What is the logic behind Buffett's more and more buying?

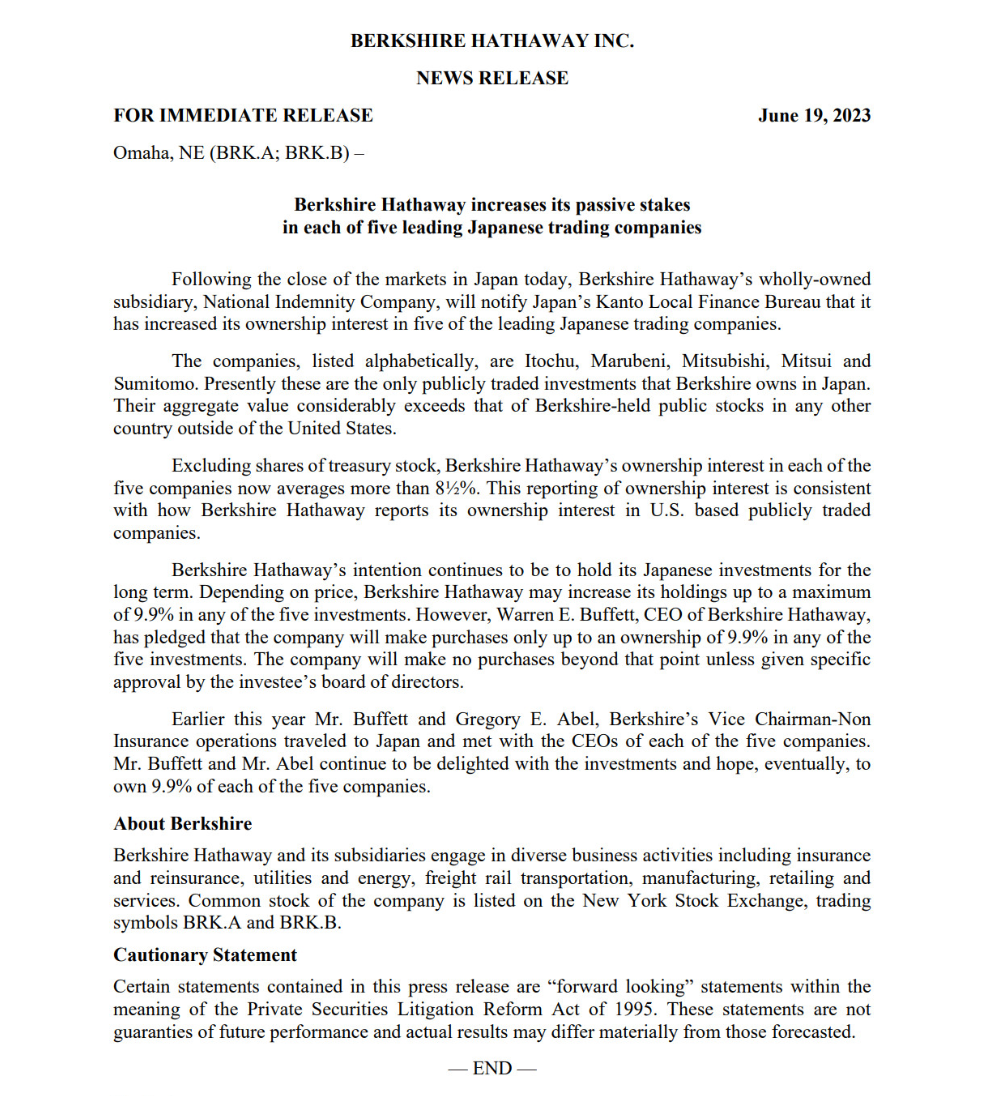

On June 19, after the close of the Japanese stock market, "stock god" Buffett (Warren Buffett) Berkshire Hathaway company issued a statement on its official website, said that it has been wholly owned subsidiary National Indemnity Company in Japan's five largest trading company's average shareholding ratio increased to 8.More than 5%。

On June 19, after the close of the Japanese stock market, "stock god" Buffett (Warren Buffett) Berkshire Hathaway company issued a statement on its official website, said that it has been wholly owned subsidiary National Indemnity Company in Japan's five largest trading company's average shareholding ratio increased to 8.More than 5%。

Investing in these five companies is tantamount to betting on Japan's "national fortunes."

