Tesla Q2 Earnings Preview: Gross Margin Likely Flat QoQ, Energy Storage Business to Shine

Overall, analysts' average forecast for Tesla's Q2 financial report is: revenue of $24.72 billion, a year-on-year decrease of 0.8%; Earnings per share were $0.62, a year-on-year decrease of 32%.

Tesla is expected to release its Q2 financial report for this year after market hours on July 23rd (Eastern Time). As time approaches, more and more analysts are gradually adjusting their latest forecasts for Tesla's financial report.

Overall, analysts' average forecast for the company's Q2 financial report is: revenue of $24.72 billion, a year-on-year decrease of 0.8%; Earnings per share were $0.62, a year-on-year decrease of 32%.

Many analysts believe that Tesla's gross profit margin may remain flat on a month on month basis. Tesla's gross profit margin for the first quarter recorded a year-on-year decline of 17.4%.

However, some analysts have given pessimistic profit margin forecasts. Barclays analyst Dan Levy stated in a report released on Wednesday that Tesla's gross profit margin for the second quarter will drop to 16% amid the ongoing price war for electric vehicles.

Electric Vehicle Business

In the second quarter of this year, Tesla's global production was 410,813 vehicles, a year-on-year decrease of 14.3% and a month on month decrease of 5.2%; The delivery volume was 443,956 vehicles, a year-on-year decrease of 4.7% and a month on month increase of 14.7%. In the first half of 2024, Tesla's cumulative sales were approximately 831,000 vehicles, a year-on-year decrease of approximately 7%.

Although Tesla's sales in the second quarter of this year exceeded analysts' expectations, it was mainly due to the previous decline in sales expectations for Tesla. At present, Tesla still faces the problem of weak growth in electric vehicle sales in several major global markets.

European market: On July 18th, the European Automobile Manufacturers Association (ACEA) released new car registration data for June, showing that Tesla's new car registration volume decreased by 7.2% year-on-year. In the first half of this year, Tesla's new car registration volume decreased by 12% year-on-year. At the same time, the company's market share is also declining. As of June, Tesla's market share in the European electric vehicle market was 10.8%, a decline from 11.6% earlier this year.

US market: Tesla has always dominated the electric vehicle market in the United States, but with increasing competition, Tesla's dominant position has also been shaken. According to Cox Automotive, Tesla's sales in the United States in the second quarter of this year decreased by 6.3% year-on-year, with sales accounting for 49.7%. This is the first time Tesla has fallen below 50% in a quarter. Despite Tesla's declining market share, the entire electric vehicle market in the United States still recorded a year-on-year growth of 11.3%, reaching a record high of 330,463 vehicles.

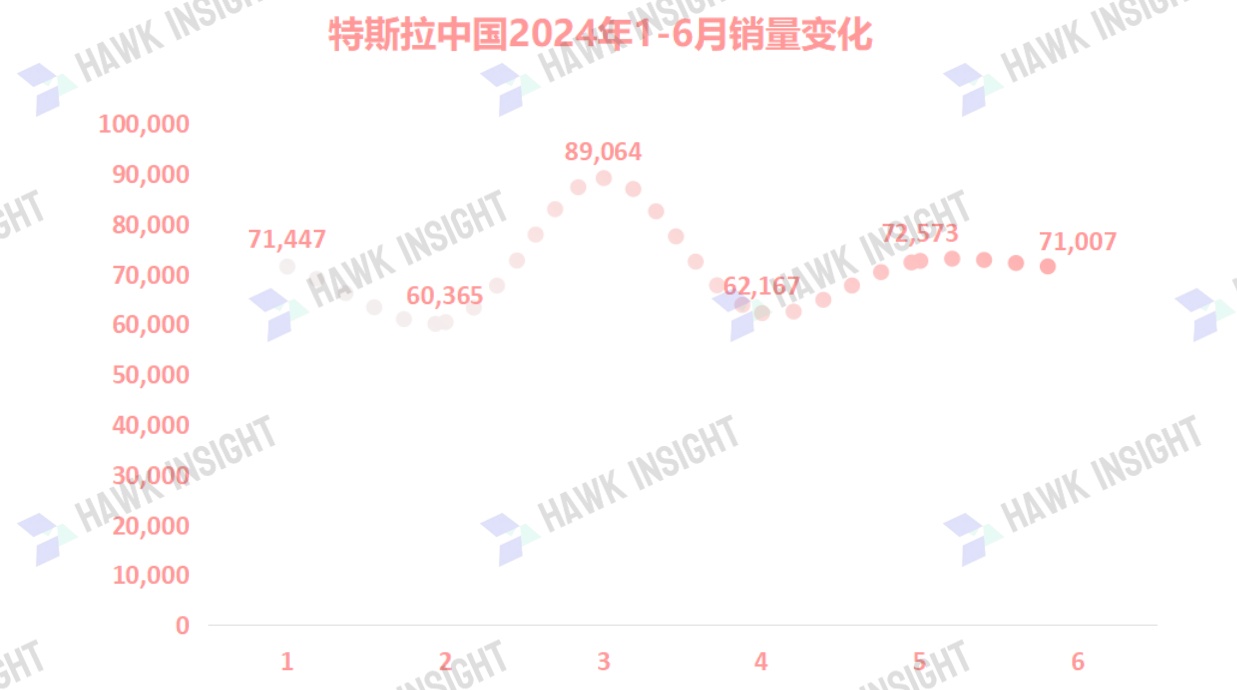

Chinese market: According to data from the CPCA, Tesla's sales in China experienced significant fluctuations in the first half of this year. In the fiercely competitive market, Tesla had to launch promotional activities (such as a five-year zero interest policy) to attract new customers.

Tesla has currently proposed two solutions to the slowdown in demand for electric vehicles, but neither of them can improve Tesla's current financial situation.

One is a low-cost model, but it is expected to be launched as early as next year, which is far from enough to quench the thirst. The second one is the autonomous taxi Robotaxi. According to media reports, the launch of Robotaxi has been postponed from August this year to October. However, analysts expect Robotaxi to have little impact on Tesla's short-term performance.

Royal Bank of Canada Capital Analyst Tom Narayan believes that Robotaxi may take several more years to be widely adopted by the public. Morgan Stanley analyst Ryan Brinkman previously stated that it is unlikely that Robotaxi will bring substantial revenue to Tesla in the coming years.

For Tesla's upcoming financial report, the market will pay more attention to Tesla's Q3 performance and sales guidance.

Energy Storage Business

In the second quarter of this year, Tesla's energy storage business will be a highlight.

Previously, the company had stated that it sold a total of 9.4 GWh of energy storage products in the second quarter, a year-on-year increase of 154% and a month on month increase of 129%, reaching a historic high. According to analysts' expectations, Tesla's energy storage business revenue will reach $2.342 billion in the second quarter, a year-on-year increase of 50%.

After the financial report is released, analysts will focus on the profit and profit margin of the business. In the first quarter of this year, Tesla's energy storage business had a gross profit margin of 25%, much higher than the gross profit margin of 16% for its automotive business. Now, many analysts believe that this business will make an increasing contribution to Tesla's profits in the coming years, and expect it to generate faster profit growth than the automotive business.

Tesla's management has previously stated that thanks to strong demand for Megapack, the company's energy storage business is expected to grow by over 75% year-on-year in 2024.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.