The United States was cut by Moody's rating outlook after March Yellen once again "difficult to calm"

At the time, Yellen made almost identical remarks: U.S. Treasuries remain the safest liquid asset in the world because the U.S. economy is fundamentally "strong."。Unexpectedly, just three months later, Moody's also announced a downgrade of the U.S. rating outlook, which appeared to be a silent counterattack to the U.S. Treasury.。

In response to the recent downgrade of the U.S. rating outlook by the authoritative international rating agency Moody's, U.S. Treasury Secretary Yellen said at a news conference in San Francisco on Nov. 13 that she disagreed with Moody's rating decision。

Yellen said the U.S. economy is fundamentally strong and U.S. Treasuries remain the world's safe and most liquid asset, and based on that, she disagreed with Moody's downgrade of the U.S. rating outlook。

Interestingly, in August of this year, almost exactly the same thing happened。At the time, Fitch, one of the three major rating agencies, also downgraded the U.S. 's long-term foreign currency debt rating from AAA to AA +。Fitch's decision directly angered Yellen, who has repeatedly hammered Fitch in public, calling Fitch's decision "arbitrary," "arbitrary" and "outdated."。

However, Moody's also confirmed that this downgrade is only for the U.S. rating outlook and does not adjust the U.S. long-term issuer and senior unsecured AAA ratings.。This suggests that, to date, Moody's has become the only one of the three major rating agencies willing to continue to maintain the highest rating of U.S. issuers.。

U.S. government debt is "unsustainable"

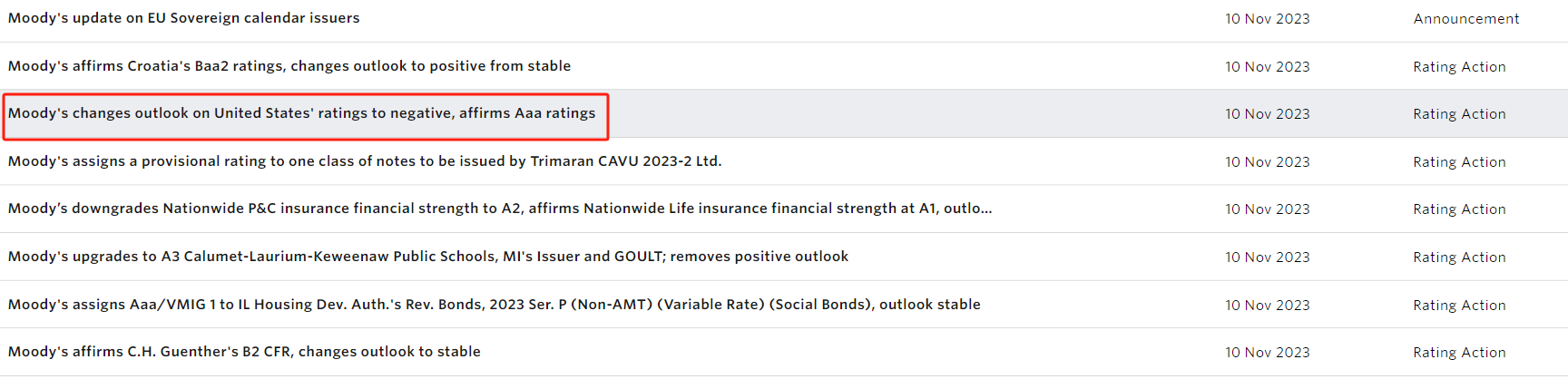

On Friday, Moody's announced on its website that it had revised its rating outlook for the United States from "stable" to "negative."。

Moody's also gave its own reasons for this: the widening budget deficit of the U.S. federal government and the polarization of the political hierarchy.。

In terms of the deficit, according to data released by the U.S. Treasury Department on October 20, the U.S. federal government's fiscal deficit reached nearly 1 in the 2023 fiscal year that ended on September 30..$7 trillion, up 23% from the previous fiscal year。Fiscal expenditure of about 6.$1 trillion, and the top items in spending are Social Security, health, Medicare, and defense.。

To add insult to injury, the cost of funding for the U.S. government also increased significantly during the reporting period as the U.S. experienced the most aggressive rate hike cycle in decades。Data show that the U.S. government's net interest expense in fiscal 2023 reached $659 billion, accounting for more than 10 percent of total spending.。Looking ahead, the weighted average interest rate on all the untasted debt the U.S. government holds in its hands is as high as 3.05%, which is also the highest since 2010.。

Moody's says rising U.S. Treasury yields add to pre-existing debt burden pressures。The company expects interest payments as a percentage of revenue to increase from 9% in 2022..7% increased to about 26% in 2033。In addition, Moody's said it believes interest payments as a percentage of GDP will increase from 1% in 2022..9% to 4 in 2033.About 5%。

Bill Dudley, a former New York Fed president and senior research scholar at Princeton University's Center for Economic Policy Studies, also said that the U.S. fiscal situation is on an "unsustainable trajectory" due to a lack of political will to resolve the crisis at a time when the cost of debt is soaring, and that the situation will get worse and government debt will be repriced at much higher interest rates than in the past 15 years.。

The game between the two parties is fierce, and the U.S. government will shut down again.

On top of that, the U.S. government shutdown crisis is not over yet.。

According to the original agreement, if the U.S. Congress does not reach an agreement on a government spending bill by Friday (November 17), the federal government will be closed again.。Although the U.S. government shutdown crisis has occurred many times in history, the ability of the U.S. Congress to cooperate in resolving the crisis is increasingly being questioned.。Earlier, former U.S. House Speaker McCarthy was ousted because he was "not tough enough," becoming the first U.S. House Speaker to be ousted in history.。

Right now, Republicans have a majority in the House, and their goal is to force spending cuts in the Biden administration, and there's no doubt that the proposal is nearly impossible to pass in the Democrat-controlled Senate。Moreover, this bipartisan game between McCarthy's ouster and the 2024 U.S. election is approaching, the bipartisan game in the U.S. Congress will only get more intense。

Currently new House Speaker Johnson has proposed a new temporary funding proposal and is reportedly seeking support from House Democrats。Under related procedures, Johnson needs at least a two-thirds majority to pass a temporary funding proposal, and to reach that threshold, the new speaker needs the support of a large number of Democrats.。

But before the vote had even begun, hard-line conservatives in the Democratic Party had already told Johnson that they would block a simple majority vote on the bill because their demands for immediate and deep spending cuts or changes to immigration laws were not met.。

Not surprisingly, this Friday, the U.S. government will usher in the history of the 22nd shutdown。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.