Cui Dongshu: March passenger car manufacturers wholesale sales of 1.99 million fuel vehicles MPV retail performance is stronger

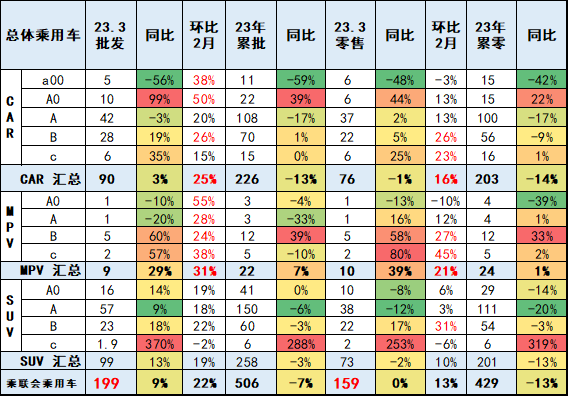

As this year's Spring Festival is the earliest of this century, in the expected stimulus policy brought about by the wait-and-see, promotional war to further promote the wait-and-see mood and other comprehensive factors, March manufacturers wholesale sales of 1.99 million vehicles, an increase of 9% year-on-year, an increase of 22%。

According to Cui Dongshu released the March passenger car market segment model trend shows that in March manufacturers wholesale sales of 1.99 million units, an increase of 9% year-on-year, an increase of 22%, driven by the new energy market, some car companies performance differentiation is obvious。Among them, the wholesale growth rate of fuel vehicles was slightly better than that of retail in March 2023.。Fuel vehicle MPV retail sales increase 39% in March 2023, strong performance。Car retail sales fell 1% year-on-year and SUV retail sales fell 2% year-on-year due to a decline in SUV demand due to weak fuel vehicles。The sedan performed better than the SUV, mainly the A0-class sedan performed better。SUV high-end strong, B-class and C-class SUV year-on-year strong。

First, the economic passenger car market trend.

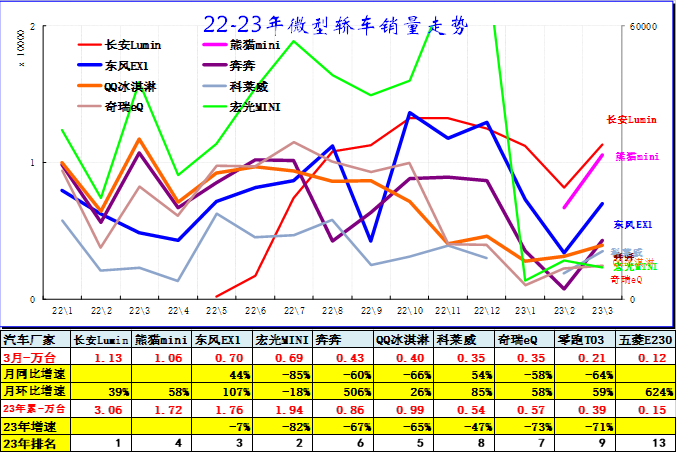

Performance of A00 Class Car Market

March 2023, A00 class car manufacturers wholesale sales 5.01 million units, a monthly increase of 146% year-on-year;.260,000 units, up 126% YoY。

At present, the trend of electric vehicles replacing mini cars is more obvious。In the past few years, the sales of fuel mini-cars have declined significantly, and the decline of the original boutique micro-cars has become more serious, and the micro-car market has recently become the main market for electric vehicles.。

Recently, Changan, Chery and other diversified A00-class main models and new products have performed outstandingly, and micro-electric vehicles have gradually reflected incremental potential.。

