Two-year loss of more than 80 billion! The delivery volume is "unsightly" Can Evergrande survive the "countdown to delisting"?

On the evening of July 26, China Evergrande New Energy Automobile Group Co., Ltd. issued three full-year 2021, mid-2022 and 2022 results announcements.。According to the financial report, Evergrande Motor's loss from 2021-2022 amounted to 84 billion yuan!

On the evening of July 26, China Evergrande New Energy Automobile Group Co., Ltd. (hereinafter referred to as "Evergrande Automobile") issued three full-year 2021, mid-2022 and 2022 full-year results announcements.。

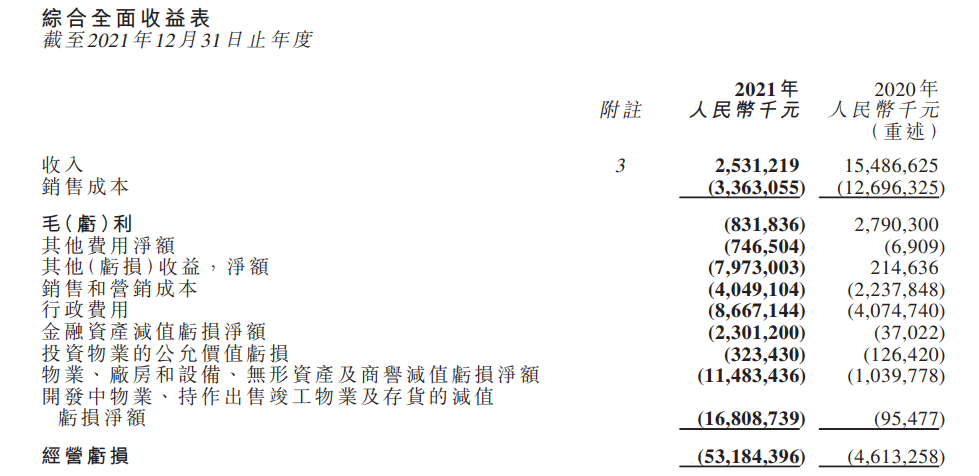

● As of December 31, 2021, Evergrande Motor's turnover was 25.3.1 billion yuan (RMB, the same below), a decrease of 83.66%。Gross loss is 8.3.2 billion, compared to 27 in 2020.$900 million narrowed sharply, but gross margins narrowed from 18 in 2020.02% dropped sharply to -32.86%。563 recorded for the full year 2021.$4.4 billion loss, more than seven times the 2020 loss。

As of December 31, 2021, the Company's cash and cash equivalents were 24.5.3 billion yuan。Total statement liabilities for 2021 are 1,829.$0.8 billion, excluding the size of the liability after prepayments of $1,176.5.9 billion yuan, down 11% year-on-year。

