Q3 earnings have not yet been released Tesla has been "bearish"?

Tesla will release its earnings report after the U.S. stock market on Wednesday (October 18)。As the earnings report approaches, the market's various predictions for Tesla have been "flying"。

Tesla will release its earnings report after the U.S. stock market on Wednesday (October 18)。As the earnings report approaches, the market's various predictions for Tesla have been "flying"。

a strategy of exchanging profits for market share

For Tesla's earnings report, the focus is mainly on two aspects, one is Tesla's delivery data, and the other is the company's car profit margin.。But for now, the market is negative on both data.。

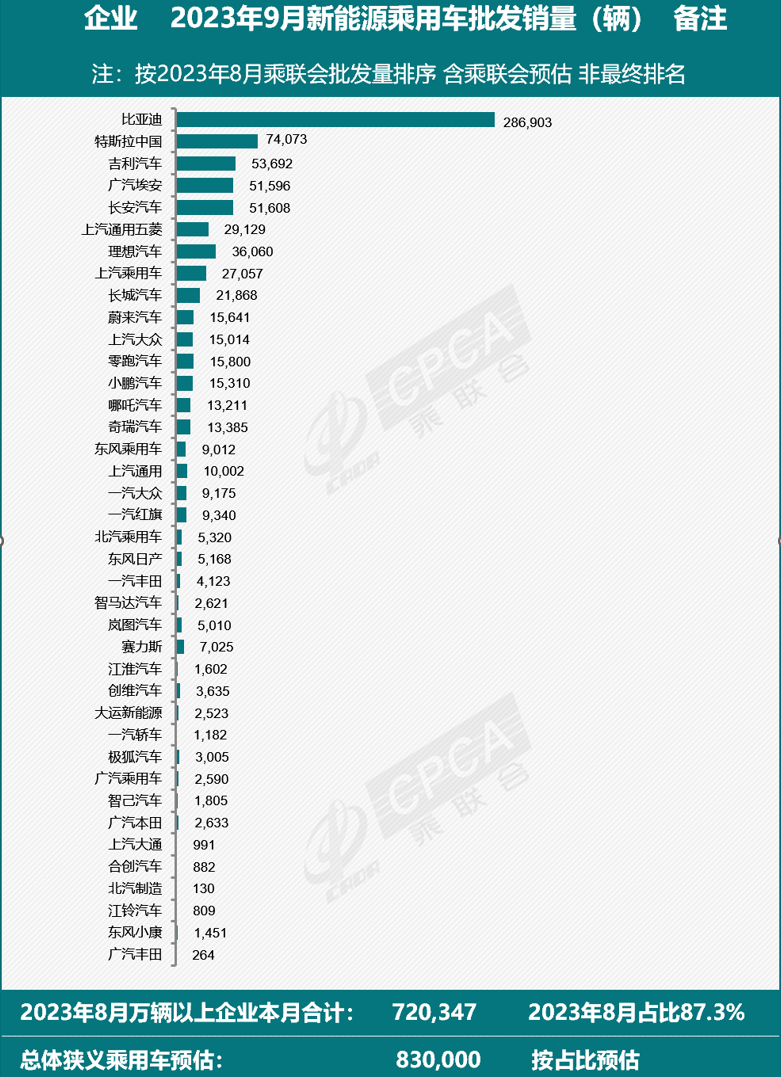

Tesla's needs are being questioned.。In China, Tesla's largest market, new vehicle deliveries were 435,059 in the third quarter, below market expectations.。In particular, Tesla sold 74,073 vehicles in China in September, down 10.9%, down 11.98%。This same-ring decline is rare for Tesla, and the market is concerned about Tesla's sales prospects.。

Separately, the sales slowdown has led the market to question Tesla CEO Musk's 2023 strategy earlier this year to focus on market share growth at the expense of profits.。

Under this strategic guidance, Tesla has significantly reduced the prices of its flagship Model 3 sedan and Model Y mid-size SUV in major global markets such as the United States and China.。The move is intended to attract new buyers and fend off growing competition in the electric vehicle sector.。

Earlier this month, Tesla announced another price cut for the Model Y and Model 3 in the U.S. by 4.2%。Since the start of the year, the company has slashed the price of the Model 3 by about 17%, and the price of the Model Y has dropped even more, to 26%.。

The market believes that Tesla's recent re-adjustment of car prices in the United States may be in response to the expiration of the "tax credit" policy.。Last week, Tesla's official website revealed that its Model 3 may no longer be eligible for the full tax credit under the Inflation Reduction Act (IRA) from early 2024.。Vehicles receiving the full tax credit must meet specific standards for parts made in North America and key minerals originating in the United States or a specific country。Tesla Model 3 models are currently eligible for the full $7,500 tax credit。Once the Model 3 loses full tax credit eligibility, it will be another "blow" to its sales.。

At the same time, Tesla's auto margins have narrowed more significantly since it adopted a price-cutting strategy。In the three months to June this year, Tesla's auto profit margin was 18.7%, compared to 22.4%。Moreover, Tesla's car profit margins are lower than those of its rival BYD.。In the first half of this year, the gross profit margin of BYD Auto and related products reached 20.67%。

Morgan Stanley analysts expect Tesla's third-quarter gross margin to fall to 17.5%, down from 18% in the second quarter..1% and 19% in the first quarter。

Big banks cut Tesla target price, "wood sister" and open a new round of selling

In these cases, the market began to "hear the wind."。

First, the big banks began to adjust their target prices for Tesla.。UBS analyst Joseph Spak cut his Tesla share price target by $24 to $266 a share, less than a month after raising it。Jefferies analyst Philippe Houchois also cut Tesla's price target by $15 to $250 per share.。Houchois said Tesla's current profit margin decline and weak fundamentals have raised questions about whether Tesla's early profit advantage was structural or a time difference.。He added that some of the company's other initiatives, including the leasing of fully autonomous driving technology, were not ready to offset weakness in the wider business.。

In addition, the market is selling Tesla shares.。For example, Cathy Wood, the famous owner of Tesla, has been selling Tesla shares recently.。

After nearly a month of suspension, Wood's Ark Investment Management sold about $30 million worth of Tesla stock in the first week of October, and several times last week it sold a total of about $20 million worth of Tesla stock.。

Wood has been adjusting its position on Tesla since mid-June, and the total number of Tesla shares sold since June 12 has exceeded 1 million shares.。

However, in addition to Tesla's own reasons, "Sister Wood" 's sell-off of Tesla also contains its views on the electric vehicle industry.。

Wood on Sunday retweeted a post about U.S. auto prices in September and commented: "[This is] an important example of price deflation associated with technological innovations such as battery pack systems.。Fed continues to make decisions based on lagging indicators。Artificial intelligence, blockchain technology, robotics and multi-omics sequencing will increase deflationary pressures。She also added: "The Fed's policy initiatives are based on lagging indicators, particularly the various PCE (personal consumption expenditure) deflators.。Investors seem to believe the Fed is on the right track。We believe deflation will be a big surprise next year。"

According to the data in the picture, among all types of cars, the price of electric vehicles is a rare category that has experienced a decline from the same period last year..4%, down 2.9%, the highest in all categories。

According to the "wood sister" said, in the case of high interest rates for a long time, the U.S. electric vehicle industry may face deflation next year, and as the industry's "leader" Tesla, is bound to face more tests.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.