Q3 revenue earnings fell short of market expectations Tesla shares fell nearly 5%

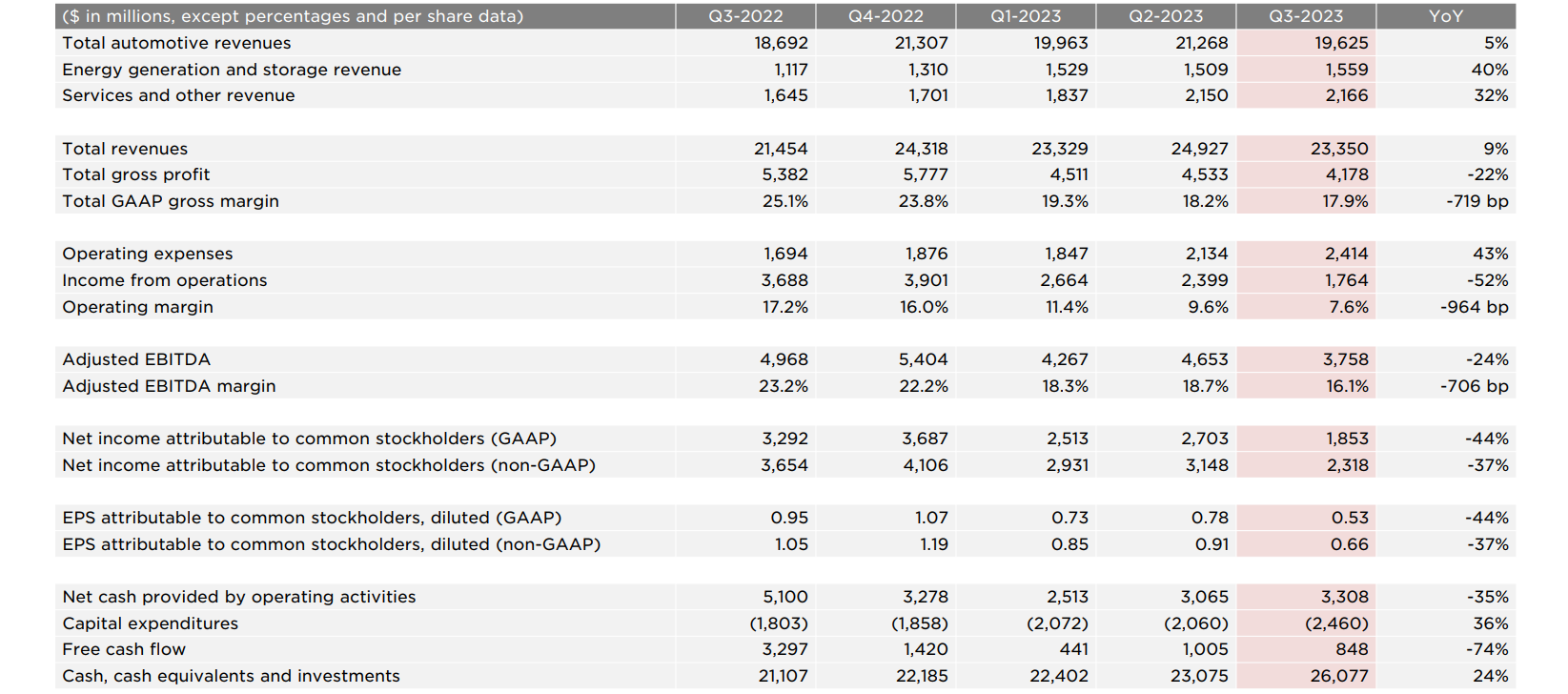

On Wednesday (October 18) after the U.S. stock market, Tesla announced the third quarter of this year's earnings。Data show that in the third quarter, Tesla achieved revenue of $23.4 billion, up 9% year-on-year, adjusted net profit of $2.3 billion, down 37% year-on-year, are lower than expected.。

On Wednesday (October 18) after the U.S. stock market, Tesla announced the third quarter of this year's earnings。

Financial data show that in the third quarter, Tesla achieved revenue of $23.4 billion, up 9% year-on-year, lower than market expectations, Wall Street had forecast revenue growth of 13% to 241.800 million dollars。In terms of earnings, Tesla's adjusted net profit (under U.S. accounting standards) was $2.3 billion in the third quarter, down 37% year-over-year, the lowest level in two years, compared with the market's previous expectation of 25.600 million dollars。The market's most concerned gross margin fell to 17 in the third quarter..9%, slightly below Wall Street expectations of 18%, and Tesla's gross margin was 18% last quarter..2%。

Tesla shares close at 242 per share on Wednesday.$68, down nearly 5%。Tesla continues to fall in after-hours trading, down more than 4%。

Profit for Sales

Earlier this year, Tesla CEO Musk outlined a strategy for this year to focus on market share growth at the expense of profits.。

Under this strategic guidance, Tesla has repeatedly lowered the prices of its flagship Model 3 sedan and Model Y mid-size SUV in major global markets such as the United States and China。In the U.S., for example, the company has cut Model 3 prices by about 17 percent since the beginning of the year, and Model Y prices have fallen even more, to 26 percent.。

As you can see from the chart below, the price cut has significantly eroded Tesla's profits。Multiple price cuts this year have allowed Tesla's gross margin to fall directly below the 20% mark。Between July and September, Tesla's automotive gross margin fell more than expected to 16.3%。

After Tesla's price cut, it did give a boost to its sales in the short term, but the boost from the price cut gradually weakened as other automakers followed suit.。

Tesla delivered a total of 435,059 vehicles in the third quarter, down 6% from the second quarter, the first quarter-on-quarter decline in a year.。The number was also well below Wall Street expectations of about 456,000 vehicles.

