The European Central Bank is also carrying out "impossible tasks" when the summer season strikes.

In the case of the ECB, the bank also needs to do everything it can to eradicate the eurozone's high inflation enemy and save the region's economy from fire and water.。Only, sometimes, the invisible inflation enemy is more terrifying than the tangible villain in the play.。

On August 4, Europe and the United States rose slightly within the day 0.04%, currently trading at 1.0954; EUR up slightly against HKD 0.06%, reported 8.5523; dollar index down 0.11%, at 102.4250。

ECB inflation governance task arduous

Discussions continue on ECB inflation governance。Yesterday, the ECB Executive Committee came out to speak out, but refused to disclose any information about the bank's policy actions in September, on the grounds that "previewing actions months in advance would be counterproductive."。

On July 26, in line with market expectations, the Fed restarted the rate hike window in its July monetary policy resolution, adjusting the policy rate to 5.25-5.A day later, on July 27, the European Central Bank also held a monetary policy meeting and decided to raise all three key interest rates in the euro zone by 25 basis points: the main refinancing rate, the marginal lending rate and the deposit facility rate to 4.25%, 4.50% and 3.75%。

Although the central banks of Europe and the United States are raising interest rates, but the difference between the two is that under the governance of the Federal Reserve, the level of inflation in the United States has been cut in half from its peak, the market debate about the Fed's upcoming end of the interest rate hike window is buzzing, but, on the ECB's side, the core inflation rate in the euro area is still strong, the purchasing power of the euro is still declining rapidly, and。

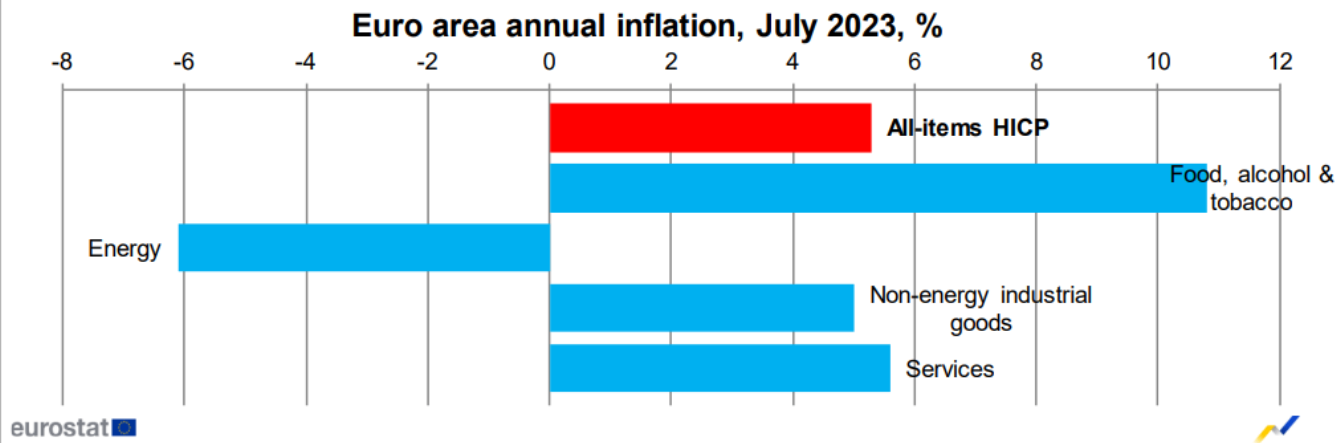

Eurozone inflation eased in July, with consumer prices up 5.3%, compared with a 5% increase in June.5%。Worryingly, core inflation in the euro area, which excludes seasonal factors and fluctuations in raw material prices, remains at 5.5%, higher than economists expected。

For this reason, some media have portrayed inflation governance in the euro area as an "impossible task."。One of the hottest blockbusters of the summer is Mission Impossible 7, which can also be used to describe the ECB's mission - to fund the entire monetary union and limit inflation to 2 percent, without significantly damaging the economy of any of the 20 eurozone countries in the process, according to the media.。

In "Mission Impossible," the well-known American actor Tom Cruise (Tom Cruise) and his team go to heaven and earth, turn things around, do everything, complete one seemingly impossible task after another, and continue to save the world。In the case of the ECB, the bank also needs to do everything it can to eradicate the eurozone's high inflation enemy and save the region's economy from fire and water.。Only, sometimes, the invisible inflation enemy is more terrifying than the tangible villain in the play.。

Liechtenstein's Ryson Banking Group said: "Nothing better reflects the ECB's dilemma than GDP and inflation data, as high inflation and weak economic growth are mutually constraining.。This contradiction makes the ECB's job even more difficult, with some experts saying that setting the same monetary policy for different national economies is "an almost impossible or extremely difficult task."。

