Google Q4 earnings report: advertising revenue is lower than expected, cloud business for the first time to achieve full-year profit

On January 30, local time, Google's parent company Alphabet released its fourth-quarter 2023 earnings after the U.S. stock market.。Specific to each business, Google's performance in the fourth quarter was mixed。

On January 30, local time, Google's parent company Alphabet released its fourth-quarter 2023 earnings after the U.S. stock market.。

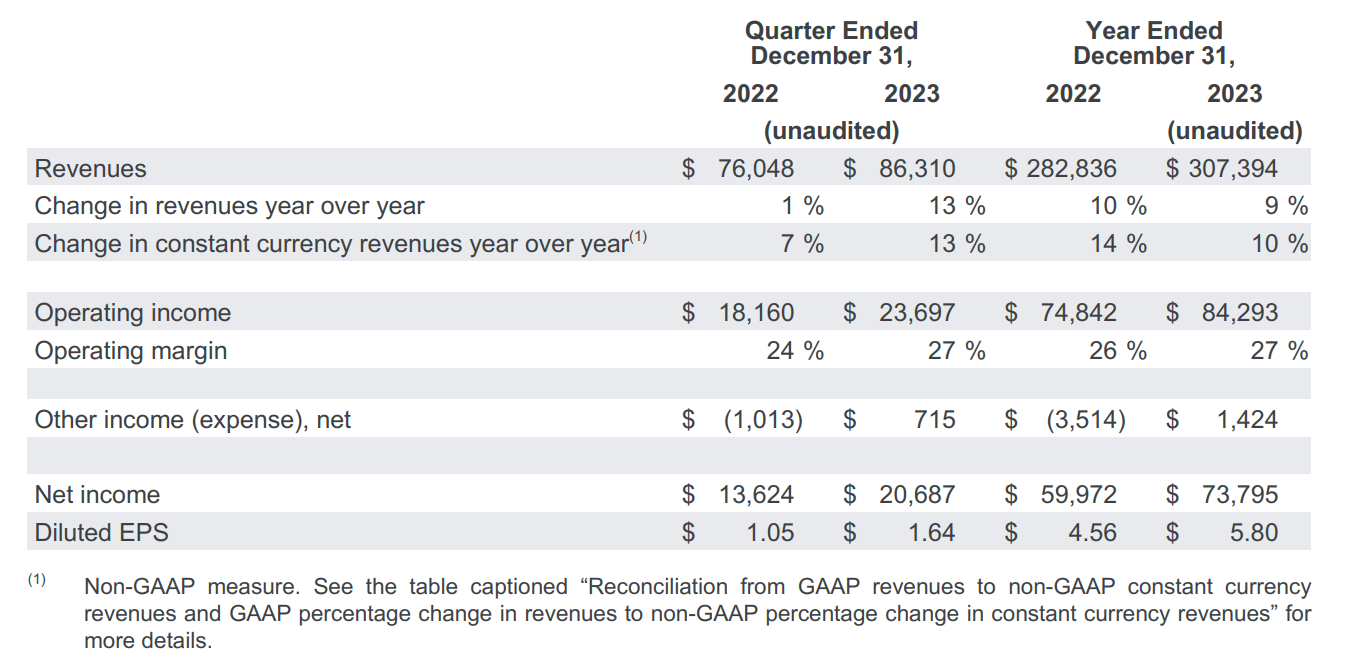

Performance data shows that Alphabet's revenue in the fourth quarter was 863.$100 million, up 13% year-over-year and better-than-expected $85.4 billion。Revenue excluding traffic procurement costs was $72 billion, better than the $71 billion expected by analysts.。

On the earnings side, in the fourth quarter, the company's operating profit was 236.$9.7 billion, up 27% year over year, lower than expected $21.4 billion。Net profit was 206.$8.7 billion, up 50% year-on-year, higher than the expected $20.2 billion。Diluted EPS 1.64, above Wall Street expectations of 1.59 USD。

