Q2 profit fell 13%, the stock market actually rose 6%, what the hell is Damo capable of?

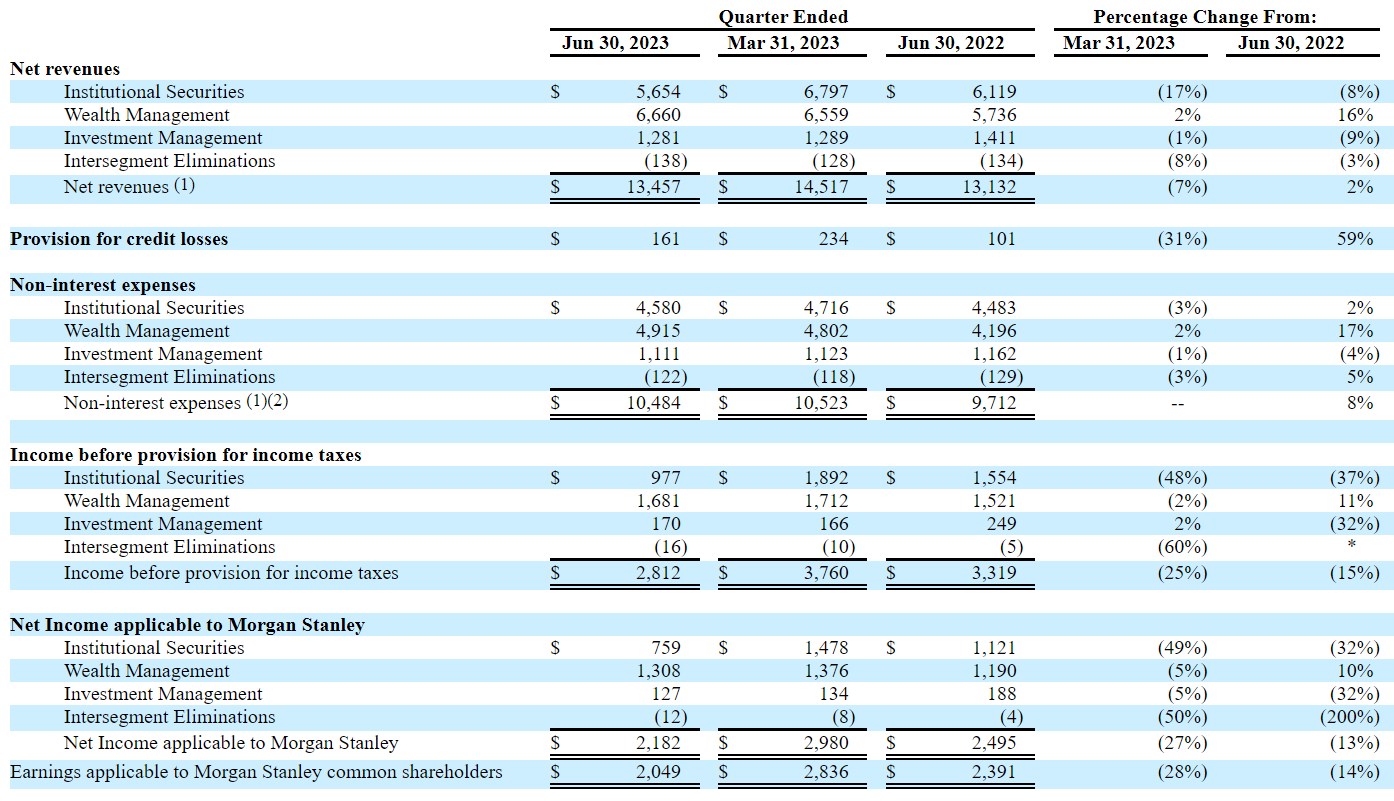

On July 18, local time, Morgan Stanley released its 2023 second quarter results report。Performance data show that Damo's second-quarter revenue was 134.$600 million, up 2% YoY。Net profit was 21.$8.2 billion, a sharp 13% year-over-year decline, but still better than the 20% decline expected by the market。

On July 18, local time, the well-known Wall Street bank Morgan Stanley (hereinafter referred to as "Damo") released its 2023 second quarter results report.。

Data show that Damo's second-quarter revenue was 134.$600 million, up 2% year-on-year, higher than market expectations of 130.$800 million; EPS 1.$24, also exceeding market expectations of 1 per share..$15; net profit of 21.$8.2 billion, down 13% year-on-year, but still better than the 20% decline expected by the market;.5%。

After the data was released, its shares rose more than 6% at one point in the session。

Damore's "report card" is not "ugly" in Wall Street's view.。Specific to each business unit:

●Institutional Securities Department

The division posted net income of $5.7 billion in the quarter, compared with $6.1 billion in the same period last year.。

Among them, investment banking revenue was unchanged from last year at 11.600 million, but down from the first quarter of this year。Due to the decrease in completed M & A transactions, transaction advisory fees were 4.$5.5 billion, down 24% from a year earlier。Stock underwriting income of 2.$2.5 billion, fixed income underwriting revenue of 3.$9.5 billion。

Sharon Yeshaya, chief financial officer of Damore, believes that while a more sluggish market has put pressure on trading, the stability of market conditions has not yet stimulated activity in the capital markets.。Nevertheless, Yeshaya's outlook for the future remains more positive, "and we expect investment banking to lead the recovery in the next quarter."。She told analysts on a conference call that M & A activity is increasing in some industries, such as finance and energy, and the backlog of deals is growing in banks.。

