Tencent Q2 Earning Unveiled: Gaming Recovers, AI LLMs Performs Outstandingly

Tencent's second quarter 2024 performance data disclosure proves the advantages of its platform and content combination strategy.

On August 14, Tencent disclosed its financial results for the second quarter of 2024, ending June 30, with impressive figures.

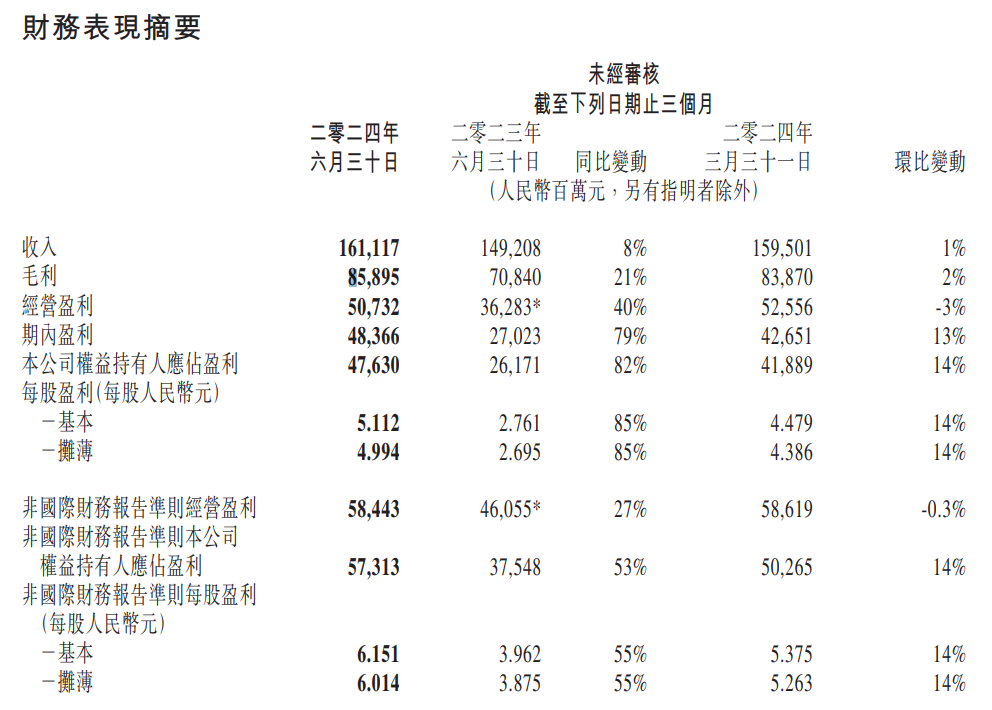

According to the data, Tencent achieved revenue of 161.1 billion RMB in Q2, an 8% year-over-year increase. Gross profit rose by 21% to 85.9 billion RMB, while net profit surged 82% to 47.6 billion RMB. Adjusted net profit reached 57.3 billion RMB, up 53% year-over-year. Diluted earnings per share increased by 85% to 4.994 RMB.

Pony Ma, Chairman and CEO of Tencent Holdings, stated, “The performance in Q2 2024 proves the advantages of our platform and content integration strategy. Looking ahead, we will continue to invest in platforms and technologies like AI to create new business value and better serve user needs.”

Four Major Businesses

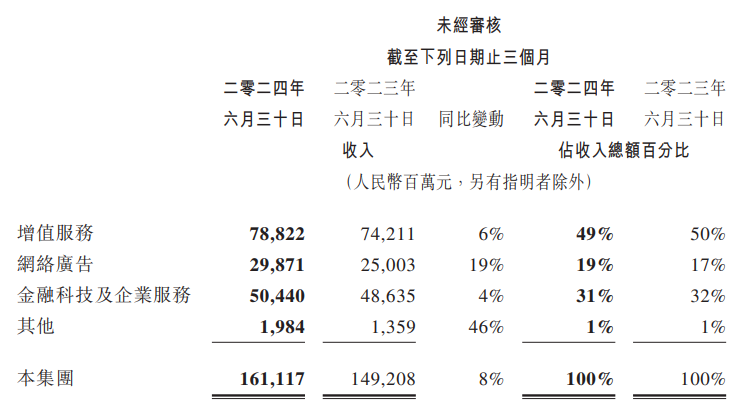

Specifically, in the second quarter, Tencent's value-added service revenue was 78.8 billion yuan, a year-on-year increase of 6%; online advertising revenue reached 29.9 billion yuan, a year-on-year increase of 19%; financial technology and enterprise service revenue was 50.4 billion yuan, a year-on-year increase of 4%; other business revenue was 19.8 billion yuan, a year-on-year increase of 46%. The first three are Tencent's three main businesses, accounting for 49%, 19% and 31% of the total revenue respectively.

Value-Added Services

Obviously, the strong growth of value-added service business is mainly due to the recovery of game business, with revenue of 13.9 billion yuan and 34.6 billion yuan in the international market and domestic market respectively, both up 9 percentage points year-on-year, successfully reversing the previous sluggish trend.

