Selection of suitable currency pairs using HF Markets correlation matrix

Understanding the correlation between currencies can help you control your exposure across your portfolio。Here's how HF Markets' correlation matrix tool works。

Understanding correlations between currencies can help you control exposure across your portfolio。Below isHow the HF Markets Correlation Matrix Tool Works。

To become a successful trader, you need to understand the sensitivity of the entire portfolio to market fluctuations, especially in forex trading。In the foreign exchange market, all currencies are traded in the form of currency pairs, so no currency pair is completely independent of other currency pairs。Since the market is always moving, the relationship between currency pairs is also very dynamic。When one currency pair rises, it is common to expect another to fall。

Once you understand these correlations and how they affect each other, you will be able to manage exposure across your portfolio。To help you do this better,HF Markets offers an advanced trading tool called the correlation matrix。But before that, let's understand how the correlation matrix works。

What is a correlation matrix??

The correlation matrix is basically a tool for summarizing the correlation between different variables, which can be used in theGet on HF Markets。The data is displayed as a table consisting of rows and columns, where the rows and columns represent variables, and each cell of the table displays the correlation coefficient。In other words, the matrix is a powerful tool to describe the correlation between all currency pairs and summarize the results in a table。

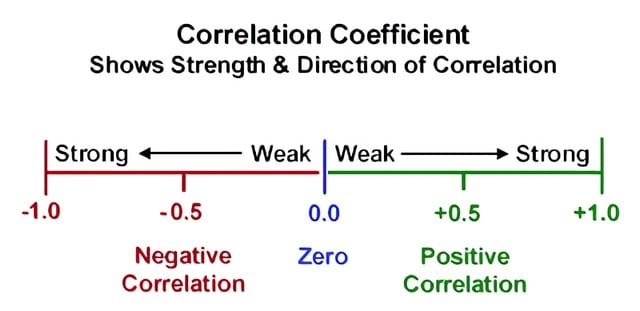

In Forex trading, the correlation matrix is used to see the strength of the relationship between different currency pairs in the market。By looking at the matrix, we can see whether two currencies move in the same, opposite, or completely random direction over a period of time。This correlation is calculated as a so-called correlation coefficient, the value of which is usually in theBetween -1 and + 1。

There are two types of correlations in the foreign exchange market, namely:

positive correlation。If the correlation coefficient is positive, it means that two currency pairs are moving in the same direction。For example,EUR / USD and GBP / USD have a positive correlation, so if one goes up, the other may also go up。

negative correlation。If the correlation coefficient is negative, it means that the two currency pairs move in opposite directions。For example,EUR / USD and USD / JPY have a negative correlation, so if one goes up, the other may go down。

From the above figure, we can see how currency pairs can influence each other by using the correlation matrix。The correlation coefficient can also tell you the strength of the correlation.。The larger the value, the stronger the correlation。

Forex correlation may change

It is worth noting that the correlation is not always the same。The high volatility of foreign exchange market sentiment and the global economy will certainly affect the movement of currency pairs in the market.。As a result, the strong correlations we see today may not reflect long-term correlations between currency pairs。

Relevance can change for several reasons:

Sensitivity of a particular currency pair to the price of certain commodities。

specific political and economic factors。

Monetary policy divergence。

How to useHF Marketscorrelation matrix

HF Markets (formerly HotForex) is a well-known Forex broker with clients from more than 100 countries and is regulated by several top financial regulators.。As a brokerage firm that has won several major awards, the firm offers a variety of asset trading options, including currency pairs, stocks and cryptocurrencies.。It also offers a range of trading tools for beginners and professionals。

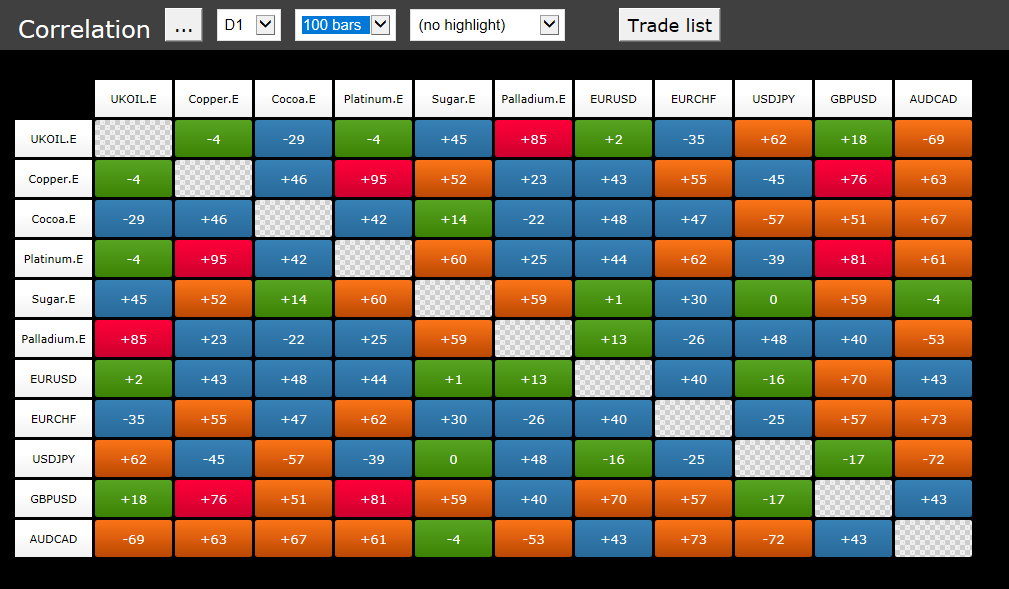

Especially for forex traders, the broker's correlation matrix tool is definitely worth a try。在在HF Markets, the correlation matrix is not only displayed in numerical form (ranging from -100 to + 100), but also allows you to identify strong and weak correlations at a glance through simple color coding。You can also change the calculation base, select the time frame to use, and determine the number of history bars, depending on the time period you will use。

