The auto industry is really can not hide the heart knot?Buffett's 11th reduction in BYD stake fell below 10%

On May 2, Berkshire Hathaway sold off a total of 196 shares of BYD, according to a May 8 HKEx disclosure document..10,000 shares at an average price of 235 per share.HK $64, a total of 4.HK $6.2 billion, with shareholding falling to 9% after reduction.87%, falling below the 10% mark and triggering the disclosure threshold。

According to the Hong Kong Stock Exchange on May 8 disclosure documents show that on May 2, "stock god" Buffett (Warren Buffett) Berkshire Hathaway (Berkshire Hathaway) sold BYD shares 196.10,000 shares at an average price of 235 per share.HK $64, a total of 4.HK $6.2 billion, with shareholding falling to 9% after reduction.87%, falling below the 10% mark and triggering the disclosure threshold。

Accompanied by 14 years! Buffett's 11th reduction in BYD's H-share stake fell below the 10% mark.

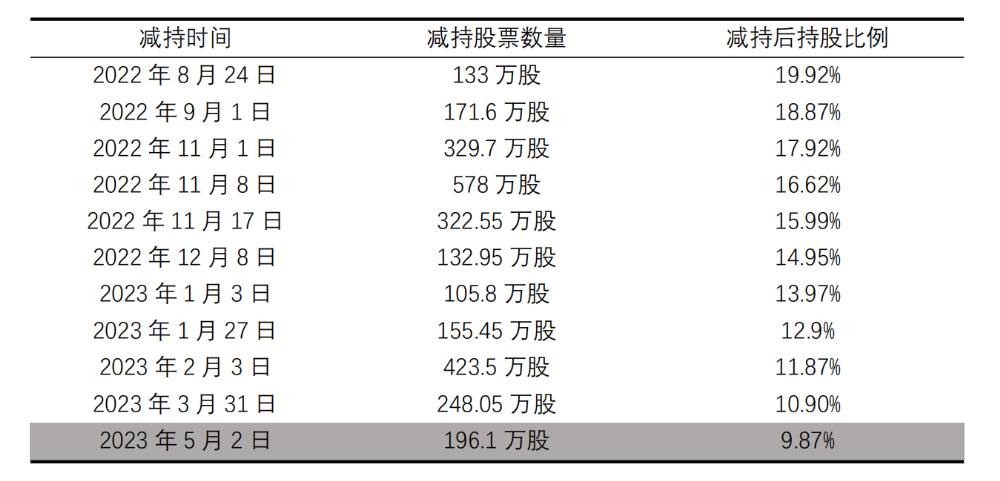

It is reported that this reduction is the HKEx this year, the fifth disclosure of Berkshire Hathaway's reduction of BYD H shares, but also since August 2022, the company disclosed the eleventh reduction of information.。Following this reduction, Berkshire Hathaway's stake in BYD is approximately 1.08 million shares。

Since Buffett bought BYD for HK $8 in 2008, the weather-beaten old man and the huge Berkshire investment empire behind him have been with the new energy vehicle upstart for 14 years.。Before 2021, the share price of BYD shares fluctuated, sometimes rising more than 10 times, sometimes halving from the high, speculators bustled, came and went, only Buffett majestically, firm position。In January 2021, BYD shares ushered in the outbreak, all the way to HK $278, people exclaimed that the "stock god" once again made a lot of money, can be glorious exit, but Buffett still choose to hold the same position.。

It wasn't until August 2022 that the stock gods finally began to choose to leave the market and got out of control, causing the HKEx to disclose the reduction six times in four months。But in that year, BYD won the global sales champion of new energy vehicles, the annual net profit for the first time exceeded 10 billion scale, a time of unlimited scenery。

When he held a position, he "let the wind and waves rise, sit firmly on the Diaoyutai," and when he left the field, he "watched your horse go as fast as a bird," perhaps in the world of "stock god," there are many ideas that we can't understand.。

Economic slowdown warning "stock god" investment strategy may change; witnessing Ford's fall in the auto industry is a heart knot that cannot be avoided.

In fact, Buffett's continuous reduction of BYD, not the latter was "targeted," perhaps because of the change in the economic environment, "stock god" investment strategy has changed, to reduce positions.。

At the Berkshire Hathaway shareholder meeting on May 6, Buffett announced Berkshire Hathaway's first quarter 2023 results。Data show that Berkshire sold $13.2 billion worth of shares during the reporting period, buying just $2.8 billion of shares and selling as much as $10.4 billion net。Not only that, but even Berkshire's existing equity investments, positions are relatively concentrated。Data show that as of March 31, about 77% of the company's equity investments at fair value were concentrated in five companies, namely, American Express ($25 billion), Apple ($151 billion), Bank of America ($29.5 billion), Coca-Cola ($24.8 billion) and Chevron ($21.6 billion).。

In response, Buffett said the market is not at the same pace as it was six months ago, and everyone is preparing for the upcoming economic slowdown this year.。Earlier, Buffett's close comrade, Berkshire Hathaway chief associate director Charles Munger (Charles Munger) also said in an interview that the golden age of investment is over。

Earlier, Buffett also said in an interview with the media that during the sale of BYD, BYD's sales performance was excellent, and the reason for selling BYD shares was "for better capital allocation."。It can be seen that Buffett's move is to plan for the future of Berkshire Hathaway。

