Although the seven sisters as a whole are still regarded as an important force in the market, the performance differentiation among their internal members has become increasingly obvious.

On January 20, the earnings of the seven sisters in the U.S. stock market were about to be announced, and Wall Street announced its latest earnings forecast.

The wave of artificial intelligence remains unabated, and Nvidia will continue to face strong growth

Among them, Nvidia is unanimously optimistic by Wall Street analysts due to its dominant position in the AI chip market, and its profit growth in the next 12 months is expected to exceed 137%.

According to FactSet data, although the seven sisters 'overall earnings growth is expected to slow to 21% in 2025, down from 33% in 2024, this growth rate is still well above the 13% average growth forecast for the remaining 493 companies in the S & P 500 index.It is worth noting that the S & P 500's earnings growth in 2024 is only 4%, while it is expected to reach 13% in 2025, indicating the market's optimistic expectations for the overall economic recovery.

Analysts said Nvidia's strong growth expectations are mainly due to its leading position in the artificial intelligence chip market.With the accelerated application of AI technology around the world, the AI chip market will reach US$52.92 billion in 2024 and is expected to reach US$295.56 billion by 2030, with a compound annual growth rate of 33.2%.

As a core player in this field, Nvidia's chips are widely used in many industries such as autonomous driving, industrial automation, and medical care, which has promoted the rapid growth of the company's performance.In addition, Nvidia's continued innovation in data centers, cloud computing and games has laid a solid foundation for its future growth.

However, in sharp contrast to Nvidia's strong performance, Tesla's performance expectations face many challenges.Although Tesla's share price has risen nearly 100% in the past 12 months, Seeking Alpha analyst Wright's Research pointed out that the company is currently overvalued and has limited room for future growth.

According to the latest forecast, Tesla's future earnings are expected to fall by 7%, mainly due to the dual impact of a high interest rate environment and the decline in the value of used electric vehicles.In addition, Tesla's vehicle deliveries in 2024 fell short of expectations, and sales fell throughout the year, which further exacerbated market concerns about its performance.

Analysts said that although the seven sisters as a whole are still regarded as an important force in the market, the divergence in performance among their internal members has become increasingly apparent.With its leading position in the AI chip market, Nvidia is expected to continue to maintain strong growth in the future, while Tesla needs to face challenges from market competition, macroeconomic environment and its own strategy execution.

Opportunities and strategies under the wave of artificial intelligence

After two years of large-scale model arms race, the integration and implementation of artificial intelligence will continue to accelerate in 2024.According to Goldman Sachs statistics, the current investment hotspots in the market are still concentrated in the second phase of AI infrastructure, and relevant infrastructure has not yet been completed.

