What is the HF Markets correlation matrix??

Understanding the correlation between currencies can help you control the risk exposure of the entire portfolio. Here is how the correlation matrix tool works in HF Markets。

Markets are always changing and the relationship between currency pairs is very volatile。When one currency pair rises, the other usually falls。

Understanding the correlation of currency pairs is useful for traders who want to hedge.。In addition, it facilitates the management of exposure to the entire portfolio。

To help you further, HF Markets offers an advanced trading tool called Correlation Matrix, which allows you to determine the strength of the relationship between different currency pairs in the market.。

What is a correlation matrix??

The correlation matrix is a tool that summarizes the correlation between different variables and can be used in high-frequency markets.。

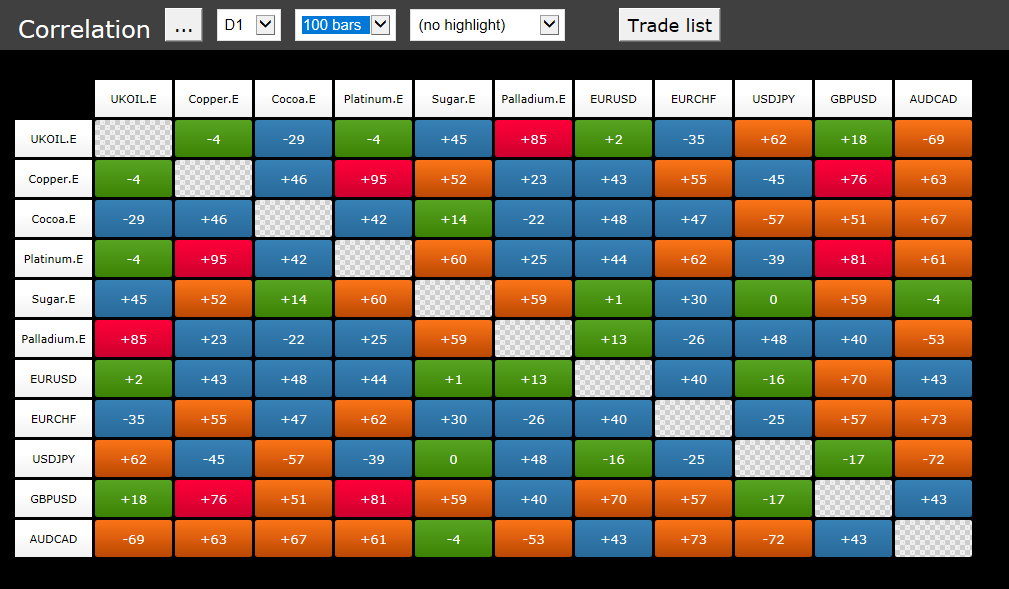

The data is displayed in a table, which consists of rows and columns representing variables, and each cell of the table shows the correlation coefficient。

The matrix is a powerful tool that can describe the correlation between all currency pairs and summarize the results into a table。In Forex trading, the correlation matrix is used to see the strength of the relationship between different currency pairs in the market。

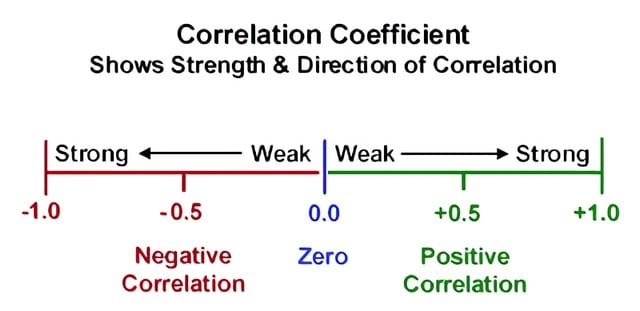

By looking at the matrix, we can see whether the movements of the two currencies over time are the same, opposite or completely random。This connection is calculated as the so-called correlation efficiency, which is usually between -1 and 1。

There are two correlations in foreign exchange, namely.

Positive correlation: If the correlation coefficient is positive, it indicates that the two currency pairs are moving the same way.。For example, EUR / USD and GBP / USD have a positive correlation, so if one currency pair rises, the other currency pair may also rise。Negative correlation: If the correlation coefficient is negative, it means that the two currency pairs move in opposite directions。For example, EUR / USD and USD / JPY are negatively correlated, so if one currency pair goes up, the other currency pair may go down。

As we can see from the above figure, by using the HF Markets correlation matrix, you can understand the mutual reaction between currency pairs。Coefficients can also tell you the strength of the correlation - the larger the number, the stronger the correlation。

How to use the HF Markets correlation matrix?

