Liabilities 2.4 trillion! Evergrande was jokingly called "debt can be enemy country" accountant: unable to express an opinion

On the evening of July 17, China Evergrande Group released three financial reports in one breath, including the 2021 and 2022 interim results announcements and the 2022 results announcement.。According to the financial report, Evergrande's two-year net loss reached 812 billion yuan, with more than 2.4 trillion, this huge number by netizens jokingly called "debt can be enemy countries"。

On the evening of July 17, China Evergrande Group (hereinafter referred to as "Evergrande") released three financial reports in one breath, including the 2021 and 2022 interim results announcements and the 2022 results announcement.。

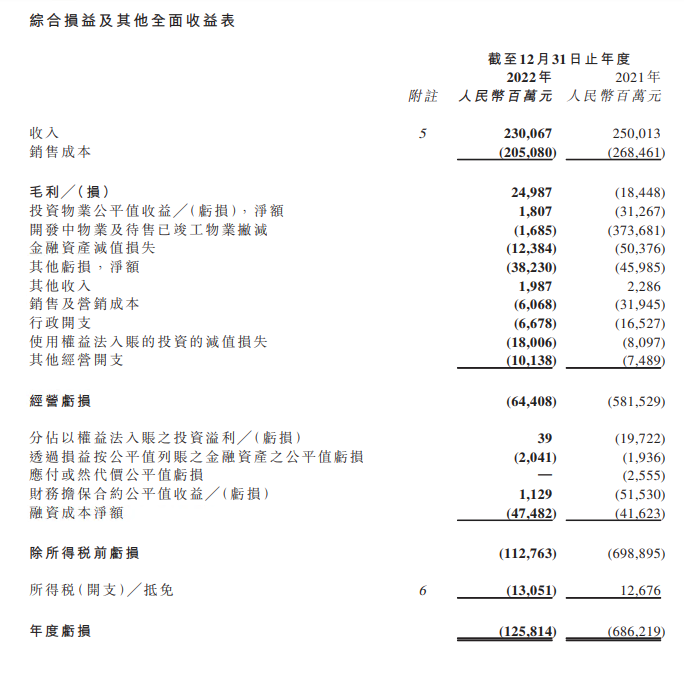

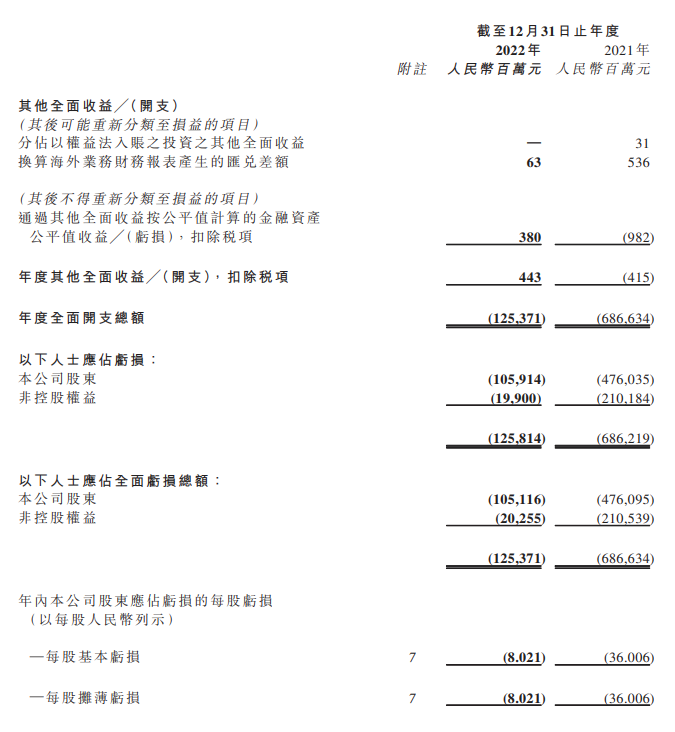

According to the financial report data, Evergrande's total liabilities as of December 31, 2021 were 25,801.500 million yuan (RMB, the same below), excluding contractual liabilities 9,743..After $500 million, $1,605.8 million, of which: borrowings of $6,073.800 million yuan, trade accounts payable and other payables 8,933..400 million yuan, other liabilities 1,050.900 million yuan。The group's annual revenue for 2021 is 2,500.100 million yuan, a decrease of 50.71%, gross loss 184.500 million yuan, net loss total 6862.200 million, loss attributable to shareholders 4,760.$3.5 billion, loss per share 36.006 yuan。

As of December 31, 2022, Evergrande had total liabilities of 24,374.$100 million, excluding contractual liabilities 7,210.17,163 after 200 million yuan.900 million yuan, of which: borrowing 6,123.$900 million, trade and other payables 10,022.600 million yuan, other liabilities 1,017.400 million yuan。The group's annual revenue for 2022 was 2,300.700 million yuan, a decrease of 7.98%。Gross profit 249.900 million yuan。Operating loss for the year 433.900 million yuan, with a total net loss of 1,258 yuan..100 million, loss attributable to shareholders 1,059.1.4 billion yuan, down 77.92%, loss per share 8.021 yuan。

As of December 31, 2022, Evergrande owned land bank 2.100 million square meters, which is 2 at the end of 2021..600 million square meters。

Evergrande's "late" earnings report, as expected by the market, is "not ideal."。The two-year net loss amounted to $812 billion, and although the loss fell from the previous year, its revenue also declined, exacerbating market concerns about its future operations.。More importantly, Evergrande is now in debt over 2.4 trillion, this huge number by netizens jokingly called "debt can be enemy countries"。

Evergrande financial report "stumped" accountant?