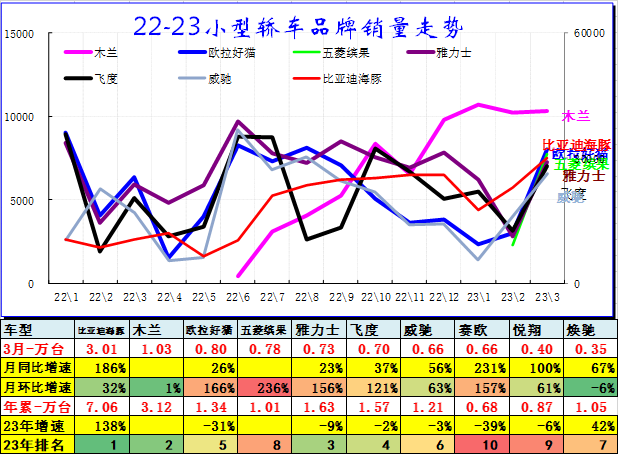

A0 class sedan main model market trend

March 2023, A0 class car manufacturers wholesale sales 9.560,000 units, down 28% year-on-year; cumulative wholesale sales of 21 manufacturers in 2023.520,000 units, down 50% YoY。

The characteristics of autonomous electric vehicles to replace fuel vehicles are obvious, and the competitive landscape has changed into a new trend of autonomy.。In the early days, Toyota and Honda maintained a strong position, and in recent years, the trend of independent fuel small entry-level cars has been relatively difficult.。

March A0-class sedans are dominated by autonomous electric vehicles, with BYD and SAIC passenger cars having stronger electric vehicles。At present, the Mulan of SAIC passenger cars performs better.。

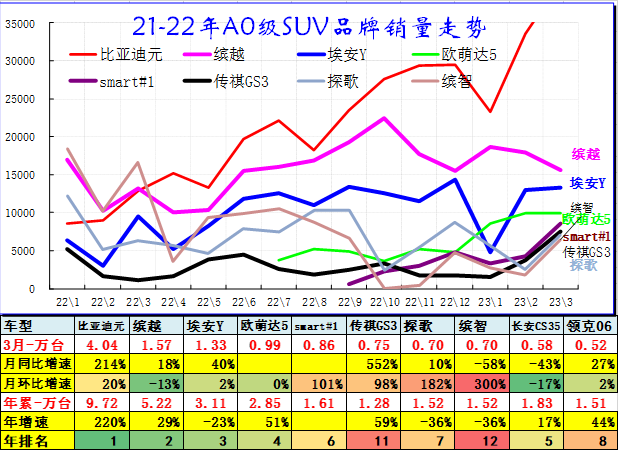

A0 class SUV sales trend

March 2023, A0-class SUV manufacturers wholesale sales 16.270,000 units, up 0% YoY on a monthly basis; cumulative wholesale sales of manufacturers in 2023 40.750,000 units, down 12% YoY。

The main model of the A0-class SUV becomes an electric car。A0-class SUVs are basically fashionable models. BYD and GAC Aean electric vehicles have strong performance, and Japanese fuel vehicles have better performance.。

II. Market Trend of Class A Passenger Cars

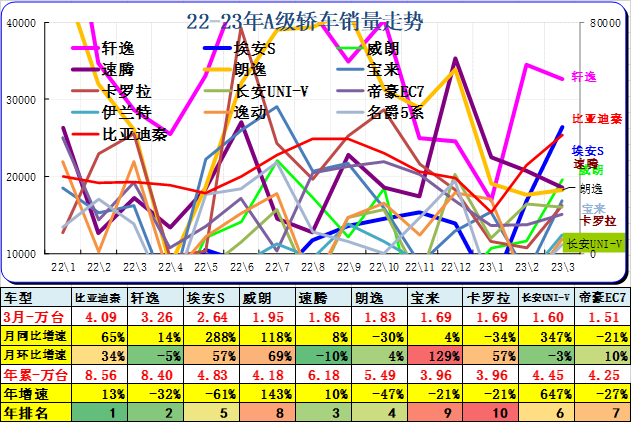

Market trend of main compact car models

In March 2023, wholesale sales of Class A sedan manufacturers 42.260,000 units, up 21% year-on-year; cumulative wholesale sales of 108 manufacturers in 2023.350,000 units, up 3% YoY。

