Is AI Over-hyped?Dario say U.S. stocks are a bit of a bubble, but not much

Recently, Ray Dalio, the founder of the famous hedge fund Golden Bridge Water Fund, said that there are not many foam in the current US stocks.

Recently, due to the rapid rise of AI related stocks such as Nvidia, the market began to worry about the AI foam in the stock market, and even more worried that the US stock market would repeat the "Internet foam".

As the aforementioned views began to spread in the market, Ray Dalio, the founder of the renowned hedge fund Golden Bridge Water Fund, spoke out in a different tone. He believes that there are not too many foam in the current US stock market.

In a newly released report, Dario said that although the market has been booming and rebounded recently, the current situation does not fully meet his definition of foam.

He believes that the criteria for forming a foam in the stock market include the following

- Compared to traditional value measurement standards, stock prices are higher (for example, by calculating the present value of cash flows during the asset's existence period and comparing it with interest rates);

- Signs of unsustainable growth (such as inferring past revenue and profit growth rates in the later stages of the cycle when capacity constraints mean growth cannot be sustained);

- A large number of novice buyers have been attracted. Because the market has risen significantly, it is considered a hot market;

- Generally bullish sentiment;

- A high proportion of purchases are financed through borrowing;

- A large number of forward and speculative purchases are made to bet on price increases.

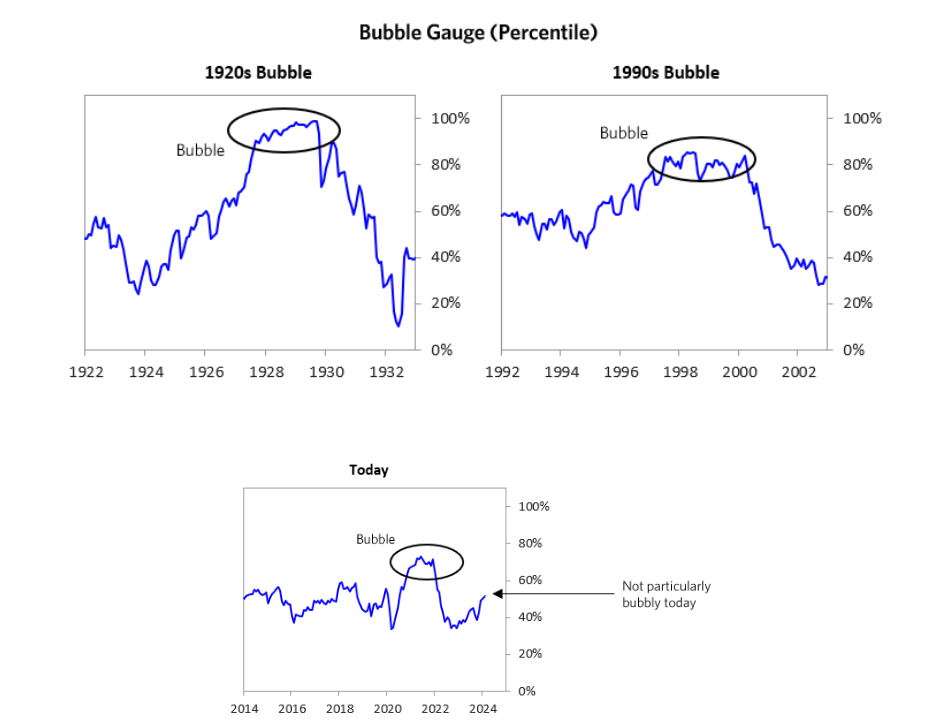

Dario wrote in the report: "When I used these criteria to observe the U.S. stock market, even some stocks that rose the most and received media attention did not seem to have too many foam. The whole market was at a medium level (the 52nd percentile). The current level was not consistent with the past foam."

Since the beginning of this year, the US stock market has continued its upward trend from last year. Among them, the S&P 500 index has risen by over 8% so far this year.

The "MAG-7" in the US stock market (Apple, Amazon, Tesla, Nvidia, Microsoft, Alphabet, and Meta) are the most closely watched. Among them, Tesla and Apple performed relatively poorly, but the other five stocks have been performing strongly this year under the wave of artificial intelligence. Dario believes that currently among the "MAG-7", Alphabet and Meta are relatively cheaper, while Tesla is a bit more expensive. But overall, the pricing of these stocks is still quite reasonable.

Dario admits that the "MAG-7" of the US stock market have driven the entire market up. Since January 2023, the market value of the "MAG-7" has increased by over 80%. These companies currently account for over 25% of the total market value of the S&P 500 index.

"The 'MAG-7' in the US stock market is a bit foam, but not a complete foam." Dario said, "considering the current and expected earnings, the valuation is slightly higher, the market sentiment is optimistic, but it does not seem excessive, and we have not seen excessive leverage or a large number of new buyers influx."

Dario's viewpoint is also supported by data from other professional institutions. A recent survey of fund managers by Bank of America shows that investor optimism has reached a high in nearly two years. A customer sentiment report from Jiaxin Wealth Management also mentioned that there was a similar enthusiasm in the market in the first quarter of 2024.

In addition, IPO activity is a useful data point for measuring the sentiment of the stock market. Due to the prosperity of SPAC (one of the legal listing methods in the United States) and strong stock market conditions driving rapid stock issuances, IPO activity has been at a very high level until 2022. But now this situation has undergone a significant reversal, with almost no IPO activity recently.

Therefore, Dario believes that the current market sentiment is in a neutral to slightly positive state, rather than in the foam region.

In terms of the influx of new buyers, Dario believes that, in dollar terms, the trading volume of the "MAG-7" (based on trading volume) is still close to the historical high, but as part of the total market value, it does not look like a speculative frenzy, which is different from the high-level activities during the COVID-19 epidemic.

However, Dario also mentioned that downside risks still exist, and the position of the "MAG-7" in the US stock market is not very stable. In the report, Dario said, "Nevertheless, if generative artificial intelligence does not have a strong impact, people can still imagine significant adjustments to these names."

Historical trends may confirm Dario's assessment that the stock market is not in the foam zone.

Nicholas Colas and Jessica Rabe, co founders of DataTrek Research, pointed out in a report last week that the S&P 500 index has risen by 31% in three years in terms of price return, which is far lower than the typical return rate formed by the foam before the crash.

"We are far from reaching this level, which indicates that investor confidence has not reached the unhealthy highest level." The report said, "This does not guarantee further rise, but we can safely eliminate the 'foam risk' from stock market concerns."

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.