the IaaS market grew 15% year-on-year..7%, PaaS market growth rate of 31.8%, the growth rate is quite stable。

From a geographical point of view, the development of China's domestic cloud services relative to the international market to lag about 5 years, and the market size is still a large gap with the international market, the overall development space is huge.。In fact, in the past ten years, China's cloud computing market has grown from the initial scale of one billion to the current scale of 100 billion, and the future prospects are quite broad.。If the field only grows at a normal rate each year, it would be a pretty tempting piece of cake.。

In this "who eats the cake first" battle, not only the "price war" drama, but also the "industry leader battle" and "split listing beach landing war" and other good drama staged in turn.。In an open fight, no one wants to give in first, no one wants to make a mistake first.。After all, any step taken now could have a significant impact on the business landscape of the industry in the future.。

Taken together, Alibaba Cloud, which is deeply involved in all three of the above battles, is under the greatest pressure.。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.