Qualcomm Q4 Earnings Revenue Net Profit Exceeds Expectations Mobile Phone Chip Business Under Pressure

On Wednesday (January 31) local time, chipmaker Qualcomm announced its fiscal 2024 first quarter results report。Qualcomm's two main business segments, QCT and QTL, both outperformed market expectations in the first quarter.。

On Wednesday (January 31) local time, chipmaker Qualcomm announced its fiscal 2024 first quarter results report。

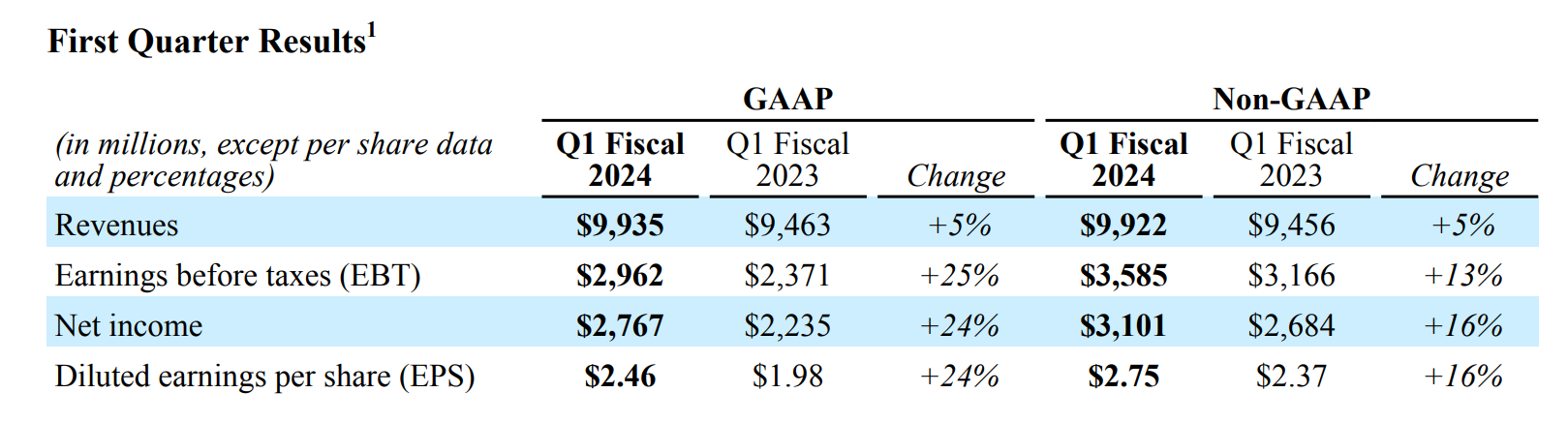

In the first fiscal quarter ended December 24, Qualcomm recorded revenue of 99.$2.2 billion, up 5% year-over-year, above analyst expectations of 95.$400 million。Net profit was 27.$700 million, adjusted EPS 2.$46, up 24% YoY, above analyst expectations of 2.37美元。

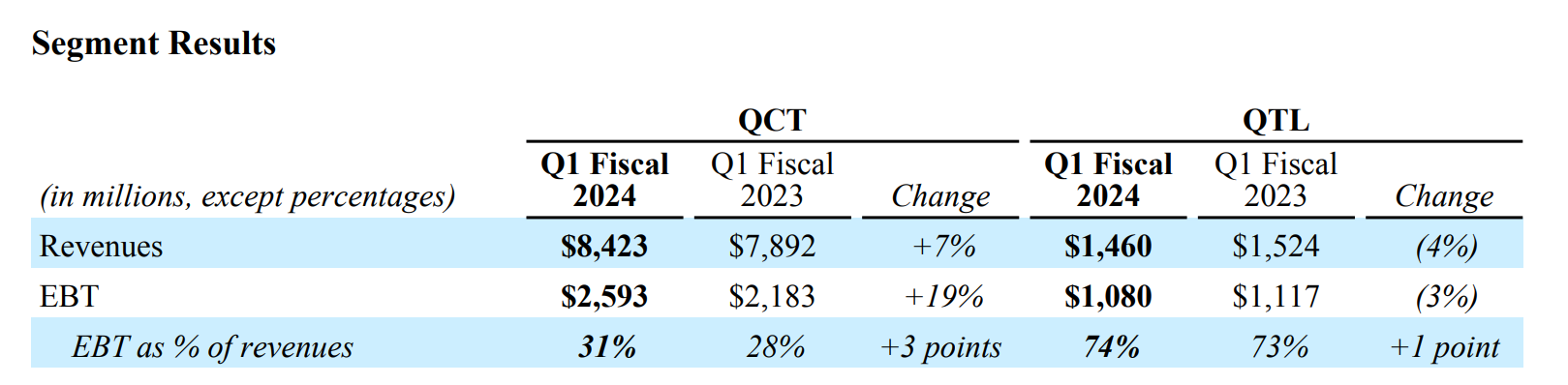

Qualcomm's main businesses are QCT and QTL, both of which outperformed market expectations in the first quarter.。

