What happened to lithium carbonate, which doubled 12 times in 3 years from flat ground to "collapse" of high-rise buildings?

On the afternoon of April 4, Shanghai Steel Union released data saying that some lithium battery materials fell yesterday, battery-grade lithium carbonate fell 12,500 yuan / ton, with an average price of 23.250,000 yuan / ton, industrial grade lithium carbonate fell 10,000 yuan / ton, the average price of 19.50,000 yuan / ton。It is worth noting that the price has fallen by more than 60% from its peak.。

Relying on the rapid development of new energy vehicles, lithium carbonate, as an important raw material in its upstream, is undoubtedly the "sweet cake" in the market.

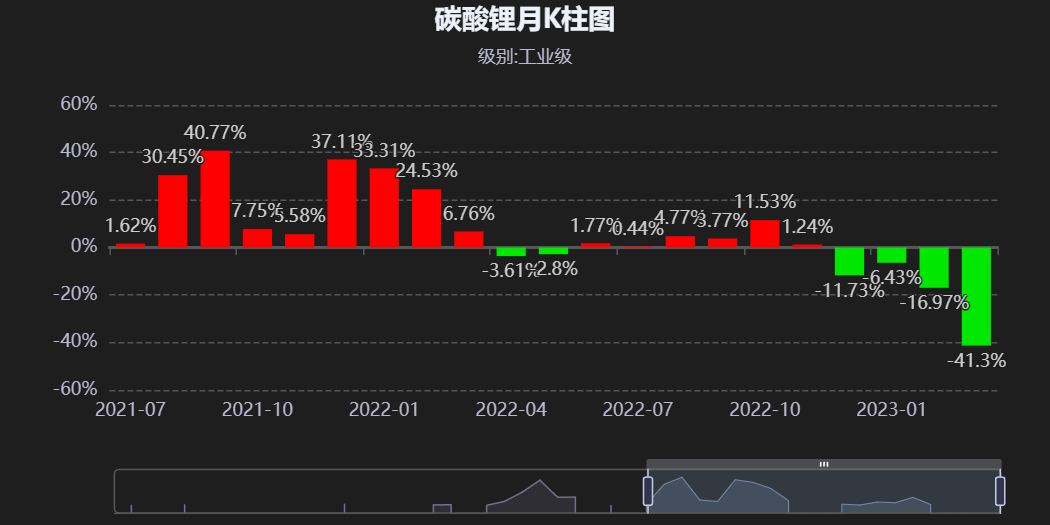

The price of lithium carbonate has soared 12 times in three years, reaching a high of 600,000 yuan / ton.

From the beginning of 2021 to the end of 2022, its price is all the way crazy, the high hit in November 2022 600,000 yuan / ton mark。You know, the price of lithium carbonate has been in turmoil ever since, with 4.A trough of 70,000 yuan / ton。Who would have thought that in three years, the difference between the highest and lowest prices of lithium carbonate is more than 12 times, which is definitely not a normal phenomenon。

The reason is that there is no doubt that the rapid development of new energy vehicles in the country during the corresponding period will certainly have a huge impact on their price increases.。

As an important raw material for the upstream end of new energy vehicles, its development is mainly constrained by the downstream demand boom.。In 2021, for example, annual new energy vehicle production 367.70,000 vehicles, up 152.5%; domestic lithium carbonate production for the same period 23.040,000 tons, up 32.97%。Lithium carbonate prices naturally rise, boosted by demand from downstream manufacturers。

Secondly, the poor performance of its downstream product lithium iron phosphate battery competition also pulled up the price of lithium carbonate.。At present, the power battery types of new energy vehicles are mainly divided into lithium iron phosphate and ternary lithium batteries, which basically divide the power battery share of the new energy market.。With the development of technology, lithium iron phosphate battery has a wider range of applications and lower costs, and is favored by head brands such as BYD and Ningde Times.。Relevant data show that in 2021, China's new energy vehicle industry lithium iron phosphate battery installed capacity of anti-super ternary lithium battery, the growth rate is significantly higher than the ternary lithium battery.。The demand for lithium iron phosphate batteries is gradually cashing in, and the demand for lithium carbonate as its upstream raw material is increasing.。