EU economy shrugs off shrinking in second quarter

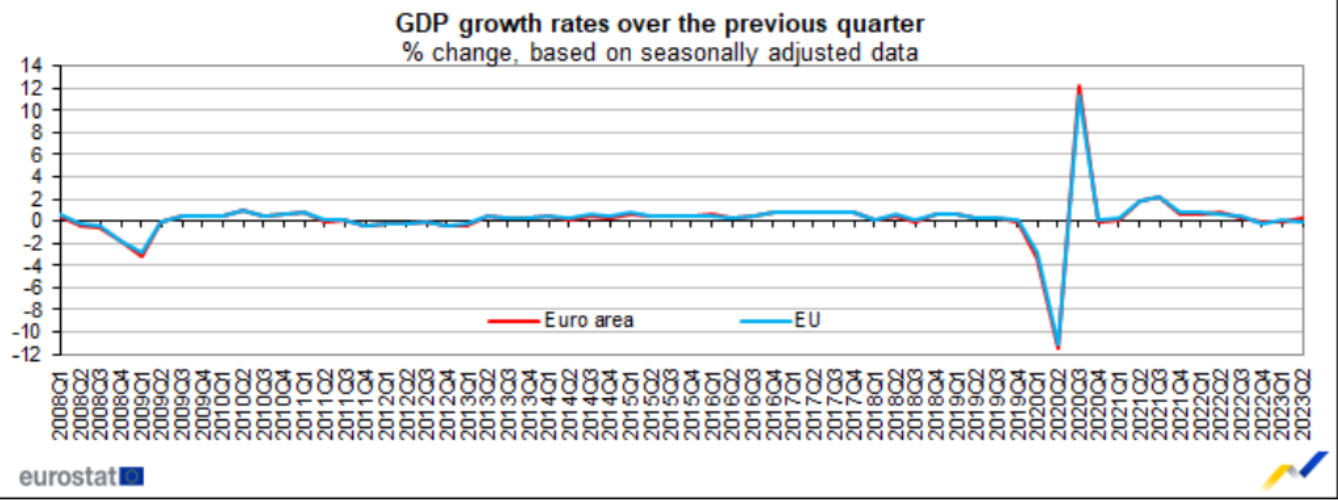

The good news is that the eurozone economy and the EU economy finally pulled out of contraction in the second quarter of this year。

Recently, according to preliminary data released by Eurostat, seasonally adjusted, euro area gross domestic product (GDP) grew by 0% in the second quarter of this year..3%, year-on-year growth of 0.6%, EU GDP growth of zero month-on-month, year-on-year growth of 0.5%。

On a country-by-country basis, Germany, the EU's largest economy, saw zero quarter-on-quarter GDP growth in the second quarter, while France and Spain saw zero quarter-on-quarter GDP growth, respectively..5% and 0.4%, Italy's GDP shrank by 0.3%, Sweden, Austria, Lithuania and other countries also experienced recession。In addition, Ireland's second-quarter GDP grew 3.3%, the highest growth rate in the euro area economy。

In the fourth quarter of last year, the eurozone economy fell by 0.1%。Data released by Eurostat in June showed that the eurozone economy also fell by 0 in the first quarter of this year..1%。Two consecutive quarters of negative growth meant that the eurozone economy was in a "technical recession," which cast a shadow over the outlook for the eurozone economy, but fortunately it climbed out of the mire in time.。

It is worth noting that some media pointed out that the euro zone's economic growth in the second quarter was largely driven by Ireland, but Ireland's GDP was very unstable due to the impact of multinational companies, with the country's economy shrinking in the fourth quarter of last year and the first quarter of this year.。In addition, zero quarter-on-quarter growth in Germany does not bode well for the overall economic outlook for the EU。

Analysts also say the European economy has been on the verge of recession since last winter due to the energy crisis triggered by the conflict between Russia and Ukraine。Despite the improvement in economic data in the second quarter, it is impossible to hide the reality of weak growth in Europe。An IMF report released at the end of July predicted that the eurozone economy would grow by 0% this year..9%, of which Germany will shrink 0.3%。

In such an economic environment, the debate over whether the ECB should continue to raise interest rates for the rest of the year is becoming heated。

ABN AMRO said the ECB may avoid raising borrowing costs for the rest of the year and start cutting interest rates in March, bringing deposit rates down to 2% by the end of 2024.。

Nick Kounis, head of macro and financial market research at the bank, said the ECB's aggressive rate hikes had led to a significant tightening of financial and bank lending conditions and were just beginning to have a dampening impact on demand.。He also said that given the timing of the rate hike, which means we could see a significant drag on the economy in the second half of this year and the first half of next year, with core inflation "likely to fall more significantly in the coming months."。

Dutch International, for its part, argues that the ECB's inflation woes could prompt it to raise interest rates further。

Peter Vanden Houte, an economist at ABN Amro, said in a note that it was too early to rule out the possibility that the ECB would raise interest rates further to 4 percent.。In July, core inflation in the euro area remained at 5.5%, and the change in the monthly rate of inflation is more important because the base effect distorts the annual data.。

The economist also noted that while headline inflation has fallen fairly quickly, it is still above the ECB's 2 per cent target, while core inflation looks set to remain high due to services inflation.。If the central bank is focused on month-to-month developments, it may still choose to extend the rate hike cycle。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.