Ali's three-year net profit to his mother was cut in half! Official announcement to raise $5 billion

HSBC says historically internet companies have tended to see their share prices fall in the short term after issuing convertible bonds.

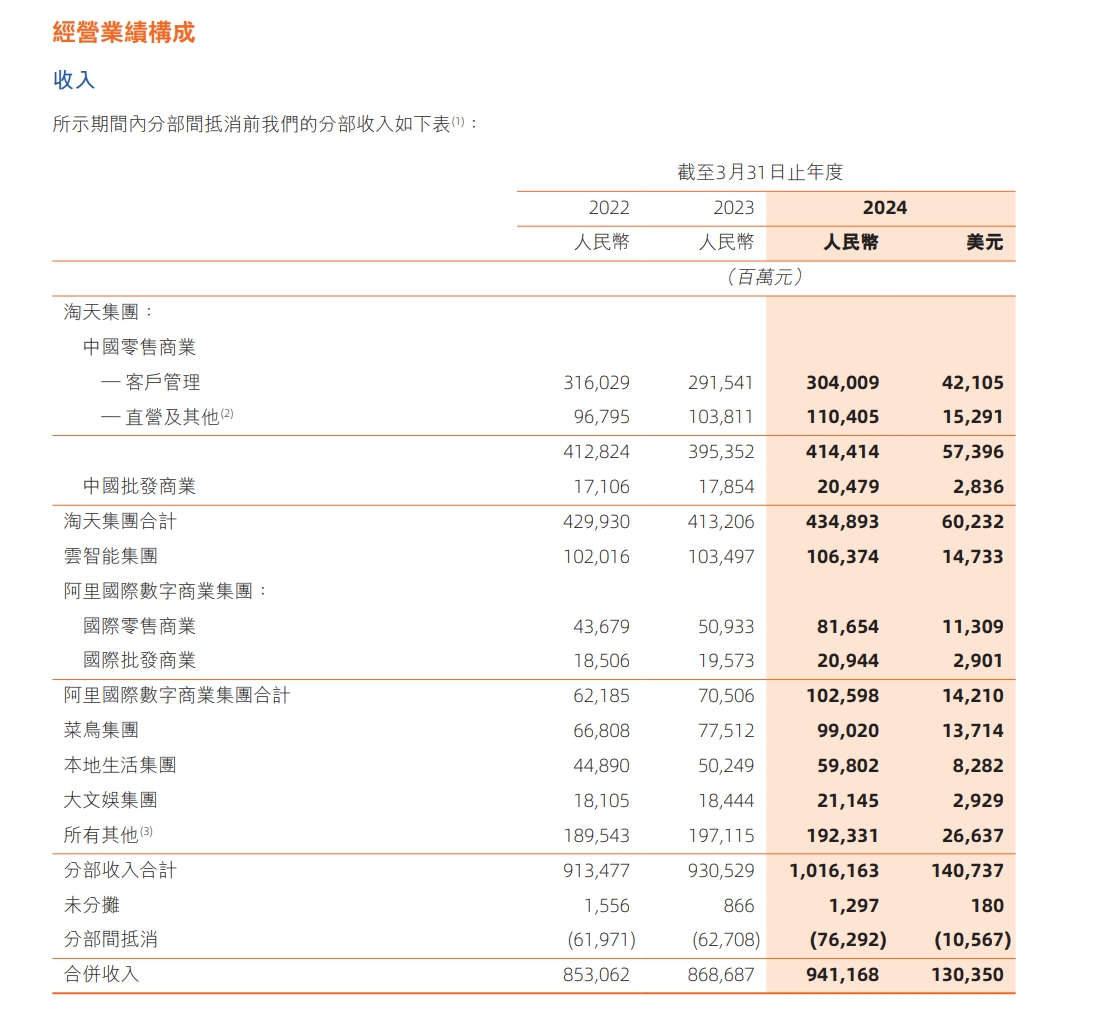

On the evening of May 23, Alibaba released its annual report for fiscal year 2024. According to the report, Alibaba Group's revenue reached RMB 941.168 billion (the same below), with adjusted EBITA profit increasing by 12% year-on-year to RMB 165.028 billion. Among them, Taotian Group, Alibaba International, Cainiao Group, and Alibaba Cloud all recorded strong performances.