In addition, the market's speculative sentiment, but also to the high heat of lithium carbonate, arch a fire.。

On April 2, at the China Electric Vehicle Hundreds Forum (2023), Funeng Technology Chairman Wang Yun said in an interview that the supply and demand of lithium carbonate and lithium hydroxide in 2022 are actually balanced, and their prices have risen sharply. There are many hype factors。He said that the current lithium carbonate resources are not scarce, the production is not very difficult, the actual cost of about 30,000 yuan, there is no reason to rise to 500,000, 600,000.。

Li Bin, chairman of Weilai Automobile, also said earlier that after the company conducted an in-depth study of the upstream link, it was found that the gap between the supply and demand of lithium carbonate was not large, and that the price increase of lithium carbonate was mainly due to speculative factors.。

There are triple positive protection plate, lithium carbonate prices all the way soaring, the high point reached an eye-popping 600,000 / ton。However, short-term positives do not extend to long-term fundamentals, and in the face of such a inflated price bubble, it is inevitable that the edifice will tilt.。

What is the price dive of lithium carbonate since the beginning of the year??

Since the beginning of 2023, lithium carbonate prices have been in a downward spiral, with prices falling to varying degrees almost daily.。

The latest news on the afternoon of April 4 shows that according to data released by Shanghai Steel Union, some lithium battery materials fell yesterday, battery-grade lithium carbonate fell 12,500 yuan / ton, with an average price of 23.250,000 yuan / ton, industrial grade lithium carbonate fell 10,000 yuan / ton, the average price of 19.50,000 yuan / ton。It is worth noting that the price has fallen by more than 60% from its peak, a far cry from the market's forecast that lithium carbonate prices will stay around $350,000 / tonne this year and next.。

The question is, last year's soaring lithium carbonate, this year suffered a plunge, where is the problem?

On the supply side, the gradual increase in lithium carbonate capacity in recent years may be an important drag on lithium prices。Data show that in recent years, China's lithium resources are mostly stored in salt lakes, with China's salt lake lithium extraction technology is increasing, lithium carbonate production enterprises to maintain steady production, coupled with the temperature recovery, salt lake production also slightly increased, the overall supply of production capacity rose.。

In other words, the expansion of production capacity leads to an improvement in the supply of lithium carbonate, easing the pressure to take goods downstream, which in turn affects the price of lithium.。

On the demand side, shrinking end demand is also an important reason for the rapid collapse of lithium battery prices.。

In January 2023, Tesla fired the first shot of the new energy vehicle price war, which directly led to a wave of price cuts by new energy vehicle companies.。In March, Hubei announced a large-scale government and enterprise subsidies for several brands of Dongfeng Group, bringing this vigorous price war to the next level.。For a time, more than 30 well-known car brands across the country have taken off and joined the brutal battle.。Almost at the same time, the price of lithium carbonate began to decline, from a peak of 600,000 yuan / ton last year to 290,000 yuan / ton on March 22.。

The market generally believes that the price reduction of new energy vehicle companies will help stimulate consumption in the industry and open up profit margins with small profits but quick turnover.。The ideal is beautiful, but it is not the case. According to the latest data released by the Passenger Car Market Information Joint Council, from March 1 to 19, the national passenger car manufacturers wholesale 74.60,000 vehicles, down 13% year-on-year。Since this year, the cumulative wholesale 381.20,000 vehicles, down 15% year-on-year。

