Tesla Q2 gross margin steadily declines Musk: still trading profits for sales!

Tesla's strong second-quarter results surprised the market, with double-digit revenue and profit increases, but Tesla, which had previously cut prices, also hit its gross margins and margins.。

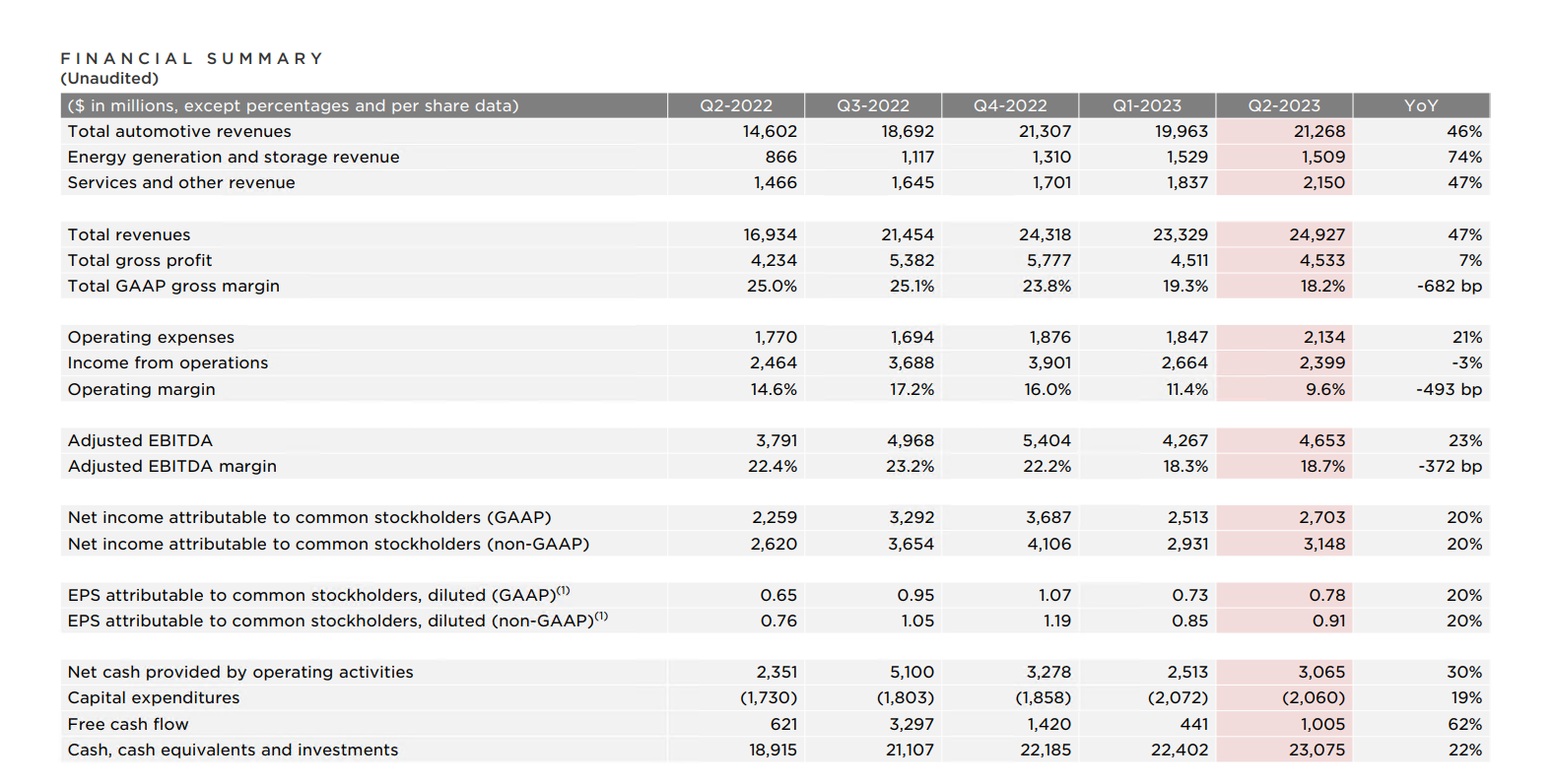

After the U.S. stock market on July 19, Eastern time, U.S. electric car maker Tesla announced its second quarter 2023 earnings。Tesla's strong second-quarter results surprised the market, with double-digit revenue and profit gains, according to earnings data.。Among them, Tesla Q2 total revenue of 249.$2.7 billion, up 47% YoY; net profit attributed to parent 27.$03 billion, up 20% year-over-year; Non-GAAP net profit attributed to 31.$4.8 billion, up 20%。

While both revenue and home-grown net profit exceeded market expectations, Tesla, which had previously cut prices in turn, also hit its gross and profit margins.。Tesla's second-quarter operating profit was 23.$9.9 billion, down 3% year-on-year and 9% from the first quarter..9%; second quarter operating margin of 9.6%; overall gross margin under GAAP in the second quarter was 18.2%, the lowest level in 16 quarters and below analysts' expectations of 18.7%。

