Box Horse bears the brunt of the IPO as soon as November, trial and error or really ready?

Lying in the greenhouse, through the winter, box horse as Ali split after the listing of the vanguard of the more appropriate.。

On June 26, according to a number of media reports, Ali's retail platform box Ma Xiansheng is stepping up preparations for listing matters, the fastest will be in the next two weeks in accordance with the listing rules of the 15th application guidelines (PN15), to apply for a spin-off listing, is expected to initial public offering time (IPO) for November.。

Ali has high hopes for box horses

The preparation of box horse fresh raw materials for listing is not groundless.。In April, it was reported that the department was working with CICC and Morgan Stanley to prepare for the listing, when the two sides expected an IPO in 2024 with a valuation of $6 billion ($42 billion).。From the equity structure point of view, the basic framework of the box horse has also been set up, box horse (Hong Kong) Limited 100% of the shares of the real control, its indirect or direct shareholding of 17 enterprises.。

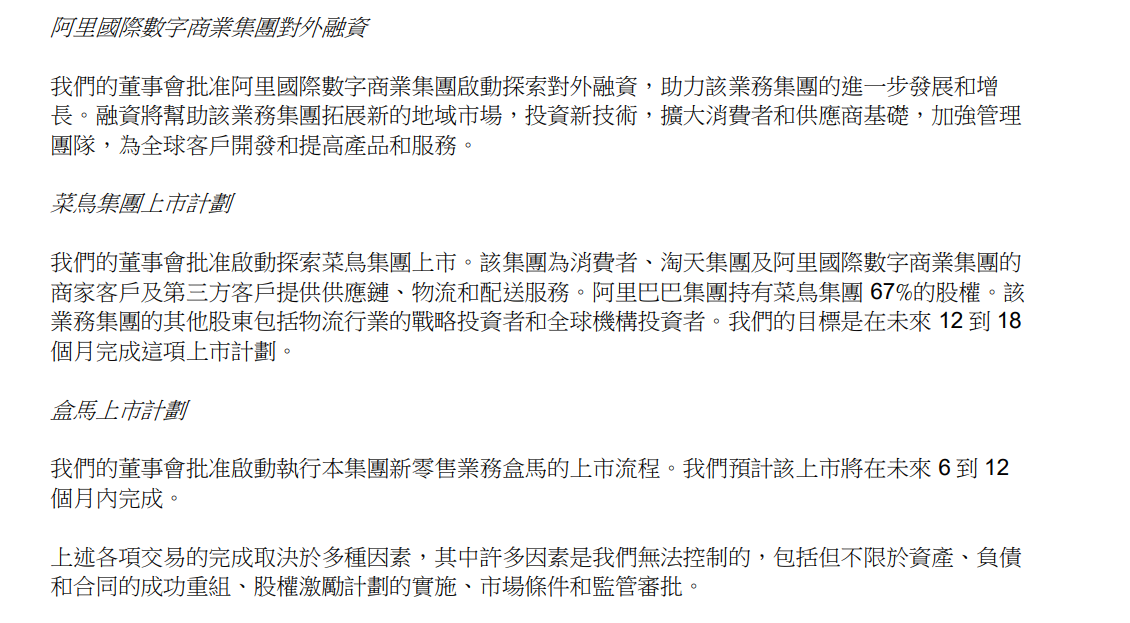

On the evening of May 18, Ali announced the fourth quarter of fiscal year 2023 (the first quarter of natural year 2023) and full-year results announcement.。In the announcement, according to Alibaba's deployment, Alibaba Cloud will move from a complete spin-off of Alibaba Group to a listing in the next 12 months.。In addition, rookie, box horse will start the listing plan, the former is expected to be completed in the next 12 to 18 months, the latter is expected to be completed in the next 6 to 12 months。Ali International Digital Business Group will also initiate external financing to support its rapid expansion in the global market.。

It can be seen that Ali has high hopes for box horses。If all goes well, Hema Xiansheng will be the first business unit to go public independently after Ali's spin-off, and it will also be the initial public offering of Ali's brand after new CEO Wu Yongming takes over.。

"Death after death."

In March this year, Zhang Yong, then chairman and CEO of Alibaba Group, issued a full letter announcing the launch of the "1 + 6 + N" organizational change.。Under Alibaba Group, six major business groups and multiple business companies will be established, including Alibaba Cloud Intelligence, Taobao Tmall Business, Local Life, Cainiao, International Digital Business, and Big Entertainment.。

After this organizational change, each business group is independently responsible for its own operating results, i.e., it is self-financing.。If the time is right, each business group may be listed independently in the future.。

In fact, as the "N" in the "1 + 6 + N" organization, Box Horse's self-financing path began as early as the end of 2021。But when Box Ma Xiansheng opened its first store in 2016, the department was positioned as a testing ground for Ali's new retail business.。At that time, Ali did not have a profit requirement for the box horse, giving it the space to give full play.。

Under such circumstances, Hou Yi, founder and CEO of Box Horse, began to boldly try new retail formats, successively launching Box Horse Fresh Standard Store, Box Horse F2, Box Horse Food Market, Pick'n Go, Box Horse X Member Store and so on.。For now, the cost of trial and error is high, and about half of these formats have been phased out.。

In 2021, Ali began to reform the structure of the box horse, taking the lead in implementing the "business responsibility system" for individual business segments, including the box horse, to make it self-financing.。What brought about such a big shift was, of course, the pain of the box horse, and overnight profitability became its top priority.。

Fortunately, the box horse enough to compete, through the early expansion and arduous cost reduction and efficiency, at the beginning of this year to achieve the main industry profitability。In addition, Ali also noted in its fiscal 2023 second quarter results that the group's direct and other revenue increased 6% year-on-year to RMB647 as of September 30, 2022..2.5 billion yuan, mainly due to the strong growth of box horse revenue, its online order revenue ratio remained at a high level of more than 65%。

Public data shows that in 2016, there was only one proofing shop for box horse fresh, which increased to 18 in 2017 and 88 in 2018.。According to the GeoQ Ana brand analysis tool, as of the first quarter of this year, there were 296 main stores (excluding X member stores and Ole stores) covering 18 provinces and 27 cities.。

In the sinking market, Box Horse has also launched Box Horse Neighborhood, Box Horse Ole, respectively, positioning community stores and brand discounts.。At the 2022 Box Horse New Zero Supply Conference, Box Horse CMO Zhao Jiayu revealed that Ole and the neighborhood grew by as much as 555%。Box Ma Ole + Box Ma Neighborhood has spread to 16 cities。In Shanghai, for example, it has been fully covered at the district and town level outside the central city, with more than 600 stores.。

In April this year, Hou Yi told the media that the overall business of Box Horse had achieved full profitability in the fourth quarter of 2022 and the first quarter of this year.。He also said that with the size and brand influence of box horses today, they already have the conditions to go public.。

Lying in the greenhouse, through the winter, box horse as Ali split after the listing of the vanguard of the more appropriate.。The listing of the box horse will correct the name of Ali's new retail model, and also indicates that its "1 + 6 + N" reform has taken a substantial and important step.。

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.