Disguised price reduction? Tesla China announces the launch of 5-year zero interest car purchase rights

According to Tesla China's official Weibo account, from July 1st to July 31st, orders for both the Standard Range and Long Range All Wheel Drive versions of the Model 3/Y will enjoy a 5-year interest free or low interest car purchase benefit.

At the beginning of July, Tesla China launched a new car purchase gift package.

According to Tesla China's official Weibo account, from July 1st to July 31st, orders for both the Standard Range and Long Range All Wheel Drive versions of the Model 3/Y will enjoy a 5-year interest free or low interest car purchase benefit.

Specifically, with a down payment of 79,900 yuan and zero interest for 5 years, the daily supply for Model 3/Y standard range version owners can be as low as 85 yuan, while the daily supply for long range all wheel drive version can be as low as 107 yuan.

If you want a lower down payment, you can enjoy low interest car purchase benefits. Whether it's the Model 3 or Model Y, as well as the standard range version or the long range all wheel drive version, you can choose a lower down payment - starting from 45900 yuan, in which case you can enjoy an annual rate as low as 0.5% (equivalent to an annualized rate of 0.92%).

Tesla's July car purchase rights can be said to be an enhanced version of June. Last month, only the Model 3/Y standard range version was eligible for a 5-year zero interest installment purchase plan.

It is worth mentioning that all versions of the Model 3/Y on Tesla China's official website have not been discounted. Currently, the prices of various models on sale are:

Model 3: Starting from 231,900 yuan for the rear wheel drive version (standard range version), 271,900 yuan for the long range all wheel drive version, and 335,900 yuan for the high-performance all wheel drive version.

Model Y: Starting from 249,900 yuan for the rear wheel drive version (standard range version), 290,900 yuan for the long range all wheel drive version, and 354,900 yuan for the high-performance all wheel drive version.

Although the official website price has not been adjusted, many people believe that Tesla's latest financial car purchase rights are actually a disguised price reduction.

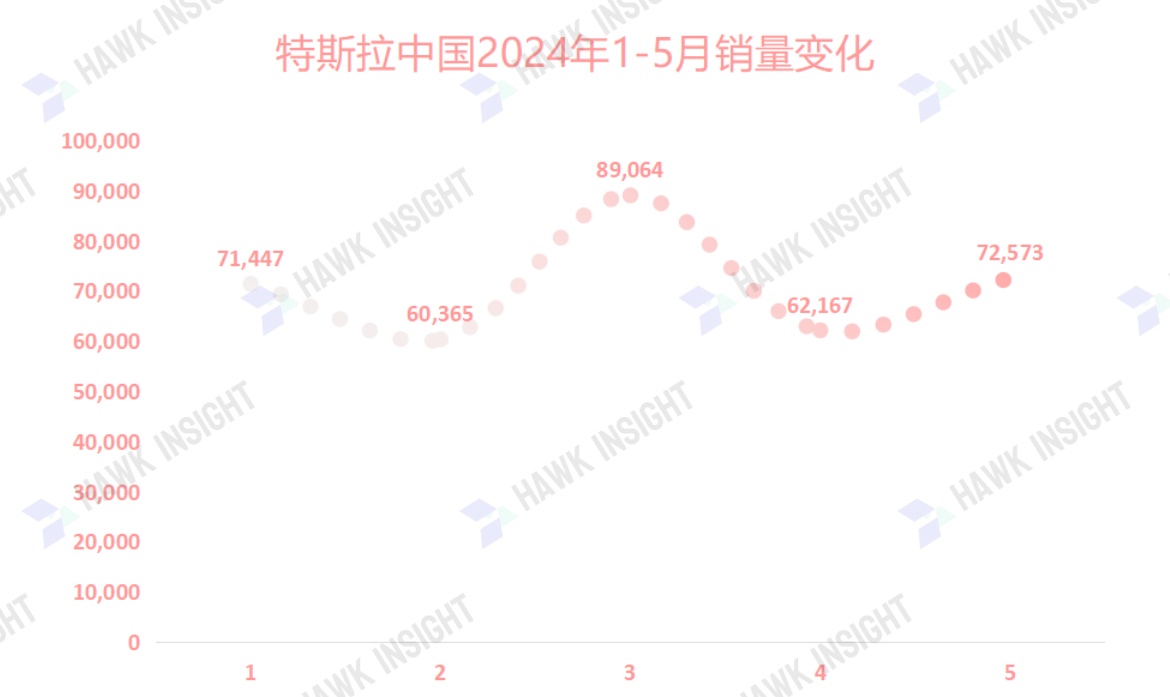

With the increasingly fierce competition in the Chinese electric vehicle market, Tesla's sales situation was not stable in the first five months of this year.

In April of this year, BYD's sales in the Chinese market exceeded Tesla's by more than five times.

In the context of declining sales in the Chinese market, Zhu Xiaotong, Senior Vice President of Tesla's automotive business and one of the company's core executives, was also revealed in early May to resign from his management positions in Europe and the Americas and return to Tesla China as Vice President of China, responsible for the production and sales business in Greater China to boost sales again.

Under the leadership of Zhu, Tesla China's sales in May increased month on month, but still decreased by nearly 7% year-on-year.

With the end of June, the results for the first half of the year will also be released. Tesla will release its second quarter delivery data in early July and release its second quarter financial report on July 19th.

However, as the data release date approaches, analysts are constantly updating their predictions for Tesla's delivery data.Last week, analysts predicted that Tesla's sales in the second quarter may decrease by 11% compared to the same period last year to 415,000 vehicles, lower than the previous market consensus of 455,000 vehicles.

In the first quarter of this year, Tesla's global delivery volume was 386,810 vehicles, far below the average market expectation of 449,080 vehicles, a year-on-year decline of 8.5%, marking the first year-on-year decline since 2020. The production of automobiles in the first quarter was 433,371 units, which was also lower than the market estimate of 452,976 units.

In the first quarter, Tesla's main model Model 3/Y delivered 369783 vehicles, a year-on-year decrease of 10%, lower than the market's expected 426,940 vehicles. The production of 412,376 vehicles was also lower than the expected 439,194 vehicles.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.