In the statement, Berkshire renewed its confidence in the Japanese market, saying that its investment vision remains "long-term holdings in Japanese assets," but depending on the price, the shareholding ratio will not exceed 9..9%。In addition, Berkshire also said in a statement that it will not do so in the future unless specifically approved by the investee's board of directors..any acquisition after the 9% threshold。

Buffett's five largest companies in Japan are Itochu, Marubeni, Mitsubishi, Mitsui and Sumitomo.。Among them, the competitive advantage of Itochu and Marubeni lies in their non-resource areas, the former in the food, financial field is quite successful, while the latter in food, electricity and other industries have greater advantages, committed to the development of offshore wind power industry.。The remaining three companies are involved in a large number of integrated trade business, covering energy, metals, machinery, chemicals, food and other fields, overall in the field of resources is relatively leading。

It is understood that the consortium of the five major trading companies control nearly 99% of Japan's large production enterprises and trading companies, it can be said that investing in these five trading companies is equivalent to betting on Japan's "national transport."。

Specifically, in this increase, Itochu's shareholding was reduced by Berkshire Hathaway from 6.21% to 7.47%; Sumitomo's shareholding increased from 6.57% to 8.31%; Mitsui's shareholding increased from 6.62% increased to 8.09%; Marubeni's shareholding increased from 6.75% to 8.3%。

Since the beginning of this year, the share prices of the five major trading companies have performed quite brightly.。Among them, Marubeni and Mitsubishi Corporation are up about 65%, Sumitomo Corporation rose more than 42%, Itochu Corporation shares rose more than 37%, Mitsui shares also rose nearly 20%, the five major trading companies during the year the average increase has reached a staggering 45.8%。

Japan may become Buffett's largest investment destination outside the United States

As we all know, Buffett has two pieces of heart, one is Apple, one is Western oil。Now, Buffett's investment empire has included another long-term investment target - Japan's five largest trading companies.。

Buffett's investment in Japan dates back to 2008。At that time, Berkshire's Israeli metalworking company, Iscar Metalworking Group, acquired the unlisted Japanese company Tacolo 71..5% stake, the latter is a subsidiary of Toshiba, has developed into a world-renowned tool manufacturer.。Three years later, Buffett traveled to Japan to participate in a ribbon-cutting ceremony for a new plant in Taekelo。In an interview with the media, Buffett said he would take the opportunity to conduct a field trip to Japan to find more investment opportunities.。

Since 2020, the "stock god" has gradually accelerated the pace of investment in Japan, first in the year for the first time disclosed the holding of 5% of the shares of the five major trading companies, and then in April this year during a visit to Japan again revealed that, following last November to increase the shareholding ratio to 6%, has once again pushed up the shareholding ratio of each trading company to 7.4% and consider further investments in Japanese stocks。

In an interview with the media, Buffett, who has always focused on value investing, said Berkshire will continue to invest in Japanese trading companies for "10, 20 years."。He believes that the stock market in the next three to five years is not important, but one thing is certain is that in 20 or 50 years, Japan and the United States will be stronger than they are now, and Japan may become the largest investment destination outside the United States.。

This time Buffett once again increased his holdings of Japan's five major trading companies, but also a side show of Buffett's determination to make a firm bet on Japan。Although the shareholding is gradually increasing, Buffett is not expected to fully acquire the aforementioned companies。He has said in his shareholder letter that the problem that overall mergers can create is that most really great businesses have no interest in letting anyone take over them.。Owning a non-controlling stake in a good business is more profitable, enjoyable and involves much less work than owning a difficult business with a 100% holding。

Where the Japanese stock market is attractive to foreign investment?

Last week, the Nikkei 225 index rose strongly to 33,800 points, rising for the 10th consecutive week, and has become the focus of the world's attention.。During the year, the index was also second only to the Nasdaq 100, which was driven by the wave of artificial intelligence, and ranked second among major markets.。

In which the influx of foreign capital contributed。According to statistics from Japan's Ministry of Finance, foreign investors have bought Japanese stocks on a net basis for nine consecutive weeks, totaling 7.4 trillion yen (about $52 billion), while overseas trading contributed 70% to Japanese stocks' gains this year。

What is the attractiveness of the Japanese stock market to foreign investors??The reason for this is that Japan's relatively loose monetary policy is the main factor.。

Starting in 2013, in order to reverse Japan's low inflation rate and economic growth rate, Japan launched a massive economic stimulus and introduced the YCC policy.。Under this policy, the Bank of Japan, in addition to keeping short-term interest rates at -0.In addition to 1%, it also seeks to keep the 10-year Treasury yield around zero by buying Treasuries.。However, such "ultra-quantitative easing" does not seem to have played a very good effect, and even in April this year, the Bank of Japan's new governor Ueda and the beginning of the term, the market is betting that the "camera decision-making faction" will gradually make YCC withdraw from the stage of history。

