ThinkMarkets Trading Session and Liquidity Guide

The best time to trade is during periods of high volatility and liquidity to obtain lower spreads。ThinkMarkets defines the market session as Asia and Nylon to determine the best time to trade。

The best time to trade is during periods of high volatility and liquidity to obtain lower spreads。ThinkMarkets defines the market session as Asia and Nylon to determine the best time to trade。

For indices, stocks and most other financial products traded on various exchanges around the world, traders can only trade during exchange hours。For forex traders, currencies do not have these restrictions because the forex market is open 24 hours a day, 5 days a week, allowing you to trade at any time.。

But that doesn't mean it has to be open 24 / 7.。Due to the difference in trading sessions, the best trading time depends on the specific period, and understanding the various forex trading sessions is critical to determining the best trading time and the best forex asset trading, so ThinkMarkets offers traders the following guidelines。

Take advantage of trading opportunities at any time

Since the forex market has no physical location or central exchange, it is considered an over-the-counter (OTC) or "interbank" market, meaning that the entire market operates electronically within a banking network.。Global traders can trade through brokers 24 hours a day according to their needs。

If you are a part-time trader and need to work during working hours, the best time to trade Forex is before and after business hours。The same is true for students, who trade whenever they have free time。The optimal forex trading time should not overlap with daily trading as trading requires optimal concentration to maximize results。

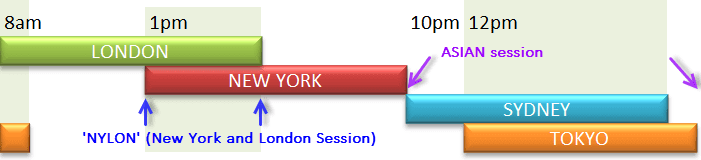

There are 4 main trading sessions, Sydney, Tokyo, London, New York。Sydney and Tokyo are often referred to as Asian sessions, while London and New York are classified as nylon sessions by ThinkMarkets.。

As a multi-asset online brokerage, ThinkMarkets offers a wide range of trading assets from Forex to Precious Metals, Commodities, Indices, Stocks and Cryptocurrencies。The Australian-based broker was founded in 2010 and has since opened more headquarters in London and regional offices in Asia Pacific, the Middle East, North Africa, Europe and South America.。

Along with its historical operations, ThinkMarkets has received numerous awards and recognition in various aspects.。They recently won the Best Value Broker Award in Asia at the 2020 Global Forex Awards。

Standard account average forex spread for traders who open an account with ThinkMarkets from 1.From 2, while ThinkZero offers 0.Best trading experience at 1 point spread。However, traders may want to take into account that ThinkZero charges 3 per side for every 1,000,000 trades..$5 commission。

As a global online brokerage firm, ThinkMarkets operates under the supervision of multiple financial regulators, for example, ThinkMarkets Australia is managed by TF Global Markets (Aust) Limited and licensed by the Australian Financial Services Authority and the Australian Securities and Investments Commission (ASIC), ABN: 69158361561。ThinkMarkets UK is registered with the Financial Conduct Authority (FCA) under the name TF Global Markets (UK) Limited (No.09042646)。

ThinkMarkets is always committed to improving its trading environment through a variety of advanced products.。Auto trading enthusiasts can use free VPS hosting, while enthusiastic traders who want to experience outside the MetaQuote platform can try ThinkMarkets' proprietary platform ThinkTrader。

The trading platform offers 3 different interfaces designed for web desktop, tablet and mobile display。In addition, custom tools such as more than 80 drawing tools and more than 125 technical analysis indicators can even be accessed via mobile screens, which will undoubtedly provide a new mobile trading experience.。

In terms of market updates, the ThinkMarkets deal will be accompanied by news from FX Wire Pro, which is known for its strict policy of adhering to objective news reporting and providing critical, credible information in real time.。Information areas covered by FX Wire Pro include economic commentary, technical-level reports, currencies and commodities, central bank bulletins, energy and metals, and event-driven bulletins。

For payment methods, ThinkMarkets provides gateways through bank transfers, credit cards (Visa and MasterCard), Skrill, Neteller, POLi online banking, BPay, and Bitcoin wallets。