In March, the sales trend of the main models of A-class cars fluctuated greatly.。Japanese Sylphy's performance is weaker。The German series is still the main lineup, FAW-Volkswagen's main models have maintained high sales。Entry-level A-class cars perform mediocre。Independent BYD Qin, Emgrand, etc. enter the top 10。

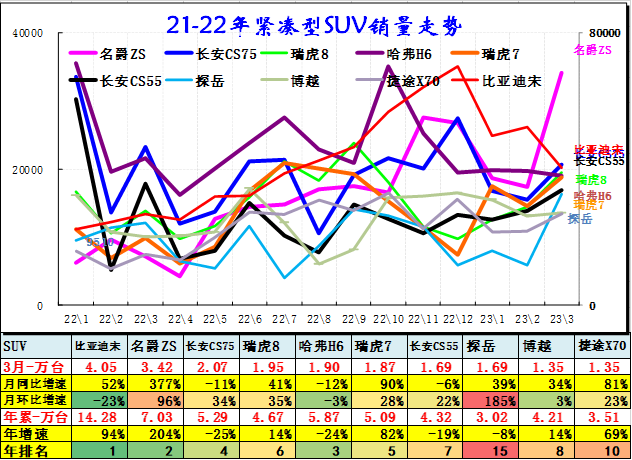

Market trend of main compact SUV models

March 2023, A-class SUV manufacturers wholesale sales of 56.590,000 units, up 7% YoY on a monthly basis; cumulative wholesale sales of 149 manufacturers in 2023.690,000 units, down 8% YoY。

A-class SUV in March 2023 wholesale leader into a new energy model BYD Song, the original leader of the fuel vehicle SUV pressure is greater。Joint venture SUV market pressure is greater, high-priced SUV can choose between power and brand, BYD power advantage drives brand advantage。

III. Market Trend of Class B Passenger Cars

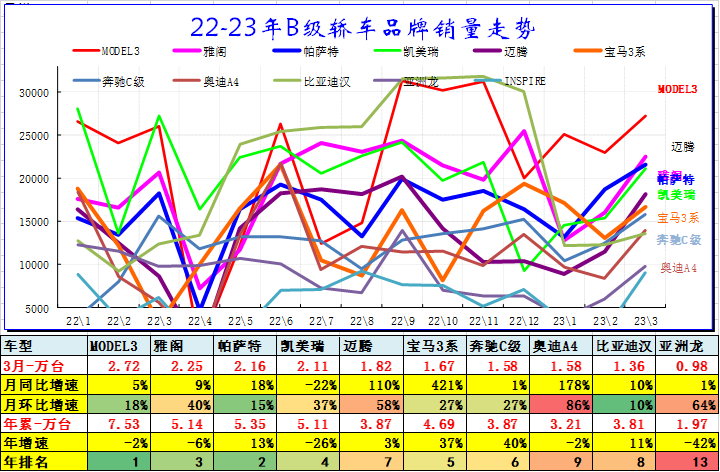

B-class car market trends

March 2023, wholesale sales of Class B sedan manufacturers 27.770,000 units, down 1% month-on-month; cumulative wholesale sales of manufacturers in 2023 69.670,000 units, down 16% YoY。

Recently, mid-to-high-end cars have been strong, but the performance of Japanese models has been relatively stable. BYD Han, a combination of electric cars and plug-in hybrids, has performed very well. Japanese models have weakened slightly, but luxury cars have performed outstandingly.。

