The wind has changed! Leave oil and gas for now, energy traders move into metals and crops

Gunvor Group, Hartree Partners LP and Vitol Group have hired crop or metal traders since last year.。While this is not the first time big energy traders have ventured into such markets, there are several reasons why their interest in such markets has risen。

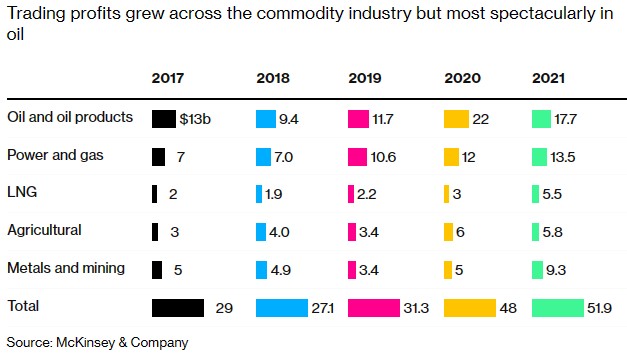

The world's top energy traders, who have made huge profits from oil and gas deals over the past few years, are now using the cash to expand in metals and agriculture。

Gunvor Group, Hartree Partners LP and Vitol Group have hired crop or metal traders since last year.。While this is not the first time big energy traders have ventured into such markets, there are several reasons why their interest in such markets has risen。

The energy crisis and the Russia-Ukraine conflict have exacerbated the market volatility that traders expect and highlighted how one commodity can affect another - for example, high natural gas prices have curbed metal production while pushing up fertilizer costs。In addition, metals such as copper and lithium are crucial to the energy transition away from fossil fuels, and the renewable diesel boom in some regions is boosting crop demand.。

Commodity consultant and agricultural giant COFCO International Ltd (COFCO International Ltd..) Manish Marwaha, former director of strategy, said: "It's wise to diversify。Profit margins and revenues from agricultural and metals trading have proven resilient in recent years.。"

Manish Marwaha said the move into other commodity markets also made sense for some major energy traders, who want to make up for lost revenue from a full exit from Russian oil operations.。Energy trading, mainly oil, gas, coal, electricity, etc., remains largely the core business of large energy traders.。They are now trading derivatives of metals and crops more than physical supplies to take advantage of fluctuations in metal and crop prices.。

Energy traders have not been without such attempts before, but they have all failed。Both Gonvo Group and Vito Group ended their attempts at crop and metal markets more than 6 years ago.。Mercuria Energy Group began investing in mining concentrates around 2015 and subsequently focused on selective investments in battery metals。

Despite their recent expansion, energy traders' share of other commodities remains small compared to companies such as Cargill (Cargill), which dominates the crop sector, or Trafigura Group (Trafigura Group), which dominates the metals sector.。

However, Roland Rechtsteiner, a partner at McKinsey, a consultancy, said the lower position could give energy traders insight into commodity cross-trades, such as the energy and food industry's scramble for crops at a time when the biofuels market is expanding.。He said: "You're basically dealing with a similar counterparty.。Volatility is a key driver of profitability in the sector。The underlying megatrend is the energy transition, which affects all asset classes。"

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.