Hengchi Tianjin Factory Has Resumed Production of 30 Billion Financing?

May 30, according to the "Hengchi" official micro-blog news, Hengchi automobile factory in Tianjin has been fully resumed production on May 23。Liu Yongzhuo, President of Hengchi Automobile, said that the company will make every effort to speed up the production and delivery of Hengchi 5 and continue to promote the development and production of subsequent models.。

May 30, according to the "Hengchi" official micro-blog news, Hengchi automobile factory in Tianjin has been fully resumed production on May 23。On May 29, Shan Zefeng, deputy secretary of the Tianjin Binhai New Area District Committee and district mayor, led a team to go to Hengchi Automobile's Tianjin factory to carry out research services.。Liu Yongzhuo, President of Hengchi Automobile, said that the company will make every effort to speed up the production and delivery of Hengchi 5 and continue to promote the development and production of subsequent models.。

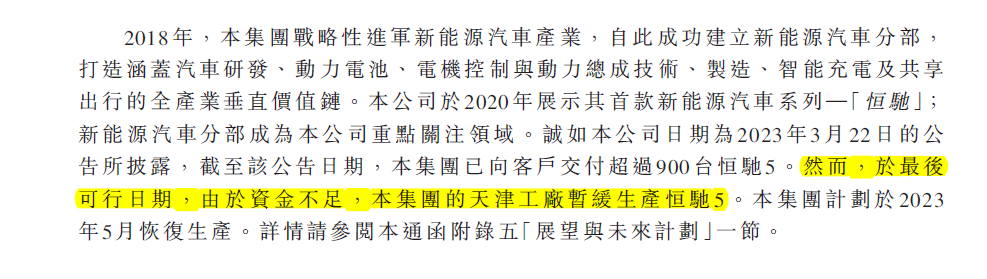

Earlier, Evergrande Motor announced on the evening of April 25 that the company's Tianjin plant had suspended production of the Hengchi 5 due to lack of funds.。

According to the company's official website, Evergrande is simultaneously developing 14 models, covering all levels and grades such as A0, A, B, C, and D, to achieve full coverage of cars, coupes, SUVs, MPVs, crossovers and other models。For capacity planning, the company has a number of bases around the world, each with an initial planned production capacity of 100,000 vehicles, which will be completed and put into operation from 2021 to 2025.。

"Love and Hate" with Faraday in the Future

The predecessor of Evergrande Automobile is Evergrande Health, and its business includes medical and elderly care services, and its projects include health spaces across the country.。On June 25, 2018, Evergrande Health announced that the company was 67.HK $4.6 billion to acquire 100% of Hong Kong's Shiying Company, while indirectly acquiring 45% of Smart King and becoming its largest shareholder.。

Smart King, a former shareholder of Hong Kong Shiying and FF represented by Jia Yueting, established a new company in November 2017 under a joint venture model.。Hong Kong Shiying contributed $2 billion to acquire 45% of its equity and paid $800 million in advance for the investment.。If the acquisition is successfully completed, Evergrande Health will become the new owner of Faraday's future.。

But in October 2018, things changed。Evergrande Health issued an announcement stating that Jia Yueting and other former shareholders used their rights to manipulate Smart King's majority of directors to demand payment from Hong Kong Shiying (i.e. Evergrande Health) without meeting the contractual payment conditions, and used this as an excuse to file an arbitration at the Hong Kong International Arbitration Centre on 3 October 2018, demanding that Evergrande be deprived of its consent rights as a shareholder in relation to the financing and that all agreements be rescinded.。

Then FF employees in the United States filed a lawsuit against Evergrande Health in the United States.。Evergrande side forced out after multiple fights。

Start a global acquisition model for Evergrande, but deliver less than 1,000 vehicles in half a year of mass production.

Although the acquisition of Faraday ended up with unsatisfactory results in the future, Evergrande did not give up building cars.。

In 2019, Evergrande Health acquired a 100% stake in Swedish company National Electric Vehicle Sweden AB ("NEVS").。In the same year, it acquired a stake in Guoneng Automobile, making it a wholly owned subsidiary of NEVS.。The reason for choosing to acquire Guoneng Automobile is that Guoneng Automobile was one of the ten enterprises with "dual qualifications" for new energy vehicles at that time.。With the help of Guoneng Automobile, Evergrande Health has solved the qualification problem of car manufacturing.。

At the same time, Evergrande Health has also acquired auto-related companies in the Netherlands, the United Kingdom, Germany and other places, solving many problems such as motors and chassis in car manufacturing.。

In August 2020, Evergrande Health announced that it was renamed Evergrande Automobile and its main business was transformed into research and development of new energy vehicles.。For the new energy vehicle business, the company said it has built a new energy vehicle industry chain covering power batteries, power generation, advanced vehicle manufacturing, car sales and smart charging.。