In addition, the intensity of competition in the automotive industry may also "dissuade" the stock gods to some extent.。

Buffett said bluntly at the shareholders' meeting that for a long time, he and Munger both believed that the auto industry was "too tough."。He cited Ford as an example: "Historically, when Henry Ford (Henry Ford) creatively launched the Model T, it seemed to have the world。But just two decades later, Ford started losing money。"

Buffett also cited his "good heart" Apple as an example, saying he could predict what Apple would do in five or 10 years, but he didn't know what the car company would do in the future.。Although the automotive industry will not disappear, the automotive industry in 5 to 10 years will certainly be very different from the present, and the automotive architecture and market structure will change dramatically.。

Perhaps for the automotive industry, the old man does have his own knot。In 1908, Ford Motor Company's epoch-making Model T was released, and its first year of production broke the auto industry's all-time record, and millions of American families have since owned their first car.。By the end of 1913, Ford Motor Company was already producing half of the country's total automobile production。However, by the time Henry Ford was in his later years, Ford began to go downhill due to poor management and the company was in the red.。In the 1940s, Ford was already behind GM and Chrysler.。

Buffett was born in August 1930, and his upbringing was accompanied by the rise and fall of Ford.。To this day, he is still thinking about it, saying that "the previous Ford financial statements were really amazing" and that many of his friends have joined Ford, including some giants.。

Munger also said at the shareholder meeting that the electric vehicle market brings huge capital costs and huge risks - but I don't like the huge capital costs and huge risks。He also later said in a Q & A, "Warren and I look for simple jobs that we can identify.。"

Perhaps for the "stock gods," to accompany the enterprise "up the mountain" road again difficult and dangerous they may not be afraid, the road ahead of the road is not yet determined, they are worried.。

Berkshire recently increased its stake in Japan's five largest trading houses to 7.4%, making it the company's largest investment outside the U.S.。In this regard, Buffett said that the decision to invest in Japan (trading companies) is actually very simple, from the overall point of view, these companies can pay good dividends, in some cases will buy back shares, he can also have a good understanding of a lot of their business, while the company can also solve the problem of exchange rate risk through financing, the next two sides may have to work together for 20, 30, 40 or 50 years.。

In addition, Berkshire has been steadily adding to its Western Oil position since March last year and now holds 23 of the company's.6% of the shares。In response, Buffett said that investing in Occidental Petroleum was a completely wise decision and that he was very bullish on Occidental's location in the Permian Basin and its numerous high-quality wells。Buffett also noted that he greatly appreciates Occidental's management and does not rule out continuing to increase his holdings in the future。

BYD: This month's sales nearly doubled year-on-year plans to build a new parts assembly plant in Vietnam

BYD, the recent good news is frequent。

At the end of April, BYD released its first quarter 2023 results。Data show that the company's net profit during the reporting period increased by more than 400% year-on-year, recording 41.300 million yuan, ushered in the "epic breakthrough"。In addition, BYD's cumulative sales in the first quarter reached 55.210,000 vehicles, up 89.47%。In the face of impressive record, during the 2023 Shanghai International Auto Show, Li Yunfei, general manager of BYD's brand and public relations department, put down his rhetoric in an interview, saying that BYD is targeting sales of 3 million vehicles this year.。

On May 8, the China Automobile Association released the April sales of major auto companies.。According to the latest data, BYD recorded 210,295 sales this month, up 98% from 106,042 in the same period last year..31%, nearly doubling; cumulative sales recorded 762,371 units, up 91% from 397,420 units in the same period last year..83%, also close to doubling。

Data show that in this month's sales, BYD ranked second only to SAIC, but the latter's cumulative year-on-year sales fell 8.8%, and BYD gap is gradually narrowing。

In addition, it is reported that on the afternoon of May 5, the Deputy Prime Minister of the Vietnamese government, Chen Honghe (Trîn Hîng Hà), met with Wang Chuanfu, Chairman of BYD Co., Ltd. in Hanoi to discuss BYD's plan to build a new energy vehicle parts assembly plant in Vietnam.。Wang Chuanfu said that BYD hopes to continue to expand the scale of manufacturing and investment in Fushou Province, and promises a new step to improve technology to achieve sustainable development.。

According to Wang Chuanfu, BYD will use the best technology to expand into the field of electric vehicle manufacturing and assembly, serving the Vietnamese market and exporting to Southeast Asia。He expressed the hope that the local government will facilitate the early completion of the investment permit and put the electric vehicle manufacturing and assembly project into operation as soon as possible.。

Earlier, according to Philippine Trade Department officials, the Philippines, Vietnam and Indonesia were also scrambling to attract BYD to build an electric vehicle assembly plant.。

If this investment expansion plan can be carried out, BYD's production scale will be further enhanced, which will help BYD allocate resources on a global scale, enjoy the cost convenience brought by economic globalization, further open up the production capacity space, profit space and overseas markets of car companies, complete its annual performance targets under high standards and high requirements, and promote domestic high-quality electric vehicles to open up the country and go global.。

As of press time, BYD shares fell 0% during the day.92%, reported 237.HK $80。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.