Q1 Net Profit Turned Up Nearly 40%! Alibaba light: there will be 3 independent IPOs of the business

On the evening of May 18, Alibaba released its quarterly results.。Q1 revenue was RMB208.2 billion, up 2% YoY。Non-GAAP net profit of 273.7.5 billion yuan, up 38% year-on-year。Group claims: Alibaba Cloud, Box Horse, Cainiao will be listed independently。

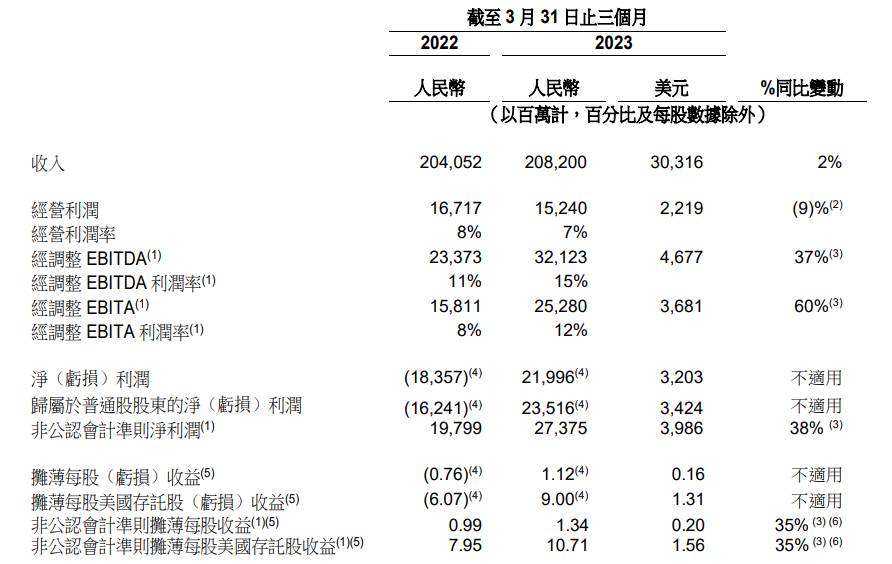

On the evening of May 18, Alibaba released its quarterly results.。Performance data show that Alibaba's revenue in the first quarter was 208.2 billion yuan (RMB, the same below), up 2% year-on-year;.4 billion, down 9% YoY; adjusted EBITA to 252.8 billion yuan, up 60% year-on-year; net profit was 219.9.6 billion yuan, compared with a net loss of 183 in the same period last year..$5.7 billion; non-GAAP net profit of $273.7.5 billion, up 38% YoY; diluted EPS of 1.$12; free cash flow is 322.6.7 billion yuan。

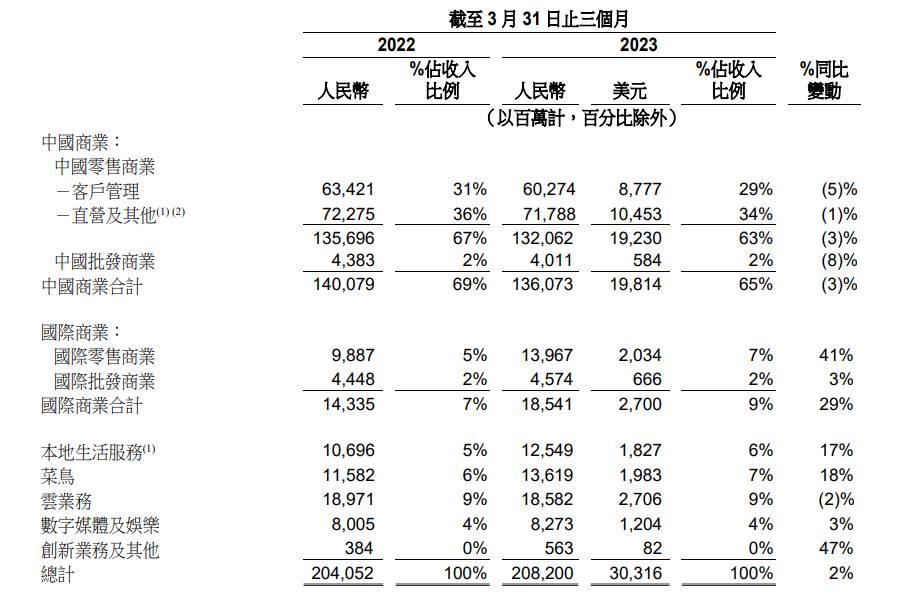

Take a look at Alibaba's first-quarter results from several major divisions of the group.