On March 27, Cui Dongshu, secretary-general of the National Passenger Car Market Information Joint Council, also issued a document saying that from January to February 2023, industrial production has recovered, but the cost is high, and the profit structure continues to favor the upstream mining and automotive industries, which are under great pressure to survive.。Data show that in January-February 2023, the automotive industry revenue of 1284.7 billion yuan, down 6% year-on-year; cost of 1126.4 billion yuan, down 5% year-on-year; profit of 41.4 billion yuan, down 42% year-on-year.。

The lackluster performance of the new energy vehicle market is an important factor in the collapse of lithium carbonate prices upstream of the industry chain.。Insufficient terminal demand leads to an upstream surplus, a reversal of supply and demand, and a decline in raw material prices。

Longzhong information lithium industry chain analyst Yu Yanan said, the continued decline in lithium carbonate prices is a microcosm of the status quo reflected in the demand for the industry chain, the most important factor is the weakening of the demand for new energy vehicles, transmission to the entire industry chain reflects the overall decline in demand, at present, the supply side of the performance is sufficient, oversupply situation continues, demand to guide price changes。

In fact, from a theoretical point of view, the sharp drop in the price of lithium carbonate can effectively reduce the manufacturing costs of new energy vehicle manufacturers and open up bidding space for them in the price war.。

In addition,The gradual mass production of sodium ion batteries has also dealt a blow to the demand for lithium carbonate.。

Wang said that with the gradual mass production of sodium ion batteries, the market demand for lithium resources gradually declined.。On the one hand, a number of companies in the industry have been in the field of sodium ion batteries, sodium power industrialization has been close at hand;。

Theoretically speaking, the energy density and service life of sodium ion batteries are relatively close to those of lithium iron phosphate batteries, and the cost is much lower than that of lithium iron phosphate batteries, which has broad market prospects。As a result, it is only a matter of time before lower-cost sodium-ion batteries replace lithium iron phosphate batteries. Car companies that recognize this are also grasping the layout for fear of missing the energy change.。Upstream materials upgrading is inevitable, but this technological change is not friendly to lithium carbonate prices。

Will the price of new energy vehicles be reduced if the price of lithium carbonate is cut??

On March 10, data released by the China Automotive Power Battery Industry Innovation Alliance showed that in February this year, my country's power battery loading volume was 21.9GWh, up 60% YoY.4%, an increase of 36.0%。Among them, the ternary lithium battery loading volume 6.7GWh, accounting for 30% of total loading.6%, up 15% YoY.0%; lithium iron phosphate battery loading 15.2GWh, accounting for 69% of total loading.3%, up 95% YoY.3%。

Since lithium iron phosphate batteries occupy 70% of the power battery market, the price of its upstream lithium carbonate cut, whether it can effectively reduce the cost of manufacturers to build cars, and thus benefit consumers??

I'm afraid it's not that simple.。

New energy vehicle engineer Lin Taoyang introduced that the production cost of the vehicle is not a simple pile of raw materials, which must have different hardware and software to cooperate with it, including supporting battery pack molds, power management systems, battery packaging processes, etc.。He also said that the current reduction in the cost of raw materials will indeed reduce the cost of new cars, but the reduction will not be as exaggerated as the change in the price of lithium carbonate.。

At the same time, new car pricing is also affected by the company's strategy, brand building, national policy subsidies and other factors, cost reduction is not all factors.。

Simply put, the sharp drop in raw material prices can indeed open up space for enterprises, but the specific pricing model of new cars is the result of a combination of many aspects.。

However, from the consumer's point of view, the expansion of corporate profit space is a good thing after all.。

The fact is also true, in March 27th, Chery new energy announced the adjustment of its models of the official guide price, the highest reduction of 9000 yuan。Regarding the reasons for the price cut, Chery New Energy's official explanation included "benefiting from the global raw material price correction."。

Societe Generale Securities pointed out in the report that at the beginning of the year, the pressure of battery companies from car companies to reduce prices has been eased, and the rational return of lithium prices has become inevitable, which will bring about the redistribution of profits in the industrial chain, which is good for material processing, battery production, vehicle manufacturing and even consumers.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.