LVMH Group's Q3 results fell short of expectations, and the "highlight moment" of luxury goods is fading.

On Tuesday, LVMH reported its third-quarter results, with sales falling short of analyst expectations.。In the three months to the end of September, the company's sales were 199..600 million euros, below analyst estimates of 204.800 million euros。

On Wednesday (October 11), the shares of French luxury goods giant LVMH Moet Hennessy Louis Vuitton (LVMH) fell sharply, falling about 6% during the session, falling to the lowest level since December last year.。

On the news, LVMH reported its third-quarter results, and its sales fell short of analyst expectations.。

In the three months to the end of September, the company's sales were 199.600 million euros, an organic increase of 9% over the same period last year。And according to FactSet, analysts had generally forecast sales of 204.800 million euros。The company's organic revenue growth also slowed to 14 percent in the first three quarters of this year.。

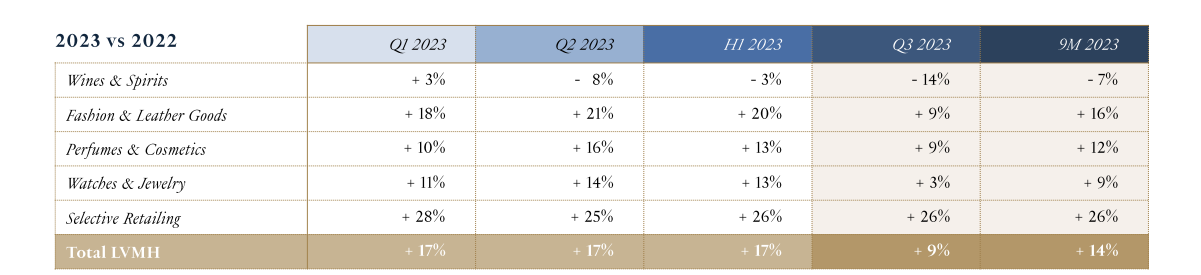

Specifically, wine and spirits were the main reason for LVMH's overall decline this time around, and were the company's only business unit to see a decline in sales, down 14%, a decline that far exceeded analysts' expectations of a 2.8%。LVMH's core business, the fashion and leather goods division, had a total revenue of 97 in the third quarter..500 million euros, sales increased by 9%, the growth rate is lower than analysts expected 11.2%。

In addition, the perfume and cosmetics, watches and jewelry two divisions also performed poorly, sales increased by 9% and 3%, respectively, while the first half of the growth rate of these two sectors were more than 10%。Among all businesses, the company's select retail units (such as Sephora) performed better, with revenue in the third quarter increasing by 26%, in line with the growth rate in the first half of the year.。

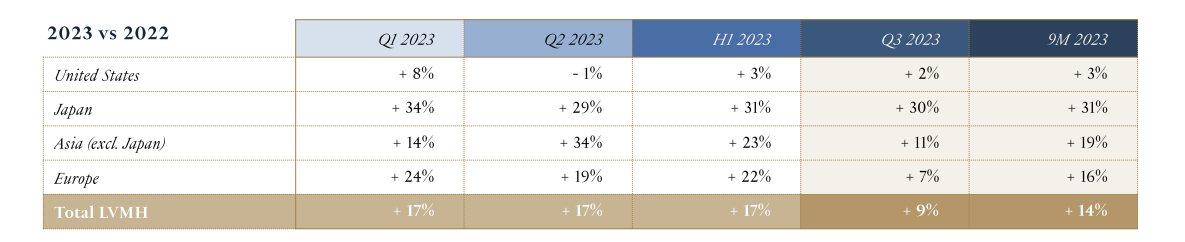

From a regional perspective, the performance varies from region to region。U.S. regional performance continues to languish, growing just 2 percent in the third quarter。Japan and the rest of Asia recorded double-digit growth of 30 per cent and 11 per cent, respectively.。The rest of Asia was affected by the downturn in the Chinese market, with growth falling sharply to 11% from 34% in the second quarter.。In addition, growth in Europe shrank from double digits to single digits, recording 7 per cent in the third quarter, down sharply from 22 per cent in the first half of the year.。

LVMH's brands include luxury brands such as Louis Vuitton, Dior and Tiffany。LVMH is the first major luxury group in Europe to report third-quarter sales, and investors are likely to see its sales results as a bellwether for consumer behavior in the coming months。

LVMH said: "In an uncertain economic environment, the Group is confident of its continued growth and will maintain a strategy focused on continuously improving the attractiveness of the brand, leveraging the authenticity and quality of its products, superior distribution and an agile organization."。

Despite weaker-than-expected performance, big banks are more optimistic about LVMH's outlook。

UBS analysts believe LVMH remains attractive in the long run。In a note to clients, the bank wrote: "We continue to believe that its first-class brand portfolio, good industry fundamentals and pricing power in an inflationary environment still make LVMH one of the best stocks to own.。"

For its part, JPMorgan said: "We believe that LVMH remains one of the companies that is relatively better able to cope with continued volatility.。However, due to the current poor earnings momentum and uncertain outlook, we believe there is limited room for absolute revaluation in the short term。"

After years of strong results fueled by surging demand for luxury goods, the industry is grappling with slowing global sales growth as consumers, particularly in the U.S. region, take into account factors such as inflation and high interest rates.。In the current Federal Reserve and other major global central banks still adhere to the high interest rate policy, the outlook for the luxury industry is becoming increasingly uncertain。

Victoria Scholar, head of investment at Interactive Investor, said that while customers with high disposable incomes are relatively unaffected by cost-of-living pressures, making luxury brands a strong industry, the "high-gloss period" of luxury goods is beginning to fade in terms of LVMH Group's performance.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.