Evergrande Auto Halts Trading Again as Several Subsidiaries File for Bankruptcy

On the morning of September 4, according to an announcement by the Hong Kong Stock Exchange, trading in the shares of Evergrande Motor was briefly suspended from 9:52 a.m. onwards.

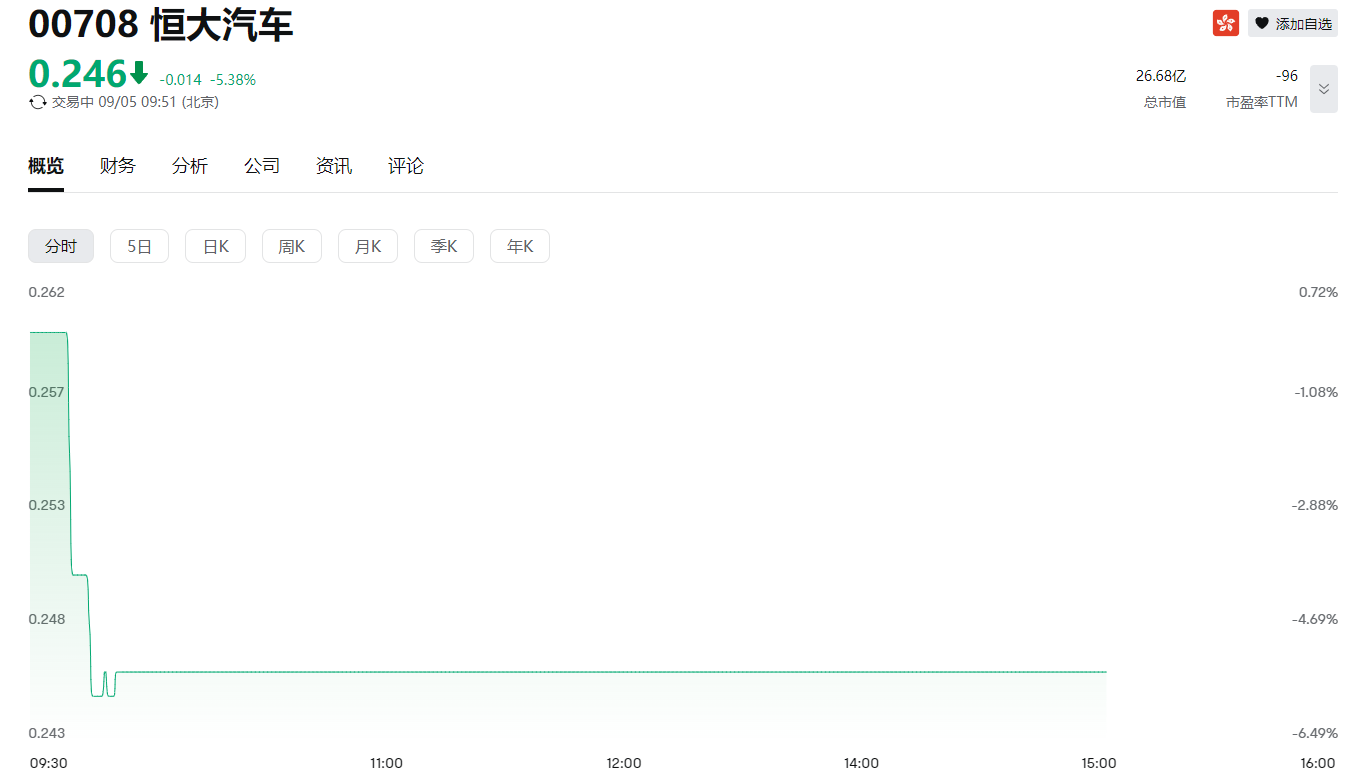

On the morning of September 4, according to an announcement by the Hong Kong Stock Exchange, trading in the shares of China Evergrande New Energy Automobile Group Limited (“Evergrande Automobile”) was briefly suspended from 9:52 a.m. onwards. As of the suspension, Evergrande Automobile dropped 5.38% to HK$0.246, with a total market capitalization of HK$2.668 billion.

