US September retail sales data burst market highly concerned about Thursday Powell's speech

October 31 to November 1, the Fed's FOMC is about to hold its next meeting on interest rates, and Thursday's speech will be the Fed chairman's last speech before entering the silent period, with the market paying close attention.。

On October 17, local time, the US Department of Commerce announced the monthly retail sales rate for September, which is called "terrorist data."。

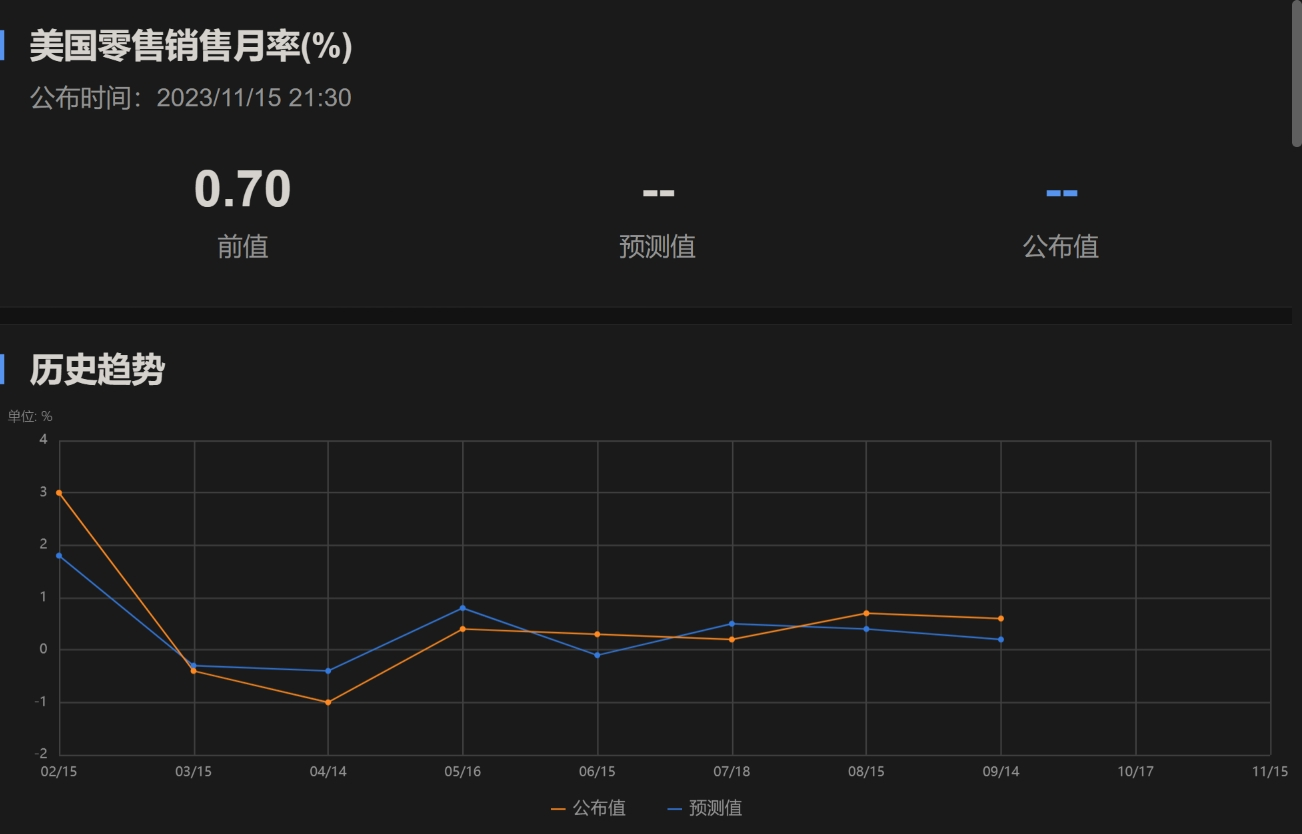

us retail sales beat expectations in september

US retail sales up 0 in September, data show.7%, significantly more than the Dow Jones economists predicted 0.3%, achieving the sixth consecutive month of positive growth。

Specifically, sales in nine of the 13 key categories released by the U.S. Department of Commerce increased compared to a month ago。

In terms of rising sub-items, grocery store retail sales led the way, up 3% month-on-month, and non-store retailer sales also rose 1.1%。It is worth noting that the increase in this sub-item may be related to the base effect, with the August retail sales data showing a sharp decline in grocery retail sales.。

In terms of declining sub-items, demand for U.S. furniture and appliances and electronics remained sluggish, with electronics and appliance stores both down 0% in September compared to the previous month..8%。

In addition, U.S. core retail sales excluding automobiles, gasoline, building materials and food services rose by 0 in September..6%。Since the U.S. sales data is not adjusted for inflation, if you follow the latest CPI data released last week (0.4%) to calculate that U.S. consumers also spent more than prices rose in September, which means that U.S. consumer spending levels may continue to be resilient in the short term.。

U.S. Treasuries are sold off again & the probability of a December rate hike soars.