Specific to each business, Google's performance in the fourth quarter was mixed。

Advertising business falls short of expectations, shares fall

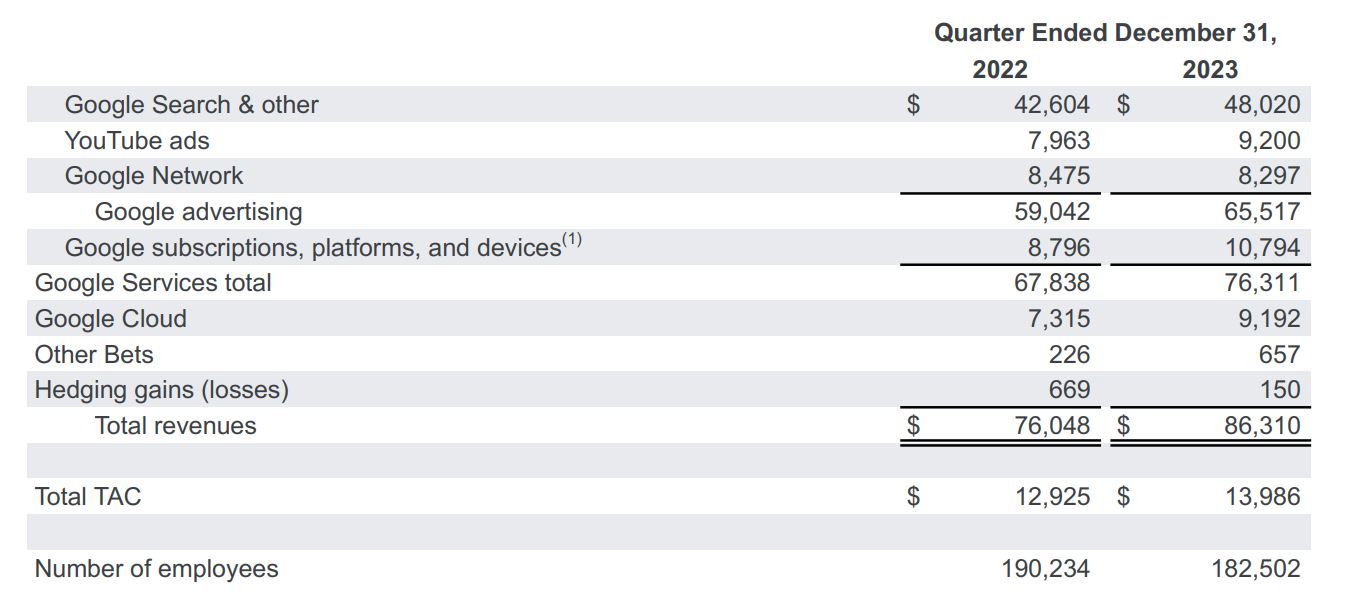

In the advertising business, fourth-quarter revenue was 655.$1.7 billion, up 11% YoY, below market expectations of $65.8 billion。Among them, the core search business recorded revenue of 480.$200 million, up 13% year-on-year, also below market expectations of 481.500 million dollars。YouTube revenue increased by 15.5% to $9.2 billion, slightly above the average analyst estimate of 91.600 million dollars。

In Google's Web business (advertising revenue elsewhere), fourth-quarter revenue fell 2% year-over-year to $8.3 billion.。The business has been a weakness in the company's overall business。Google's payment to Apple for Internet search-related fees is a key point in the U.S. Department of Justice's antitrust lawsuit against Google, and this key point is related to the business。