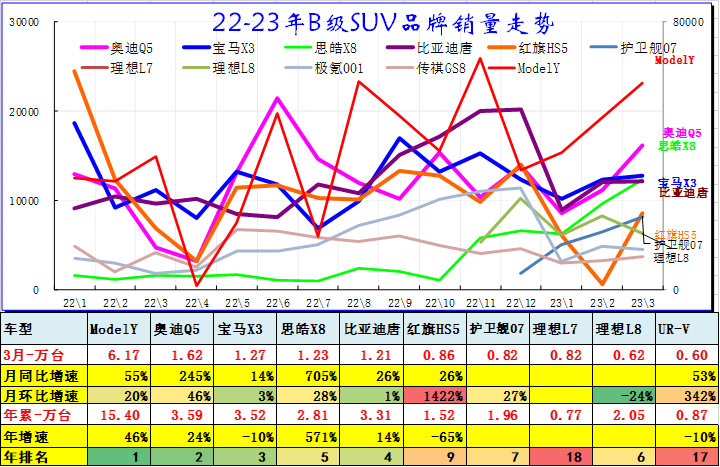

B-class SUV market trends

March 2023, B-class SUV manufacturers wholesale sales 23.430,000 units, up 3% month-on-month; cumulative wholesale sales of manufacturers in 2023 59.70,000 units, down 15% YoY。

In March 2023, the wholesale market of B-class SUVs is still the leader of electric vehicles. Fuel vehicles are stronger than Audi and BMW, while luxury vehicles will still perform better under the promotion of future policies.。

IV. Market Trend of Luxury Passenger Cars

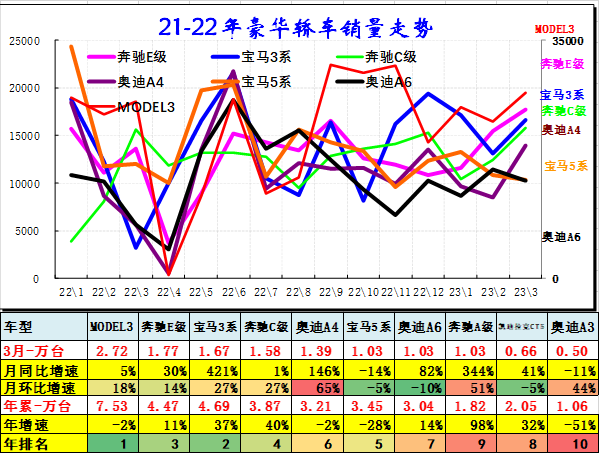

Luxury car main model market trend

Due to the impact of new energy and the serious shortage of supply, the three giants of Mercedes-Benz, Audi, and BMW luxury cars are not competitive in China. The core model of luxury cars is C-class luxury cars, but recent traditional luxury cars are conservative due to lack of cores.。

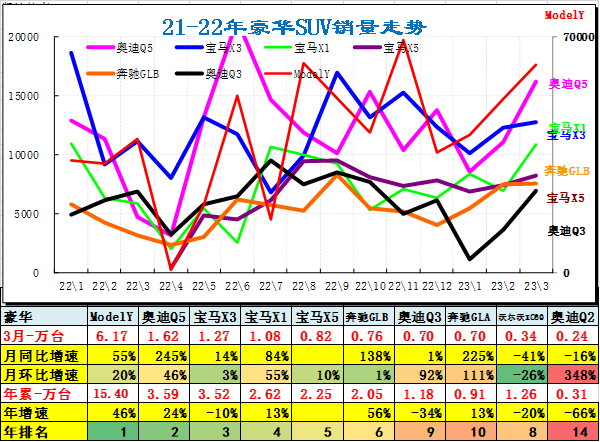

Luxury SUV Main Models Market Trend

Luxury SUV market capacity is very large, each has a better performance。Mercedes-Benz, Audi and BMW all had relatively strong competitive performances in March.。

With the implementation of the policy of halving the purchase tax, the luxury SUV market has more room for growth and relatively stable competition.。The trend of domestic BMW X3 is very strong, Audi Q5 is also very strong, Audi Q5 is better in March。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.