In response, Tesla said that while there were car price cuts at the beginning of the first and second quarters, operating margins remained healthy at about 10 percent in the second quarter.。This reflected continued cost-cutting efforts, continued production climbs at the Berlin and Texas plants, and strong performance in other businesses such as energy and services.。

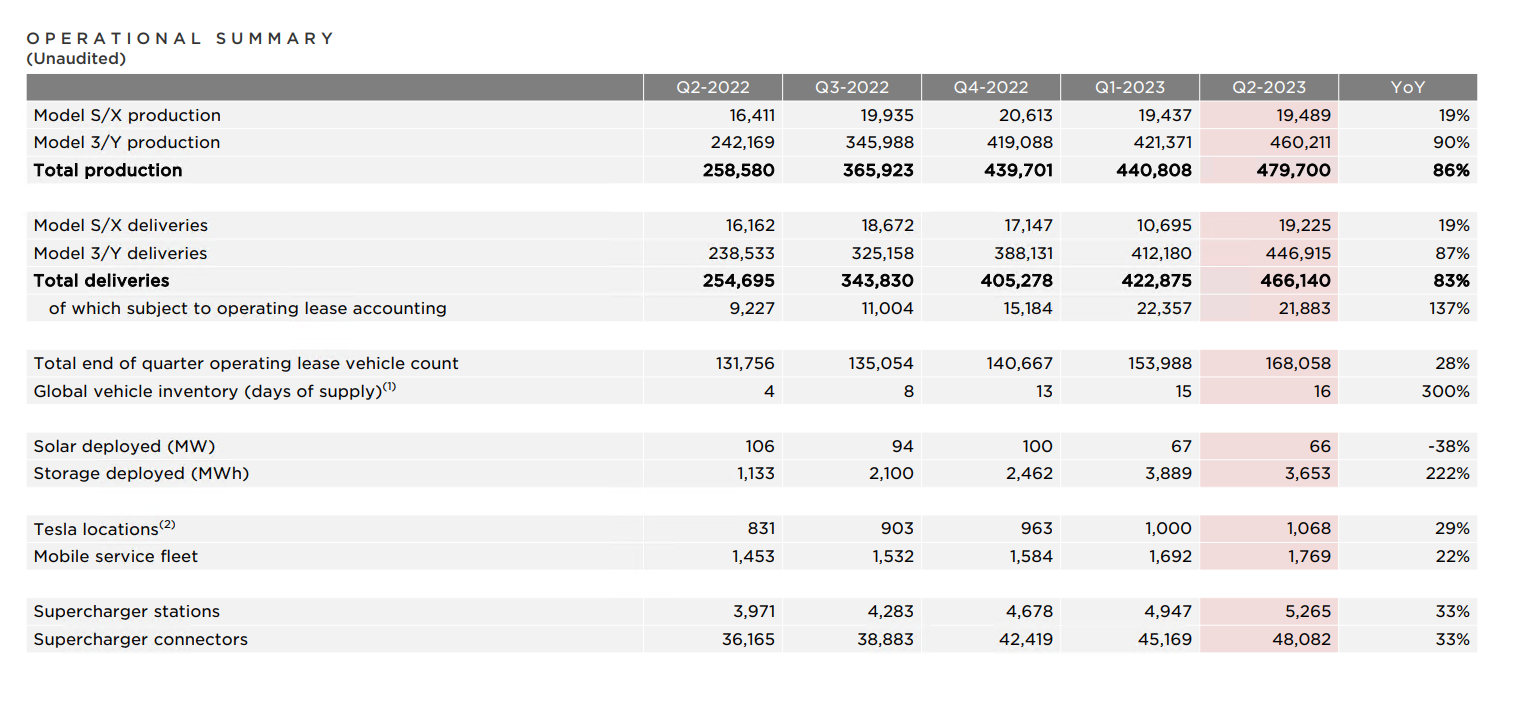

Let's look at production and delivery.。In the second quarter, Tesla produced 479,700 vehicles and delivered 466,140 vehicles.。Of these, Mode3 / Y production was 460,211, up 90% YoY; Mode 3 / Y deliveries were 446,915, up 57% YoY; high-end Model S / X production was 19,489, up 19% YoY; Model S / X deliveries were 19,225。

As you can see, while frequent price cuts have put pressure on Tesla's gross and profit margins for two consecutive quarters, the good news is that sales have received positive feedback.。

In this regard, some analysts have issued a new view on Tesla's earnings。Wedbush Securities analysts noted that the "most important" auto gross margin reached 18.1%, higher than Wall Street expectations of 18.0% and about 17.5% market expectation。Tesla remains stable after price cuts in the U.S. and China, gross margins are now stable, and should bottom out in the next one to two quarters。

CFRA analysts are more cautious in pointing out that investor expectations are clearly high。The company's lower gross margin remains a major concern, and said the fundamentals of U.S. electric vehicles have become more uncertain, with U.S. electric vehicle trading prices falling by an average of 20 percent and inventory turnover days reaching 103 days.。

Musk: Still trading profits for sales!