HF Markets (formerly Hotforex) is a well-known Forex broker with clients from more than 100 countries and is regulated by several top financial regulators.。The brokerage firm has won several prestigious awards and offers a variety of assets including currency pairs, stocks and cryptocurrencies, as well as a range of trading tools for beginners and professionals.。

For forex traders, the broker's correlation matrix tool is definitely worth a try。At HF Markets, the correlation matrix is not only displayed as a numerical value (ranging from -100 to 100), but also with a simple color coding, which can easily identify the strength at a glance。

You can also change the calculation basis, select the working time period, and determine the number of historical bars based on the time period to be used。

According to the table, you can collect some details, such as:

strength of correlation

The table consists of cells and numbers in different colors, allowing you to see the strength of the correlation。In addition, you can also highlight subsections of the grid, choose to focus on specific forex correlations。

simulation scenario

The Correlation Matrix tool allows you to calculate the average calculation results across all open positions in the currency。You can calculate the risk of the entire portfolio by simply selecting any number of currency pairs and calculating the average of the current correlation between them。

Foreign exchange correlation of changes

It is worth noting that the correlation is not always the same。Foreign exchange market sentiment and sharp fluctuations in the global economy will certainly affect the movement of currency pairs in the market.。

Therefore, the strong correlations we see today may not reflect the long-term linkages between currency pairs。Relevance can change for a number of reasons, such as:

The sensitivity of certain currencies to certain commodity prices Specific political and economic factors Divergence in monetary policy

Conclusion

If you intend to develop in the foreign exchange market for a long time, you must understand the foreign exchange correlation。This allows you to trade more efficiently and reduce the risk of loss。

Importantly, however, correlations in the foreign exchange market can change due to extreme volatility, so it is important to track correlations from time to time。

The relevance matrix tool can undoubtedly save you time, because you only need to look at the table before deciding to take any action。

In addition, HF Markets offers other tools such as Trade Terminal, Connect and Trading Calculator to help improve your trading performance。

HF Markets is an award-winning Forex and commodities broker founded in 2010, offering trading services and facilities to retail and institutional clients.。Since opening, HF Markets has opened around 1.5 million live accounts worldwide with over 200 employees.。

From its services, HF Markets allows customers to join the broker to trade without having to prepare a large deposit。In addition, there are various account types, trading software and tools to facilitate online trading of forex and CFDs by individual and institutional clients。

HF Markets is the registered brand name of HF Markets (Europe), which is regulated by various financial regulators according to its location。Details are as follows:

HF Markets (SV) Ltd, registered as an international business company in Saint Vincent and the Grenadines with registration number 22747IBC2015。HF Markets (Europe), licensed and regulated by the Cyprus Securities and Exchange Commission (CySEC), license number 183 / 12。HF MarketsSA (PTY) is a financial service provider (FSP) licensed and regulated by the South African Financial Sector Conduct Authority (FSCA) under license number 46632.。HF Markets (Seychelles) is incorporated under the laws of the Republic of Seychelles, registration number 8419176-1, regulated by the Seychelles Financial Services Authority (FSA), securities dealer license number SD015。HF Markets (DIFC) Ltd, licensed and regulated by the Dubai Financial Services Authority (DFSA), license number F004885。HF Markets (UK) Ltd, authorised and regulated by the Financial Conduct Authority (FCA), company reference number 801701。

Traders can become professional clients, manage and assess risk if they are more experienced, knowledgeable and have a more mature trading environment。As a result, professional clients can get better rates but less regulatory protection。

Trading through HF Markets gives traders access to a variety of trading tools, such as Forex CFDs, cryptocurrencies, rare metals (gold, silver, etc.), energy (oil and gas), commodities (such as coffee, copper and sugar), indices, bonds and popular stocks (such as Google, Apple and Facebook)。

HF Markets offers the lowest spreads in the market, with spreads in zero accounts from 0。The broker's quotes for major forex currency pairs are accurate to five decimal places。As a result, traders have the opportunity to obtain more accurate pricing and optimal spreads。

HF Markets has received a number of prestigious titles, including the great honour of being among the world's top 100 companies in world finance.。Other awards include "Global Brand" magazine's "World's Best Customer Financial Security" award, "2019 Global Forex Awards" "Best Global Forex Replication and Trading Platform" award, "2019" International Business Magazine "" Mena "award for the fastest growing Forex broker, etc.。

After opening an account in HF Markets, traders will be able to meet all their trading needs through various forex trading platforms。Whether traders prefer to trade on desktop or mobile, MetaTrader 4 can be used on desktop (terminals, multiterminals and web terminals) and mobile phones (iPhone, iPad and Android)。

Clients' funds are held in separate accounts and only the major banks are used by the market, as successful traders must focus their full attention on trading rather than worrying about the safety of their funds。

HF Markets does not charge any transaction fees when making deposits and withdrawals, and has a variety of payment methods, with a choice of wire transfers, bank cards and online payments (Neteller, iDeal, Soport Banking and Skrill), ensuring that traders can trade quickly 24 / 7 on weekdays.。

Traders can earn extra income by joining affiliate programs offered by Markets。Clients who join the program will get some advantages, such as a 60% net spread based on sub-client trading volume, and net income of up to $15 per lot.。More information about HF Markets can be found on its official website, which supports 27 languages。

In summary, HF Markets is one of the award-winning Forex and Commodities Brokers。Traders can choose from a variety of account types at HF Markets, which itself is a trader's favorite due to its low spreads, ideal for traders with limited funds and a desire to have more opportunities to profit。

HF Markets is a global forex and commodities broker that facilitates retail and institutional clients.。HFM, formerly known as HotForex, has positioned itself as the preferred forex broker for traders worldwide through a variety of account types and trading tools。In addition, HF Markets allows scalpers and traders to freely use smart trading systems。

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.