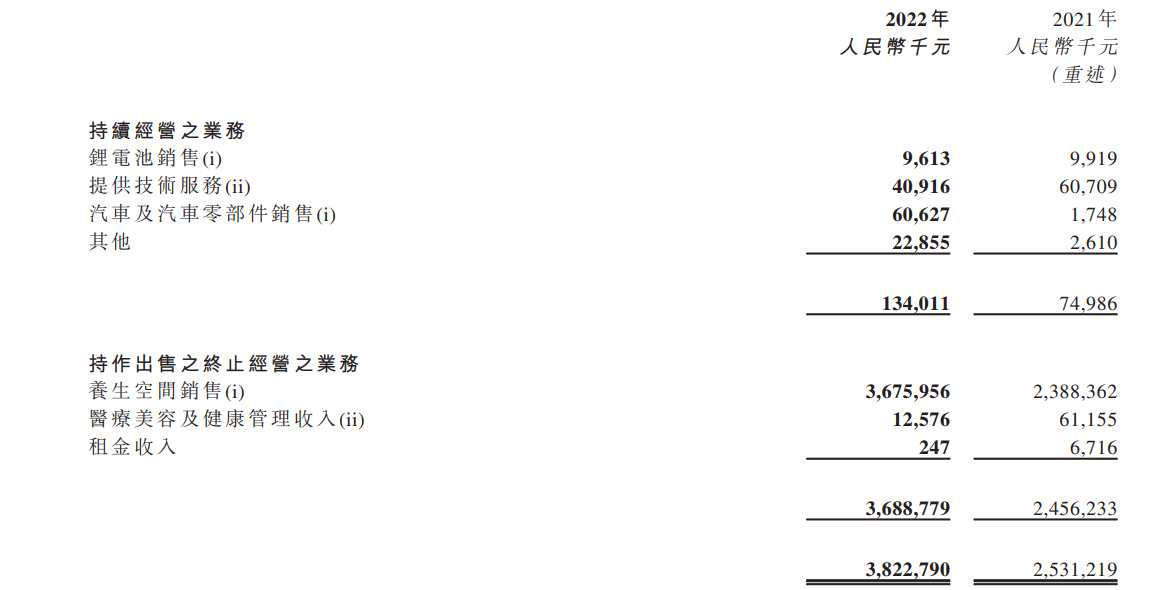

In the second half of 2021, due to Evergrande's decision to divest its health management business and focus its business on the new energy vehicle segment, the company's 2022 financial statements were re-presented compared to 2021.。

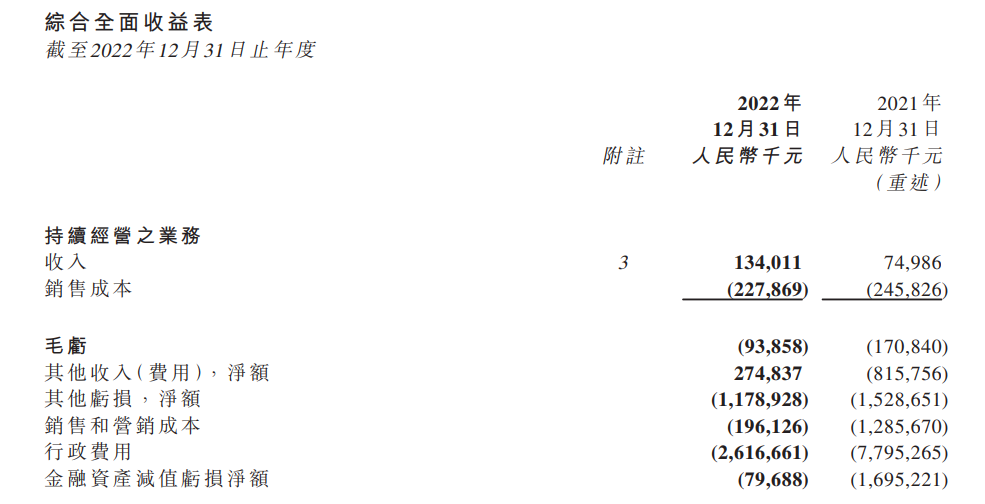

● As of December 31, 2022, the turnover of continuing operations (mainly including the new energy vehicle segment) was 1.3.4 billion yuan, up 78% from 2021 turnover of 74.99 million yuan.71%。The increase in revenue was mainly due to the Group's commencement of sales of the Hengchi 5 model.。Gross profit loss from continuing operations from 1 in 2021.The decrease of $7.1 billion to $93.86 million was primarily due to the start of delivery of the HSI 5 and the start of revenue generation for the segment.。276 for the whole year of 2022.$6.3 billion loss, down 50% from 2021 loss.90%。Together with the loss in 2021, Evergrande Motor's loss in the past two years amounted to 84 billion yuan!

As of December 31, 2022, the Company had accumulated approximately 116 outstanding debts due..2.6 billion yuan, the company's overdue commercial tickets accumulated about 185.1.2 billion yuan。

Gradual divestiture of health business

Although Evergrande's name is related to the car, the company's predecessor was Evergrande Health.。In August 2020, Evergrande Health announced that it was renamed Evergrande Automobile and its main business was transformed into research and development of new energy vehicles.。But because building new energy vehicles is a "money-burning" business, Evergrande did not immediately divest the original business after the name change, but left a health management division, gradually divested.。

From 2020 to 2022, the company's new energy vehicle division has been "maintained" by the health management division.。In August 2021, the company decided to divest the health segment and focus its resources on the new energy vehicle segment.。In 2022, Evergrande will continue to gradually withdraw from the health management service industry, including providing health management, health care, medical care, rehabilitation and elderly care services through its membership platform.。Annual sales of the Company's wellness spaces decreased from approximately 19,000 units in 2021 to less than 1,000 units in the reporting period。In 2022, the health management services business will continue to provide medical beauty and health management services to customers, and will be discontinued at the end of the year.。

