Microsoft's Fourth Quarter 2023 Results Exceeded Expectations Why Stock Price Goes in Reverse?

Microsoft's fiscal fourth-quarter adjusted earnings per share and revenue both beat Wall Street analysts' expectations, but the slowdown in its core business still worried analysts, causing its shares to fall sharply by nearly 3 percent after the session。

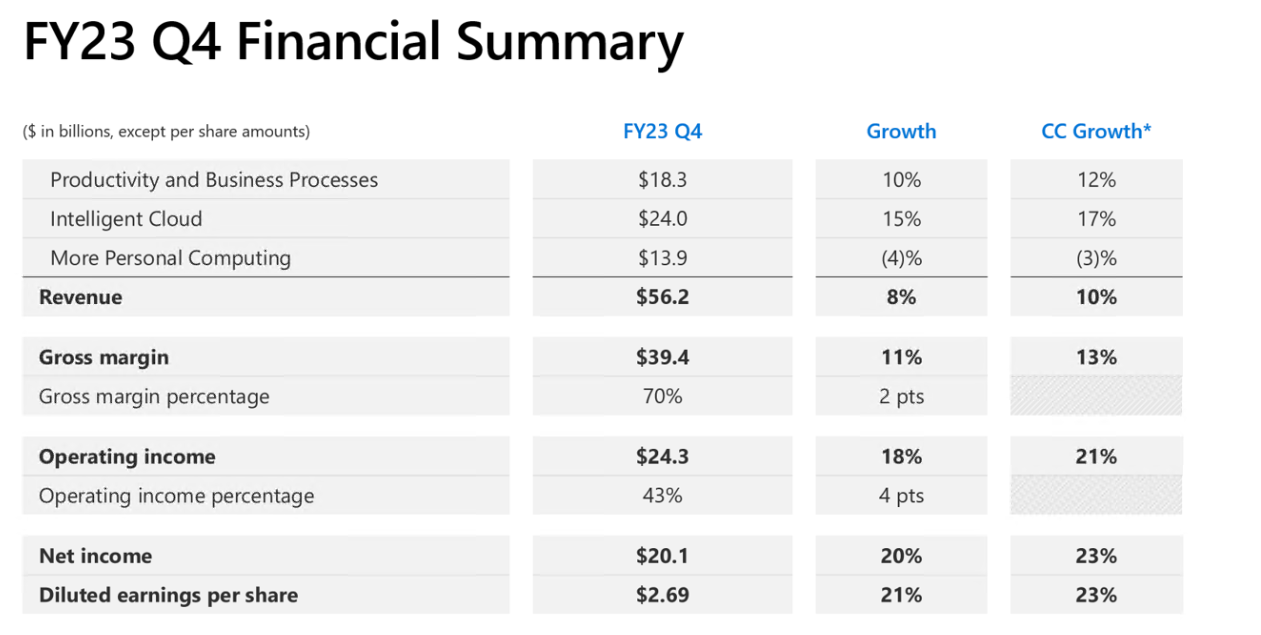

After the U.S. stock market on July 25, Silicon Valley tech giant Microsoft announced its fourth quarter and full fiscal year 2023 results for the fiscal year ended June 30 this year。Financial data show that Microsoft's fourth-quarter revenue was $56.2 billion, up 8% year-on-year, higher than market expectations of 554.$7.8 billion; operating profit rose 18% year-over-year to $24.3 billion, net profit rose 20% year-over-year to $20.1 billion, and diluted net profit per share rose 21% year-over-year to $2.69美元。

The above data show that Microsoft's fourth-quarter adjusted earnings per share and revenue exceeded Wall Street analysts' expectations, but the slowdown in its core business still caused concern to analysts, which led to a sharp drop in its after-hours stock price of nearly 3%。