In a post-performance conference call, Tesla CEO Elon Musk said in response to the sharp decline in profit margins during the reporting period that it "makes sense" to sacrifice vehicle profit margins in exchange for more production, and Tesla will cut prices if the economic environment continues to deteriorate.。

But Musk is not indifferent to the profit margin aspect, and during the conference call, Musk also said that the company is in early discussions with other automakers to license fully autonomous driving software, which could increase the company's overall gross margin.。A one-time transfer of self-driving software will also be launched in the third quarter.。

The billionaire also revealed caution about Tesla's third quarter。He expects production in the third quarter of 2023 to decline slightly from the second quarter, mainly due to upcoming upgrades at Tesla's various plants, during which some capacity may be idle.。

Although guidance for the third quarter may disappoint investors。However, Musk said he has "very high confidence" in Tesla's long-term value.。He believes that the company is on track to be worth five or even ten times its current size。He also recommends holding Tesla like Buffett Value Investments, saying Tesla has long-term investment value and buying if the market panics.。

Finally, Musk still reiterated on the call that this year's production target of 1.8 million vehicles is above the long-term target of 50% growth.。

Cybertruck "Painting Cake" Still Has No Accurate News of Production Date?

Why both revenue and profit surged in the second quarter, but Tesla's share price dived after hours?It turns out that the news on Cybertruck and Robotaxi, the issues that investors were most concerned about on this quarterly conference call, did not give investors a satisfactory answer.。

It is worth noting that Tesla officially announced on Twitter on July 15 that the first Cybertruck was completed at the Texas Super Factory in the United States.。This makes investors think that Tesla will announce a specific delivery date for the model in this earnings report。

At the investor conference in May this year, Musk said that Cybertruck, an electric pickup truck that has skipped tickets many times before, will complete the first delivery of new cars this year.。But now the time has passed more than half of the time, Musk in the earnings call still failed to disclose the specific delivery date of Cybertruck, still "painted cake" said that next year will be mass production of Cybertruck, later this year to start delivery, and said Cybertruck "will contain a lot of technology," "production is difficult to predict."。

The model was officially unveiled at the launch as early as November 2019, and Tesla also plans to launch it in 2021。It is reported that since the announcement of Cybertruck, Tesla has received more than 600,000 bookings, but due to a series of problems such as production capacity and final product form, the launch of the model has suffered several delays.。Delayed from the end of 2021 to the end of 2022, then to the beginning of this year, then to the middle of this year, and now to 2024。

However, in this financial report, Tesla still disclosed Cybertruck but more details。Public information shows that the Cybertruck model is about 19 feet in length (about 5.8 meters), with four doors and more than 6 feet (about 1.83 meters) long bottom (cargo box length), shorter than Ford's best-selling pickup F-150 Lightning。

RobotaxiSurprise Fallen

In addition, Musk in the last quarter earnings call had revealed that in the development of the next generation of cars, internally called Robotaxi, after the public appetite, Musk in the Q & A session did not make relevant disclosures on Robotaxi, but said "by the end of this year, Tesla's self-driving technology will surpass human。"

Earlier this year, Musk said Tesla wanted to upgrade its self-driving system to reach the level of technology required by Robotaxi.。Analysts have also given the emerging business a valuation of up to $870 billion.。

Since 2016, Musk has been promising that Tesla will deliver self-driving cars, and at that time promised that Tesla will complete a full journey across the United States without driving intervention in 2017.。So far, this goal has not been achieved.。

Positive progress in both FSD and charging networks

Regarding autonomous driving, Musk revealed an important decision, "Just like the North American Charging Standard (NACS), we are open to licensing FSD hardware and software to other automotive companies, and we have had early discussions with a large OEM (foundry) about using Tesla FSD.。"

In the past two months, eight automakers have announced cooperation with Tesla to reach charging agreements, including Volkswagen, Ford, GM, Rivian, Volvo, Polar, Mercedes-Benz, Nissan and other automakers, which indirectly makes Tesla The market value has more than doubled. If FSD can successfully replicate the progress of the opening of NACS charging standards, it may further increase Tesla's market value performance。

Another point of concern about FSD is that Musk has finally let go, stating that "Tesla customers will be allowed to transfer FSD to another vehicle in the third quarter of this year."。This is a 'one-time pardon, "by which the FSD can be transferred to the new car instead of being locked onto the old model。"

In Musk's view, the battle for autonomous driving will have a significant impact on the automotive industry, and the realization of FSD will make any decline in profit margins irrelevant, because FSD will bring incalculable value to the car.。

Interestingly, Musk also expressed "disdain" for many car companies on autonomous driving technology: "Competitors who want to challenge Tesla in the field of autonomous driving, and want to copy us, need to spend more than a billion dollars to buy Supercomputers for training。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.