All in all, for a company that has been in business since 2010, ThinkMarkets has been quite successful in terms of legal status and trading technology innovation.。As an additional guarantee of safety for traders, the broker highlighted its commitment to a $1 million insurance protection plan, which is achieved through ThinkMarkets and Lloyd's of London insurance policies, in the unlikely event of bankruptcy Provide up to $1 million in protection for customers' funds。

nylon zone

The most active session occurs during the London session (as does Europe), while the most liquid session occurs during the New York session, and the London trading session is simultaneous。These are known as "nylon" trading sessions (New York and London) and are the most liquid forex trading sessions of all market trading sessions, with maximum liquidity and trading volume.。

The New York trading session begins at 08: 00 Eastern time and ends at 17: 00 Eastern time。Meanwhile, the London trading session begins at 03: 00 EST and ends at noon EST.。Between 08: 00 and 12: 00 EST, the foreign exchange market opens two trading sessions at the same time or overlapping。

This is the most active period for market participants in various financial centers around the world, and ThinkMarkets believes it has enough volatility to trade assets with high liquidity and low spreads.。The best time to overlap is London / New York time (13: 00 GMT - 16: 00 GMT)。

This overlap creates high price action rates and very high breakout opportunities。Breakout strategies in trading are a common practice used by experienced traders when prices break through key levels。The overall momentum of the breakout was from the start of the New York trading session to the end of the London trading session。

Asian Region

During this period, banks in London and New York will end their official trading sessions and Asian banks will be open for trading.。The Asian session begins at 22: 00 GMT when the Sydney market opens, it is called the "Sydney Open," but it is actually the opening of the New Zealand financial market.。Asian session lasts until close at 08: 00 GMT in Tokyo。

Asian sessions typically have low liquidity when most currency pairs trade within a range。Low liquidity also means that currency pairs are generally traded at relatively large spreads, as trading volumes are not as large as nylon。

Much of the activity in the Asian session takes place in the early morning when relevant economic news is released, and the most suitable currencies for trading during the session are the Japanese yen, Australian dollar and New Zealand dollar。ThinkMarkets believes forex traders should also pay attention to press releases from the Australian, New Zealand and Japanese statistical offices。

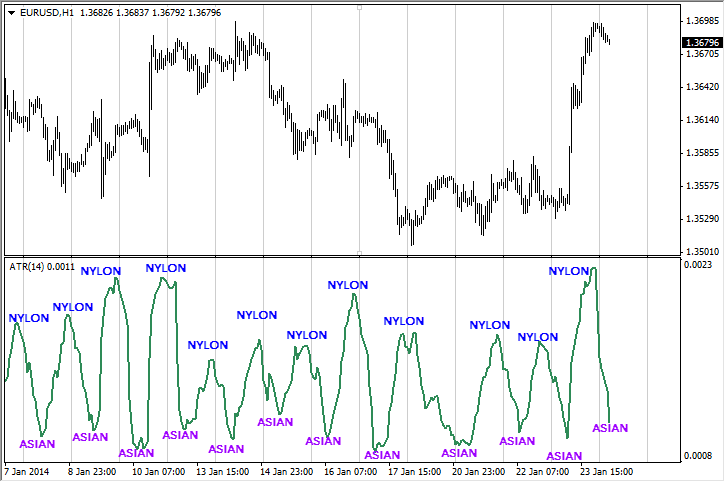

24 - Liquidity cycle

ThinkMarkets provides a visual representation of liquidity changes over a 24-hour period, including the 14-period ATR (Average True Volatility Range) indicator。It is a volume agent, each horizontal line represents 24 hours。

Note that volume and liquidity were lowest during the Asian session, increased during the European and London open, and peaked during the nylon session.。It is not accurate to the hour or minute, but shows the cycle of daily volume increases and decreases。

Finally, the best trading time depends on availability, time zone and personal trading style。For example, if you only want to target a few targets in a low volatility environment, then the Asian trading session is sufficient; however, if you want to win large bonuses in high volatility and huge price fluctuations, then early trading sessions in nylon More suitable。

ThinkMarkets is an award-winning online broker that has become a highly regulated brand globally since 2010, constantly striving to give traders access to a wide range of financial markets through its advanced platform, ThinkTrader。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.