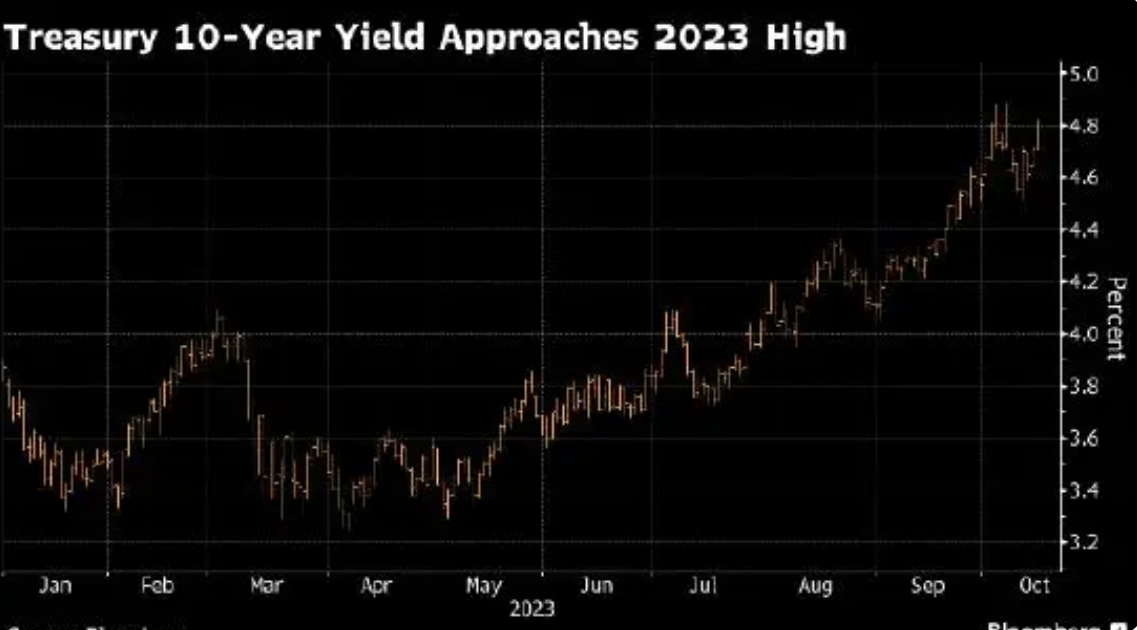

On the one hand, strong U.S. sales data again led to a sharp sell-off in U.S. Treasuries。

U.S. 10-year Treasury yields climbed rapidly after yesterday's data..15 percentage points to 4.85 per cent; two-year Treasury yields, which are highly sensitive to interest rate expectations, rose by 0 per cent..08 percentage points to 5.18%。This month, the sell-off in U.S. Treasuries reached historic highs, with the 10-year yield at one point reaching 4.A 16-year high of 89%。

David Russell, TradeStation's head of global marketing strategy, said: "The American consumer can't stop spending.。All retail sales reports for the third quarter beat expectations, allowing us to see a strong GDP figure later this month.。It also leaves the Fed with no reason to ease policy, which keeps the 10-year Treasury yield moving towards 5%。"

Gregory Faranello, head of U.S. interest rate trading and strategy at AmeriVet Securities, believes it seems possible that "yields are trying their recent highs again."。"While events in the Middle East have led to a small amount of money going to quality assets, the long end is still struggling.。"

Peter Schaffrik, global macro strategist at Royal Bank of Canada Capital Markets (RBC Capital Markets), said, "My guess is that after the Israeli-Palestinian conflict, a lot of people bought Treasuries and ended up building long positions again, betting wrong.。"

On the other hand, market expectations that the Fed will raise interest rates again in December are rapidly heating up。

According to CME Fed Watch, after the release of U.S. retail sales data for September, the market's expected probability of a December rate hike rose to about 43%, compared to 34% on Monday, representing that the relevant futures markets are pricing in the Fed's December rate hike.。While for now, it is almost certain that the FOMC will not raise rates at that time, if the economic data continues to be strong, it is not ruled out that the committee may choose to raise rates at future meetings.。

On Thursday, Fed Chairman Jerome Powell will speak at the Economic Club of New York, and analysts expect Powell's view of the recent rapid rise in bond yields - which could help the Fed meet its inflation target, but also signal that policy is approaching an important juncture - to be a major topic at the meeting.。

October 31 to November 1, the Fed's FOMC is about to hold its next meeting on interest rates, and Thursday's speech will be the Fed chairman's last speech before entering the silent period, with the market paying close attention.。

As for the future direction of policy, Eric Winograd, senior economist at AllianceBernstein Fixed Income Products, said, "The data released from the last Fed meeting to now, including the blowout employment data, strong core CPI and strong retail sales, how can you not raise interest rates if you are the Fed and really rely on the data??"

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.