Who said AI infrastructure is over?

On Friday, Microsoft President Brad Smith revealed two things in a blog post.

First, the popularity of AI infrastructure remains unabated, and US$80 billion will be spent to build data centers this fiscal year.

Second, by June 2025, half of projected spending will be spent in the United States.

Public sources show that cloud infrastructure providers such as Microsoft and Amazon have been racing to build new data centers to expand computing power.In the previous fiscal year ending June 2024, Microsoft's capital expenditures exceeded US$50 billion, most of which was related to the construction of server farms driven by demand for artificial intelligence services.

Smith also warned the incoming Trump administration against "high-pressure regulation" of artificial intelligence.Smith wrote: "The most important priority for American public policy should be to ensure that the American private sector can continue to move forward with the wind.”

In terms of spending on data centers, there are two main destinations.First, it is used to purchase Nvidia's artificial intelligence chips and Dell's artificial intelligence infrastructure clusters.Second, buy electricity.Artificial intelligence facilities require a lot of electricity, and Microsoft has reached an agreement with the Three Mile Island nuclear power plant in Pennsylvania to reopen a reactor at the nuclear power plant, which is also a considerable cost.There is also news that other top Internet companies, such as Amazon and Google, have also signed nuclear power agreements.

After two years of large-scale model arms race, artificial intelligence integration will continue to erupt in 2025.

According to statistics from well-known investment bank Goldman Sachs, AI infrastructure has not yet been completed.In addition to Microsoft, the world's top Internet giants, such as Amazon, Google, Meta, Oracle, etc., have announced large-scale AI infrastructure plans this year and next.

Even Nvidia, the chief AI leader, said at the latest earnings call that AI is only at the "early stage" and its future applications will be more extensive and advanced.

Nvidia's long-term vision is that within the next decade, companies will have thousands of "digital employees" to perform complex tasks-such as programmers, circuit designers, marketing project managers, legal assistants, etc.

So, in the face of this wave of artificial intelligence dividends, how should ordinary people participate?

Buying an ETF may be a good choice.

Since the stock price of the artificial intelligence concept is relatively high, taking Nvidia as an example, it costs US$140 to buy a share of Nvidia; the stock prices of Oracle and Google are both above US$150; Microsoft's stock price is around US$400; and Meta's stock price is as high as nearly US$600.For many people, buying a share of each of these companies will cost a lot of their savings.

In contrast, artificial intelligence-related ETFs have become a good choice, because buying an ETF is equivalent to buying a basket of stocks, which can achieve the above-mentioned "package and buy effect", but there is no such high buying threshold.

Generally speaking, the capital threshold of ETFs is between individual stocks and over-the-counter funds. Buying a lot (100 shares) may only cost more than 100 yuan, and the lower one is even less than 100 yuan, which is much lower than the threshold of individual stocks.