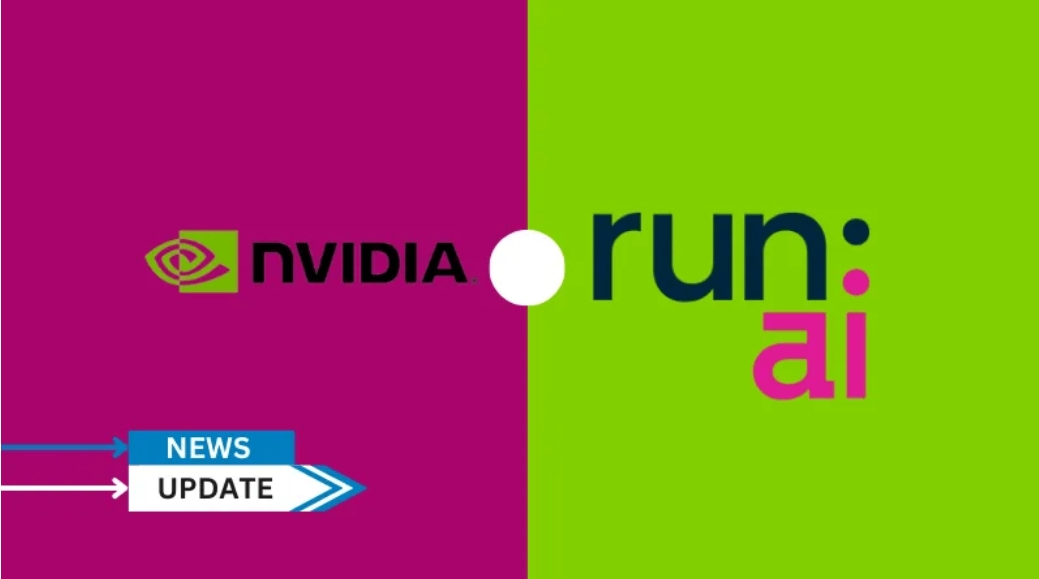

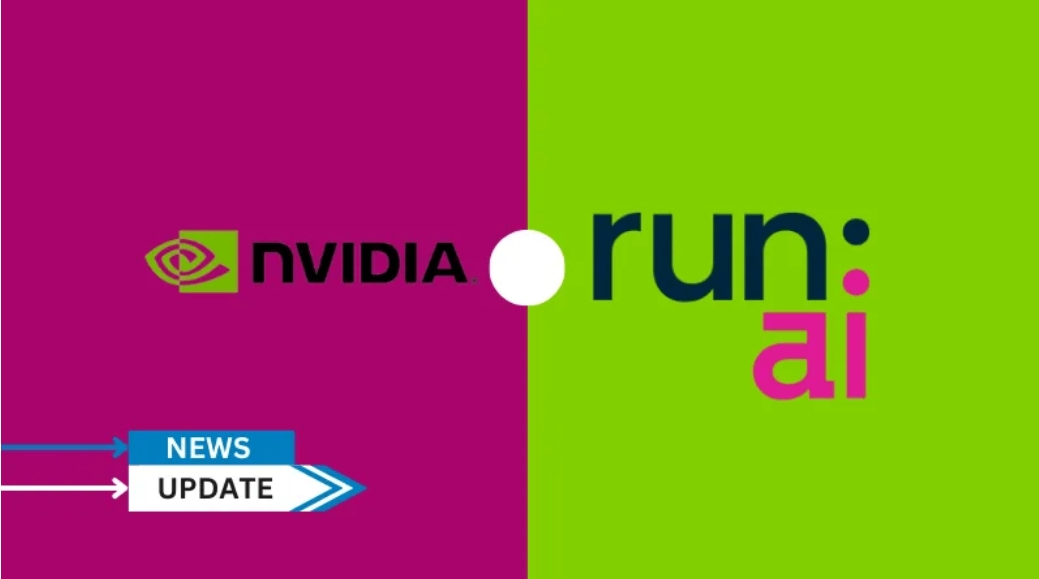

At the same time, a wave of mergers and acquisitions in the AI field is also emerging.Nvidia's acquisition of Israeli startup Run:ai received unconditional approval from the European Union, a move that is seen as an important deployment for Nvidia in the field of AI infrastructure.