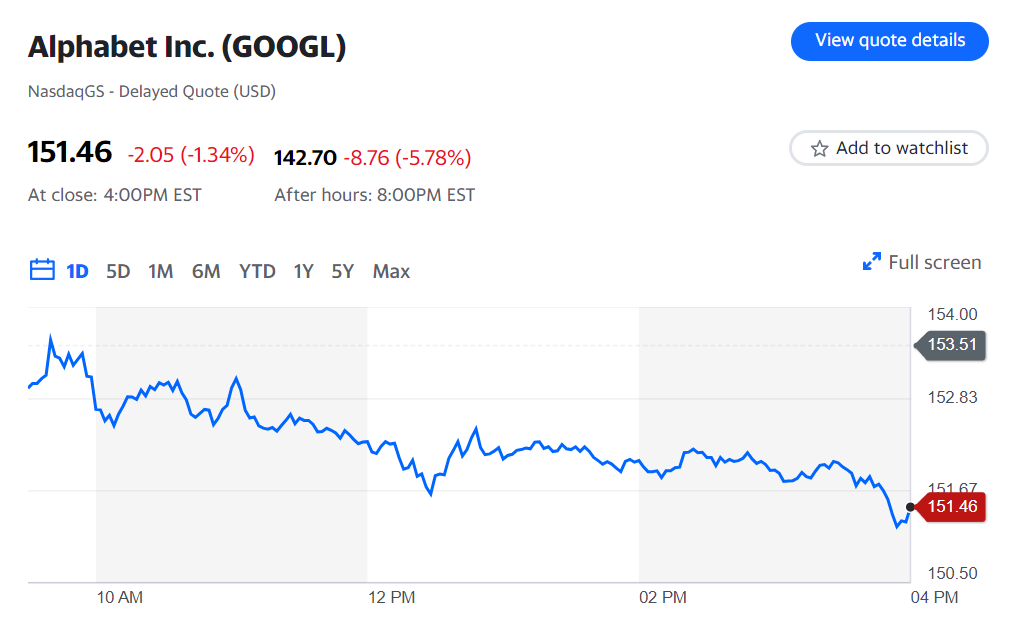

Google-A down nearly 6% after hours, hit by lower-than-expected ad business。

The lower-than-expected performance of the search business indicates that Google's search engine is facing more uncertainty.。Google's search engine has dominated the world for years, but with the rise of generative artificial intelligence, companies such as Microsoft and OpenAI able to offer AI programs that answer user questions in the form of conversations (such as ChatGPT), Google's "supremacy" position is increasingly threatened.。

Google is already incorporating new AI technologies into its products, and last month it released Gemini, its most powerful big language model.。But there have been concerns that Google has been a bit too slow to respond to drastic changes in the market and has fallen behind Microsoft in the AI race.。This has also hit the confidence of advertisers to some extent.。

Investing.Com analyst Thomas Monteiro (Thomas Monteiro) said: "Alphabet's disappointing advertising revenue data shows that global businesses are still uncertain about the pace of global central bank rate cuts.。"

In addition, Google's search engine and advertising network is currently beset by litigation, which is also a negative factor for it.。Regulators accuse Google of abusive tactics and argue they are stifling innovation and competition。A case brought by the U.S. Justice Department entered the trial phase last fall and will enter the closing arguments phase in May this year.。Google also recently lost an antitrust trial that could reduce the commission Google receives from apps on its Play Store.。

Cloud business for the first time to achieve full-year profit, this year will continue to reduce costs and increase efficiency

In the fourth quarter, Google's cloud business had revenue of 91.$900 million, better-than-expected $8.9 billion, up 26% year-over-year。The business segment made its first quarterly profit last year, but revenue growth in Google's cloud business slowed as customers streamlined their cloud spending.。The 26% growth rate in the fourth quarter is much slower than the 32% growth rate in the same period in 2022.。Moreover, compared with the old rival Microsoft's Azure, Azure grew faster in the same period。Microsoft reported on Tuesday that sales of its cloud platform Azure rose 30 percent in the fourth quarter.。

From an earnings perspective, the Google Cloud business unit achieved operating profit in the fourth quarter 8.$6.4 billion, is what analysts expect 4.More than twice the $2.7 billion。This is Google Cloud's first full-year profit.。

In recent years, Google has been trying to expand its market share in cloud computing.。The company currently ranks third in the cloud computing market, behind rivals Amazon and Microsoft.。

In order to speed up the catch-up with AI, Google continues to invest heavily in the servers, data centers and research needed for AI.。In the fourth quarter, Google's capital spending surged 45% year-over-year to $11 billion, the highest level in years.。Chief Financial Officer Ruth Porat also said on a conference call that capital spending this year will be significantly higher than in 2023.。

In the case of increasing investment this year, Google continues to implement the strategy of cost reduction and efficiency。During the earnings call, CEO Sundar Pichai and Porat both noted that Google will continue to streamline its business to achieve cost savings and efficiency gains.。

And Google's cost-cutting and efficiency measures include cutting non-priority projects, layoffs, etc.。Pichai said: "In different teams, we have closed a number of non-priority projects that will help us invest and operate well in growth areas.。Polat, for his part, said the company was committed to eliminating organizational layers to improve efficiency, and warned that this would lead to a slowdown in hiring at the company.。

Porat revealed that severance-related costs due to layoffs are expected to reach $700 million in the first quarter of this year。In fiscal 2023, Google incurred a total of $2.1 billion in employee severance and related expenses, and $1.8 billion in office space optimization exit expenses.。

At the same time, Porat also said that Google will continue to invest in top engineering and the recruitment of top technical personnel, and "where possible, in order to support our growth, we will redistribute talent throughout Alphabet."。"

Alphabet had about 182,500 employees at the end of December, up slightly from the end of the third quarter.。But Alphabet's headcount has fallen significantly compared to the end of 2022, when the company had more than 190,000 employees.。

With investors apparently still unhappy with Google's fourth-quarter results, some analysts predict that Google will have to continue to improve profit margins and even further layoffs.。

In addition to these businesses, Google's other businesses (Other Bets) had revenue of 6% in the fourth quarter..$5.7 billion, operating loss of 8.$6.3 billion, less than the $1.3 billion loss expected by analysts。The business unit includes self-driving car project Waymo and life sciences unit Verily。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.