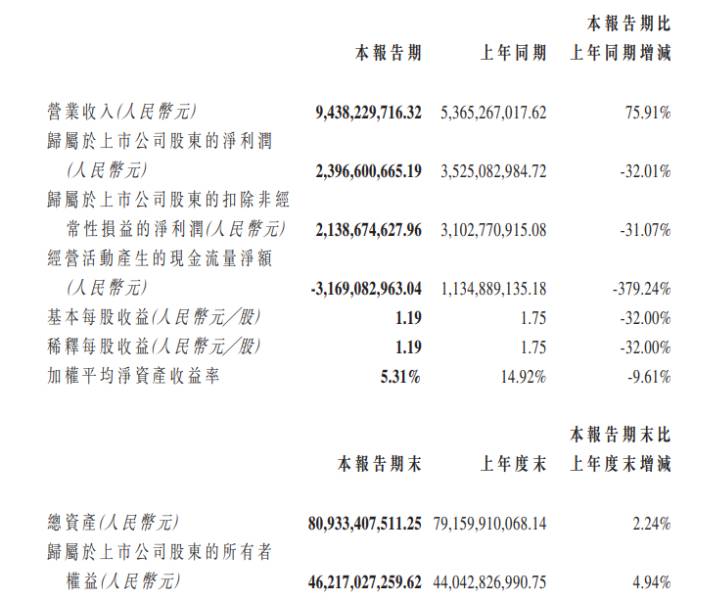

Ganfeng Lithium's 2023 Q1 Financial Report "Unbearable" All Performance Indicators Declined Significantly Year - on - Year

Ganfeng Lithium's operating income in the first quarter of 2023 was 94.RMB3.8 billion, up 75% YoY.91%, down 33.58%; net profit attributable to parent 35.2.3 billion yuan, down 32.01%, down about 58% month-on-month。

On the evening of April 27, energy metals giant Ganfeng Lithium announced its first quarter 2023 results。Performance data show that Ganfeng Lithium 2023Q1 revenue of 94.3.8 billion yuan (RMB, the same below), up 75% YoY.91%, down 33.58%; net profit attributable to parent 35.2.3 billion yuan, down 32.01%, down about 58% month-on-month; net cash flow of -31.6.9 billion yuan, down 379.24%, diluted EPS of 1.19 yuan, down 32%。Ganfeng Lithium said that the decline in revenue for the period was mainly due to the release of the company's related production capacity and year-on-year growth in operating income.。

Compared to its bright 2022 earnings report, Ganfeng Lithium's first quarter 2023 earnings report looks much inferior。In 2022, the company's turnover increased by 274.6%, gross profit growth of 367.4%, earnings per share of 10.18 yuan。

The impact of first-quarter earnings was quickly reflected in its share price.。AH shares all lower today。Among them, A shares closed at 64 as of midday..60 yuan, a decrease of 1.64%; H shares closed down 3 as of midday.66% to 51.HK $30。The day before (April 27) Ganfeng lithium AH shares rose about 3%, by the northbound funds increased 774.90,000 shares, southbound funds increased holdings by 12.70,000 shares。

