Tesla Achieves Ten Consecutive Gains! Now ARKK's Largest Holding Ever

On July 9th, Tesla's stock price achieved ten consecutive gains, marking the longest rise since June last year. Tesla surged, bringing its weight in the Casey Wood flagship ETF to a historic high.

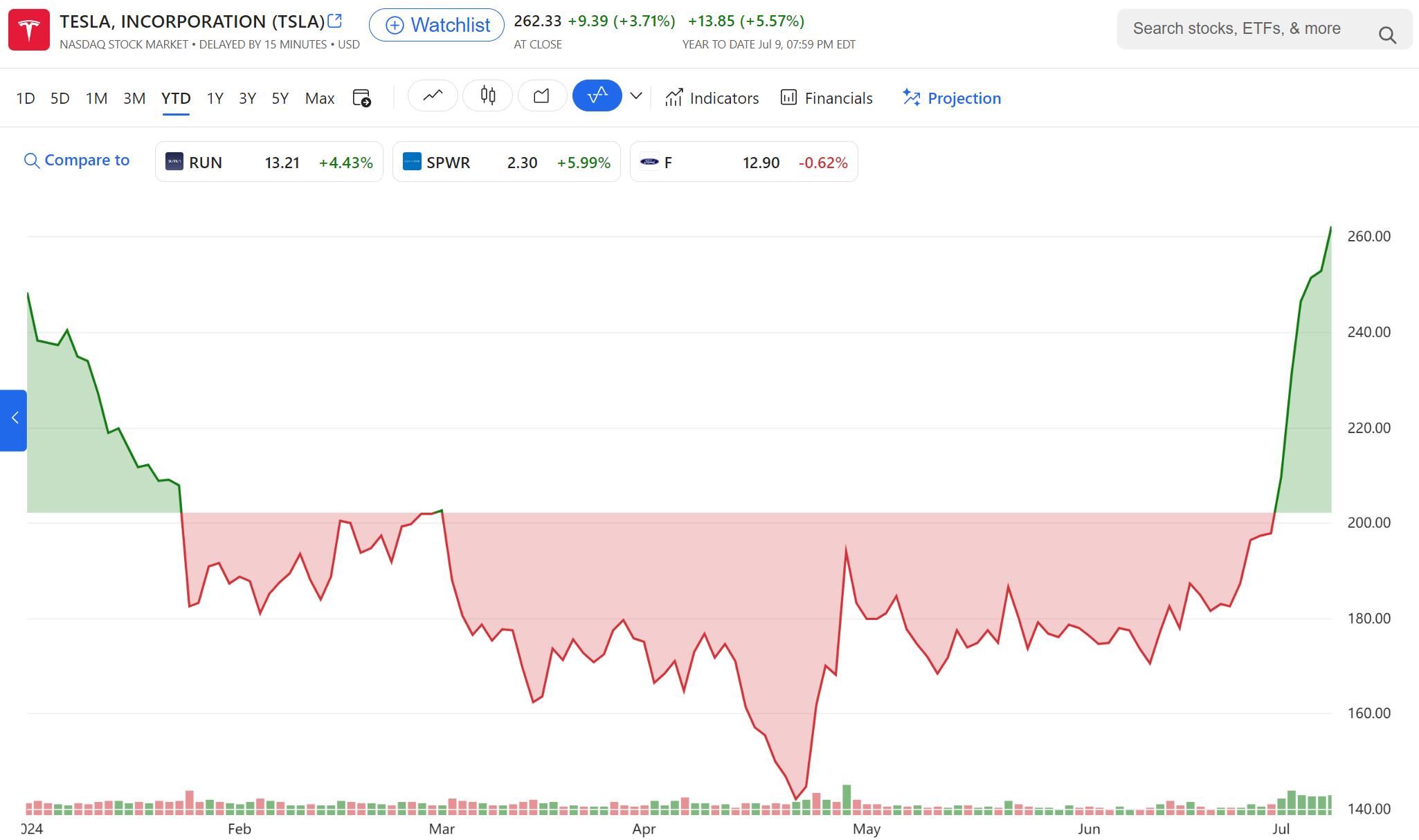

On Tuesday (July 9th), Tesla's stock price achieved ten consecutive gains, the longest rise record since June last year. On Tuesday, it closed up 3.71% at $262.33.

This "ten consecutive gains" record also helped Tesla recover the decline earlier this year. As of Tuesday, Tesla's stock price has risen by 5.57% this year.

Tesla surged, bringing its weight in Cathie Wood's flagship ETF to a historic high.

According to statistics, Tesla currently holds a weight of 15.4% in the ARK Innovation ETF (ARKK). Although the fund has reduced its holdings in Tesla in recent weeks, this proportion remains high.

Strategas Securities believes that this weight represents the fund's confidence in Tesla reaching a level of nearly a decade. Tesla has long been one of Wood's highly bullish stocks, and Wood has repeatedly praised Tesla in public, believing that the stock is severely undervalued. In June of this year, she raised her forecast for Tesla's stock price to $2,600 in 2029, which is approximately $3,100 in a bull market scenario.

Earlier this year, during a downturn in Tesla's stock price, Wood's funds repeatedly bottomed out on the stock. In April of this year, Tesla replaced Coinbase Global and became ARKK's top holding stock, which has continued to this day. Currently, the second largest position of this ETF is Roku, accounting for approximately 9.1%. Coinbase ranks third, accounting for approximately 8.5%.

"The price increase is definitely a huge catalyst," said Todd Sohn, ETF strategist at Strategas. "They usually keep the upper limit of their holdings at around 10% to 11%, but now they are letting it continue to rise."

ARKK has not bought Tesla stocks in recent months, but according to daily updates sent to customers by the company, the ETF sold several times in July. Since the beginning of this year, the ETF has fallen by about 12%.

Ark Investment Management, the parent company of ARKK, has six actively managed ETFs with a total assets of approximately $11 billion. These funds have a net outflow of $3.4 billion this year, of which ARKK has an outflow of $2 billion.

Among the 10 Tesla ETFs that account for 10% or more of the entire investment portfolio, 3 belong to Wood Group. In addition to ARKK, the other two ETFs are the $1.5 billion ARK Next Generation Internet ETF (ARKW) and the $839 million ARK Autonomous Technology&Robotics ETF (ARKQ).

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.