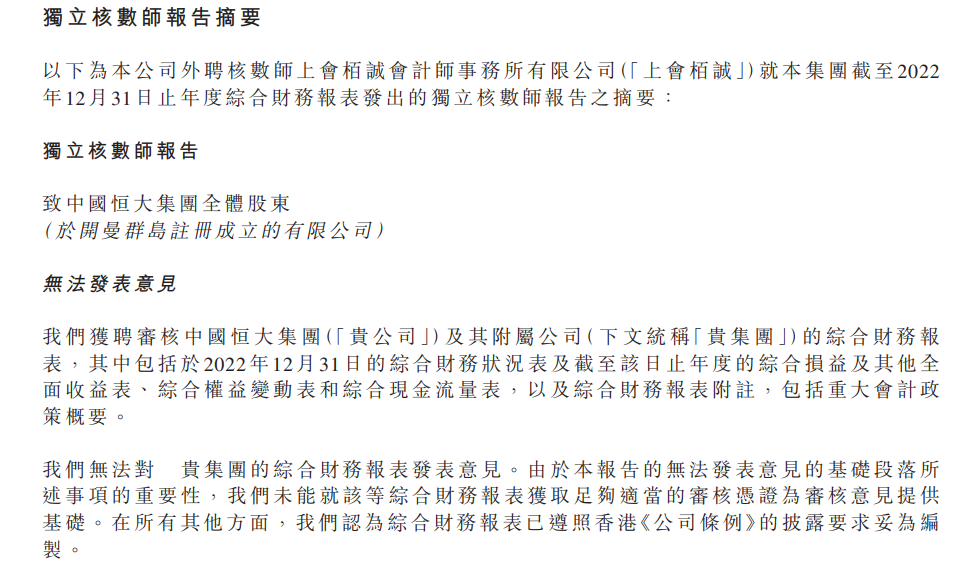

The accounting firm's reaction to Evergrande's consolidated financial statements was also "unusual."。Evergrande's external auditor, Shanghui Chengcheng Certified Public Accountants (hereinafter referred to as "Shanghui Chengcheng"), said that it was unable to express an opinion on the matter.。

According to the meeting, the inability to express an opinion is based first and foremost on the fact that Evergrande has a number of uncertainties about going concern.。Evergrande's losses, liabilities, cash position and the number of lawsuits involved, a combination of circumstances that may prevent Evergrande from realizing its assets and liquidating its liabilities in the normal course of business。And there are a number of uncertainties about the many measures Evergrande has taken to improve its cash and financial position.。The uncertainty of future cash flows raises significant doubts about the Company's ability to continue as a going concern, and thus the potential cumulative impact on the consolidated financial statements is so significant that the firm is unable to express an opinion.。

Second, for the 2021 financial results, the Board believes that it is unable to obtain sufficient and appropriate audit credentials to provide a basis for an audit opinion and is therefore unable to express an opinion on the 2021 consolidated financial statements.。

Prior to the appointment, Evergrande's auditor was PricewaterhouseCoopers (PricewaterhouseCoopers).。On January 16, 2023, Evergrande and its three companies, Evergrande Property and Evergrande Automobile, announced at the same time that, at the suggestion of the three companies, PricewaterhouseCoopers resigned as the company's auditor, effective today.。At the same time, the appointment of the new auditor.。

Regarding the replacement of the accountant, Evergrande said that the completion of the 2021 audited financial statements was important for Evergrande's resumption of trading, but that the two sides could not agree on the scope of work and timetable due to additional audit work and procedures required by PwC on a number of matters.。That's why Evergrande needs to "hire someone else."。

In its letter of resignation, PwC stated that it was unable to conduct a full audit due to the lack of information on certain material matters related to the audited financial statements.。In addition, PwC was unable to determine the scope of the follow-up work and the time required to complete it, and agreed to resign.。It is worth mentioning that the cooperation between PricewaterhouseCoopers and Evergrande has a long history, since Evergrande went public in Hong Kong in 2009, the two have been cooperating for 14 years this year.。

The latest progress in the restructuring of Evergrande's foreign debt: a hearing on the restructuring agreement will be held this month.