Despite the lower-than-expected delivery data, in the earnings call, Musk reiterated his goal of producing and delivering 1.8 million electric vehicles by 2023。In the first three quarters of this year, Tesla delivered about 1.3 million vehicles worldwide, which means that Tesla needs to complete about 500,000 vehicles in the fourth quarter to meet its annual delivery target.。Judging from its sales in the third quarter, the quarterly sales of 500,000 vehicles will be a difficult task for Tesla.。

Tesla also knows that gross margins have fallen sharply, but now they have ignored gross margins, and in order to further increase sales, Tesla has recently been cutting prices around the world.。

A day before Tesla's third-quarter earnings release, Tesla cut prices by $3,650 on the base Model 3 in the UK。A week ago, Tesla slashed the prices of Model 3 and Model Y in the United States again。Of these, the price of the Model 3 was reduced by $1,250-2,250, while the price of the Model Y was reduced by $2,000.。At the same time, Tesla also adjusted the price of the Norwegian Model Y。

Industry observers believe that with some signs of weak demand for electric vehicles now, Tesla and other automakers will have to continue to cut prices to compete for a limited customer base.。Analysts expect more unexpected price cuts for Tesla in the final months of 2023, and its profit margins will likely remain below its self-proclaimed "lower bound."。

Cybertruck is expected to start deliveries by the end of next month.

During the earnings call, Musk revealed that Cybertruck has begun trial production at Tesla's Giga, Texas plant near Austin.。The first Cybertrucks will be delivered at an event at the factory on November 30.。

The Cybertruck will be the company's first new passenger car model in more than three years.。Cybertruck is expected to challenge Rivian's R1T, Ford's F-150 Lightning and GM's Chevrolet Silverado EV in the red-hot electric pickup market。

Musk also confirmed that the Cybertruck, which debuted in 2019, has more than 1 million refundable bookings.。But he said that Cybertruck will face "huge challenges" to achieve mass production.。He said Tesla could produce more than 125,000 Cybertrucks a year at this stage, and that number could rise to 250,000 by 2025.。Musk said his most optimistic guess is that Tesla will reach that output sometime in 2025.。

At the same time, Musk also warned that it would take a year to 18 months for Cybertruck to achieve positive cash flow.。

Musk said: "I want to emphasize that to achieve mass production of Cybertruck and then turn Cybertrunk's cash flow will face huge challenges, which is normal.。He then stressed that he believed it could be the company's best product ever.。"When you have a product with a lot of new technology or any brand new car plan, especially a product like Cybertruck that is different and advanced, you will have problems proportional to the number of new things you are trying to solve at scale.。"

He later added: "It will take a lot of work to achieve mass production and positive cash flow at a price that people can afford.。"

Tesla's free cash flow decreased 74% to 8% in the third quarter..$4.8 billion, but Tesla is still sitting on $26 billion in cash, cash equivalents and investments, which leaves plenty of room for maneuver.。

Mexican factory delayed

Tesla's Cybertruck successor could be built at new plant in Mexico。

In March, Tesla announced the construction of a $5 billion factory near Monterrey, Mexico, where the company will produce a new line of electric vehicles.。The plant is expected to start production in 2025.。

Musk noted on the call that while Tesla is laying the groundwork for the construction of the Mega plant in Mexico, he wants to understand the state of the global economy before "going all out" to expand.。He sees the rising interest rate environment as a major obstacle to plant construction.。

"For Mexico, we are working on infrastructure and factory design, while we will manufacture engineering development for the new production line there," Musk said.。"I think we just want to get a sense of what's going on in the global economy before we go all in on the Mexican plant.。I'm concerned about the high interest rate environment we're in.。"

To keep inflation in check, the Fed has raised rates 11 times since March 2022, from 0.25% to the current 5.5%。Musk has complained more than once that high U.S. interest rates are affecting the nation's economy, including car sales.。

Across the industry, U.S. electric vehicle sales continue to grow, but at a slower pace than in the past few years.。The unsold inventory of many car companies has begun to pile up.。Car companies, including General Motors and Ford, are cautiously setting their sales targets.。Now that the number of consumers willing to spend on electric vehicles has become more limited, and prices have generally fallen, automakers' profit margins are being squeezed。

After expressing concerns about the global economy, Musk said: "I don't want to get into uncertainty as quickly as possible.。"

During the call, Wells Fargo analysts pressed Musk on whether he felt Tesla would not "go all out" to build the Mexico Mega plant unless the economy was strong, and whether the company could achieve its projected 50% CAGR without the plant.。

Musk responded: "We will definitely build a factory in Mexico.。We felt really good about it, we put a lot of energy into looking for different positions and we felt really good about that position.。We'll build it, it'll be great。He added, "The pressure is really just a matter of time... I'm going to break records financially, it's just that interest rates have to come down."。"

Despite Musk's repeated focus on high interest rates, analysts are keenly capturing a hint of something not quite right from the few words he said about the Mexican plant。Seth Goldstein, a Morningstar stock analyst, said in an interview after attending Tesla's conference call, "I don't think Mexico will be a significant part of its delivery growth in the next two or three years.。"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.