Continue to add code energy storage track Tesla another super factory "settled" in Shanghai

On April 10, Tesla announced plans to build a new energy storage plant in Shanghai dedicated to the production of the company's energy storage product Megapack。This is Tesla's second energy storage super factory worldwide and the company's first energy storage super factory project outside the United States.。

On April 10, Tesla announced plans to build a new energy storage plant in Shanghai dedicated to the production of the company's energy storage product Megapack。This is Tesla's second energy storage super factory worldwide and the company's first energy storage super factory project outside the United States.。

Tesla to develop energy storage business

According to information released by Tesla China on Weibo, the Tesla Energy Storage Super Factory project is scheduled to start in the third quarter of 2023 and start production in the second quarter of 2024.。It is reported that Tesla claims that each Megapack battery can store more than 3MWh of energy to meet the electricity needs of 3,600 households for one hour.。

Tesla expects its Shanghai energy storage plant to initially plan an annual output of up to 10,000 commercial energy storage batteries, with an energy storage scale of nearly 40 GWh and a supply range covering the global market, reflecting Musk's decision to deepen partnerships with the Chinese market.。Because for Tesla, China is an extremely important market。Earlier, Tesla released data showing that Tesla's deliveries continued to grow in March, with the Shanghai Super Factory delivering 88,869 vehicles, up 35% year-on-year.。

Musk has previously pledged to expand Tesla's energy storage business, putting it on par with the company's car manufacturing operations.。It is understood that Tesla's Megapack battery can be used for utility-scale power storage, such as to save wind and solar energy for later use。Energy production and storage make up a relatively small portion of Tesla's business, accounting for about 5% of the company's revenue in 2022.。

Not long ago, Tesla officially announced the "secret plan" in the third chapter, has set the goal of a comprehensive shift to sustainable energy, by 2050 to achieve 100% sustainable energy, and Tesla energy storage super factory project is one of the important initiatives to achieve this goal。

Tesla's subsequent price cuts may be more robust.

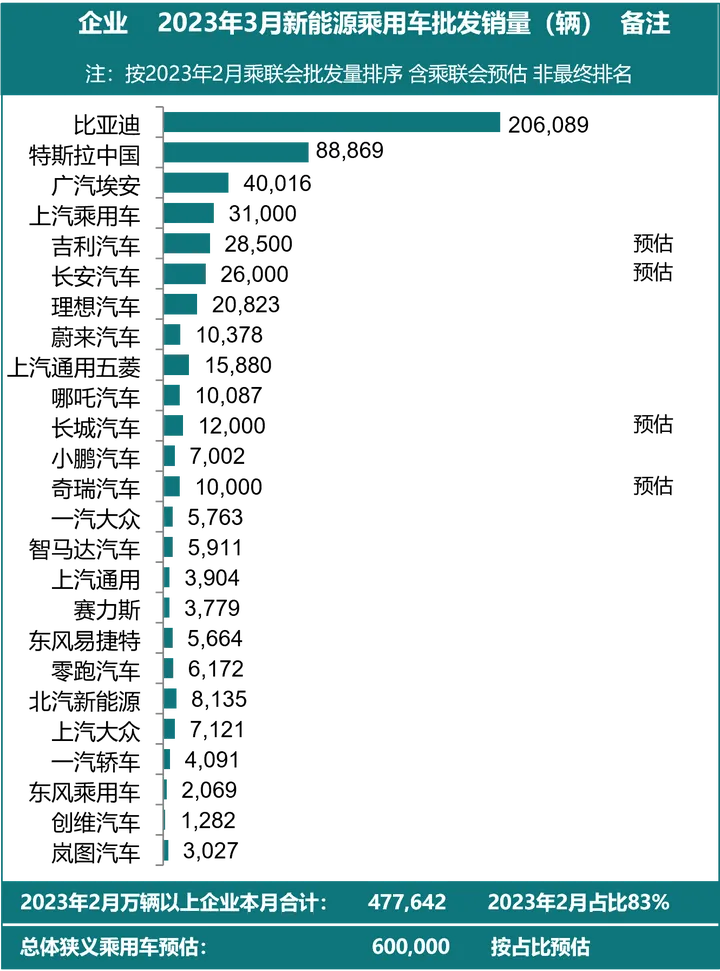

Although Tesla is currently facing competition from new energy vehicle companies such as BYD, Weilai, Ideal and Xiaopeng in China, Tesla has repeatedly competed for most of its market share by virtue of its higher gross profit margin than its peers.。According to the March new energy vehicle sales data disclosed by the Federation of Passengers, Tesla ranked second with nearly 90,000 units sold, and although it is two times worse than BYD, Tesla is also more than two times better than GAC Ean, which ranks third.。

Subsequent to the gradual improvement of Tesla's energy storage business, its gross margin or further increase, so that Tesla's price reduction will be more and more confident.。Tesla previously lowered the price of cars sold in China several times last year due to lower material costs, while also offering various incentives to buyers。As soon as deliveries fall, Tesla will immediately cut prices to regain market share。

It's worth noting that last Thursday, Tesla again lowered the price of its U.S. models, with the most significant drop in high-end models, which is Tesla's third price adjustment for high-end models this year.。

Specifically, the starting prices of the Tesla Model S and Model X models were lowered by $5,000 each to 8.$4.99 million and 9.$4.99 million。The biggest drop occurred in the Model X plaid version, which has been cut by 3 this year..$40,000, discount reached 24.46%。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.