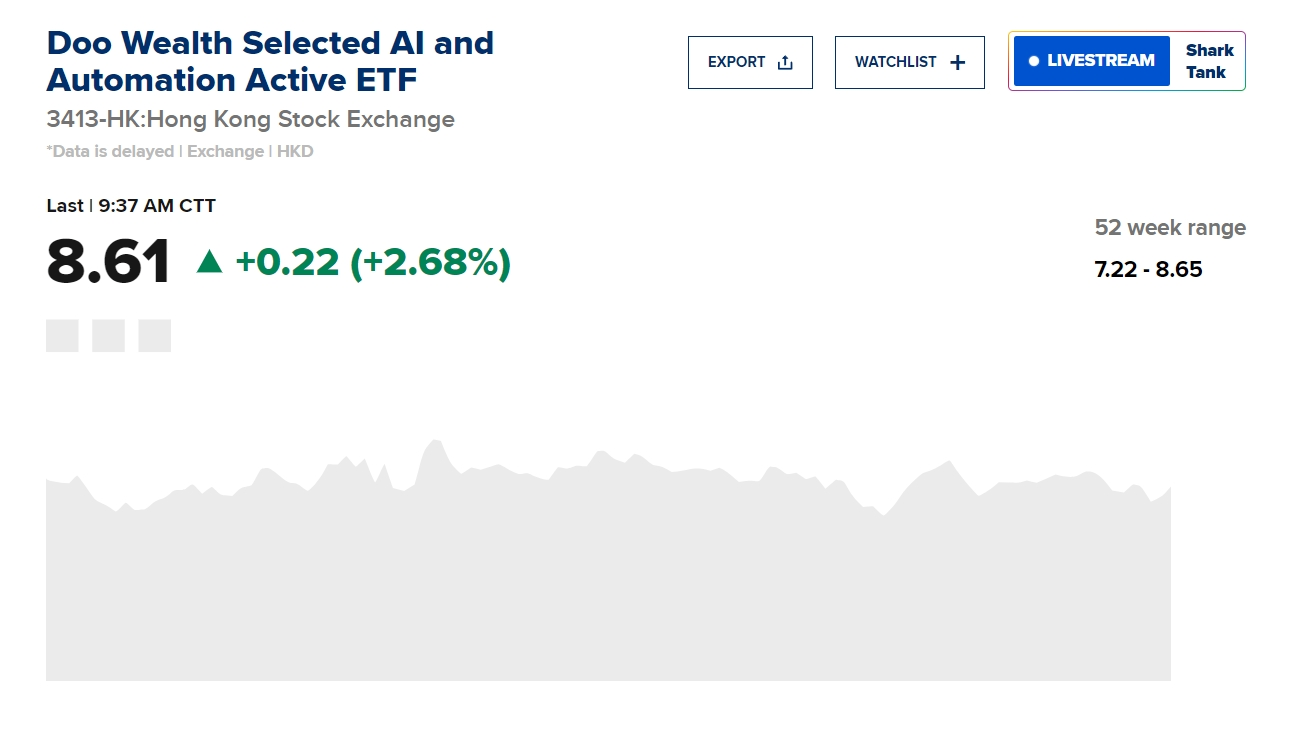

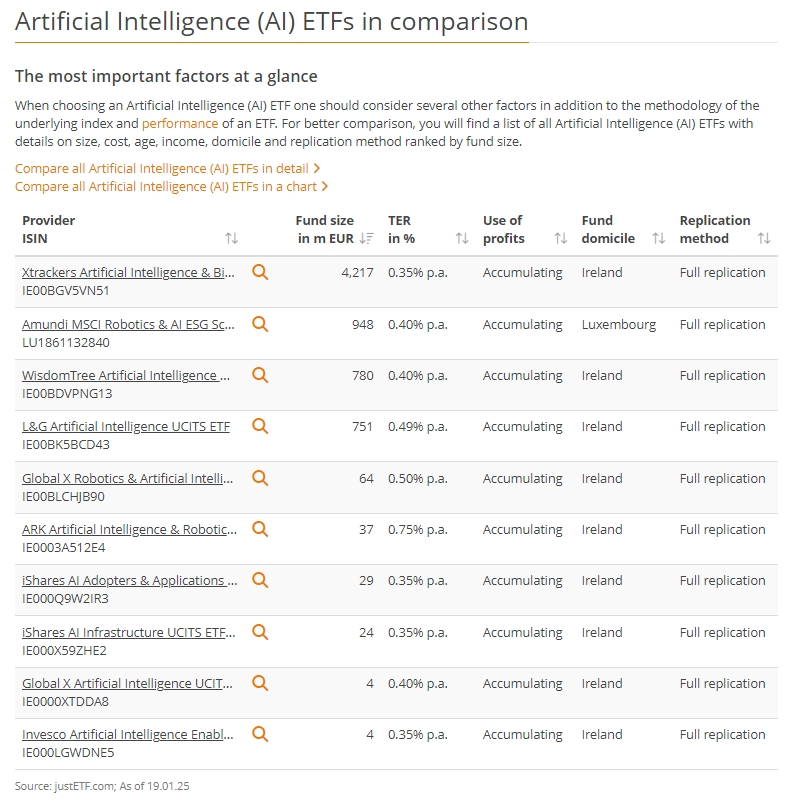

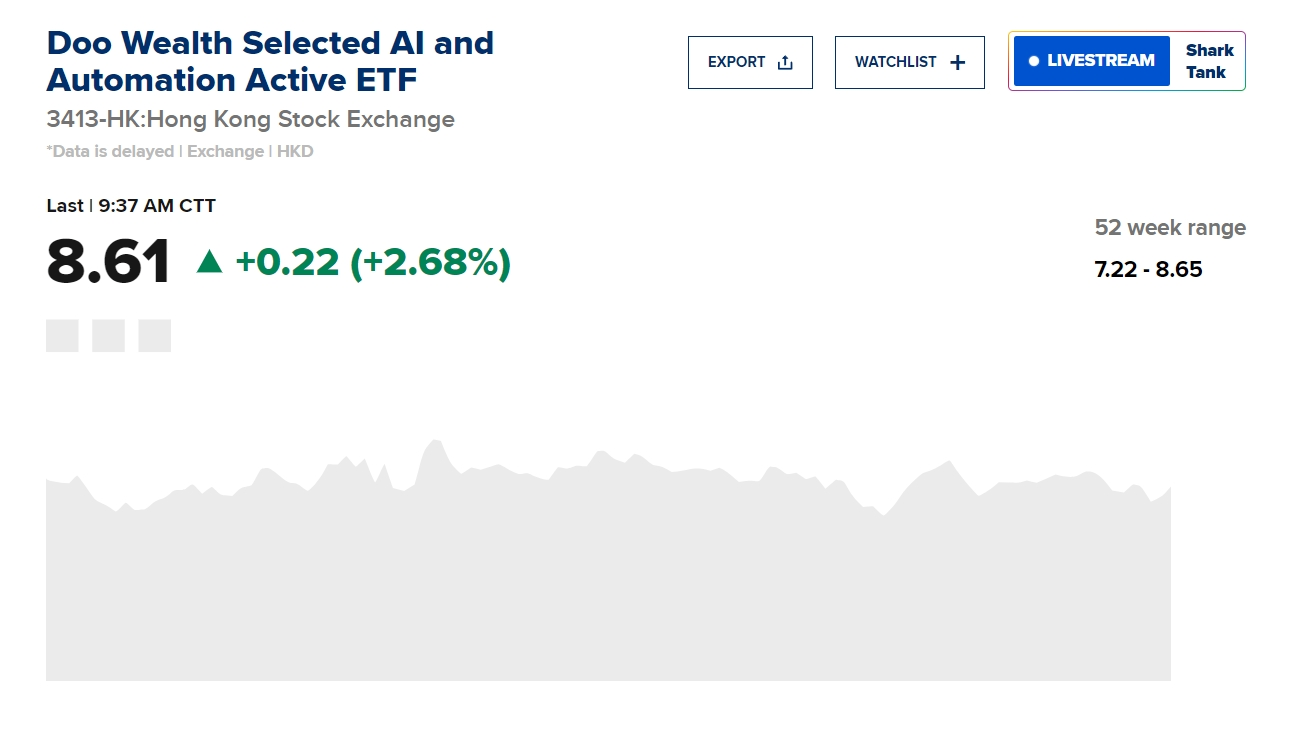

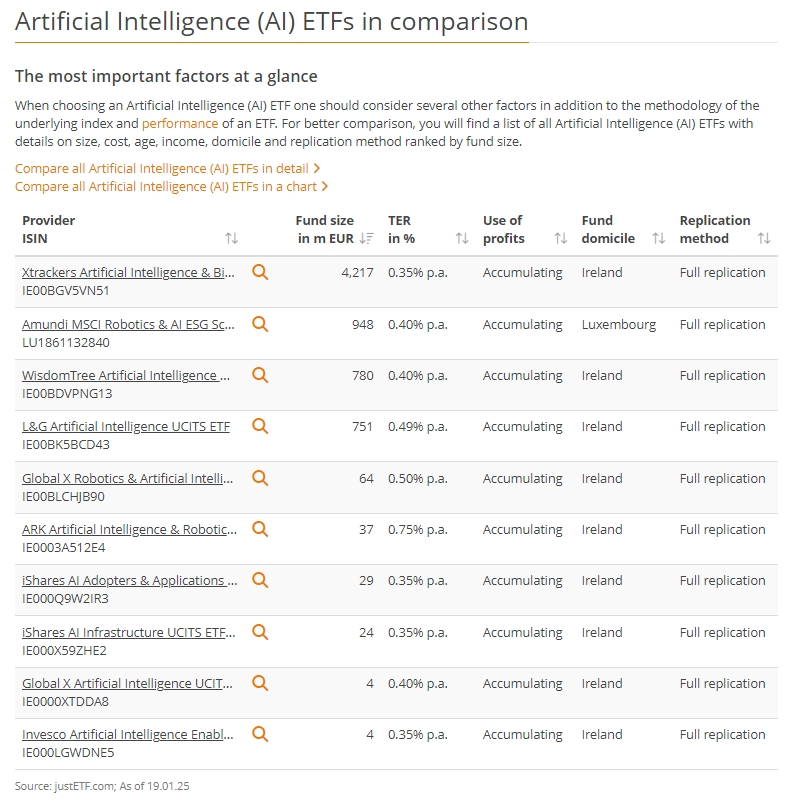

Faced with high stock prices and complex technical analysis, how can ordinary investors participate in this wave of artificial intelligence dividends?Buying artificial intelligence-related ETFs may be an ideal choice.

ETFs have a wide selection of products, providing investors who are not familiar with individual stock analysis with a simple and transparent investment method.Unlike individual stocks, ETFs have no risk of suspension or delisting. Even in extreme bear markets, they can keep trading going normally and provide investors with the opportunity to stop losses and exit.

From a global perspective, generative AI is moving from concept to application, and its contribution to the global economy is huge.According to McKinsey, generative AI is expected to create approximately US$7 trillion in value to the global economy and increase the overall economic benefits of AI by about 50%.In China, the technology is expected to drive transformation in industries such as advanced manufacturing, electronics and semiconductors, consumer packaged goods, energy and banking.

However, the rapid development of the AI market is also accompanied by many challenges.On the one hand, the popularity of AI technology may lead to overcapacity in certain market segments; on the other hand, issues such as data privacy and algorithm bias have also caused market concerns.In addition, the rapid development of AI technology may also have a profound impact on the job market. It is estimated that by 2030, about 50% of work content in China will be automated, which means that about 200 million workers will need to undergo skills transformation.

As AI technology deeply penetrates into various industries, its return on investment (ROI) will also become a key indicator to measure the success of a company.Therefore, when selecting AI-related ETFs, investors should pay attention to the diversity of their underlying assets and market performance to achieve long-term and stable investment returns.

The following are some popular artificial intelligence ETF products on the market, for example only and no recommendations: