Q3 outstanding performance led to an 18% surge in stock prices! Pinduoduo market capitalization and Ali only "tens of billions of dollars away"

On November 28, Pinduoduo announced its financial results for the third quarter ended September 30, 2023, with excellent overall performance.。Affected by the bright results, on November 28, Pinduoduo closed at 138.$96, up more than 18% to a 31-month high。

On November 28, Pinduoduo announced its financial results for the third quarter ended September 30, 2023, with excellent overall performance.。

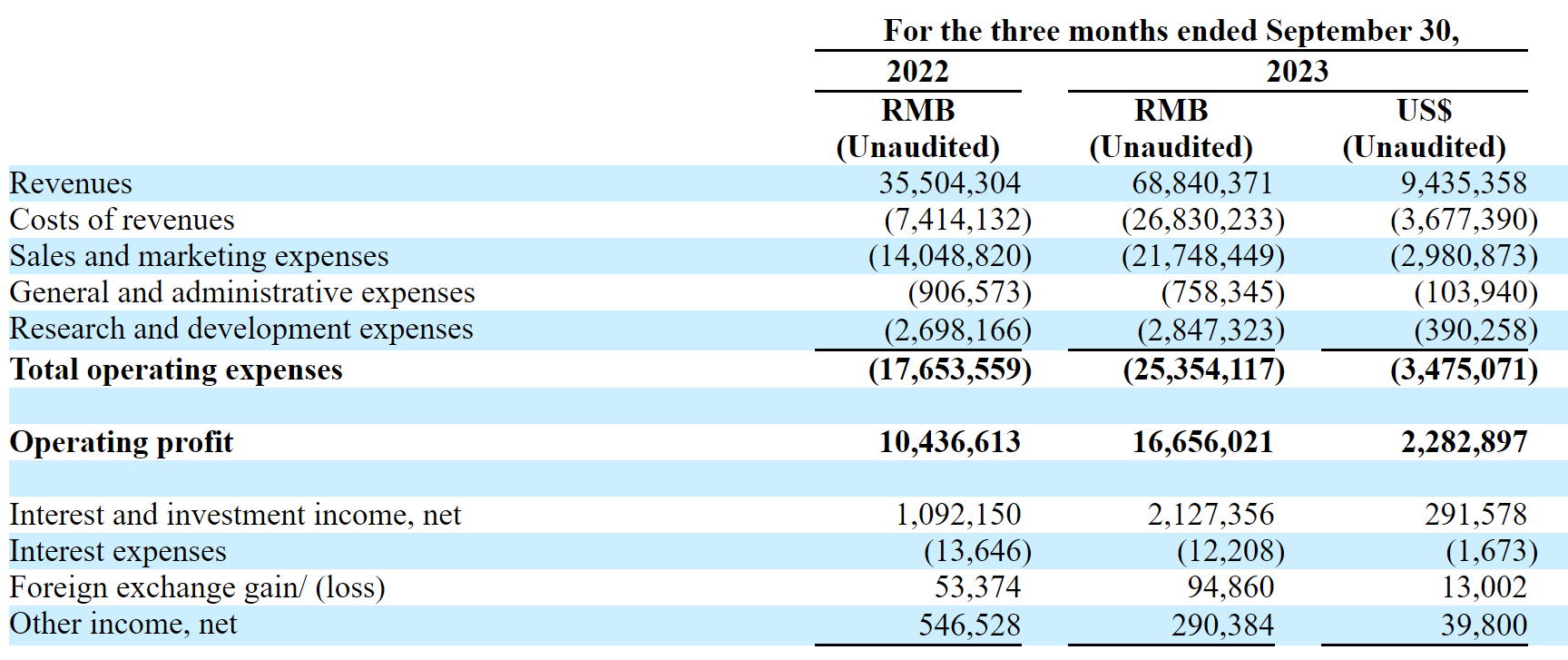

Performance data show that in the third quarter, Pinduoduo's total revenue was 688.400 million yuan (RMB, the same below), up 94% YoY。Operating profit was 166.600 million yuan, up 60% year-on-year。Net profit attributable to common stockholders was 155.400 million yuan, up 47% year-on-year。

The increase in total revenue was mainly driven by an increase in revenue from online marketing services and transaction services, according to Pinduoduo.。

● Online marketing services (i.e. advertising business) and other revenue of 396.900 million yuan, up 39% year-on-year。

● Trading services revenue of 291.500 million yuan, up 315% year-on-year。

In addition, Pinduoduo's cash position grew significantly in the third quarter。Net cash from Pinduoduo's operating activities in the third quarter was 325.400 million yuan, 116 in the same period last year.500 million yuan, up 180% year-on-year。The company explained that the significant increase was mainly due to an increase in net profit and changes in working capital.。

As of September 30, 2023, Pinduoduo's cash, cash equivalents and short-term investments were $202.8 billion, up 36% from $149.4 billion at the end of last year.。

Pinduoduo's market value is only one step away from Alibaba.