After a year, earnings performance is worlds apart

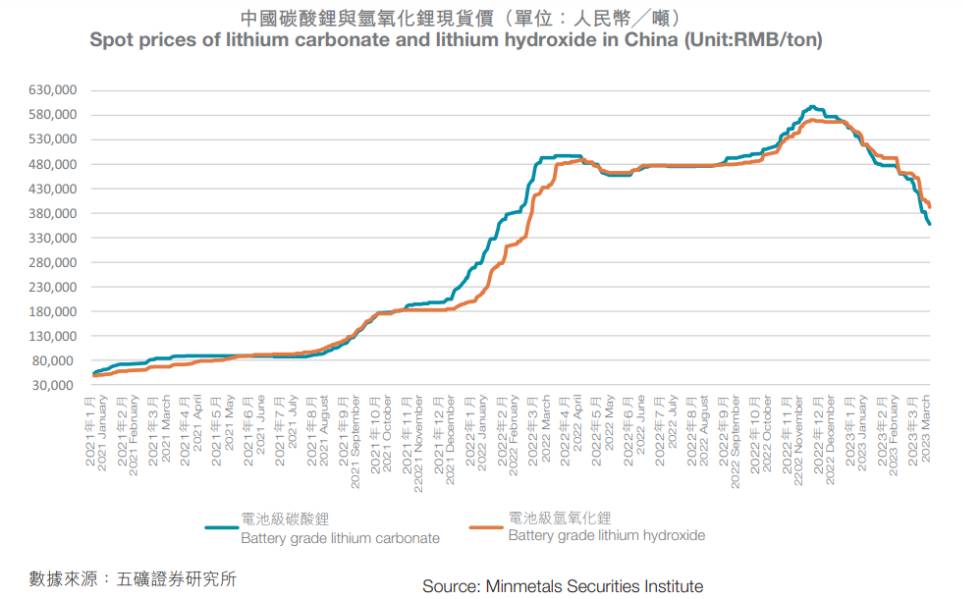

In the first two years, commodity prices rose wildly, as an indispensable raw material for new energy, lithium prices remained high, and Ganfeng lithium industry naturally benefited from it.。But the good times are short, and lithium prices have continued to fall this year.。Take lithium carbonate and lithium oxide, for example, since the end of last year, the spot price has been all the way down.。

Battery grade lithium carbonate market prices also continued to decline, from nearly 600,000 yuan per ton fell below 200,000 yuan, down more than 60%。According to data released by Shanghai Steel Union, battery-grade lithium carbonate rose 5000 yuan / ton on April 28, with an average price of 18.90,000 yuan / ton, industrial grade lithium carbonate rose 7,500 yuan / ton, the average price of 15.90,000 yuan / ton。Ganfeng Lithium is the world's largest producer of lithium metal and the largest supplier of lithium compounds in mainland China, accounting for 82% of its revenue..9%, lithium battery accounted for 15.6%, greatly affected by lithium price fluctuations。Except for Ganfeng Lithium, the rest of the lithium companies reported varying degrees of net profit decline in the first quarter.。

Recently, lithium prices began to stabilize the trend, some large banks predict that lithium prices will follow a stable trend。

Everbright Securities believes that the current valuation of lithium ore has been pulled back to a cost-effective range, on the one hand, lithium prices are expected to stabilize in the follow-up, on the other hand, the second quarter demand is expected to be good superimposed on the opening of a new round of replenishment demand for cathode materials and battery plants, the lithium ore plate also has a boost。

CICC said that the accelerated downward trend in lithium carbonate prices is difficult to sustain, short-term with the consumption of smelter inventories lithium prices are expected to gradually stabilize or even rebound, but due to the supply side of the clearing is not yet sufficient, lithium prices downward trend is difficult to say reverse。

Citi had earlier released a research report saying that it believed that Ganfeng Lithium Energy was at the end of its destocking cycle and that battery manufacturers would restock in late April and May, and that if demand improved further, lithium prices might have bottomed out and there was some room for upside.。Citi opens a 30-day positive catalyst observation period for Ganfeng Lithium H shares and gives them a target price of 124.HK $1, rating "Buy"。

For Ganfeng Lithium, access to high-quality and stable lithium resources is critical to the long-term stable development of its business.。The company has been active in the global lithium mine in recent years.。At present, the company has acquired 62% of Shangrao Songshugang Tantalum and Niobium Mine Project through Xinyu Ganfeng Mining; completed the equity delivery of Mali's Goulamina spodumene project to acquire 50% of Mali's lithium industry; completed the tender offer for Bacanora, which currently holds 100% of Bacanora and Sonora's lithium clay projects; completed the acquisition of 100% of Lithea's PPG lithium salt lake project。In addition, last year the company also increased the research and development of lithium salts, solid-state batteries, etc., the research and development investment increased by 316.2%。

Eagle Statement: This article is for reference only and does not constitute personal investment and operational advice.。Special reminder, the article is original content, without permission may not be reproduced。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.