In addition to releasing its results report, Evergrande also released the latest news on offshore debt restructuring on the evening of the 17th.。

Previously, Evergrande proposed a restructuring plan for the foreign debt, according to the main body of the bond, respectively, Evergrande agreement arrangement, Jingcheng agreement arrangement and space-based agreement arrangement.。According to the latest announcement, Evergrande will hold a hearing on these restructuring agreements。

In the Evergrande Arrangement, the hearing of Evergrande's proposed implementation of the Arrangement in the Hong Kong Special Administrative Region is scheduled to be held on July 24 at 11: 30 a.m. in the High Court of the Hong Kong Special Administrative Region; the hearing of Evergrande's proposed implementation of the Arrangement in the Cayman Islands is scheduled to be held on July 25 at 10 a.m. local time (i.e. 10 p.m. HKSAR time) in the Cayman Islands Grand Court.。

The hearing of the King Cheng Agreement is scheduled to be held on 24 July at 10 a.m. British Virgin Islands time (i.e. 10 p.m. HKSAR time) in the High Court of the Eastern Caribbean Supreme Court.。The hearing on the UN-SPIDER AGREEMENT is scheduled to be held on 24 July at 11.30 a.m. (HKSAR time) in the High Court.。

Evergrande's debt problems date back to 2020。

At the end of August 2020, when a letter of help from Evergrande to the government suddenly came online, it triggered widespread discussion and Evergrande's debt surfaced.。At a time when public opinion is buzzing, Evergrande's announcement of a 30% discount on national real estate has stunned the market.。Then Evergrande began "self-help action"。In November 2020, Evergrande first scored 148.500 million yuan to clear the position of Guanghui Group equity, after 125.7 billion war investment successfully converted to common stock, in December Evergrande property listed on the Hong Kong Stock Exchange, in January 2021 Evergrande and early repayment of Hong Kong dollar bonds to calm the hearts of the people, this set of self-help "combination fist" hit down, making its crisis temporarily lifted。

But when the time comes to the second half of 2021, Evergrande has had a number of negative events in a row, once again raising market concerns。June Evergrande commercial tickets overdue; Moody's, Fitch downgrade Evergrande's rating。In July, some banks in the Hong Kong Special Administrative Region suspended the mortgage of Evergrande's real estate; Evergrande cancelled the special dividend。August Evergrande to 32.HK $500 million to sell shares in Hengteng Network; in the same month, it was interviewed by the People's Bank of China and the China Banking and Insurance Regulatory Commission.。September financial explosion; notify banks to suspend interest payments; sell Shengjing Bank shares for about 10 billion yuan。In October, Evergrande sold assets to repatriate about 2.4 billion yuan.。Heng Teng Network shares sold again in November to withdraw funds 21.HK $300 million。In December, Evergrande asked the international rating agencies to withdraw the rating, and then its guarantee of 2..Default on $6 debt。

Since then, Evergrande has repeatedly postponed its performance report for the 2021-2022 period until July this year.。

Time is short! Evergrande is only two months away from the "delisting" deadline.

At present, China Evergrande, Evergrande Automobile and Evergrande Real Estate are still suspended.。The shares of the three companies have been suspended from trading on the HKEx for 16 months since 21 March 2022.。Under the Listing Rules, HKEx has the right to delist any securities that have been suspended for 18 consecutive months, i.e., the deadline for the "delisting" of three Evergrande companies will be September 20, 2023.。

At present, three Evergrande companies, Evergrande Property has released its 2021, 2022 and 2022 annual reports on June 5.。Evergrande Automotive, on the other hand, is scheduled to hold a board meeting on July 26, which will release the three results after approval by the board.。

According to the HKEx's guidelines, Evergrande, in addition to publishing its financial results, is also required to conduct an independent investigation into the enforcement of Evergrande's $13.4 billion pledge guarantee by the relevant banks, publish the results of the investigation and take appropriate remedial measures.。Other requirements include having sufficient business operations and valuable assets to support their operations, disclosure of important information, corporate management integrity and independent internal control reviews, etc.。

Among them, the most striking is the progress of the incident about the 13.4 billion yuan pledge guarantee of Evergrande property being enforced by the relevant banks.。

On March 22, 2022, Evergrande Property announced that in the process of reviewing its 2021 results, it was found that about $13.4 billion of deposits, pledged deposits for third parties, had been enforced by banks。And said the company will set up an independent investigation committee and arrange experts to investigate the pledge guarantee.。

In response to this missing deposit, on the evening of July 22, China Evergrande issued a preliminary investigation into the matter.。According to the announcement, between December 2020 and August 2021, based on the capital needs of Evergrande Group at that time, Evergrande Property provided the above-mentioned funds to China Evergrande in three installments through a third party, in the form of a pledge of certificates of deposit.。The investigation report also said that three of the company's executive directors were involved in the above arrangement and that the company's board of directors subsequently asked them to resign.。

On February 15, 2023, Evergrande Property announced the results of an independent investigation and remedial measures.。Evergrande Property said that according to the relevant laws and regulations, for the 13.4 billion yuan of deposit slips that have been deducted / transferred, they can recover from the guarantor in accordance with the relevant laws and regulations and the agreement of the pledge guarantee contract, or from the actual inflow or user of the funds in accordance with the credit and debt relationship.。At the same time, the company said that it was discussing with China Evergrande a plan to repay the amount involved in the pledge, which was mainly offset by the transfer of assets by Evergrande Group to the Group.。

Evergrande Property will issue a further announcement after the implementation of the relevant repayment plan.。The countdown to "delisting" has begun, and there is not much time left for Evergrande to remedy this pledge guarantee.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.