Forecast of US Dollar Trend in 2024

With the Federal Reserve poisoned to begin cutting interest rates this year, the dollar may drift generally downward.However, its performance against individual currencies may vary widely.

2024 is expected to see a divergence in the trajectory of the US dollar. At the outset, the dollar may experience a decline on a broad trade-weighted basis but is anticipated to stabilize over time. While overall, a downward trend is projected for the dollar, the performance against various currencies may vary significantly.

For international investors, this signifies opportunities in allocating to foreign markets, albeit requiring careful selection. Currency fluctuations can impact returns, either positively or negatively.

Impact of Monetary Policy

In recent years, the robust performance of the dollar has been primarily supported by the relative strength of the US economy and high interest rates. However, with the Federal Reserve hinting at halting rate hikes last fall, the dollar began its descent. With expectations of the Fed shifting towards rate cuts by mid-2024, the interest rate differentials are expected to narrow, thereby diminishing the allure of holding dollars. Despite nominal US interest rates still surpassing most other G10 countries, the gap is narrowing.

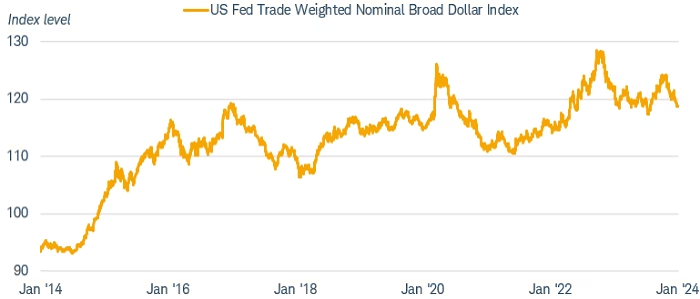

Federal Reserve's Trade-Weighted Dollar Index

One of the challenges in discussing the outlook for the US dollar is determining which dollar index to use. In a floating exchange rate system, the dollar can move in multiple directions simultaneously.

We tend to look at the Federal Reserve's broad trade-weighted index to obtain a comprehensive indicator of the dollar's trend. Because this index is weighted by the value of trade with other countries, it provides a way to assess the strength of the dollar based on its usage. However, it does not always account for other forms of demand for the dollar, such as investment or hedging needs, and may mask the dollar's performance relative to individual currencies within the overall trend.

This index is primarily dominated by the currencies of six countries or regions as they are the largest trading partners of the United States. These six countries or regions include Canada, China, Japan, Mexico, the United Kingdom, and the eurozone.

Historical Performance of the Dollar

After reaching its highest point in a decade in 2022, the dollar retraced approximately 10% from its peak but still remains above its five-year average. The robust drivers of the dollar's performance in recent years have been the relative strength of the US economy and high interest rates. With the Fed signaling a pause in rate hikes last fall, the dollar began its descent. It is anticipated that the Fed will shift towards rate cuts by mid-2024, narrowing the interest rate differentials and reducing the attractiveness of holding dollars.

The chart below depicts the US trade-weighted index dating back to January 2014, reaching its peak in mid-2022 and subsequently undergoing a decline.

Comparison of Global Monetary Policies

Apart from the US, the monetary policies of other countries will also influence the trajectory of the dollar. With economic growth slowing in Europe and the UK, the Bank of England and the European Central Bank may follow the Fed in cutting interest rates. In contrast, the Bank of Japan may end yield curve control and raise short-term rates for the first time in decades. These adjustments could pose challenges to the dollar.

Expected performance of other major currencies:

- Japanese Yen (JPY): The Bank of Japan is expected to end yield curve control and may raise short-term rates from negative levels in 2024, leading to yen appreciation. Domestic investors may repatriate funds, reducing the demand for dollars.

- Mexican Peso (MXN): Mexico has benefited from inflows of foreign investment as US policies encourage production to move closer to home. Despite easing inflation pressures, the central bank has maintained high-interest rates. With real interest rates of about 4.5%, as per 10-year government inflation-linked bonds, Mexico remains attractive to investors.

Opportunities in Emerging Market Currencies

The loose monetary policy in the US typically has a positive impact on emerging market (EM) currencies, especially those with significant USD-denominated debt. In 2024, lower US interest rates could stimulate the global economy, alleviate high debt burdens, and make investments in EM countries more appealing. With the Fed shifting from a tightening bias to a neutral or easing bias, EM currencies are expected to continue benefiting from loose monetary policies in major G10 countries.

Nominal Emerging Market Economies U.S. Dollar Index

The Federal Reserve's nominal emerging market economies U.S. dollar index tracks the value of the US dollar against a basket of EM currencies. EM countries vary widely, with significant differences in yields. China dominates among countries issuing debt in their local currencies, with relatively low yields. On the other hand, EM countries issuing debt in USD offer higher yields but come with substantial economic and political risks.

The chart below illustrates the Federal Reserve's nominal emerging market economies U.S. dollar index, indexed to 100 in 2006, reaching 127 as of December 29, 2023.

Investment Strategy Recommendations

Overall, as long as the Fed hints at lowering rates, the dollar may decline on a trade-weighted basis at the beginning of the year. However, the downside for the dollar may be limited as other central banks are expected to start easing policies by mid-year. While a lower interest rate environment is generally favorable for EMs, the risk spectrum is wide. Investors need to assess specific currency exposures and risk levels, prudently allocating to international investments.

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.