Continuation of strength! ADP data falls short of expectations Gold stands on 2030 highs

Beijing time on the evening of April 5, spot gold continued to be strong, standing at $2030 / oz, a new high since March last year。

Yesterday evening, spot gold continued to be strong, standing at $2030 / oz, the highest since March last year。

The main reason is that on Wednesday, local time, the market called "small non-farm" American automatic data processing company (ADP) employment data report finally released。U.S. ADP employment recorded 14 in March, report data shows.50,000, weaker than the expected 200,000, with the previous value from 24.20,000 to 2: 10,000。21: 45, U.S. Markit services PMI final value recorded 52 in March.6, less than expected 53.8 and 53 of the previous value.8。22: 00, US March ISM non-manufacturing PMI recorded 51.2, also lower than the expected 54.5 and 55 of the previous value.1。

U.S. private sector job creation fell far short of expectations in March, report says, and wage growth showed weakness。Only trade / transport / utilities and construction employment recorded increases in March, while financial services, manufacturing and professional / business services employment all recorded decreases of varying degrees.。In addition, the median annual rate of wage growth in all of these industries is not immune, neither of which is as good as last month's data.。

ADP employment data has always been one of the important indicators of the U.S. job market, and its data is often regarded as a predictor of the U.S. labor market.。

So, the above data suggest that the Fed's successive rate hikes, overlaid with a series of recent economic events, are likely to have spread to the labor market, overlaid with recent tech head layoffs, and the risk of further Fed tightening may increase。

Data released overnight also showed that U.S. job vacancies fell to their lowest level in nearly two years in February, while U.S. industrial orders fell for the second consecutive month in February, once again confirming the gradual saturation of the U.S. labor market and the slowdown in economic growth.。

Nela Richardson, chief economist at ADP, said the March jobs data was one of several signals of a slowing economy.。

Indeed economist Nick Bunker also said the U.S. labor market is cooling significantly, as evidenced by job openings falling by about 1.3 million in two months.。He also said that at this rate, the indicator would return to pre-pandemic levels this summer.。

U.S. 10-year Treasury yield falls to 3 after data release.266%, the lowest level since September 12 last year, which indicates that the market is expected to cut interest rates again..

Separately, after the ADP report, swap contracts showed that the likelihood of the Fed raising interest rates by 25 basis points at its May meeting was cut to around 44%, compared with 50% before the report and as high as 70% earlier this week.。

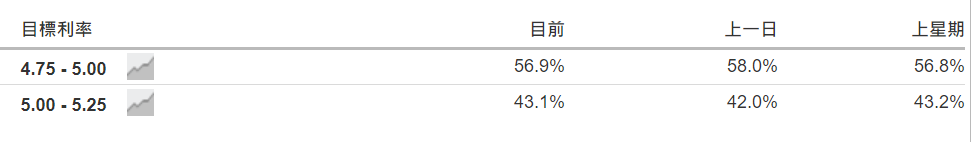

CME's "Fed Watch" tool shows that the Fed is expected to keep interest rates unchanged in May, with interest rates peaking at 4.75% -5.00% and expects to start cutting interest rates in July。

Lee Hardman, monetary economist at MUFG, said ,The dollar continues to be expected to weaken further in the next three to six months, and recent developments are expected to cause some investors to lose confidence in regional U.S. banks, increasing the downside risk to the dollar, which the Fed is well aware of.。He also said he partially agrees with the dovish repricing that is taking place in the U.S. interest rate market, arguing that the Fed is close to the end of the rate hike cycle.。

Still, Cleveland Fed President Loretta Mester previously said on Tuesday that while the economy appears to be slowing, the Fed may raise interest rates further in order to keep inflation falling to its 2 percent target and keep inflation expectations stable.。She said the Fed would need to raise rates above 5% and stay at that level for some time。

Ivailo Vesselinov, chief strategist at Emso Asset Management Ltd, also noted that the battle against inflation looks far from being won.。Despite the latest signs of weak economic activity, if the anti-inflation process hits a bottleneck later this year, the Fed will still have trouble validating current market pricing of rate cuts。

Overall, the market is still going to focus on U.S. non-farm payrolls data due later this week, which could provide new guidance on the Fed's monetary policy outlook.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.