U.S. Treasury bonds collide with two billionaires who can be better.?

Bill Ackman, founder of hedge fund Pershing Square Capital Management, said he was shorting 30-year U.S. Treasuries.。

Bill Ackman, founder of Pershing Square Capital Management, a hedge fund, said he was shorting 30-year U.S. Treasuries.。

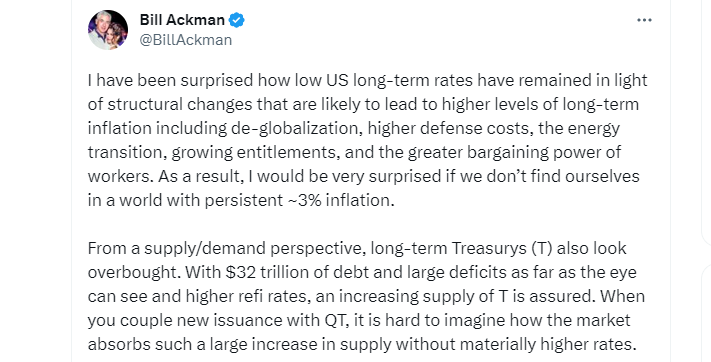

Ackerman revealed his hedge fund's new bet on shorting 30-year Treasuries on social platform "X" (formerly Twitter), a move he called a means of hedging the impact of rising long-term interest rates on stocks。

Ackerman explained his reasons for shorting U.S. debt: "First, to hedge against the impact of rising long-term interest rates on stocks, and second, because we think it's a high probability independent bet."。Few macro investments still provide a fairly likely asymmetric return, and this is one of the。"

Bond prices tend to be inversely related to interest rates。When interest rates rise, bonds usually fall。Traders may short bonds if they think they will fall。

The Fed has raised interest rates sharply over the past year to cool soaring inflation.。While this has helped ease consumer price pressures, at the same time the market is concerned that any further rate hikes could hurt the U.S. economy.。

Ackerman said deglobalization, high defense costs, the energy transition, growing benefits and increased bargaining power for workers could trigger higher levels of inflation。

He argues that if the long-term inflation rate is 3% instead of 2%, on top of that, add 0.5% real interest rate and 2% term premium, then the 30-year Treasury yield could reach 5.5%, and "This could happen soon."。

Ackerman said, "The best hedge is the hedge you will invest in anyway, even if you don't need to hedge。That meets that requirement, and I think we need to hedge. "。He added that they implemented these hedges by buying options rather than directly shorting bonds。

Ackerman has made huge gains in hedging in the past。Last year, Pershing Capital made about $5 billion in profits by hedging the epidemic and raising interest rates early。

His re-shorting of bonds comes just a day after Fitch downgraded the U.S. long-term foreign currency debt rating to AA + from AAA, citing an expected deterioration in the U.S. fiscal position over the next three years and a high and growing government debt burden.。The news surprised the market.。

Fitch mentioned that the Fed is expected to raise interest rates further to 5 by September..5% to 5.75%。"While headline inflation fell to 3% in June, core PCE inflation in the Fed's key price index remained high, up 4.1%。This could prevent the federal funds rate from being lowered until March 2024.。In addition, the Fed will continue to reduce its holdings of mortgage-backed securities and U.S. Treasuries, which will further tighten financial conditions。"

Interestingly, another billionaire, Warren Buffett, has a very different view.。Buffett said his fund bought $10 billion in U.S. Treasuries on Monday, the same amount it bought last Monday.。

Buffett has not been affected by Fitch's downgrade of the U.S. credit rating.。He acknowledged that Fitch had some good points, but said investors should not worry too much.。Buffett says company will continue to buy $10 billion in Treasuries every week。

Buffett's Berkshire Hathaway is one of the world's largest holders of U.S. government debt.。At the end of March, the company reported $104 billion in short-term investments in U.S. Treasuries.。

Buffett has recently stressed that Berkshire's bond holdings are increasing in value as Fed rate hikes push up bond yields。He estimated in April that Berkshire's investment in Treasuries would yield $5 billion, or an annual return of nearly 5 percent.。

Buffett said in an interview that he doesn't agree with the federal government's actions, but he still has confidence in the U.S. Treasury and the dollar。He said: "The dollar is the world's reserve currency and that's what everyone knows.。"

Goldman Sachs is also optimistic about the dollar and U.S. debt.。Goldman Sachs says dollar and Treasuries remain global safe havens for investors even as Fitch downgrades U.S. government debt。

Goldman Sachs economist Michael Cahill said in a note on Thursday: "We do not believe there will be any meaningful bond holders forced to sell as a result of the downgrade.。When investors desperately need safety, they still need to turn to Treasuries。"

Cahill added: "For similar reasons, the dollar remains a safe haven in a market with rising yields and falling equity markets, which is a key reason why the dollar has performed so well in 2022.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.