According to the 2022 financial results, the company's continuing operations amounted to 13.$400 million, discontinued operations held for sale 36.8.9 billion yuan, of which sales of health space accounted for the majority of revenue, reaching 36.7.6 billion yuan。

On April 24, 2023, Evergrande Automobile announced the transfer of all issued shares of Huai Bao and FlamingAce to China Evergrande for RMB 2.。The transfer covers a total of 47 existing health space projects under the Health Management segment and the New Energy Vehicle segment.。After the completion of the transaction, Evergrande will hold the remaining two health valley projects in Tianjin and Nanning in the short term.。

Full force to develop auto business, but with many difficulties

In order to develop new energy vehicles, the company is still gritting its teeth and investing heavily in research and development despite the company's tight capital chain.。Its R & D expenses are increasing year by year, with R & D expenses in 2019-2021 of 2.9.5 billion yuan, 16.6.4 billion yuan and 26.6.9 billion yuan。By 2022, Evergrande's capital seems to be a bit overwhelmed, and the company did not disclose specific data on R & D spending in its 2022 earnings report。However, it was mentioned in the financial report that according to the group's capital situation, the group will focus more on the vehicle field in 2022, and the investment in power battery research and development and base construction will gradually slow down.。

In addition, the company has "downsized" its R & D staff.。In 2022, the company had 811 researchers, while in 2021, the company had more than 1,285 researchers in research and development.。

In March this year, the company announced that in order to concentrate financial resources to support the mass production of Hengchi 5, the company began to promote cost savings, its Swedish subsidiary NEVS to take downsizing measures to optimize the staff structure.。Evergrande also warned that the company was at risk of shutdown if it could not get new liquidity, and said it planned to seek more than 29 billion yuan in financing.。

Prior to this, Evergrande Automobile has conducted a number of external financing。Since September 2020, the Company has conducted four rounds of equity fund-raising activities, raising a total of approximately HK $33 billion, almost all of which has been used for the development and production of new energy vehicles, paving the way for the commissioning of Hengchi New Energy Vehicles.。

Evergrande Automobile has paid so much for the transformation of new energy, so how is the company's car sales??

In 2021, Evergrande Motor will simultaneously develop six models of Hengchi 1, Hengchi 3, Hengchi 5, Hengchi 6, Hengchi 7 and SX41。In the same year, Hengchi 1, Hengchi 3, Hengchi 5, Hengchi 6, Hengchi 7 completed the engineering prototype and related tests.。Among them, Hengchi 5 successfully rolled off the production line at the Tianjin manufacturing base in December 2021.。

The Hengchi 5 opened for pre-sale in July 2022, was officially mass-produced in September, and began delivery in October, making it Evergrande's first mass-produced model.。By the end of May 2023, HSI 5 will have delivered more than 1,000 vehicles.。In other words, only 1,000 vehicles were delivered by Hengchi 5 in 8 months.。

In addition, the automotive space sales business under the NEV segment also underperformed in 2022。In 2022, the company operated 20 automotive living space projects, achieving sales of 314 units (2021: 20,090 units), or a total sales area of 2.50,000 square meters (2021: 2 million square meters), with a pre-sale amount of 2.500 million yuan (2021: 17 billion yuan)。In order to speed up sales, the company is giving buyers an average discount of up to 32%, although this is still unable to stop the precipitous decline in this part of the business。

In the face of such performance, the external auditor will be the accounting firm said, can not comment on this。One is that there are significant doubts about the uncertainty of the Group's sustainable operations, and even if the Group takes steps to actively improve, there are many uncertainties.。The other is because the auditor believes that it is not possible to obtain sufficient and appropriate audit evidence to provide a basis for an audit opinion.。

Since the suspension of trading on April 1, 2022, Evergrande Auto has been suspended for 16 months, and according to the listing rules, the HKEx has the right to delist any securities that have been suspended for 18 consecutive months, which means that the final deadline for Evergrande Auto to be "delisted" will be October 1, 2023.。The countdown has begun, whether Evergrande will be "delisted," two months later。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.