Net income from fixed income transactions fell 31% YoY to 17.$200 million, below expectations of $2 billion。Stock net income down 14% to 25.$500 million, the bank said, "primarily due to lower cash and derivatives due to lower customer activity and lower market volatility."。

Provision for credit losses was $97 million, up from $82 million in the same period last year.。The company said the increase was mainly due to the deterioration of credit in the commercial real estate sector and the moderate growth of the overall investment portfolio.。

● Wealth Management

The department is the biggest highlight of this quarterly report。Revenue from the business rose 16 percent in the second quarter from a year ago to $6.7 billion, higher than Wall Street's estimate of $6.5 billion.。Net profit from the business rose 10% year-on-year to $1.3 billion, contributing half of the bank's total profit.。Transaction sales more than tripled from the previous year to 8.$6.9 billion。Damo's net interest income surged 23% to 21 in the second quarter, benefiting from higher interest rates.600 million dollars。

Expenses for the quarter increased year-on-year。Among them, the cost of compensation rose, including the payment of 3 to about 3,000 laid-off employees..$0.8 billion in severance payments and expenses related to certain deferred compensation programs related to investment performance。In addition, $99 million in integration-related expenses。

Morgan Stanley laid out a plan earlier this year to double profits from its wealth management business in the coming years.。The bank's new long-term goal is to earn more than $12 billion before tax, driven by asset growth, more lending and an expanding market.。

The bank had about $100 billion in inflows in the second quarter, including about $90 billion in inflows from the wealth sector.。

● Investment management department

Net income reported in the second quarter was $1.3 billion, down 9% from the same period last year.。The size of assets currently managed by investment management companies is about 1..4 trillion dollars。

In addition, Damo executives are more optimistic about the outlook, which has boosted market confidence to some extent.。

"I am most encouraged by the evidence of growth seen in a variety of different environments," Yeshaya said, "which allows us to adapt well to changing environments and markets.。"

James Gorman, chief executive of the bank, said: "The company has achieved solid results in a challenging market environment.。The quarter began with macroeconomic uncertainty and sluggish customer activity, but ended on a more constructive tone.。"We are confident in our ability to deliver growth in a variety of market environments and will maintain a strong capital position."。"

'At the helm 'Gorman will step down next year, how the three hot candidates are doing?

Since Gorman took the helm of Damo in 2010, Damo's stock has outperformed other competitors。Under his leadership, Damo has focused more on expanding into more stable businesses such as wealth and asset management and reducing its reliance on volatile investment banking and trading.。Now the 65-year-old "helm" of Damo is stepping down.。Gorman said in May that he planned to resign within a year.。

Before leaving office, though, Gorman had some unfinished business。The company said it was in talks with U.S. prosecutors and regulators to resolve an investigation into its block trading practices.。Gorman has listed the matter as one of the things he wants to deal with before he resigns.。

Damore board to focus on Gorman successor at summer and fall meetings。Currently, the next "helmsman" has three hot candidates。Includes Co-President Ted Pick, Co-President for Wealth Management Andy Saperstein and Investment Management CEO Dan Simkowitz。

As popular candidates, the three men's business abilities are inevitably compared。

The Institutional Securities segment (which includes investment banking and trading) operated by Peake posted net income of 56.$500 million, down 8% from the same period last year and slightly above analysts' expectations of $5.5 billion。Wealth Management, which is run by Saperstein, reported revenue of $6.7 billion for the quarter, up 16 percent from a year earlier and above expectations of $6.5 billion.。The business had net new assets of $89.5 billion, well above analysts' expectations of $60.3 billion.。UBS analysts describe asset inflows as "very strong"。Investment management, which Simkowitz oversees, reported a 2% drop in revenue in the second quarter。

Despite the differences in performance across business units, Gorman stressed that their performance is not the only consideration in selecting a CEO.。

Morgan Stanley and Mitsubishi UFJ Financial Group will restructure their joint venture in Japan

On the same day as Morgan Stanley's quarterly report, the bank and Mitsubishi UFJ Financial Group said the two companies will integrate and restructure Japanese equity sales for institutional clients, as well as two joint ventures for corporate access, research and some execution services。

By this year, the two had been working together for 15 years.。During the 2008 global financial crisis, Mitsubishi UFJ Financial Group invested $9 billion in Damo and acquired a 20% stake.。After the partnership, they formed two securities joint ventures in Japan in 2010.。In the year to the end of March 2023, the net operating income of the two joint ventures combined was 381.3 billion yen (approximately 27.$600 million), close to Nomura's 488.7 billion yen。

Morgan Stanley Mitsubishi UFJ Securities is 51% owned by Damo, while Mitsubishi UFJ Morgan Stanley Securities is 60% owned by Mitsubishi UFJ Financial Group。It is expected that the business functions being consolidated will be gradually transferred to Morgan Stanley-led entities.。

It is understood that the initial goal was a full merger of Japanese brokerage firms, but it was later reduced to partial integration due to differences in business models and system and regulatory obstacles.。

Equity underwriting business expected to be restructured within two brokerage divisions。The two companies will also cooperate on foreign exchange transactions.。The main banking unit of Mitsubishi UFJ Financial Group will use Damo's global foreign exchange business platform to scale up and provide more competitive services to customers.。

In addition, a spokesman for Mitsubishi UFJ Morgan Stanley said that as part of the integration, about 100 employees from the entity led by Mitsubishi UFJ Financial Group will be transferred to the Morgan Stanley-led joint venture.。

The two plan to implement the above plan in the first half of 2024, but before that, they still need to obtain regulatory approval.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.