Boosted by bright earnings, Pinduoduo closed at 138 on Nov. 28..$96, up more than 18% to a 31-month high。The total market value of Pinduoduo has also reached 184.7 billion US dollars.。It is worth noting that on the same day, Alibaba fell 1%, the intraday share price had fallen to a nearly 1-year low, closing at 76.$72 for a total market capitalization of $195.4 billion。The market capitalization gap between the two has narrowed to about $10 billion, and the market capitalization of Pinduoduo is only one step away from surpassing Alibaba.。

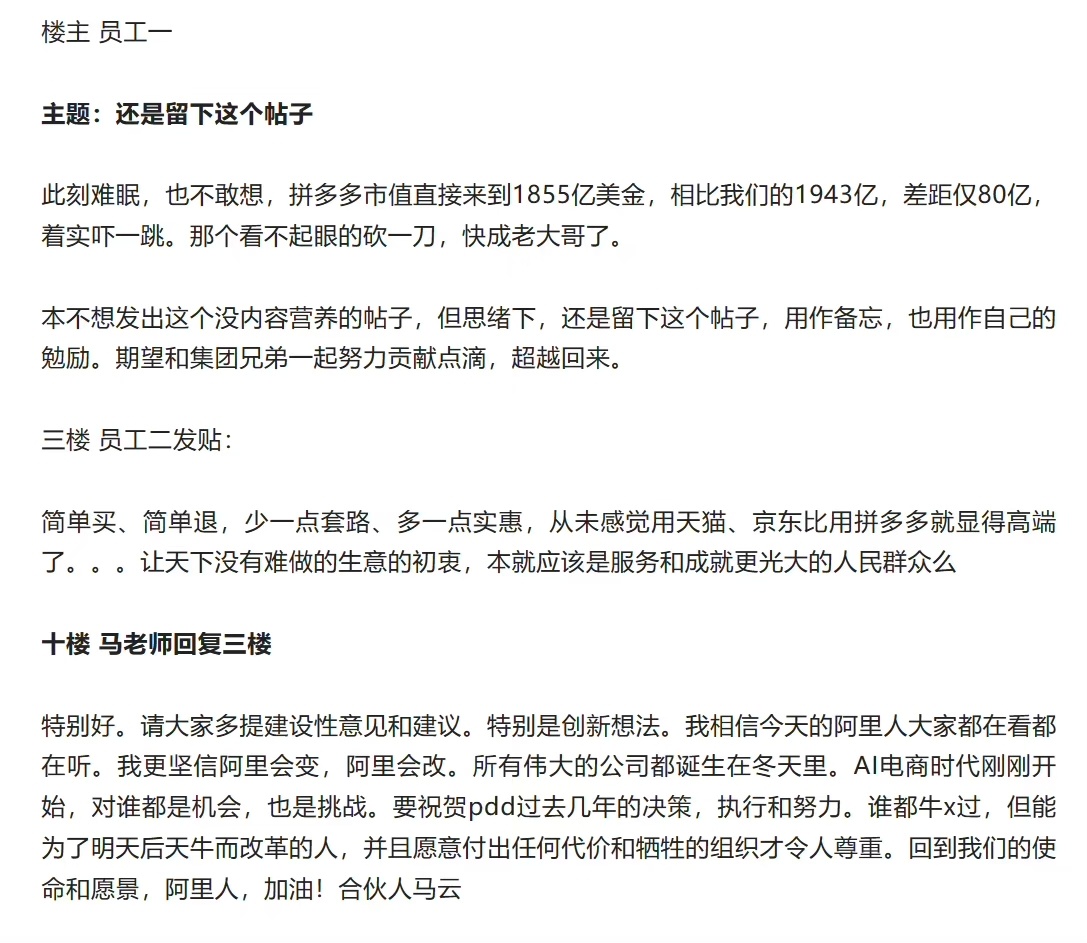

The fact that Pinduoduo's market capitalization is about to surpass Alibaba's has made Alibaba's internal employees very emotional.。

It is reported that an Alibaba employee posted on the company's intranet with emotion, saying, "The humble slash is about to become Big Brother.。Subsequently, another Alibaba employee replied: "Simple buy, simple refund, a little less routine, a little more affordable, never feel with Tmall, Jingdong than with a lot of high-end."。Let the world have no difficult business of the original intention, should be to serve and achieve more brilliant people?。"

In response, Alibaba's founder Jack Ma rarely appeared on the company's intranet and replied to this post: "Especially good.。Please provide more constructive comments and suggestions。Especially innovative ideas.。I believe everyone in Ali today is watching and listening.。I firmly believe that Ali will change, Ali will change。All great companies are born in winter。The era of AI e-commerce has just begun, and it is an opportunity and a challenge for everyone.。would like to congratulate the pdd on its decision-making, implementation and efforts over the past few years。No one has a cow x, but only those who can reform for the sake of tomorrow's post-Taurus, and who are willing to pay any price and sacrifice, are respected.。Back to our mission and vision, Ali people, come on! Partner Ma Yun "