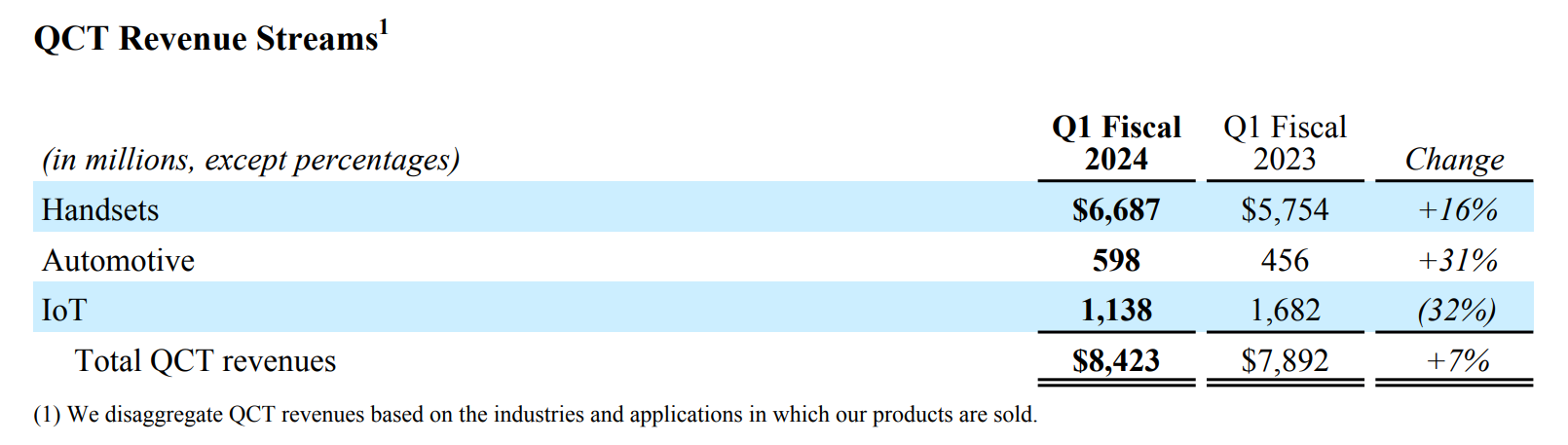

● QCT business unit: mainly responsible for the development and sales of communication technology-based chips and their one-stop solutions, is Qualcomm's main source of revenue.。The business unit consists of three business segments: mobile terminals, automobiles and the Internet of Things.。

For the first fiscal quarter, Qualcomm reported revenue for its QCT business segment of 84.$2.3 billion, up 7% year-over-year, higher than analyst expectations of 79.900 million dollars。

In Qualcomm's chip business, chip revenue from mobile terminals in the first fiscal quarter was 66.$8.7 billion, higher than expected 63.$700 million, up 16% year-over-year, compared with a 27% decline in the previous quarter。The car's chip revenue is 5.$9.8 billion, up 31% YoY, higher than expected 5.$18.3 billion。IOT CHIP REVENUE OF 11.$3.8 billion, down 32% year-on-year, below market expectations of 12.$200 million。

In addition to the results, Qualcomm also said on Wednesday that it has reached a chip supply agreement with Samsung to supply chips worldwide for Samsung's high-end Galaxy S24 models.。It is understood that the Samsung Galaxy S24 phone has artificial intelligence functions on various devices。Qualcomm said: "This marks the beginning of how generative AI will change the overall smartphone experience and highlights the huge opportunity for the Snapdragon platform.。"

However, it is worth noting that the deal does not cover all of Samsung's latest models, some of which will use their own chips.。This is a very unusual phenomenon, because Samsung's previous generation of mobile phones only used Qualcomm chips。

In fact, in terms of mobile phone chips, Qualcomm is currently facing many challenges。

On the one hand, Chinese company Huawei can only use Qualcomm chips on its 4G phones due to U.S. export restrictions, while Taiwanese semiconductor company MediaTek has also been intent on challenging Qualcomm's position in the mid-to-high-end Android phone segment。Summit Insights analyst Kinngai Chan said that after a brief comparison of Qualcomm's performance and outlook with MediaTek, "it clearly confirms our concern that Qualcomm is losing market share in Android phones in China.。"

On the other hand, global smartphone shipments are still in a slow recovery phase, which also poses a challenge to Qualcomm's business growth.。During the conference call, Qualcomm said that mobile phone shipments declined in 2023 and are expected to be "flat or slightly up" in 2024.。Qualcomm CEO Cristiano Amon said the company was working to "prepare for growth while responding to an industry-wide inventory decline."。"

In order to reduce its dependence on the mobile phone market, Qualcomm is currently trying to expand its chip market share in the automotive, PC and VR sectors.。

In mid-January, Qualcomm unveiled its AI chip for VR / MR devices - the Snapdragon XR2 + Gen 2 chip - at CES 2024, the world's largest consumer technology exhibition.。Qualcomm said that Samsung and Google have both indicated that they will cooperate with them in VR / MR devices。

