Hedge Funds Crazy Short Essential Consumer Goods Stock Tesla Top U.S. Short List for March in a row?

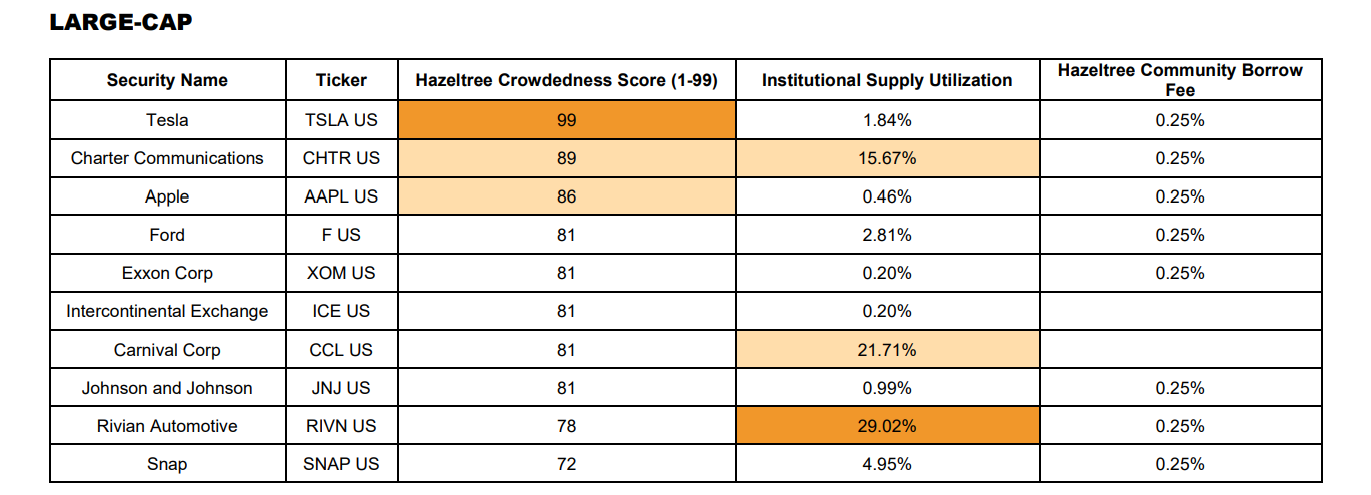

On Sept. 12, securities lending data firm Hazeltree released a report that disclosed the percentage of securities shorting in August。

On Sept. 12, securities lending data firm Hazeltree released a report that disclosed the percentage of securities shorting in August。Among them, among large-cap U.S. stocks, Tesla's stock topped the list of short sellers。

According to Hazeltree, Tesla had the highest percentage of U.S. large-cap stocks shorted by funds in August, and this is the third month in a row that Tesla has topped the list of shorting stocks.。Tesla is followed by communications companies Charter Communications and Apple。

In addition, U.S. electric vehicle manufacturer Rivian has the highest institutional supply utilization rate (the percentage of the supply of specific securities lent by institutional investors)。

Hazeltree said the data in the report was derived from data from its proprietary securities finance platform, which tracks about 12,000 global stocks in the Americas, EMEA (Europe, Middle East and Africa) and Asia Pacific.。In addition, the data came from the Hazeltree community, which includes about 700 asset management funds.。

Tesla is actually shorted.。On June 30 this year, research firm Whale Wisdom disclosed to the US Securities and Exchange Commission (SEC) a series of different strategies for shorting Tesla.。

Among the strategies to short Tesla are fund investors such as Diamond Hill, Leuthold Funds and Forum Funds, according to data compiled by research firm Whale Wisdom。One of Blackstone's funds, on the other hand, holds short positions in other hedge funds and investment managers.。

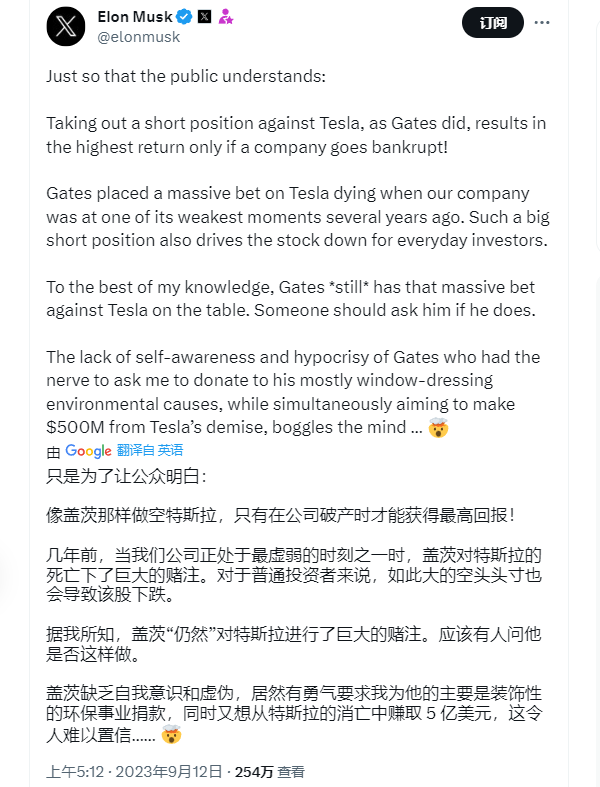

In addition, it has been reported that Microsoft co-founder Bill Gates also holds a short position in Tesla, in response to which Tesla CEO Musk said on his social media platform X (formerly Twitter): "Shorting Tesla like Gates will only get the highest return if the company goes bankrupt!"。

A Goldman Sachs report this week showed that hedge funds have been rapidly shorting U.S. stocks in recent weeks, with total short positions reaching a six-month high。The Goldman Sachs report shows that in the fiscal year ended September 8, hedge funds were shorting consumer discretionary stocks, including Tesla.。

However, it is worth noting that, unlike the market trend of shorting Tesla, Damo analyst Adam Jonas has recently "sung more" to Tesla.。Jonas is optimistic that the Tesla Dojo supercomputer will add up to $500 billion to the company's market value.。To this end, Damo has significantly increased Tesla's price target by nearly 60% from the previous $250 to $400.。

Also, Dan Izzo, founder of hedge fund Blackbird Capital, said, "Honestly, I only lost money shorting Tesla.。However, he did not disclose whether he currently holds a position in Tesla.。But he added, "Not because my view is wrong, but because market irrationality may last longer than I can justify."。"

In addition to Tesla, Apple has recently faced a "short crisis."。The founder of Wall Street hedge fund Satori Fund recently publicly shorted Apple and said he wants to short Apple stock around the time of Apple's iPhone 15 fall launch。Apple's stock price has been tumbling since August, with a total decline of more than 10% and a evaporation of more than $300 billion in market value.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.