Tencent Q2 results inventory: game business stagnates, WeChat video number performs brightly

On August 16, Tencent released its second quarter earnings report。Revenue in the second quarter was RMB149.2 billion, up 11% year-on-year and down 1% from the previous quarter, according to the results.。Profit for the period was $38.6 billion, up 33% year-on-year, with net profit margin rising to 26% from 22% in the same period last year.。

On August 16, Tencent released its second-quarter results for the second quarter ended June 2023.。

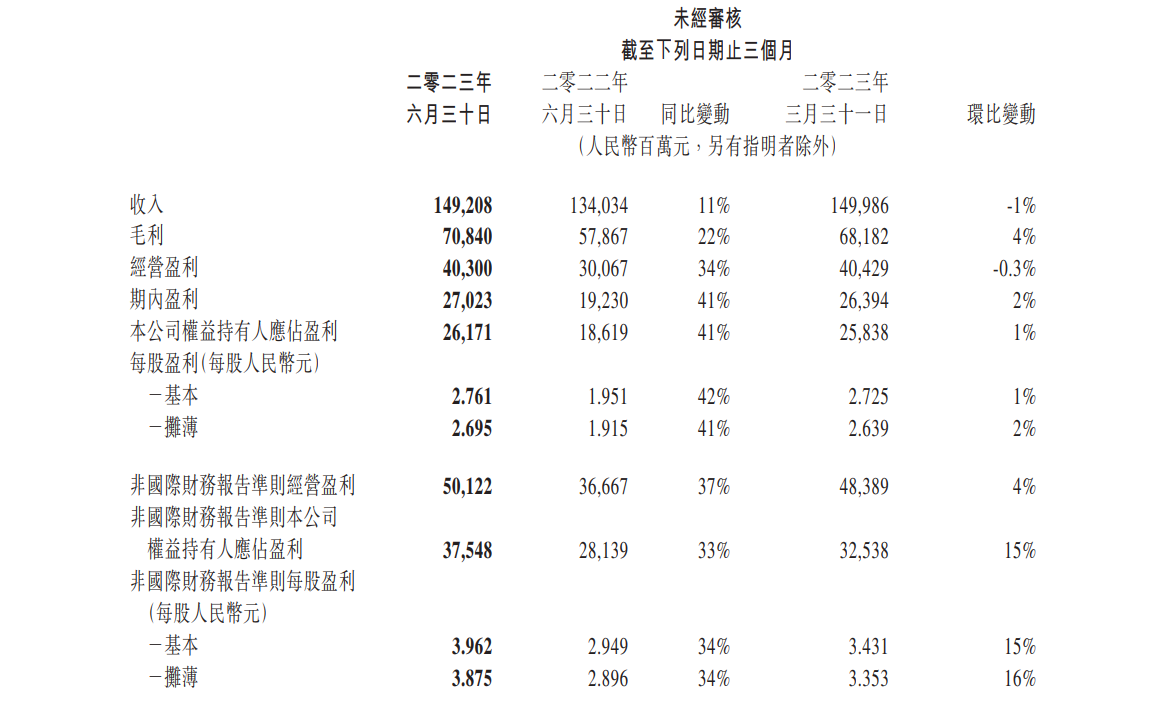

According to the results, revenue in the second quarter was RMB149.2 billion (RMB, the same below), up 11% YoY and down 1% YoY.。Gross profit was $70.8 billion, up 22% year-on-year and 4% month-on-month.。Operating profit was 40.3 billion yuan, up 34% year-on-year.。Profit for the period was $38.6 billion, up 33% year-on-year, with net profit margin rising to 26% from 22% in the same period last year.。Profit attributable to equity holders was $26.2 billion, up 41% year-on-year.。Basic earnings per share of 2.76 yuan。

At the end of June, Tencent's net cash was $17.7 billion, compared with $31.5 billion at the end of the previous quarter.。The company said the change was mainly due to dividend payments and share buybacks, most of which were funded by free cash flow generated.。

In the second quarter, Tencent spent about $16 billion on research and development, maintaining a high level for six consecutive quarters, and from 2020 to the second quarter of this year, Tencent spent more than $180 billion on research and development.。

In this earnings report, the most eye-catching is the game business and Tencent cloud business, in the earnings call is also frequently "asked."。

Q2 Gaming Business Stagnates, Tencent: Expected to Return to Growth in Next Quarter

Tencent's gaming business underperformed expectations in the second quarter.。Despite year-over-year growth in monthly and daily live numbers for both mobile and PC games, Tencent's home market game revenue was $31.8 billion in the second quarter, flat year-over-year, down 9% from the previous quarter, due to a decrease in highly commercial content released in several of the largest games.。

Gaming revenue in the international market was 12.7 billion yuan, up 19% year-on-year, up 12% after excluding the impact of exchange rate changes, but down 4% from the previous year.。Among them, PC-side game revenue continues to grow。On the mobile side, the signs of declining player activity after the epidemic have faded, especially in PUBGMOBILE。In addition, recently released games also bring contributions, such as "Victory Goddess: Nikki"。

For the game business decline, Tencent believes that this is a temporary phenomenon。The company released a large amount of commercial content for traditional advantage games in the first quarter, resulting in a significant increase in total game revenue, but entered a pause period in the second quarter, resuming commercial content releases in the third quarter and expecting a return to year-over-year growth in the third quarter。