The financial report shows:

● China Business segment mainly includes China retail business such as Taobao, Tmall, Taote, Taocai, Hema, Tmall Supermarket, Gaoxin Retail, Tmall International and Ali Health, as well as wholesale business including 1688。Revenue from retail business in China's commercial segment was 1,320 in the first quarter..6.2 billion yuan, down 3% year-on-year;.1.1 billion yuan, down 8% year-on-year。Among them, both Taote and Taocai continued to achieve year-on-year narrowing of losses in the first quarter.。

•。International retail business revenue for the first quarter was 139.6.7 billion yuan, up 41% year-on-year; international wholesale business revenue was 45.7.4 billion yuan, up 3% year-on-year。The segment, which operates platforms such as Lazada, AliExpress, Trendyol and Daraz, saw overall order volume growth of 15% year-on-year in the first quarter。Among them, AliExpress launched a new service for global consumers in the first quarter, Choice。Choice's rapid growth in daily orders in the first quarter drove AliExpress to double-digit order growth in the quarter。In addition, Lazada recorded double-digit order year-over-year growth in the Southeast Asian market.。

● Local living services mainly include "home" (hungry?) and "destination" (Gaud and Flying Pig) businesses, with first-quarter revenue of 125.4.9 billion yuan, up 17% year-on-year。Among them, hungry GMV growth and order growth increased significantly.。Meanwhile, orders for Gode and Feizhu business grew rapidly year-on-year due to a strong recovery in travel and tourism demand.。In March, the number of active users per day reached a record high of 1.500 million, Feizhu's domestic hotel booking value increased by more than 70% compared to the same period in 2019。

● The revenue of Cainiao segment mainly comes from its domestic and international one-stop logistics services and supply chain management solutions.。Rookie's revenue (after offsetting the impact of cross-segment transactions) for the first quarter was 136.1.9 billion yuan, up 18% year-on-year。72% of total revenue comes from external customers。Revenue growth was primarily driven by an increase in average revenue per order for international logistics fulfillment solution services and an increase in demand for consumer logistics services。

● Alibaba's cloud business division consists of Aliyun and Dingding。Cloud segment revenue (after offsetting the impact of cross-segment transactions) was 185 in the first quarter..8.2 billion yuan, down 2% year-on-year。The decline in revenue for this segment was primarily due to delays in delivery of hybrid cloud projects due to the impact of the epidemic and the phasing out of use of its overseas cloud services by head customers.。Alibaba also mentioned that the cloud business segment accounted for 55% of revenue contributions from non-Internet industries in the first quarter.。Businesses including financial services, retail, media, and automotive drove solid year-on-year revenue growth in the non-Internet industry.。

For generative AI, Alibaba mentioned that since its release, it has received more than 200,000 enterprise users from various industries to apply for access to the test request.。It also said that in the near future, the company plans to integrate the new big language model Tongyi Qianchen into all business applications within the Alibaba ecosystem.。And at the 2023 Spring Nail Summit held on April 18, Nail has launched an intelligent functional product integration based on the Tongyi Thousand Questions language model.。

Regarding the recent price cuts of Alibaba Cloud, Alibaba believes that these measures will help customers increase the adoption rate of public clouds in China and release potential development opportunities for enterprises to use artificial intelligence technology.。

● In the Digital Media and Entertainment segment, first-quarter revenue was 82.7.3 billion yuan, up 3% year-on-year。Among them, thanks to the normalization of demand for offline ticketing services, businesses such as barley and Taobao tickets showed strong growth.。In addition, Youku's total subscription revenue grew 13% year-over-year in the first quarter.。

● Innovation Business and Other Segments First Quarter Revenue of 5.6.3 billion yuan, up 47% year-on-year。

New Capital Management Committee, six major business group directors open board members

Alibaba's Board of Directors approved the establishment of a new Capital Management Committee, which is responsible for planning and implementing comprehensive capital management to enhance shareholder value.。The committee will consider and decide on important matters related to Alibaba Group as a holding company, including various capital market transactions, shareholder return plans, subsidiary equity incentive plans, financing, listing and spin-off.。