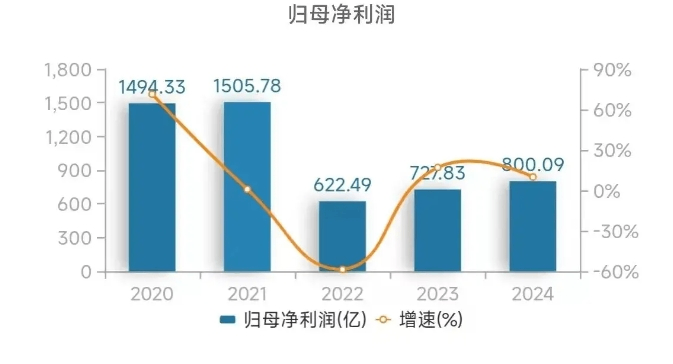

However, due to Alibaba's increased investment in its e-commerce business (core user experience of Taobao and Tmall, core public cloud products and AI infrastructure, and overseas e-commerce), retention incentives granted to Cainiao employees, and the decline in the market value of its invested listed companies, Alibaba's net profit attributable to shareholders excluding non-recurring items continued to shrink, falling from RMB 150.5 billion in fiscal year 2021 to RMB 80 billion in fiscal year 2024, a drop of 46.9% over three years, nearly halving.

Similarly, Alibaba's stock price has also seen a significant decline.

Over the past three years, Alibaba's highest market capitalization on the U.S. stock market was USD 619.5 billion on June 25, 2021. As of the close of trading on May 23, its market capitalization was USD 205.8 billion, a near 70% drop. Apart from regulatory pressure, Alibaba itself is also partly to blame. Continuous personnel changes and strategic transformations have left investors overwhelmed; the transition from e-commerce to cloud computing, and expansion into digital entertainment and emerging fields, although having long-term growth potential, face enormous market competition and uncertainty; management issues and uneven resource allocation during business integration have also negatively impacted the company's operational efficiency.

Specifically, Taotian Group's revenue reached RMB 434.9 billion, with high retention rates among platform consumers continuing; Alibaba International Digital Commerce Group's revenue exceeded RMB 100 billion, a 46% year-on-year increase; Cainiao Group's revenue grew by 28% year-on-year, with daily cross-border and international order fulfillment volumes exceeding 5 million packages; Alibaba Cloud's adjusted EBITA increased by 49% year-on-year.

Additionally, according to the financial report, Alibaba sacrificed profits in the e-commerce sector by increasing investments in cross-border businesses like AliExpress Choice and Trendyol to capture market share. As of April 2024, orders from Choice based on fully managed and semi-managed services accounted for over 70% of AliExpress's total orders. Revenue growth in Alibaba Cloud was also a highlight this quarter. According to the financial report, Alibaba Cloud's revenue grew by 3% to RMB 25.595 billion, with core public cloud product revenue achieving double-digit growth and AI-related cloud product revenue achieving triple-digit growth. Adjusted EBITA increased by 45% year-on-year to RMB 1.432 billion.

It is worth mentioning that Alibaba is still striving to reduce costs and improve efficiency. According to the financial report, as of March 31, 2024, Alibaba's total number of employees was 204,891, down from 219,260 on December 31, 2023. This means that within one year, Alibaba's workforce decreased by 14,369 employees.