Here is what the table looks like on the platform。

Based on the table, you can get some details such as:

strength of correlation

The table consists of cells and numbers in different colors, allowing you to see the strength of the correlation。In addition, it allows you to highlight sub-sections of the grid and choose to focus on specific forex correlations。

"If" scenario

The Correlation Matrix tool allows you to calculate the average correlation between all your open trading currencies。You simply select any number of currency pairs and calculate the average of the current correlations between them, allowing you to calculate the risk of the entire portfolio。

According to the table, you can get some details, such as:

strength of correlation

The table consists of cells and numbers in different colors, allowing you to see the strength of the correlation。In addition, it allows you to highlight sub-sections of the grid and choose to focus on specific forex correlations。

"Assumption"Scenario

The Correlation Matrix tool allows you to calculate the average correlation between all currency pairs in which you hold a position。You simply select any number of currency pairs and calculate the average of the current correlation between them, allowing you to calculate the risk of the entire portfolio。

If you plan to participate in the Forex market for a long time, then you must understand the correlation between Forex。This allows you to trade more efficiently and reduce the risk of losing money。However, it is important to note that the correlation of the foreign exchange market may change with high volatility。That's why it's important to keep track of correlations on a regular basis。

The correlation matrix tool can save you time because you only need to look at the table before taking any action。In addition,HF Markets also offers several other tools to help improve your trading performance, such as trading terminals, connectivity tools and trading calculators。For more information on this broker, please refer to the following description:

HF Markets is an award-winning forex and commodities broker。Established inIn 2010, the company provided trading services and facilities to retail and institutional clients.。In more than 9 years of business operations, HF Markets has opened approximately 1.5 million live accounts and has 200 employees worldwide.。

According to its services,HF Markets can be considered a medium-sized broker。Clients do not need to prepare large amounts of capital to join the broker for trading.。In addition, the broker offers a variety of account types, trading software and tools to meet the needs of individual and institutional clients for online forex and CFD trading.。

HF Markets is a registered brand of HF Markets (Europe)。Depending on the location, the company is regulated by multiple financial regulators。Specific information is as follows:

HF Markets (SV) Limited, registered as Saint Vincent and the Grenadines International Business Corporation, registration number 22747 IBC 2015。

HF Markets (Europe), licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 183 / 12。

HF Markets SA (PTY), licensed and regulated in South Africa by the Financial Conduct Authority (FSCA) as a Financial Service Provider (FSP), license number 46632。

HF Markets (Seychelles), incorporated under the laws of the Republic of Seychelles, registration number 8419176-1, regulated by the Seychelles Financial Services Authority (FSA), securities dealer license number SD015。

HF Markets (Dubai International Financial Centre) Limited, licensed and regulated by the Dubai Financial Services Authority (DFSA), license number F004885。

HF Markets (UK) Limited, authorised and regulated by the UK Financial Conduct Authority (FCA), company reference number 801701。

Traders can choose to become professional clients if they have greater experience, knowledge and a complex trading environment where they can manage and assess their own risk。As a result, such customers receive more favorable rates but less regulatory protection relative to retail customers。

通过HF Markets trading gives traders access to a variety of trading tools such as Forex, cryptocurrencies, spot metals (gold, silver, etc.), energy (oil and gas), commodities (such as coffee, copper and sugar) as well as indices, bonds and popular stocks such as Google, Apple and Facebook。

HF Markets offers some of the lowest spreads in the market, starting at zero (zero account)。The broker quotes five decimal places for major forex currency pairs。As a result, traders have the opportunity to obtain more accurate pricing and optimal spreads。

HF Markets has received many very important honors, including major honors from the World Financial Magazine's Top 100 Global Companies。Other honors include the Best Global Forex Copy Trading Platform Award from Global Brand Magazine, International Business Magazine2019 Middle East Very Fast Growing Forex Broker Awards etc。

在在After opening an account in HF Markets, traders will have access to a variety of Forex trading platforms for all their trading needs。Whether traders prefer to trade on the desktop or on the move, they can use MetaTrader 4 desktop (terminal, multi-terminal and web terminal) and mobile (iPhone, iPad and Android).。

The client's funds are kept in a segregated account。Only major banks wereHF Markets is used because they believe that successful traders should concentrate on trading without worrying about the safety of their funds。

Traders don't need to worry about transaction fees when making deposits and withdrawalsNo transaction fees, diversified payment options allow traders to trade quickly during standard business hours, weekly5 days。

Traders can do this by joiningEarn extra income from affiliate programs offered by HF Markets。Clients who join the program will get some advantages, such as 60% of the net spread based on sub-client trading volume, up to $15 net income per lot, etc.。More information about HF Markets is available on its official website, which supports 27 languages。

It can be concluded from the above comments thatHF Markets is an award-winning Forex and Commodities Broker。HF Markets offers a variety of account types for traders to choose from and has become a trader's first choice due to its low spreads。This situation is ideal for traders with limited funds who want more profit opportunities.。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.