Surprisingly, under the leadership of the new central bank governor, Japan has chosen to continue its previous easing policy and maintain a relatively loose liquidity environment, which is particularly valuable in an environment of repeated inflation.。Looking at several of the world's major developed countries, the Bank of Australia and the Bank of Canada have been forced to restart the process of raising interest rates after the suspension of interest rate hikes;。

As a result, Japan has been transformed from an inflationary barren soil into a depression for foreign investment, with funds from across the ocean embracing the world's few pure land of investment that is still stimulating inflation.。

Last week, the Bank of Japan held a meeting on interest rates and announced that it would keep the policy rate at -0..1% unchanged, keeping the 10-year Japanese government bond yield target at around 0% and not modifying the yield curve control (YCC) policy, giving the market another boost。

The Bank of Japan says it will not hesitate to increase easing if necessary to achieve a sustainable 2% inflation target。The bank will also continue to buy bonds on a large scale, continue to buy Treasuries at fixed rates, and have the flexibility to increase bond purchases if necessary.。Bank of Japan Governor Kazuo Ueda said that the current economic uncertainty is still very high, sustained and stable realization of the 2% price increase target "will take time."。

In the current round of monetary policy with proper stimulus, the participation of Ueda and men has contributed。As you can see from his past experience, the new Prime Minister of the Bank of Japan has never been stingy in launching massive monetary easing when the economy needs stimulus。

In the 1990s, Japan's potential growth rate plummeted from 4 per cent to 1 per cent in 10 years, dragged down by the bursting of the bubble economy and an ageing population.。In order to address the problems of continued deflation and the deteriorating economic situation, in February 1999, the Bank of Japan decided to introduce a zero interest rate policy and made it clear in April of that year that it would "maintain the zero interest rate policy until deflationary pressures are removed."。

Behind the zero interest rate policy at this point, there is the shadow of Ueda and the man。At the time, he was a member of the Bank of Japan's Policy Committee and actively guided the landing of the policy by constantly expressing his policy intentions.。In addition, when then-central bank governor Yoshihiro Kushiro decided to tighten monetary policy in 2000, Kazuda voted against it, arguing that the Japanese economy was "at risk of a resurgence of deflation."。Sure enough, two months later, dragged down by the U.S. tech bubble, Japan's economy is down again.。

Can Japanese stocks still go up??

Institutions are also divided on the future direction of the Japanese stock market。

Some institutions believe that the future direction of the Japanese stock market is closely related to its monetary policy, if the Bank of Japan is determined to end the YCC policy, the Japanese stock market may be under pressure, promoting the return of foreign investment.。

China Merchants Securities said that if the next year, Japan's economic recovery certainty, inflation continues to more than 2%, and the international financial and foreign exchange environment is stable, the Bank of Japan or the opportunity to end negative interest rates and YCC policy, will have a significant spillover effect.。On the one hand, 10Y Japanese bond yields will be under significant upward pressure, the yen or a sharp appreciation。On the other hand, it will promote the return of Japanese stock funds and accelerate the incremental inflow of international capital into Japanese financial markets.。

Ping An's first team said that the enthusiasm for short-term foreign allocation of Japanese stocks may continue, but there is more uncertainty about the sustainability of the current round of Japanese stock gains。First, there may be a risk of cooling risk appetite in U.S. and European stock markets。In the event of a correction in the U.S. and European stock markets, Japanese stocks will probably be affected as well.。Second, the risk of yen appreciation is increasing。Japan's monetary policy shifts to rising pressures amid prolonged higher inflation。Once again, Japan's economic "thriving" may only be temporary。The relatively positive performance of Japan's nominal economy, as well as its increase in the stock market, may not be sustainable.。Finally, it remains to be seen whether the "Daily Special Assessment" will actually materialize.。Over time, especially after 1-2 earnings quarters, the profitability, buyback and market capitalization management capabilities of Japanese listed companies will be examined.。

Some institutions also said that Japan will not end its massive stimulus program in the short term, and the Nikkei may rise further.。

Bank of America Securities Japan chief economist Izumi Devalier (Izumi Devalier) recently said that the Bank of Japan has maintained more than 20 years of loose monetary policy is expected to normalize, but eventually to the end of 2024 to achieve。Nikkei may move further up as Japan's domestic economy improves further。

Charu Chanana, market strategist at Saxo Bank, said in a report: "The tailwind in the Japanese stock market continues to increase.。While there had been previous predictions that Berkshire would continue to increase its stake, the announcement came earlier than expected and will further boost optimism about Japanese stocks。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.