Although Faraday Future and Evergrande Motors broke up, both companies are pushing ahead with their own car-building plans。Unfortunately, the two sides of the car are not very smooth, the market has repeatedly two companies "dystocia" rumors。

Until 2021, Evergrande unveiled nine pure electric models at the Shanghai Auto Show.。Wait until September 2022, Hengchi 5 began mass production。However, Evergrande's launch of the Hengchi series did not have a significant response in the market, with weak performance.。As of March 22 this year, the company delivered more than 900 Hengchi 5 vehicles.。That is to say, in the past six months of mass production, the delivery volume of Hengchi 5 is less than 1,000 vehicles, which is much inferior to many "new car-building forces" in China.。

2 yuan to sell 47 health space projects, Evergrande cars come true?

On April 24, 2023, Evergrande Automobile announced the transfer of all issued shares of Huai Bao and Flaming Ace to China Evergrande for RMB 2.。The transfer covers a total of 47 existing health space projects under the Health Management segment and the New Energy Vehicle segment.。After the completion of the transaction, Evergrande will hold the remaining two health valley projects in Tianjin and Nanning in the short term, in addition, the company will focus on the development and production of new energy vehicles, focusing on the car track.。

Evergrande Automotive is a special presence among domestic auto companies, the company's main business is divided into health management division and new energy vehicle division, the two divisions of business can be said to be unrelated。But all along, the company's new energy vehicle division has been relying on the health management division to "keep"。Because the initial stage of building a car is very expensive, its new energy vehicle segment is basically at a loss.。

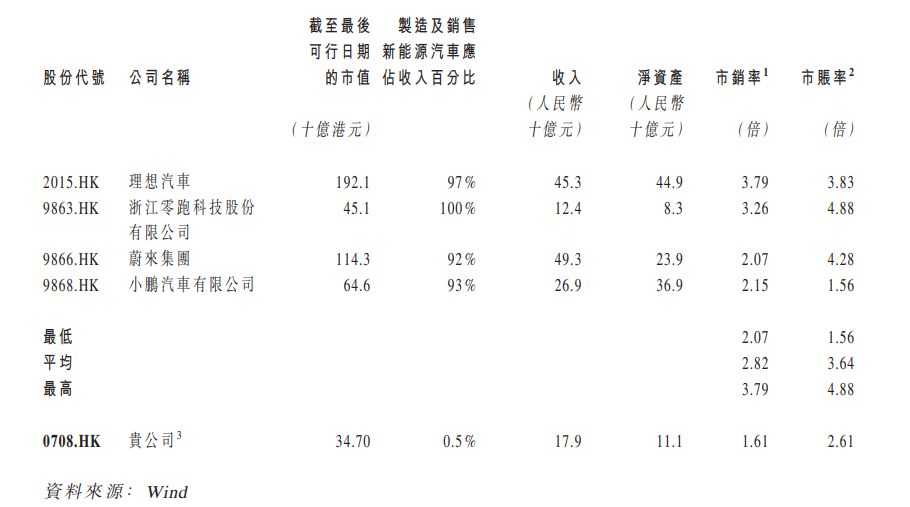

As a result, the Company's revenue is contributed almost exclusively by its Health Management segment。Compared with other domestic new energy vehicle companies, Evergrande's revenue from manufacturing and selling new energy vehicles is pitifully low, only 0.5%。

After Evergrande's divestiture of the health space project, it is conceivable that the next financial report will be a sustained loss, but I do not know how long the loss state will last.。

Evergrande's capital chain is very tight。In order to support the new energy business, Evergrande's R & D costs have skyrocketed in recent years.。In order to develop new energy vehicle projects such as complete vehicles, batteries and motors, the company's research and development expenses will increase from 2% in 2019..9.5 billion yuan increased significantly to 16 in 2020.6.4 billion yuan。In addition to consuming internal financial resources, Evergrande has also conducted multiple rounds of equity financing。Since September 2020, the Company has conducted four rounds of equity fund-raising activities, raising a total of approximately HK $33 billion, almost all of which has been used for the development and production of new energy vehicles, paving the way for the commissioning of Hengchi New Energy Vehicles.。

Evergrande is also actively seeking to improve the capital chain.。Earlier, the company announced that in order to save costs, its Swedish subsidiary NEVS to take downsizing measures to optimize the staff structure.。In addition to "saving the source," Evergrande is also actively seeking "open flow."。Company plans to seek more than 29 billion yuan in financing。and warned that the company was at risk of shutting down production if it could not obtain new liquidity。

The resumption of production at Hengchi's Tianjin plant may signal an improvement in Evergrande's capital flow.。But it's going to be difficult for the company to meet its nearly $30 billion financing target for now。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.