On the news front, public information shows that a related subsidiary of Evergrande Auto, Evergrande Hengchi New Energy Vehicle (Shanghai) Co., Ltd. (hereinafter referred to as "Evergrande Hengchi"), has filed a new bankruptcy reorganization lawsuit, and the handling court is the Shanghai Third Intermediate People's Court.

According to the announcement, the applicant is Chint Electric Co., Ltd., which has applied to the court for bankruptcy liquidation of Evergrande Hengchi on the grounds that it cannot repay its due debts and clearly lacks the ability to repay.

It is worth noting that this is not the first subsidiary of Evergrande Auto hovering on the brink of bankruptcy.

On July 28th, Evergrande Automobile announced that its subsidiaries, Evergrande New Energy Automobile (Guangdong) Co., Ltd. and Evergrande Intelligent Automobile (Guangdong) Co., Ltd., received notices from relevant local people's courts on July 26th. The notice requires individual creditors of the relevant subsidiary companies to apply to the relevant local people's court for bankruptcy reorganization of the relevant subsidiary companies on July 25th.

In the announcement, Evergrande Auto admitted that the above-mentioned notice will have a significant impact on the production and operation activities of the company and its related subsidiaries.

The successive bankruptcies and reorganizations of related subsidiaries are undoubtedly adding insult to injury for Evergrande Auto.

On the one hand, the company is facing serious losses and operational difficulties.

At the end of August, Evergrande Auto released its 2024 interim report. Data shows that in the first half of 2024, the company's revenue was only 38.377 million yuan, a year-on-year decrease of 75.17%. The gross profit was 2.433 million yuan, a year-on-year decrease of 103.99%. The net loss increased by 19.4.73% year-on-year to 20.256 billion yuan, exceeding the loss for the entire year of last year.

As of June 30, 2024, the Tianjin Manufacturing Base has produced a total of 1700 Hengchi 5 vehicles and delivered a total of 1429 new energy vehicles. It is understood that the Tianjin manufacturing base has ceased production operations since the beginning of this year.

In addition, as of June 30, 2024, the company's total assets amounted to 16.369 billion yuan and its liabilities reached 74.35 billion yuan. The total amount of cash and cash equivalents, as well as restricted cash, is only 54.96 million yuan, a decrease of 60% compared to the end of last year.

On the other hand, although Evergrande Auto has stated that it is seeking to "sell itself" at this stage, it has not made any substantial progress.

At the end of May this year, Evergrande announced that nearly one-third of the company's shares would be acquired.

Evergrande Auto stated that the joint and several liquidators, representing China Evergrande Group (in liquidation), Evergrande Health Industry Group Co., Ltd., Acelin Global Limited (collectively referred to as the "Potential Seller"), and a third-party buyer (referred to as the "Potential Buyer") independent of the company and its affiliates, have entered into a term sheet. The potential seller and potential buyer may enter into a final purchase and sale agreement for the shares of Evergrande Auto held by the potential seller.

After reaching a purchase and sale agreement and being bound by its terms and conditions, the preliminary plan is to immediately acquire 3.145 billion shares of potential unsold shares of Evergrande Auto, which account for approximately 29% of the company's issued shares. At the same time, there are 3.203 billion potential shares for sale, accounting for 29.5% of the company's issued shares, which will become a subject for potential buyers to exercise their options within a certain period of time after the purchase and sale agreement date.

However, according to the announcement released by Evergrande Auto on August 26th, as of the announcement date, discussions between potential sellers, potential buyers, and the company are still ongoing. And it was stated that the potential seller and potential buyer have not yet entered into a purchase agreement, and the potential buyer and Evergrande Auto have not yet entered into a credit agreement.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.