How to use Autochartist Risk Calculator from HF Markets

In scientific research, scientific calculators may be of great help to us。However, as traders, what tools do we have to do the calculations??What exactly needs to be calculated?

If you can passAutochartist to optimize risk management while also providing trading opportunities, why not give it a try?

We are familiar with the various tools we use in our daily lives, such as hammers for tapping, tape for sticking, or calculators for calculating。Specifically, in scientific research, scientific calculators may be of great help to us。However, as traders, what tools do we have to do the calculations??What exactly needs to be calculated?

In this article, we would like to introduceHow to use Autochartist as a risk calculator from HF Markets。

AutochartistWhat is it?

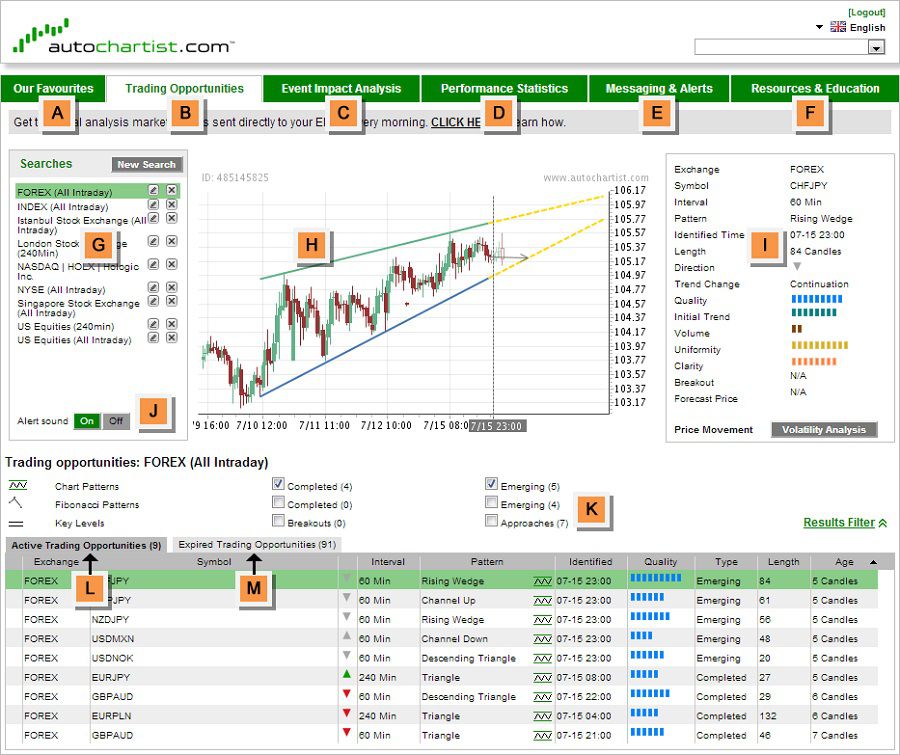

Autochartist is a market scanning tool that helps traders find the best trading opportunities and ultimately make the best decisions about when and how to trade.。

Using this tool in real time, traders can find market opportunities from various technical perspectives。This feature saves time when we are looking for potential transaction settings。

HF MarketsTraders can enjoyAutochartistThe many benefits include:

In financial markets such as foreign exchange, indices, commodities, stocks, CFDs and futures.Autochartist offers over 1000 opportunities to trade。

When the market is open, traders can get the identification of chart patterns, Fibonacci patterns and key levels in real time。

Autochartist regularly searches the market for new, high-quality trading opportunities that traders can benefit from, saving time.。

Visual quality indicators can help experienced traders perform advanced search operations, while also improving the ability of inexperienced traders to recognize patterns。

The Autochartist website and online interface provide a wealth of research and educational resources, providing users with articles, videos, e-books, webinars, and other content。

使用 Autochartist Risk Calculator

Compared to the ability to automatically scan the market and present trading opportunities,Autochartist is also a way to eliminate manual calculations that seem to take a long time.。In fact, Autochartist has an additional feature called a risk calculator, where we just enter the asset percentage and the transaction risk amount。Next, Autochartist will calculate the correct trading volume so that we can minimize the loss。

"The best investment is an investment in the tools of your own industry.。"

With BenjaminFranklin's introduction above is the same, let's match our words with our deeds.。The first step to take is to drag the risk calculator onto any of the chart windows as follows:

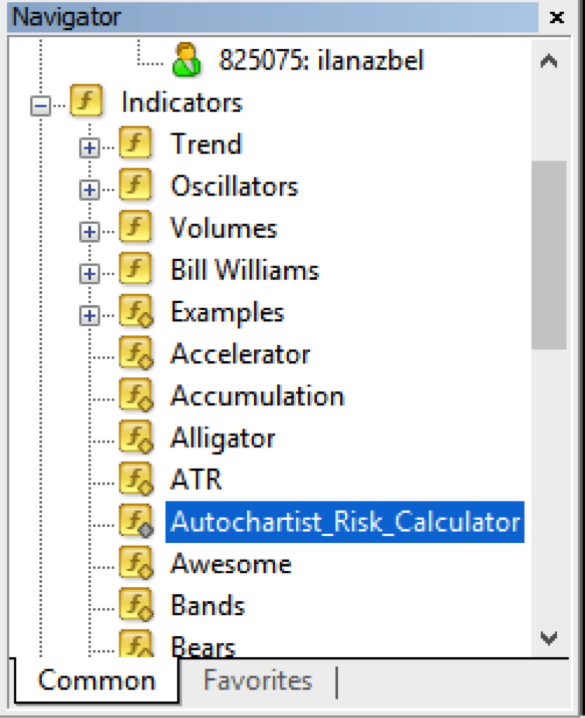

Upon successful startup, the Risk Calculator displays the following:

Risk Calculator Dashboard contains several functions。Therefore, there are the following recommended settings:

In reference to the figure above, pay attention to the following details:

- Show Expected Trading Ranges. By ticking the checkbox, you will show ranges that can be used to determine price changes that have been recorded over the past six months to the present day of the week and time of day.

- As to the Custom Entry Price, you can check the box to set your own price in the next column.

- Adjust the Stop-Loss to set your preferred price at which you're comfortable losing your positions.

- Risk in Pips indicates the number of pips difference between the entry price and stop loss.

- Risk Cash Amounts refers to the amount of money to risk on this trade.

- The Volume should be considered as the position size to take, with the goal of risking the amount of money stated at the desired Stop-Loss level.

Refer to the figure above and note the following details:

Show expected trading rangeBy selecting the check box, you will be shown a range that can be used to determine the price movements recorded from the last six months to this week and time of day。

对于Custom Enter Priceyou can select the checkbox in the next column to set your own price。

AdjustmentStop Loss Price, set the price at which you want to lose your position。

Risk PointsRefers to the point difference between the entry price and the stop price.。

Cash amount at riskis the amount of risk taken on this transaction。

Trading volumeshould be considered as the size of the position to be taken, with the objective of taking the risk of a specified amount at the required stop loss level。

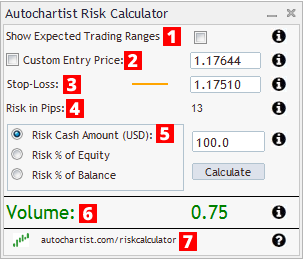

Set up transaction: current market price

When trading at the current market price, the steps to set the trade size are as follows:

Determine the level at which to set the stop loss and move the orange line to that level。

If the orange line is below the current price, the indicator thinks you plan to trade long。Conversely, if the orange line is above the current price, the indicator thinks that you plan to make a short trade。

Determine the amount of risk taken on this transaction。Set the amount of cash, the risk percentage of the asset, or the risk percentage value of the balance.。

ClickCalculate button。

In the chart shown below, the position size that must be entered into the order window:

Set up transactions: pending orders

When setting up a pending order, the steps to get the correct transaction size are as follows:

Click"Custom Input

PriceNext to the check box。Then, a green line will appear representing your entry level on the pending order setting。

Move the green entry line to your trading entry level。

Move the orange stop-loss line to the desired stop-loss level。

Determine the amount of risk taken on this transaction。Set the amount of cash, the risk percentage of the asset, or the risk percentage value of the balance.。

ClickCalculate button。

The position size that must be entered into the order window can be seen in the following illustration:

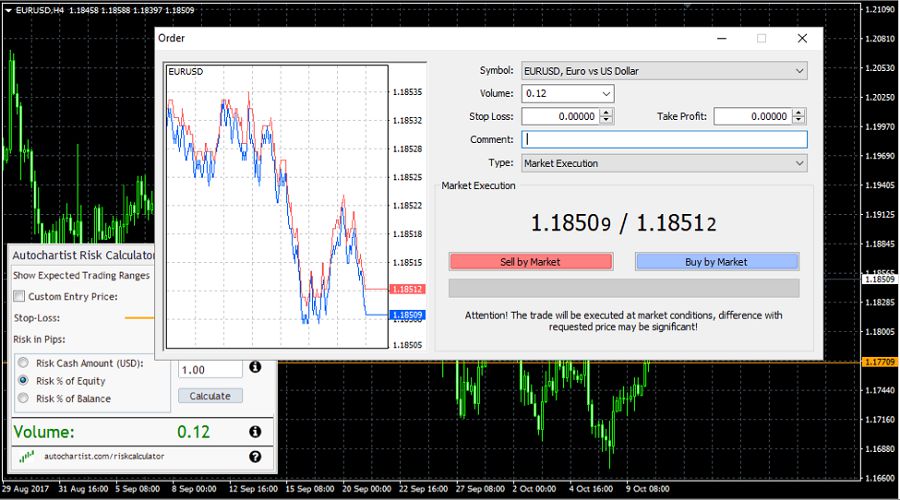

Using the Expected Trading Range as a Volatility Guide

Autochartist's volatility analysis data is connected to the risk analyzer.。Therefore, if you check the "Show expected trading range" checkbox, and combine the position sizes of each level, you will get the expected trading range, as shown in the figure below:

Therefore, when determining the stop loss level, you can consider both the expected price volatility and the trading method。You can observe how the position size of each level is determined。In this example, set the0.A position size of 11 will allow you to risk 1% of your capital, with an entry price of the current market price and a stop loss price of 1.17598%。

Analyzing the trends and patterns of the market will definitely help improve your returns or profits, but also learn more about how the market works。Utilizing a variety of digital and online tools may provide you with more comprehensive information and signals than just browsing common news and free signals。

To control the risks associated with the Forex market, traders can use a simple tool called a Forex calculator。But unlike the calculator we brought to school as children, this calculator is very specialized。There are over a dozen different types of forex calculators designed to ensure that anyone can become a top trader regardless of their ability in math。To make things easier, these calculators are available for free online。We can includeFind them on a wide range of brokerage sites, including the Autochartist Risk Calculator。

在在Using the Autochartist risk calculator on HF Markets will help you maximize profits and mitigate risks without manually calculating every aspect of your trading position in advance。In addition to Autochartist signals and risk management tools, HF Markets offers more trading features to explore。If you want to know more, here is a good summary of this broker:

HF Markets is an award-winning Forex and commodities broker。Since its inception in 2010, the company has provided transaction services and facilities to retail and institutional clients.。Operating for more than nine years, HF Markets has approximately 1.5 million active accounts and 200 employees worldwide.。

According to its services,HF Markets can be considered a mid-range category。Customers do not need to prepare large deposits to join the broker to trade.。In addition, there are various account types, trading software and tools for individual and institutional clients to trade forex and CFDs。

HF Markets is a registered trademark of HF Markets (Europe)。Depending on the location, the company is regulated by various financial regulators。Here are the details:

HF Markets (SV) Limited, as an international business company of Saint Vincent and the Grenadines, registered under number 22747 IBC 2015。

HF Markets (Europe) is authorized and regulated by the Cyprus Securities and Exchange Commission (CySEC) under license number 183 / 12。

HF Markets SA (PTY) is authorised and regulated by the Financial Industry Regulatory Authority of South Africa (FSCA) under licence number 46632。

HF Markets (Seychelles) is established under the Securities Dealer License Number SD015 of the Seychelles Financial Services Authority (FSA)。

HF Markets (DIFC) Limited, licensed and regulated by the Dubai Financial Services Authority (DFSA), license number F004885。

HF Markets (UK) Limited, authorised and regulated by the UK Financial Conduct Authority (FCA), company reference number 801701。

Traders can become professional clients if they have a richer, more informed and more complex trading environment where they can manage and assess their own risk。As a result, these types of customers can get more favorable rates, but they enjoy less regulatory protection than retail customers。

与HF Markets trading gives traders access to a variety of trading tools such as Forex, cryptocurrencies, spot metals (gold, silver, etc.), energy (oil and gas), commodities (such as coffee, copper and sugar), indices, bonds, and popular stocks such as Google, Apple and Facebook.。

HF Markets offers some of the closest spreads in the market, starting from zero spreads on Zero accounts。The broker quotes the main forex currency pair to five decimal places.。As a result, traders have the opportunity to get more accurate pricing and optimal spreads。

HF Markets has been awarded several highly acclaimed titles, including being selected as one of the world's top 100 companies by World Financial Magazine.。Other accolades include Global Brand Magazine's Best Global Client Money Security Award, Global Forex Awards 2019's Best Global Forex Copy Trading Platform, International Business Magazine's 2019 Fastest Growing Forex Broker, and more.。

在在After opening an account in HF Markets, traders will get access to various forex trading platforms for all their trading needs。Whether traders prefer to trade on the desktop or prefer to trade anywhere, anytime, they can use MetaTrader 4 (terminal, multi-terminal and web terminal) and mobile phones (iPhone, iPad and Android) on the desktop.。

The client's funds are held in a segregated account。Markets only use major banks because they believe that successful traders should focus their full attention on trading and not worry about the safety of their funds.。

Traders don't need to worry about transaction fees when making deposits and withdrawals。No transaction fees are charged, and multiple payment methods allow them to choose bank wire transfers, bank cards and online payments during standard working hours (Neteller, iDeal, Soport Banking, and Skrill)。HF Markets ensures fast trading by traders during standard working hours 24 / 5。

Traders can join theAffiliate programs offered by Markets earn extra income。Clients participating in this program will get some advantages, such as 60% of the net spread based on the trading volume of the sub-client, up to $15 net income per lot, etc.。More information about HF Markets is available on their official website, which supports 27 languages。

It can be concluded from the comments above thatHF Markets is an award-winning Forex and commodities broker。HF Markets offers multiple account types for traders to choose from and is the broker of choice for traders due to its low spreads。This situation is ideal for traders who have limited funds and want more opportunities to maximize profits.。

HF Markets is a global forex and commodities broker serving retail and institutional clients.。As the HotForex in the brokerage industry, HFM positions itself as a Forex broker for traders worldwide through its various account types and trading tools.。In addition, HF Markets allows scalping traders and traders unlimited access to expert advisors。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.