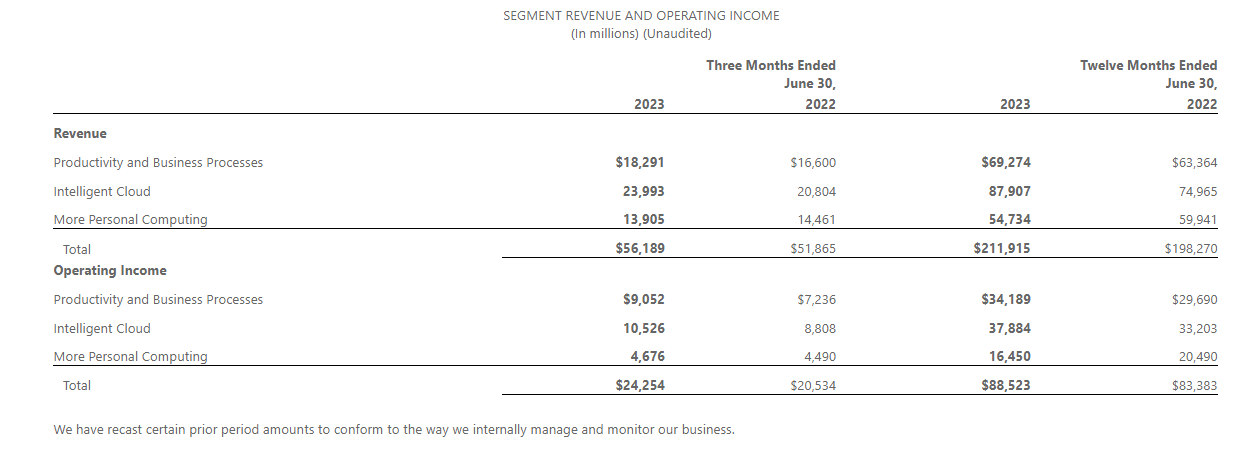

By business。In terms of productivity and business, Microsoft's fourth-quarter productivity and business revenue was 182.$9.1 billion, compared to 166 a year earlier.$0 billion, up 10% year-on-year。Due to the 15% year-over-year increase in Office 365 revenue for business and 12% year-over-year increase in Office business products and cloud services revenue, it is worth noting that the number of personal 365 subscribers increased to 67 million。

In the smart cloud business, Microsoft's smart cloud division had revenue of 239 in the fourth quarter..$9.3 billion, compared with 208.$04 billion, up 15% YoY。Server products and cloud services revenue increased 17% year-over-year, driven by Azure and other cloud services revenue growth of 26% year-over-year。

While revenue from Azure and other cloud services grew at 26% year-over-year after currency changes, it was slower than the 31% growth rate in the previous quarter.。You know, Microsoft's cloud computing business has been its growth engine for years, but it's been hit hard by concerns about the health of the global economy, and many tech customers have been cutting back on cloud computing spending。At its peak during the epidemic, Microsoft's Azure cloud service achieved 50% or more year-over-year growth.。

In terms of personal computing, Microsoft's fourth-quarter personal computing revenue was 139.$0.5 billion, compared with 144.$6.1 billion, down 4% YoY。

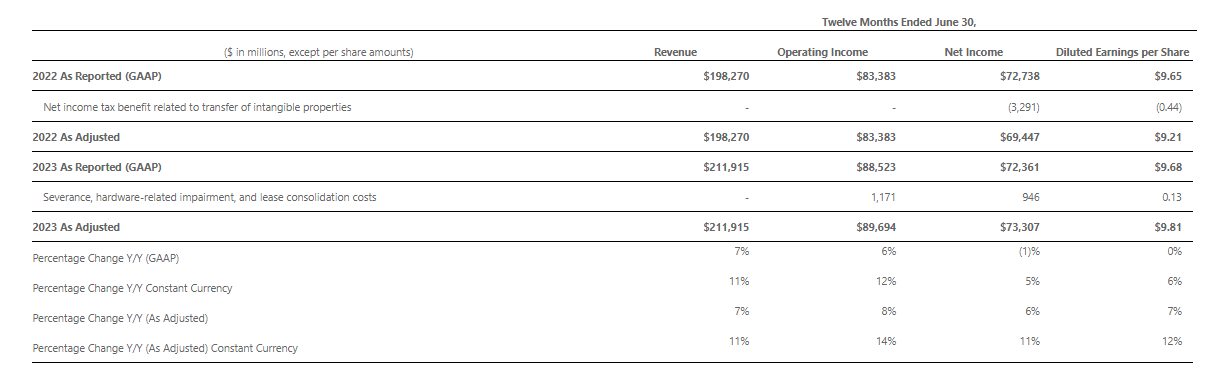

Let's look at Microsoft's full-year results for fiscal 2023.。For the entire fiscal year 2023, Microsoft's revenue was 2,119.$1.5 billion, compared with fiscal year 2022 of 1982.7% increase from $7 billion; adjusted revenue is also 2,119.$1.5 billion, compared with fiscal year 2022 of 1982.$7 billion compared to an increase of 7%, exceeding analysts' expectations of 1899.600 million dollars。

Operating profit。Microsoft's operating profit for fiscal 2023 was 885.$2.3 billion, compared with 833 in fiscal 2022.$8.3 billion vs. 6% growth; adjusted operating profit of 896.$9.4 billion, compared with 833 in fiscal 2022.8.3 billion US dollars, up 8%。

Net profit aspect。Microsoft's net profit for fiscal year 2023 was 723.$6.1 billion, compared with 727 in fiscal 2022.$3.8 billion vs. 1%; adjusted net profit at 733.$07 billion, compared with 694 in fiscal 2022.6% increase over $4.7 billion。

Diluted earnings per share。Microsoft's diluted earnings per share for fiscal 2023 were 9.$68, compared with 9 in fiscal 2022.$65 vs. essentially flat; Adjusted diluted earnings per share of 9.$81, compared with 9 in fiscal 2022.7% increase compared to $21。

Finally, Microsoft's management said on the first quarter and full fiscal year 2024 results that management expects smart cloud revenue of $23.3 billion to $23.6 billion, personal computing revenue of $12.5 billion to $12.9 billion, productivity and business revenue of $18 billion to $18.3 billion, and operating costs of $1.6 billion in the first quarter of fiscal year 2024..6 to 16.$800 million, Azure revenue growth is expected to be 25% to 26% in the first quarter of fiscal 2024。

Is AI a benefit or a drag on Microsoft??