At CES 2024, Qualcomm also introduced the breakthrough innovation of its Snapdragon digital chassis solution。According to Qualcomm, in 2023, Qualcomm's Snapdragon digital chassis solution has appeared in more than 75 models and more than 3.500 million cars.。Qualcomm also said that revenue from this segment of the business is expected to reach $4 billion by the end of 2026 and $9 billion by the end of the decade.。

In addition, Qualcomm also mentioned that PC manufacturers such as Dell Technology Group and Lenovo Group plan to launch laptops using Qualcomm chips.。Qualcomm pointed out that the chip is faster than Apple's internal processor。

● QTL business unit: refers to Qualcomm's patented technology licensing business, also known as "Qualcomm Tax," which accounts for a relatively low percentage of total revenue.。

For the first fiscal quarter, revenue for the QTL business segment was 14.$600 million, down 4% year-over-year, but slightly above analysts' expectations of 14.100 million dollars。

In the patent business, Qualcomm said Apple will extend a license agreement until March 2027.。Qualcomm said in September that it had signed an agreement to supply chips to Apple by 2026.。At the same time, Qualcomm pointed out that part of the patent agreement reached with Apple after the antitrust lawsuit will expire next year.。

Analysts believe that Qualcomm's overall performance in the fiscal quarter was pretty good。Thomas J of Great Hill Capital.Hayes said that for Qualcomm, "5% revenue growth and 24% earnings growth were very constructive in the challenging environment of the earnings season."。

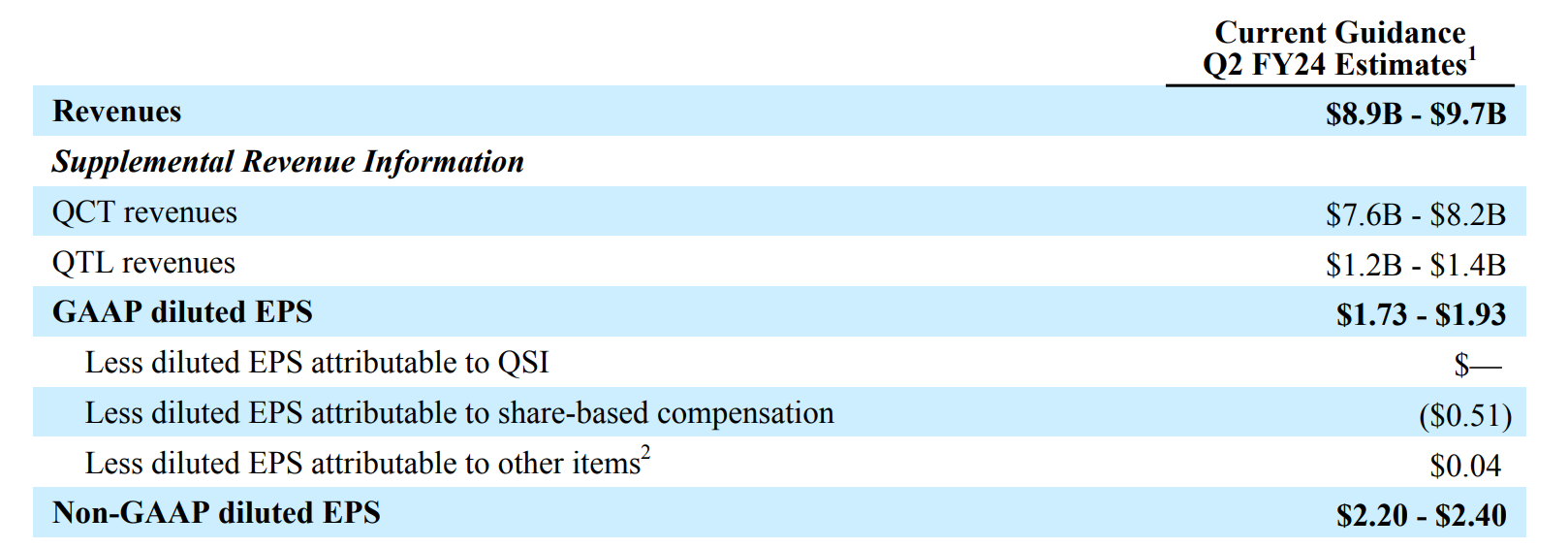

For the second quarter results, Qualcomm also gave a slightly higher level of guidance than the market expected.。

Qualcomm expects second-quarter revenue of $8.9 billion to $9.7 billion, adjusted earnings per share of 2.2 to 2.4美元。Specifically, Qualcomm expects revenue from its QCT business unit to be between $7.6 billion and $8.2 billion, with a median of $7.9 billion, higher than analysts' expectations of $7.8 billion..600 million dollars。For the QTL business unit, Qualcomm expects revenue to be between $1.2 billion and $1.4 billion, with a median of $1.3 billion, in line with expectations of $1.3 billion.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.