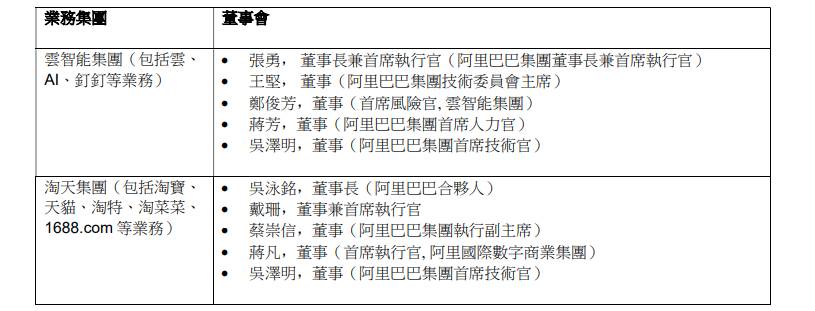

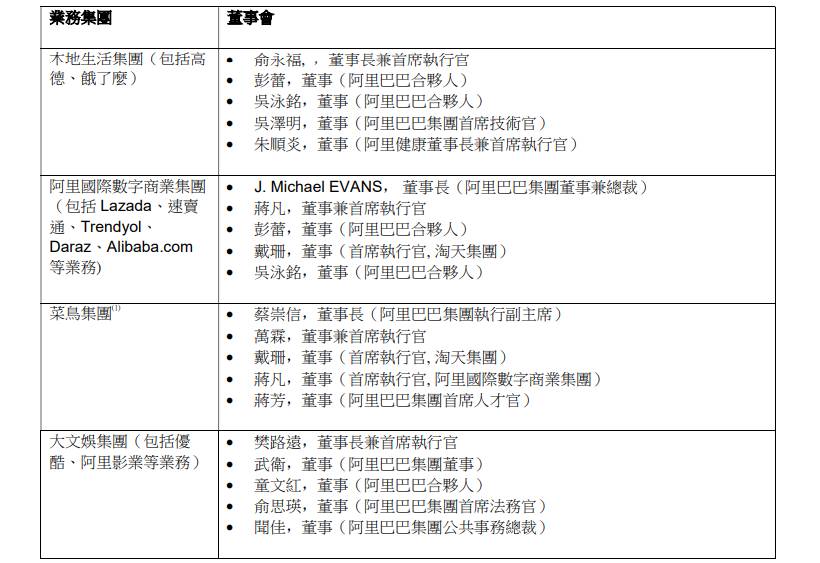

The board members of the six major business groups were also disclosed in the earnings report.。Among them, the Cloud Intelligence Group is personally led by Zhang Yong, highlighting the importance Alibaba attaches to the business.。

Ali cloud, box horse, rookie and so on to seek listing, the fastest or in six months to complete!

Earlier Alibaba said it would propose 1 + 6 + N organizational changes, and in this quarterly report Alibaba also disclosed the latest developments。In the independent listing progress, it is expected that the fastest completion will be the box horse.。Alibaba announced that the board of directors has approved the launch of the listing process for the executive box horse, and expects the listing to be completed in the next 6 to 12 months。In January this year, Box Horse CEO Hou Yi revealed in an internal letter that while Box Horse is growing at a high rate in 2022, the main format - Box Horse Fresh Life - has achieved profitability.。

Under the AI wave, Alibaba Cloud's listing is undoubtedly eye-catching。The Alibaba Board of Directors has now approved the complete spin-off of the Cloud Intelligence Group through a dividend distribution to shareholders.。and plans to bring in external strategic investors through private placement before the spin-off。The Group announced that it plans to complete the above plan in the next 12 months.。

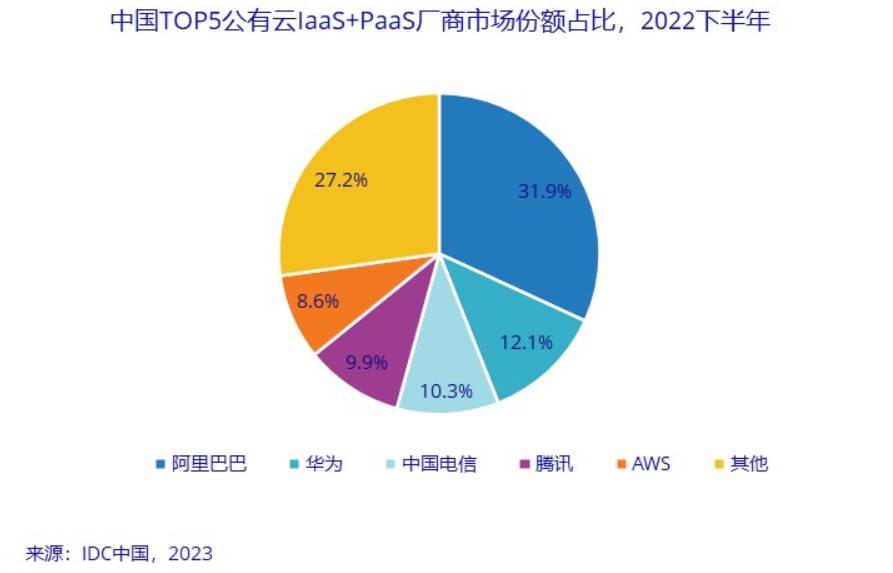

Last month, IDC released the "China Public Cloud Services Market (Second Half of 2022) Tracking" report, the report shows that in the domestic IaaS + PaaS market, Alibaba Cloud's market share ranks first, accounting for about 32%, and believes that "Alibaba Cloud is deeply engaged in the actual needs of large public cloud customers, and the growth rate is obvious in the Internet, finance, education and other industries."。In addition to seizing share in China, Alibaba Cloud is also developing rapidly.。It is reported that Alibaba Cloud currently operates 86 availability zones in 28 geographic regions around the world, serving more than 4 million customers worldwide.。

After offsetting the impact of cross-segment transactions, Alibaba's cloud business reached 772 revenue in fiscal 2023..03 billion, with an adjusted EBITA of 14.2.2 billion yuan, up 24% year-on-year, making profits for two consecutive years。In the second year of profitability, Alibaba Cloud chose to divest and go public. Obviously, Alibaba wants to seize the opportunity in the next important technological changes in cloud computing and AI.。Alibaba Cloud listed separately or will accelerate the pace of Alibaba's attack in the cloud market and AI field!