In terms of new games, Tencent recently launched two large PC games in China, "Intrepid Contract" and "Ark of Destiny."。Among them, the Intrepid Compact (English name: Valorant) has previously landed overseas, and according to Newzoo data, the Intrepid Compact will have more than $300 million in the U.S. in 2022.。The game also won the TGA's "Best Esports Game" award in 2022, which is known as the Oscar in the gaming industry, and is considered promising to be Tencent's next phenomenal game product.。

It is worth mentioning that the game on WeChat small program growth significantly。The number of monthly active accounts of the applet exceeded 1.1 billion, of which WeChat Mini Game attracted more than 400 million monthly live users and 300,000 game developers.。

Liu Chiping, executive director of Tencent, said in a telephone conference that well-known game companies and small studios are actively developing and operating small games based on the Tencent applet framework, including casual games, card games and other types of games.。In the second quarter, there were more than 100 small games with a single quarterly revenue of more than 10 million RMB.。

Liu Chiping said that for Tencent, small games also have important strategic value。First of all, Tencent has the largest casual game community in China through small games, and monthly live users are far from any single game APP on the supermarket market.。Second.Small games allow Tencent to expand its user base and attract new players, providing Tencent with game distribution and advertising revenue with high margins and a platform economy model.。

Tencent said it has been paying close attention to game platforms, especially small game platforms。In terms of users and revenue, Tencent's platform is more than five times larger than any app-based casual game.。As new casual gaming experiences appear on the platform, it is growing at an extremely fast rate year by year。

The big model is going well,Tencent Cloud Announces Full Support for Mainstream Open Source Models

In the second quarter, Tencent's cloud and other enterprise services revenue was 13.5.9 billion yuan, achieving low double-digit year-on-year growth。Overseas, Tencent Cloud's international business maintained double-digit growth in the first half of the year, with revenue driven by overseas partners rising 66% year-on-year.。

In the second quarter, Tencent made a number of advances in AI and large models.。

In the second quarter, Tencent officially released the country's first AI-native vector database。The database supports up to the industry-leading 1 billion-level vector retrieval scale, controlling the latency to the millisecond level, increasing the retrieval scale by 10 times compared to traditional stand-alone plug-in databases, and has a peak query capacity of millions per second.。

In terms of infrastructure for large models, in the second quarter, Tencent's HCC (High-Performance Computing Cluster) high-performance computing cluster will improve performance by 3 times, self-developed star pulse network will improve communication performance of large models by 10 times, and AI native vector database will support a billion-level retrieval scale.。

On August 16, Tencent cloud TI platform announced full access to more than 20 mainstream models such as Llama 2, Falcon, Dolly, Vicuna, Bloom and Alpaca。These mainstream models support direct deployment calls, simple application processes, and low-code operations throughout the process.。Support enterprise, developer one-click call, low code operation。Tencent Cloud has also become the first batch of large model manufacturers to put on shelves and support open source models in China.。

Tencent founder Ma Huateng said in his earnings report, "We are providing a model library for our partners with Tencent Cloud Model as a Service (MaaS), and we are also polishing our self-developed proprietary base model.。"

For the development of AI, Tencent also revealed some news on the phone。

The first is related to the big model, Tencent revealed its proprietary base big model, which is progressing very well.。"Model training is on track, and we have started testing proprietary base models in different internal usage scenarios, including Tencent Cloud, Finance, Technology, and Gaming departments, allowing them to start testing models and start making adjustments in model performance, with upgrades in the second half of this year."。"

In the cloud business, Tencent said it will make more efforts in the second half of the year。And said that Tencent's latest one-stop industry model solution, MaaS, is expected to bring new growth points to the cloud business, and help enterprises efficiently deploy open source models through Tencent Cloud's "Maas" solution.。

WeChat video number performs brightly, advertising revenue growth is strong

In addition to gaming and cloud business, Tencent Q2 earnings report has some other highlights。

In the financial technology and corporate services business, revenue in the second quarter was $48.6 billion, up 15% year-on-year and stable from the previous quarter.。Among them, revenue from fintech services achieved double-digit year-on-year growth, driven by increased offline commercial payment activity。At the same time, enterprise services revenue improved, achieving low double-digit year-over-year growth, thanks to revenue generated from live video number delivery transactions and a slight increase in cloud services.。

In terms of communications and social networks, specifically, the combined monthly active accounts of WeChat and WeChat are 13.2.7 billion, up 2% year-on-year, with video numbers performing brilliantly, with total user usage almost doubling year-on-year。The number of monthly active accounts on QQ mobile terminals is 5.7.1 billion, up 0.4%。

In terms of digital content, the number of paid members of Tencent Video in the second quarter was 1.1.5 billion, down 5% YoY, but up 2% QoQ。QQ Music Paid Members Reached 100 Million in June。

In the online advertising business, revenue in the second quarter was $25 billion, up 34% year-on-year and 19% month-on-month.。With the exception of the automotive transportation industry, all key advertiser industries achieved double-digit year-on-year growth in advertising spending on our platform。Among them, the video number advertising performance is strong, revenue of more than 3 billion yuan。

In the call, Tencent believes that it is currently in a huge opportunity, there are many long-term and more direct opportunities, such as video account, advertising currently covers only a small part of the operation.。Looking ahead, the company will gradually increase the advertising percentage of WeChat video numbers and translate it into more revenue。

In addition, Tencent also said that as the company develops its e-commerce business in video numbers, using existing infrastructure such as applets, Tencent believes it is "in a good position" to breed opportunities to double advertising revenue.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.