S & P 500 could slip 26% in first half of year

According to Morgan Stanley strategists, the expensive U.S. stock market is sending a major warning signal that the S & P 500 could fall 26% in the first half of the year。Specifically, strategists believe the S & P 500 could hit a low of 3,000 in the first half of 2023 - down 26% from its recent close.。This is "very much in line with consensus at this point," especially as retail investors are more optimistic than they have been in more than a year, they said.。

According to Morgan Stanley strategists, the expensive U.S. stock market is sending a major warning signal that the S & P 500 could fall 26% in the first half of the year。Specifically, strategists believe the S & P 500 could hit a low of 3,000 in the first half of 2023 - down 26% from its recent close.。This is "very much in line with consensus at this point," especially as retail investors are more optimistic than they have been in more than a year, they said.。

A strategy team at the bank, led by Michael Wilson, said recent economic data suggested the U.S. economy may be able to escape a recession, but it also ruled out the possibility of a Fed pivot.。

The team led by Michael Wilson ranked first in last year's survey of institutional investors because Wilson correctly predicted the stock's sell-off.。That makes interest rates higher across the curve and stocks more expensive than at any time since 2007, they added。

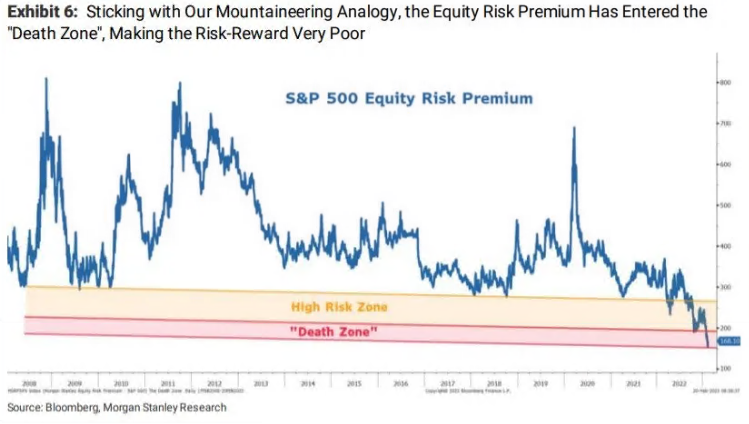

In addition, Wilson said the equity risk premium has entered a level known as the "death zone," which makes the risk return very low, especially with the Fed far from ending monetary tightening and earnings expectations still 10 to 20 percent too high.。He wrote in a note on Monday: "It's time to get back to base camp before the next earnings drop.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.