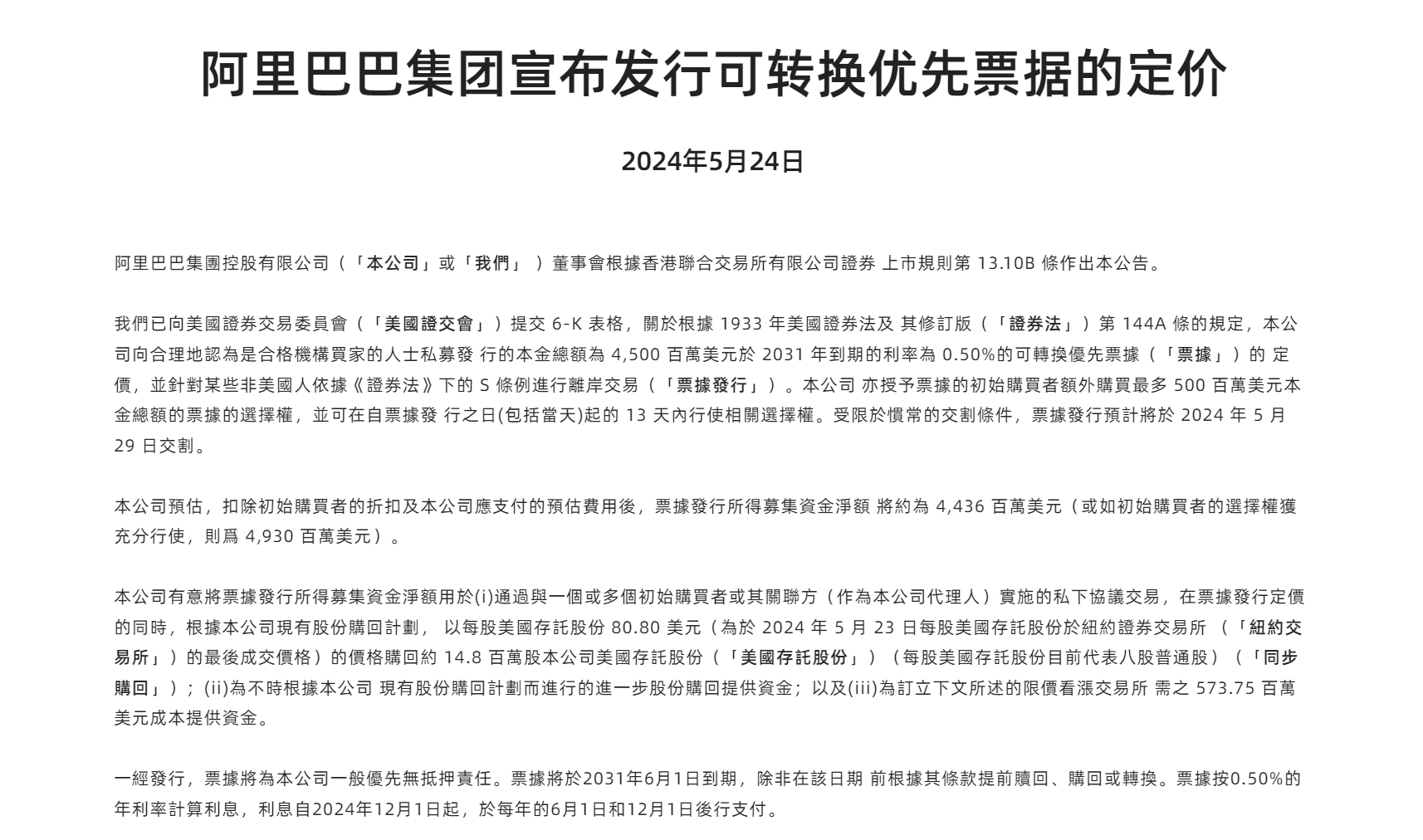

After the financial report was released, Alibaba officially announced its plan to privately issue USD 4.5 billion in principal amount of convertible senior notes due 2031. Analysts say that the main purpose of this issuance is to provide funds for stock repurchases and growth, noting that Alibaba currently needs funds to invest in its core commerce and cloud businesses, as well as to increase its bet on artificial intelligence.

According to the announcement, Alibaba expects to grant the initial purchasers of the notes an option to purchase up to an additional USD 500 million in principal amount of notes, which can be exercised within 13 days from the issuance date of the notes (including the issuance date). In this way, the transaction could raise up to USD 5 billion.

Alibaba stated that it plans to use the net proceeds from the issuance of the notes for: repurchasing certain Alibaba American Depositary Shares under the existing share repurchase plan at the same time as the pricing of the notes; providing funds for further share repurchases from time to time under the company's existing share repurchase plan; and funding the costs of entering into capped call transactions.

Following the news, Alibaba's Hong Kong and U.S. stocks both fell. Alibaba's Hong Kong shares fell by more than 6.5% at one point, closing down 5.24% at HKD 78.65. Alibaba's U.S. shares were trading at USD 80.94 on Thursday, down 2.13%.

HSBC stated that historically, the stock prices of internet companies tend to decline in the short term after issuing convertible bonds. Over the past three years, stock prices have fallen by an average of 8% on the first day after the announcement and by 23% by the 30th day. The bank also believes that Meituan, Tencent, NetEase, and Pinduoduo may follow suit, estimating that Meituan and Tencent are the most likely to issue convertible bonds.

S&P stated that it plans to assign an "A+" long-term issue rating to Alibaba's proposed issuance of U.S. dollar-denominated senior convertible bonds and that the issue rating is subject to S&P's review of the final terms and conditions. Alibaba plans to use the proceeds for stock repurchases.

·Original

Disclaimer: The views in this article are from the original Creator and do not represent the views or position of Hawk Insight. The content of the article is for reference, communication and learning only, and does not constitute investment advice. If it involves copyright issues, please contact us for deletion.