Ma Yun's encouragement comes at a time when Alibaba is fluctuating.。Some time ago, while releasing its third-quarter results, Alibaba also brought bad news about business development: it will no longer push for a complete spin-off of Cloud Intelligence Group; Hema's initial public offering (IPO) plan has been suspended, etc.。These have exacerbated uncertainty about the company's development, leading to sluggish market sentiment。

Bright global business performance

And unlike Alibaba's many changes this year, Pinduoduo's recent year has been a good one.。One of the most eye-catching is its overseas version of Duoduo - Temu.。

Since its launch in the United States in September 2022, Temu has won a large number of consumers with the advantage of "high quality and low price," and is currently "killing the Quartet" in many overseas countries.。

In February of this year, Temu spent $14 million on two 30-second commercials for the Super Bowl, which has long been the world's most commercially valuable super event.。

While running ads at the Super Bowl would be a big ad spend for Temu, Temu also used it for promotional purposes。

Statistics from data agency SensorTower show that there were more than 42 during the Super Bowl weekend..60,000 people downloaded the Temu app, and in the following month, Temu's global cumulative downloads reached 50 million.。

In addition, Temu has pledged to buy multiple ad units during the Super Bowl in February.。

Temu's business has expanded rapidly this year thanks to its parent company's strengths in supply chain and marketing.。Within a few weeks of its launch, Temu topped the list of app stores in the United States, followed by rapid expansion in countries such as Australia, New Zealand, France, Italy, Germany, the Netherlands, Spain and the United Kingdom.。In July this year, Temu entered the Asian market through Japan and South Korea.。It then entered the Philippines on August 26 and landed in Malaysia on September 8.。

In an October report, Goldman Sachs said: "Temu has rapidly expanded its footprint beyond the United States to other international locations, and we believe that now that it serves in more than 40 countries, we will continue to see growth opportunities in the coming quarters."。"

During the call, Liu Jun, vice president of finance at Pinduoduo, answered questions about the company's global business。She said that the company's idea has always been to use the supply chain experience accumulated over the years to create a new form of supply channels and shopping experience for consumers around the world, and to connect factories directly to consumers through a flexible supply chain.。At present, consumers from 40 countries around the world and from different cultural backgrounds are already buying products directly from quality factories through the company's services.。

But at the same time, Liu Jun said: "Pinduoduo's global business is still in a very early stage, many measures, strategies are still climbing, our team is also constantly improving the understanding of the needs of consumers in different markets around the world."。"It was a challenging but at the same time very interesting process.。We look forward to working with more partners on this journey to make life easier and more enjoyable for consumers around the world.。"

China's domestic market multi-point force, fight more to get Damo "sing more"

In terms of China's domestic business, Pinduoduo's development is also very impressive.。Executive Director and Co-CEO Zhao Jiazhen mentioned in the phone conference, in the past "Double Eleven" promotion, the user scale of "tens of billions of subsidies" has exceeded 6..200 million。

In addition, Pinduoduo's community group-buying business, Kuaituan, has quickly attracted users by virtue of its free, efficient and convenient features, and now accounts for nearly half of the market share.。And Pinduoduo's fresh agricultural products business - Duoduo's grocery shopping is also gaining ground in many parts of China.。Some market participants said that a lot of food has accumulated enough market share, can be with the United States group preferred "wrist"。

At the third quarter results call, Chen Lei, chairman and co-CEO of Pinduoduo Group, said: "Agricultural products are strategic for Pinduoduo.。We started out as an agricultural product, and we have a lot of users who started out with the platform from agricultural products.。We are through agricultural products to serve a good group of users, so that they eventually stay in our platform。But until today, from the overall point of view, although the online rate of agricultural products is relatively low, the future of this category still has great potential.。"

Chen Lei also stressed: "In the future, agriculture is still an important foothold for the high-quality development of the platform.。He added that the company will continue to use its unique scientific and technological advantages and platform resources to help improve the efficiency of the circulation of agricultural products, promote the actual landing and transformation of agricultural science and technology innovation, and connect better quality agricultural products directly from the origin to consumers, bringing real income increase to agricultural producers.。

Led by the rapid development of the business, Pinduoduo has risen nearly 46% this year.。In contrast, the old e-commerce Alibaba U.S. stocks fell nearly 11%, Jingdong U.S. stocks fell 48%。

After the third-quarter results of Pinduoduo, Damo released a research report saying that the strong third-quarter results of Pinduoduo mean that the market share of its domestic e-commerce business continues to expand, as well as the strong growth momentum of its cross-border e-commerce business Temu, which is expected to continue in the fourth quarter of this year and next year.。The bank noted that Pinduoduo is its first choice in China's e-commerce sector.。

Damo will also raise its earnings forecast for 2023 - 2025 by 21%, 16% and 12% respectively.。At the same time, the target price of Pinduoduo will be significantly raised from $140 to $170, with a rating of "overweight."。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.