In the second quarter, the revenue of several long-standing games such as Tencent's "Honor of Kings" and "Peace Elite" resumed growth, and the successful release of new games such as "Valorant" and "Golden Spatula Wars" has reached a record high in the domestic market. For the foreign market, games such as "PUBG MOBILE" and "Brawl Stars" under Supercell have grown rapidly, and the average daily active users of the latter have also set a record high, with revenue increasing by more than 10 times year-on-year.

During the period, Tencent also released "Dungeon & Fighter: Origin" (DNF mobile game) produced by South Korean company Nexon, which activated millions of IP fans and successfully dominated the domestic game best-selling list.

However, Tencent President and Executive Director Martin Lau pointed out in a conference call that due to the cyclical nature of the game industry, growth will fluctuate greatly in different periods; moreover, today's consumers have higher expectations and requirements, and the success of new games is becoming increasingly difficult.

In terms of social networks, Tencent achieved revenue of 30.3 billion yuan, a year-on-year increase of 2%. By changing the self-made TV series of Yuewen IP, many popular TV series were launched in the second quarter, driving the number of long video paid members to increase by 13% year-on-year; in addition, Tencent Music paid membership books increased by 18% year-on-year; the revenue from the service fees of the mini-game platform and the sales of virtual props for mobile games also contributed to this business.

Online Advertising

It is reported that Tencent's online advertising mainly includes the fee income of advertisers on Tencent social platforms (WeChat Moments, Video Accounts, Mini Programs and Souyisou, etc.) and web pages for advertising, which is the fastest growing business of the group in the quarter.

In the second quarter of this year, Tencent upgraded its advertising technology platform. The enhanced algorithm can provide users with more accurate content more efficiently, which has greatly increased the revenue of video accounts, long videos and mini programs, and the user usage time has also surged year-on-year.

The growth of the advertising business mainly comes from the strong promotion of games, e-commerce and education.

Since last year, Tencent has been betting on video accounts to compete for the market share of live e-commerce, and has achieved steady growth during the period. Last year, the total GMV of video accounts reached 100 billion yuan, and the average daily usage time of users was 40 minutes.

However, the reduction in advertising budgets of some Internet service companies also led to a year-on-year decline in the revenue of the mobile advertising alliance.

Financial Technology and Corporate Services

As Tencent's second largest source of revenue, due to the "slowing growth of commercial payment revenue, slow growth of consumer spending, and stricter risk control measures", the weak consumer spending in the quarter and the cold consumer loan services, Tencent's financial technology revenue (including Tencent Cloud, commercial payment activities, enterprise WeChat and other related service revenue) fell 4% month-on-month to 50.4 billion yuan.

However, thanks to the growth in cloud service business revenue (including the improved commercialization of WeChat for Enterprise) and the growth in technical service fees for video account merchants, the revenue growth rate of enterprise service business recorded double digits.

It is worth noting that the application of AI large models has played a significant positive role in To B business.

For example, Tencent's Hunyuan large model has been implemented in nearly 700 businesses and scenarios within the group, helping to upgrade SaaS products such as Tencent Conference and Enterprise WeChat.

In May of this year, Tencent launched the AIGC application "Yuanbao", with the deep AI search function covering public accounts as its core competitiveness. Users can experience the application's long text intensive reading, Wenshengtu, Wensheng 3D and other functions, and completed the Deepin Upgrade of AI search mode.

In terms of cloud computing, Tencent said it will adhere to the "company development simultaneously" strategy - on the one hand, it provides customers with convenient public cloud services; on the other hand, it provides flexibly deployable private cloud services for customized and project-based government and enterprise businesses.

Big buyback

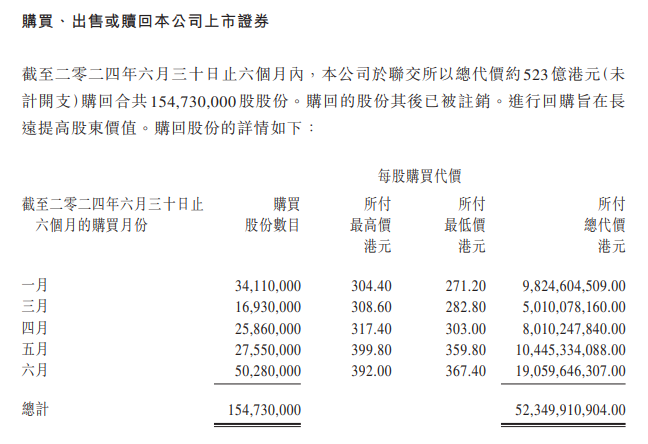

On the same day, Tencent also issued an announcement stating that the company had repurchased a total of 154.73 million shares on the Hong Kong Stock Exchange within the six months ending on June 30, 2024, for a total price of approximately HK$52.3 billion. The shares repurchased have subsequently been Logout.

At the beginning of this year, Tencent promised a repurchase target of over 100 billion Hong Kong dollars per year, and now its repurchase efforts continue to increase.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.