Zhang Yong, Chairman and CEO of Alibaba Group, believes that the current development of AI has brought new opportunities for cloud computing vendors to improve their computing power and expand their product lines.。With the further development of AI, the demand for computing power will increase exponentially, especially for high-performance computing power. Therefore, Alibaba Cloud must be fully prepared to serve the new era of AI.。

Rookie also seeks to go public in the next 12-18 months。In contrast to the full spin-off of Cloud Intelligence Group, Cainiao will be 67% owned by Alibaba Group, with other shareholders including strategic investors in the logistics industry and global institutional investors.。In addition, Alibaba's board of directors also approved Ali International Digital Business Group to start exploring external financing.。

Regarding the business spin-off, Zhang Yong said: "The global situation is becoming increasingly complex, we take the initiative to implement organizational changes, give the business greater independence to enhance its competitiveness, meet the changing needs of different customers, and capture new market opportunities."。"

While constantly adjusting its organizational structure, Alibaba is continuing to execute its share repurchase program。In the first quarter, Alibaba repurchased about 21.5 million American depositary shares (equivalent to about $1.9 billion, according to earnings data..72.4 billion shares of common stock)。Under the current authorization, Alibaba has approximately $19.4 billion in repurchase facilities, valid until March 2025.。

HSBC Global Research released a report saying Alibaba's first-quarter results were broadly in line with expectations, but its China retail business customer management (CMR) revenue fell 5% year-on-year, offsetting the impact of international business growth.。The bank expects Alibaba's CMR revenue to return to positive growth in the quarter ended June this year, and expects overseas operations to also drive revenue growth。The bank cut Alibaba's revenue forecast for fiscal 2024 by 0.3%, cloud business revenue is expected to turn negative at the end of the 2023 fiscal year.。The Group's strategic focus on quality rather than quantity is expected to have a more lasting impact on cloud revenue growth。

The bank raised Alibaba's earnings forecast for fiscal 2024-2025 slightly by about 1%.。In addition, the bank still believes that Ali's restructuring activities may unlock the value of certain business units, but the full spin-off of the cloud business in the future may also cause problems, as cloud computing and international commerce are the group's long-term growth drivers.。The bank believes that Alibaba's share price may fluctuate in the short term, lowering its target price for Alibaba's H-shares from HK $139 to HK $137, maintaining a "buy" rating.。

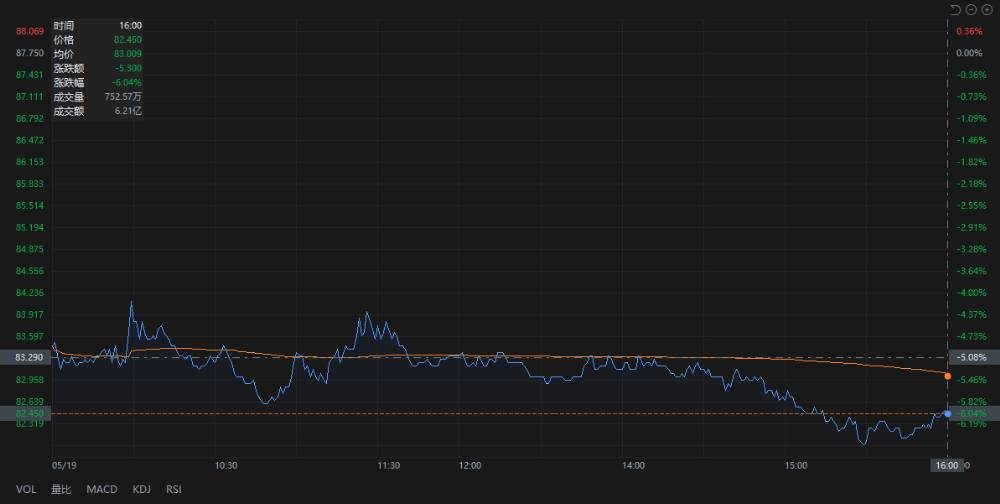

It is worth noting that, although Alibaba released a more satisfactory financial results, but limited by the overall decline in the market, Alibaba-SW shares today under pressure, closed at 82.HK $45, down more than 6%。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.