PDD 2024Q2 net profit increased 144%, but management issued a profit warning

Chen Lei said that PDD will not make buybacks or dividends in the next few years.

On August 26th, e-commerce giant Pinduoduo released its financial report for the second quarter of 2024.

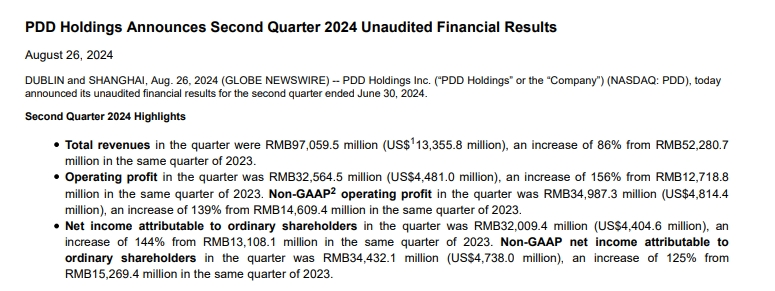

The data shows that the company achieved a revenue of 97.06 billion yuan (RMB, same below) in the second quarter, compared to 52.281 billion yuan in the same period of the previous year, an increase of 86%, with market expectations at 99.985 billion yuan; the net profit attributable to ordinary shareholders of Pinduoduo was 32.0094 billion yuan, a year-on-year increase of 144%; not according to US GAAP, the net profit attributable to ordinary shareholders of Pinduoduo was 34.4321 billion yuan, a year-on-year increase of 125%.

Regarding this financial report, Chen Lei, Chairman of Pinduoduo Group and Co-CEO, said: "The steady progress made in the past few quarters has been encouraging, but we also see the challenges ahead. We are committed to transforming to high-quality development and cultivating a sustainable consumer ecosystem. We will continue to increase our investment in platform trust and security, support high-quality merchants, and unswervingly improve the merchant ecosystem."

Chen Lei also said, "We are willing to accept short-term sacrifices and potential declines in profitability."

Pinduoduo's Q2 performance was stable with increased investment in technology R&D

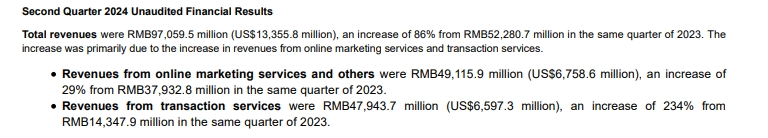

Specifically, in terms of revenue, during the reporting period, the revenue from online marketing services and other services (mainly advertising revenue) was 49.1159 billion yuan, a 29% increase from 37.9328 billion yuan in the same period of 2023; the revenue from transaction services (including Temu) was 47.9437 billion yuan, a 234% increase from 14.3479 billion yuan in the same period of 2023.

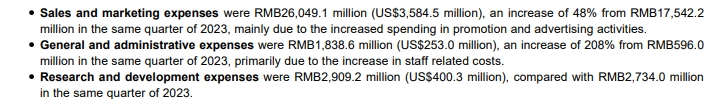

In terms of expenditure, Pinduoduo's sales and marketing expenses in the second quarter were 26.0491 billion yuan, a 48% increase from 17.5422 billion yuan in the same period of 2023.

In the second quarter of this year, Pinduoduo mainly did three major things. The first was to increase support for high-quality merchants and brands, continuously upgrade logistics, after-sales and other service experiences, bringing benefits to both supply and demand sides; the second was to promote the brand of the producing area through a hundred-person team, through the "Agricultural Cloud Action" which went deep into the fields of major agricultural producing areas, promoting seasonal fruits from the village to the city; the third was during the "618" period, to do simple and affordable, attracting more new merchants and new products to directly connect with new consumption.

At the same time, in the second quarter, Pinduoduo increased its investment in technology R&D (2.9 billion yuan, a year-on-year increase of 6%), mainly to further govern the merchant ecosystem. Zhao Jiazhen, Executive Director and Co-CEO of Pinduoduo Group, said that in order to further strengthen the governance of the merchant ecosystem, the platform optimized the process of merchants' entry and product listing, and actively patrolled the products that have been listed through technical means, combined with refined review of the team, to crack down on illegal cheating merchants and create a better business environment for high-quality merchants.

Overall, despite facing fierce competition in the external environment, Pinduoduo's performance in the second quarter is still stable. Among the two major pillars of revenue, the growth rate of commission income has slowed down, but it still achieved a high growth of over 230%, and the growth rate of advertising income has slowed down to 29% year-on-year, but it is also a highlight performance. In the future, Pinduoduo will continue to challenge the quarterly revenue level of 100 billion yuan.

Senior executives took turns to "pour cold water" and Pinduoduo's closing price plummeted by nearly 30%

Before the release of the financial report, the market expected Pinduoduo's performance in the second quarter very much, and Pinduoduo's stock price once rose by 1% before the US stock market. However, at the post-performance press conference, the senior executives of Pinduoduo took turns to pour cold water on the market. By the end of the US stock market, Pinduoduo turned to a sharp drop of 28.51%, creating the largest single-day drop since its listing, and the market value evaporated more than 55 billion US dollars.

First, Chen Lei announced the "profit reduction" of Pinduoduo.

Chen Lei said that in view of the fierce competition faced by the company in multiple business lines, and the overall still in the investment stage, Chen Lei said that Pinduoduo will not repurchase or distribute dividends in the next few years. In addition, in order to support the long-term healthy development of the platform and the construction of high-quality supply, Chen Lei also pointed out that Pinduoduo has been prepared to sacrifice short-term profits in the next period, and the management has reached a consensus on this.

Subsequently, Zhao Jiazhen also took the stage and said that the company's profits may fluctuate.

Zhao Jiazhen said: "Although the company expects that profits may fluctuate in the next few quarters, the management's commitment to building a healthy and sustainable platform ecosystem will not change. We will continue to make long-term and patient investments to achieve long-term healthy development of the platform ecosystem."

Chen Lei also believes that Pinduoduo's global business is still in the early stage of exploration, and may face many changes and challenges in the future, and non-business challenges are becoming more and more severe.

In the United States, Temu is being reviewed by the US Department of Homeland Security on the "small exemption" import policy. Originally, the review system stipulated that any package delivered by direct mail to individual buyers, as long as the value is less than 800 US dollars, can enter the United States duty-free, but Temu's rapid expansion has still attracted the attention of European and American regulatory authorities.

In Europe, the EU has included Temu in the list of platforms facing the highest level of digital review by the EU. This means that by September 2024, Temu will be required to comply with the strictest rules and obligations of the DSA, including assessing and mitigating "systemic risks."

The European Commission accused Temu of being able to achieve this by taking measures such as modifying its user interface to better report and detect suspicious lists, improving its review process to quickly remove illegal goods, and optimizing its algorithms to prevent the promotion and sale of prohibited goods.

At this telephone meeting, the senior management of Pinduoduo did not respond positively to the regulation of Temu in the overseas market. However, Chen Lei believes that no matter how the market environment changes, consumers' demand for "more cost-effective" and "good service" on the e-commerce platform will not change. He said: "Pinduoduo will continue to implement the high-quality development strategy and be prepared for long-term investment, to continuously refine the internal skills, actively explore technology and model innovation, and meet market competition and various challenges."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.