On the post-earnings call, Microsoft Chairman and CEO Satya Nadella (Satya Nadella) on the AI and cloud business, said: Microsoft remains focused on three key priorities: to help customers take advantage of the breadth and depth of Microsoft's cloud to get the most value from their investment, to continue to lead the AI platform landscape by injecting AI at every layer of the technology stack, and to increase operating leverage.。

He stressed that sales of Aure's cloud services accounted for more than half of its $110.9 billion in cloud revenue in fiscal 2023, the first time Azure accounted for the majority of Microsoft's annual cloud business.。

Microsoft Chief Financial Officer Amy Hood (Amy Hood) said that despite the current strong demand for Azure AI services, but the current contribution of AI services to Azure revenue is only about 1 percentage point, as Microsoft accelerates investment in cloud infrastructure, the impact of AI on Microsoft's revenue will be concentrated in the second half of fiscal year 2024.。

Hood said that looking back at the 2023 fiscal year, you will see two accelerations, normal Azure workloads plus some AI workloads。So that's why I often comment that this is both an overall business cloud need and an AI capacity building。

Hood added that in the long run, I think it's always good to consider that we build a commercial cloud business that's growing 22 percent a year.。And then capital spending growth is almost 23%, 24%.。So in a sense, it's an alternative capital plus some new capital to drive new growth。

"Our products are really scalable in terms of potential markets, and they hit new budget pools, so I discussed these investments with the CIO - it's an opportunity for growth."。Hood stressed.。

In-depth artificial intelligence, Nadella said that AI's boost to Microsoft will gradually appear in the second half of the new fiscal year。

Speaking about AI, Nadella also highlighted several new AI products and features, including GitHub Copilot, Power BI Copilot, Copilot for Windows, and the latest Microsoft 365 Copilot。

"Assuming that global technology spending grows from 5% to 10% of GDP - which may be accelerated by the AI wave - then the question is how much of that will go to the various parts of our commercial cloud and how competitive we are in those parts.。"We already had the authoring tools, then we had all the communication and collaboration tools, and now we have Microsoft 365 and CoPilot as the third pillar."。"

According to Nadella, feedback shows that these suites have significantly improved productivity, such as GitHub Copilot's ability to increase developer productivity by 40% to 50% or more and generate higher quality code, and Microsoft hopes that Microsoft 365 Copilot will also validate this conclusion.。

Microsoft and Meta Expand AI Cooperation

According to Microsoft technology official public number July 26 news shows that Microsoft in the direction of AI development and the next city。Recently, at the Microsoft Inspire conference, Meta and Microsoft announced that they will support the Llama 2 Large Language Model (LLM) series on Azure and Windows.。

Specifically, Llama 2 is designed to help developers and organizations build generative AI tools and experiences.。Meta and Microsoft are working together to realize the vision of "making artificial intelligence work for more people," and we are particularly excited about Meta's open source path to Llama 2.。Microsoft is pleased to be Meta's partner of choice as it debuts the new version of Llama 2 to commercial customers。

Azure customers can now more easily and securely fine-tune Llama 2 models with 7B, 13B, and 70B parameters on Azure。In addition, Llama will be optimized to run natively on Windows。Windows developers will be able to use Llama by targeting DirectML execution providers with ONNX Runtime, enabling seamless workflows to bring a generative AI experience to their applications。

Meta and Microsoft are long-term partners in the field of artificial intelligence. They have worked together to integrate ONNX Runtime with PyTorch to create a good developer experience for PyTorch on Azure. Meta has also chosen Azure as a strategic cloud provider.。This cooperation is based on the evolution of the partnership between the two parties to accelerate innovation in the era of artificial intelligence and will further consolidate Microsoft's position as an open model ecosystem and a global artificial intelligence supercomputing platform.。

Azure's AI-built supercomputing platform is uniquely designed with facilities, hardware and software to support the world's leading AI organizations in building, training and deploying demanding AI workloads。The combination of Llama 2 models with Azure AI enables developers to take advantage of Azure AI's powerful tools for model training, fine-tuning, inference, and in particular Azure's ability to keep AI secure。

Incorporating the Llama 2 model in Windows helps drive Windows to become the go-to place for developers to build AI experiences based on customer needs and unleashes the ability for developers to build with world-class tools like Windows Subsystem for Linux (WSL), Windows Terminal, Microsoft Visual Studio, and VS Code。

Model Catalog Aspects。The model catalog, currently in public preview, is central to the underlying model, enabling developers and machine learning (ML) professionals to easily discover, evaluate, customize, and deploy large pre-built AI models at scale.。

Content security aspects。Services such as Azure AI Content Security add another layer of protection to ensure a safer online experience with AI applications。Part of our work with Meta is combining Meta's security technologies with Azure AI content security。As a result, Llama 2 models deployed in Azure AI default to a layered security approach。

Overall, Microsoft's expansion of Azure's model catalog with Llama 2 and its partnership with Meta is a big step forward in enabling a responsible, open approach to AI.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.