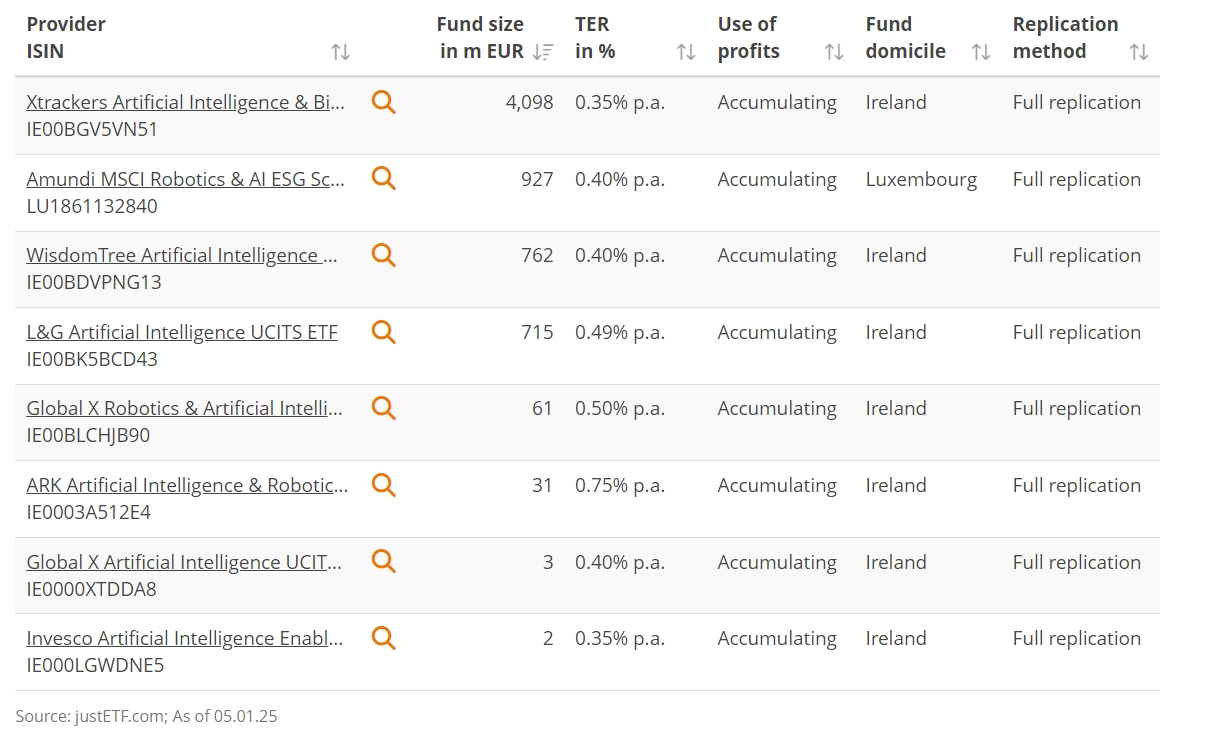

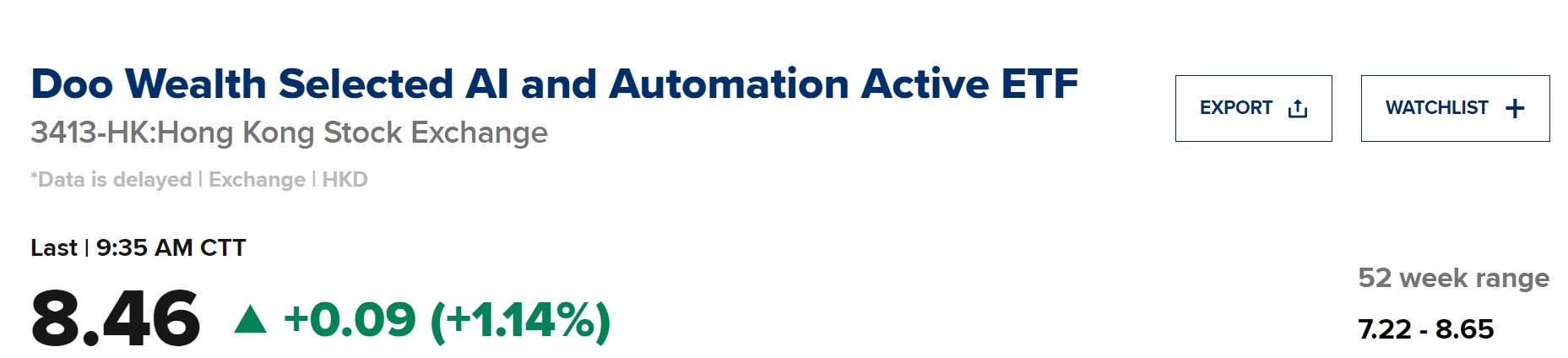

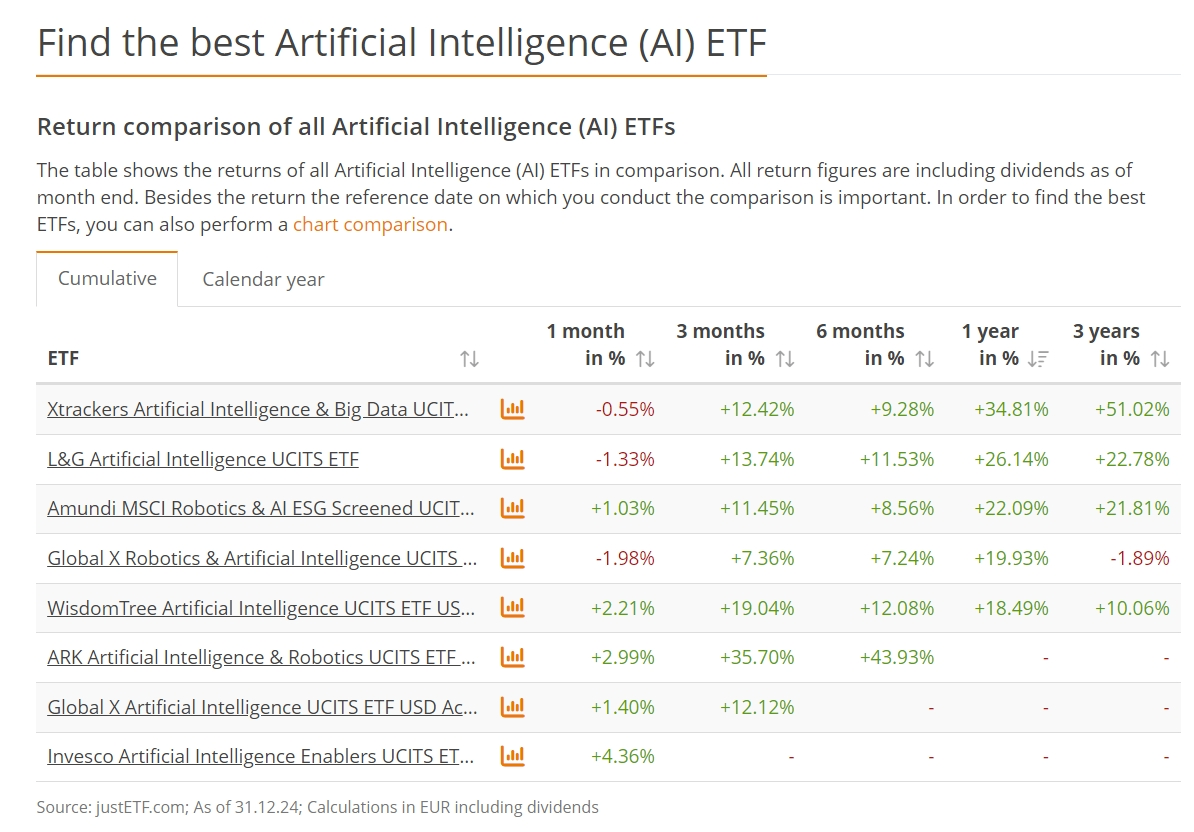

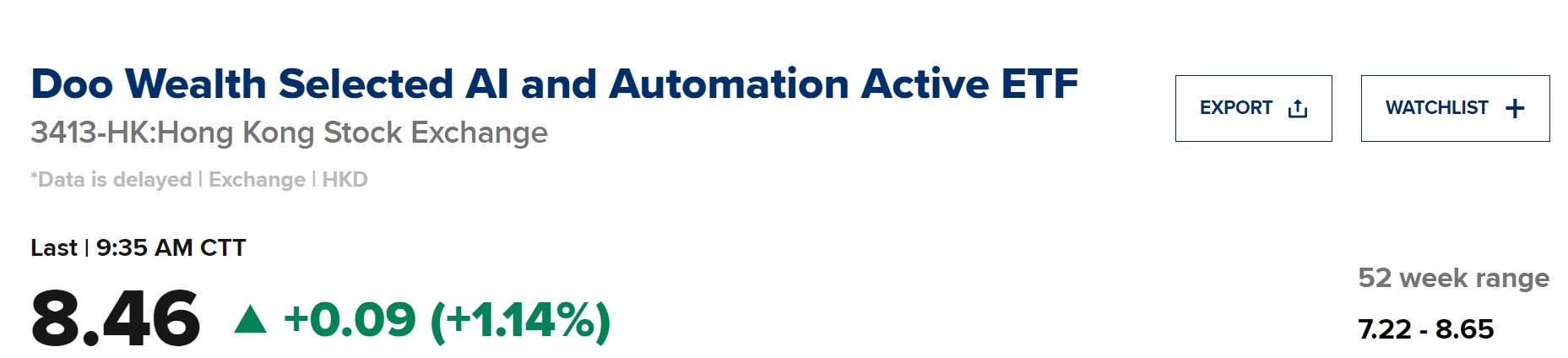

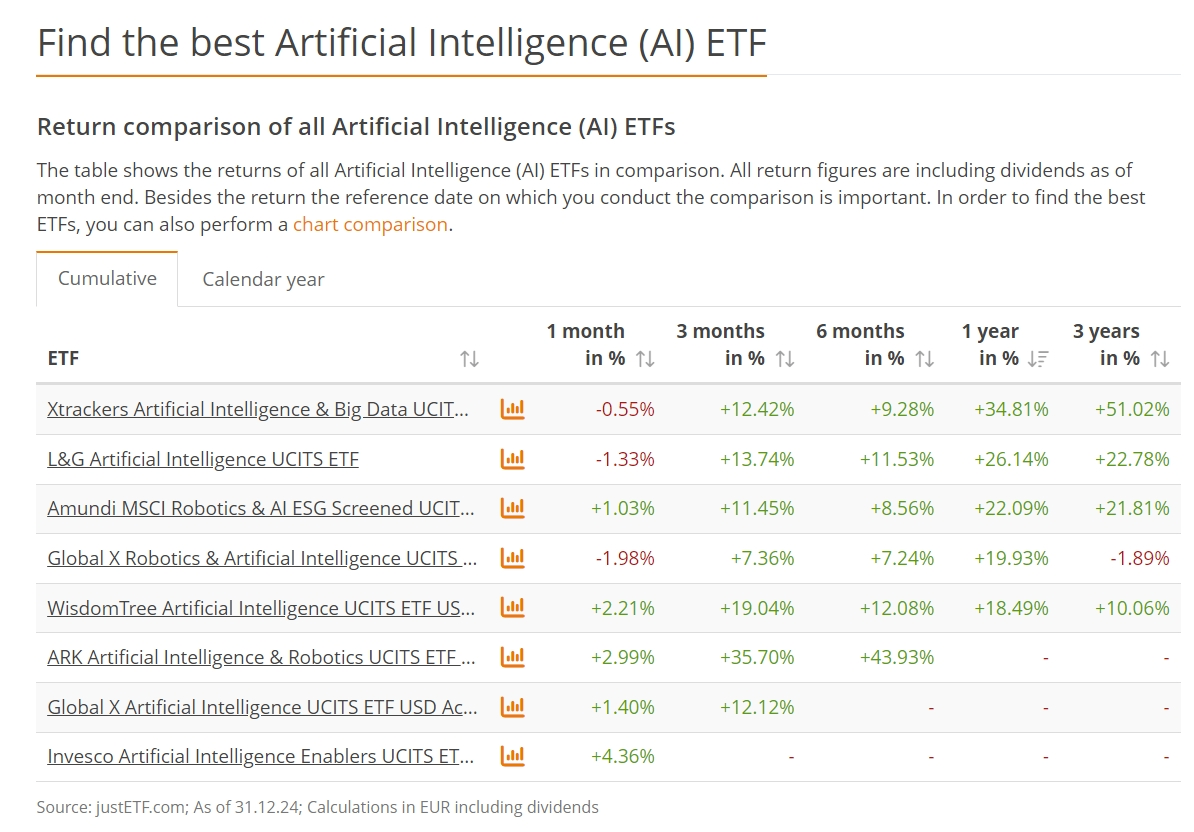

The following are some popular artificial intelligence ETF products on the market, for example only and no recommendations:

Moreover, ETFs have a rich selection of individual stocks.For investors unfamiliar with individual stock analysis, ETFs provide a simple way to invest without having to delve into each company.

There is also no risk of trading or delisting in ETFs.ETFs may fall sharply along with the industry or the broader market, but they will not be violent, so they can keep trading going normally in extreme bear markets, giving investors the opportunity to stop losses and exit.

With low thresholds, transparent transactions, rich options, no thunder, and support on-site trading, ETFs are the best choice for ordinary investors or novice investors to participate in the artificial intelligence market.