Buffett Enters Insurance Industry Again! Berkshire's mysterious position exposed

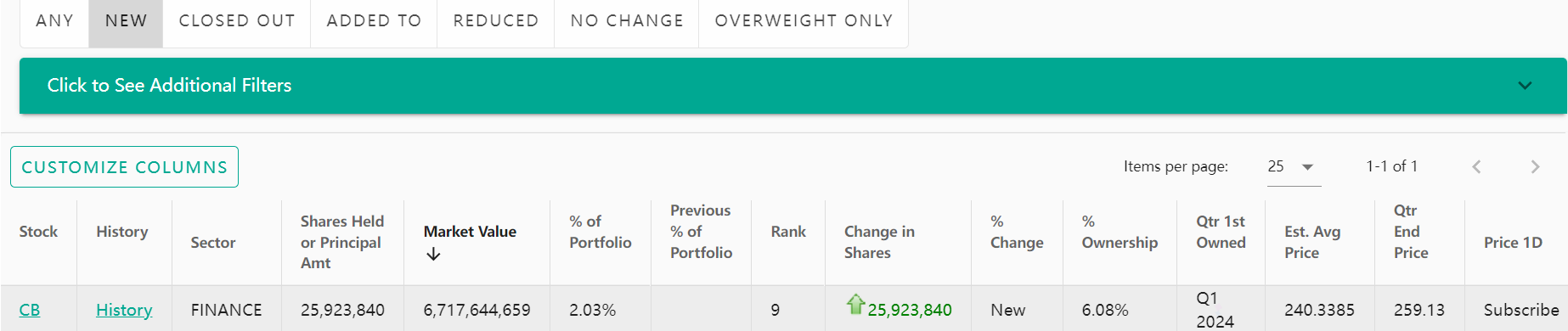

According to the documents, as of March 31, Berkshire holds over 25.9 million shares of Anda Insurance, valued at approximately $6.7 billion. Anda Insurance has also become Berkshire's ninth largest holdings.

On Wednesday, Berkshire Hathaway, a subsidiary of Buffett, disclosed its latest holdings in the latest 13-F document. In this regulatory document, it was found that Buffett quietly invested heavily in an insurance stock.

Mysterious Heavy Stock Exposed

Previously, it was speculated that Buffett may have bought a bank stock significantly. Because in the second half of last year, Berkshire's cost of holding equity in "banking, insurance, and finance" increased by $3.59 billion, and another $1.4 billion in the first quarter of this year.

Now this mysterious stock has finally been revealed, which is Chubb, one of the world's largest insurance companies listed in New York.

According to the documents, as of March 31, Berkshire holds over 25.9 million shares of Chubb, valued at approximately $6.7 billion.

Buffett has been increasing his stake in Chubb since the beginning of the year, but Berkshire has requested regulatory authorities to keep the increase confidential.

In the United States, institutional investment managers managing over $100 million are required to report their holdings in regulatory documents, but they may request "confidential treatment" of some of their positions. This can prevent other investors from buying the same stock, thereby pushing up the price of the stock.

It is reported that in the third and fourth quarters of last year, Berkshire obtained permission to keep one or more of its shareholding details confidential. Until now, the company has only shown its position in Chubb, indicating that Buffett has completed the basic construction of his position in Chubb. As of the end of the first quarter, Chubb accounted for approximately 2% of Berkshire's investment portfolio and has become Berkshire's ninth largest holdings.

Berkshire's requirement for "confidential processing" of its holdings is relatively rare. The last time its holdings were kept confidential was when it purchased Chevron and Verizon in 2020.

Chubb is one of the largest insurance companies in the world, with operations in 54 countries. The company offers products such as family insurance, car insurance, and liability insurance.

Insurance company Ace Limited acquired the original Chubb for $29.5 billion in cash and stock in 2016, and the merged company adopted the name "Chubb".

The current Chubb is led by CEO Evan Greenberg and has approximately 40,000 employees. Evan Greenberg is the son of Maurice Greenberg, former chairman and CEO of insurance giant American International Group.

Chubb's stock price closed at $252.97 on Wednesday, with a total market value of over 100 billion. So far this year, Chubb Insurance's stock price has risen by 12%. After exposure of Berkshire's holdings, Chubb rose more than 8% in after hours trading.

"Chubb is an attractive equity investment for Berkshire because it operates a business familiar to Berkshire: property casualty insurance," said Cathy Seifert, a research analyst at CFRA, in a report. "As investors react to this news and speculate whether Berkshire will retain Chubb's equity or make a complete acquisition, the company's stock price may rise on Thursday morning."

Seyfert stated that Berkshire's equity allows it to access one of the best performing financial industry subsidiaries at a valuation lower than its peers. Seyfert wrote, "We cannot speculate whether Berkshire will directly acquire Chubb Insurance, but we note that their business portfolio is highly complementary."

Berkshire has a huge influence in the insurance industry, with a range of family and life insurance services under its umbrella. Geico, the fourth largest car insurance company in the United States, is a partner of Berkshire. General Reinsurance, a reinsurance giant, also belongs to Berkshire. In addition, Berkshire also acquired insurance company Alleghany for $11.6 billion in 2022.

Buffett once stated that the property casualty insurance business is Berkshire's "core" because it helps generate liquidity and then reinvest the funds.

Other significant position changes

Besides Chubb, what other noteworthy changes in Buffett's holdings in the past quarter are there?

The first step is to reduce his holdings in Apple stocks, as mentioned by Buffett at his annual shareholder meeting on May 4th.

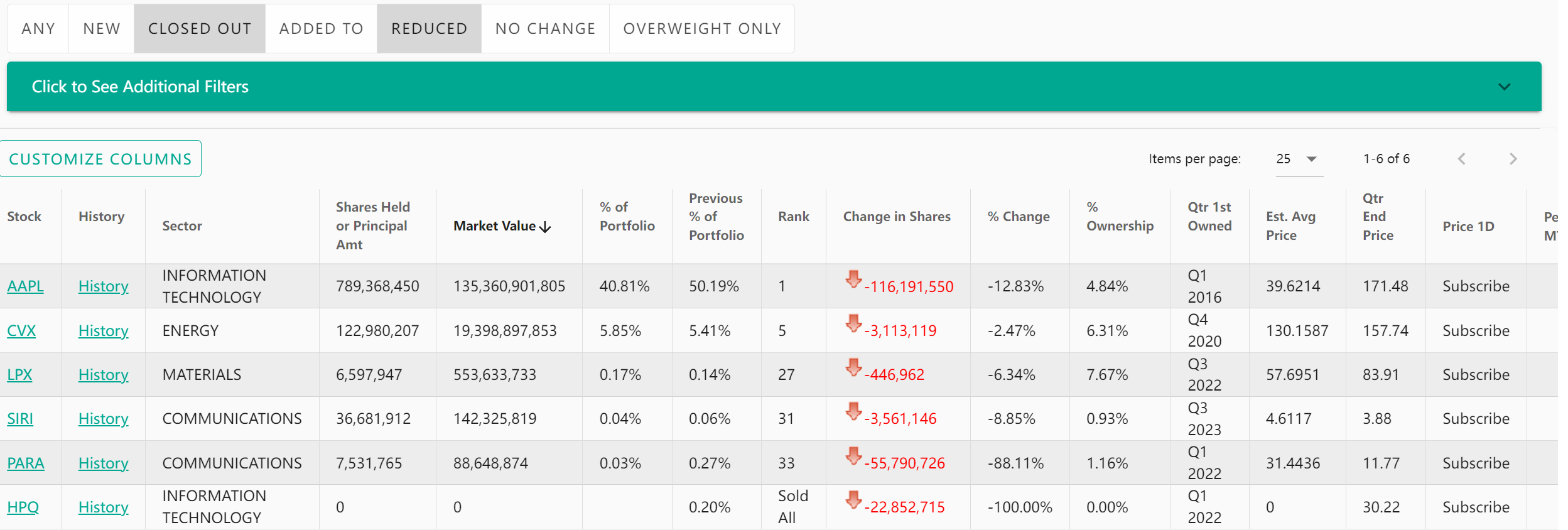

According to the 13-F file, Berkshire has reduced its holdings of over 116 million shares in Apple Inc. Nevertheless, Apple remains Berkshire's largest heavyweight stock, with its share in its investment portfolio decreasing from approximately 50% to around 40%. Although he significantly reduced his holdings in Apple, Buffett has stated that by the end of this year, Apple will still be Berkshire's largest holding.

Berkshire also reduced its holdings in four stocks, including Louisiana Pacific and Sirius XM, and sold off all of its holdings in computer manufacturer HP.

As Buffett remained cautious about the market and did not make too many new investments, as of the end of March, Berkshire had a record high of $189 billion in cash and equivalents.

Previously at the shareholder meeting, Buffett stated that by June this year, Berkshire's cash holdings could reach $200 billion. He said that considering what is happening in the world, cash looks quite attractive compared to high priced stocks.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.